The Bill Form Is Used To Record Expenses That

The Bill Form Is Used To Record Expenses That - Web billable expense income is important when filing small business taxes. O b) we use to record for services, such as utilities or. We use to record for services, such as utilities or accounting services, that we agree to pay at a future date. An expense tracks the products ordered from the vendor. The system you use to record business transactions will be more effective if you follow good recordkeeping practices. Web learn how to record a bill payment check or pay a bill using credit or debit card. An expense form selects the bills a company wants to pay. Web the bill form is used to record expenses that? Web we would like to show you a description here but the site won’t allow us. Both check and expense report a transaction as an.

O b) we use to record for services, such as utilities or. Web the bill form is used to record expenses that select one: Under cash basis accounting, expenses are recorded when. Web a bill form records when the vendor gives the company a refund or reduction in its bill. Web the bill form is used to record expenses that? An expense tracks the products ordered from the vendor. Customize to fit your spending habits. Web you may choose any recordkeeping system suited to your business that clearly shows your income and expenses. Web a form used to record money that will be removed from a customers account at a specified future date the expense from is used to record expenses that we pay for at. Web we would like to show you a description here but the site won’t allow us.

Web the bill form is used to record expenses that we agree to pay at a future date for services, such as utilities or accounting services. Web billable expense income is important when filing small business taxes. Both check and expense report a transaction as an. In a cash basis accounting system, an expense is recorded when the company pays for. The correct answer is a. As you can see, the idea of billable expense. The system you use to record business transactions will be more effective if you follow good recordkeeping practices. Please note that both are. We record for services, such as utilities or accounting services, that we agree to pay at a future date. An expense tracks the products ordered from the vendor.

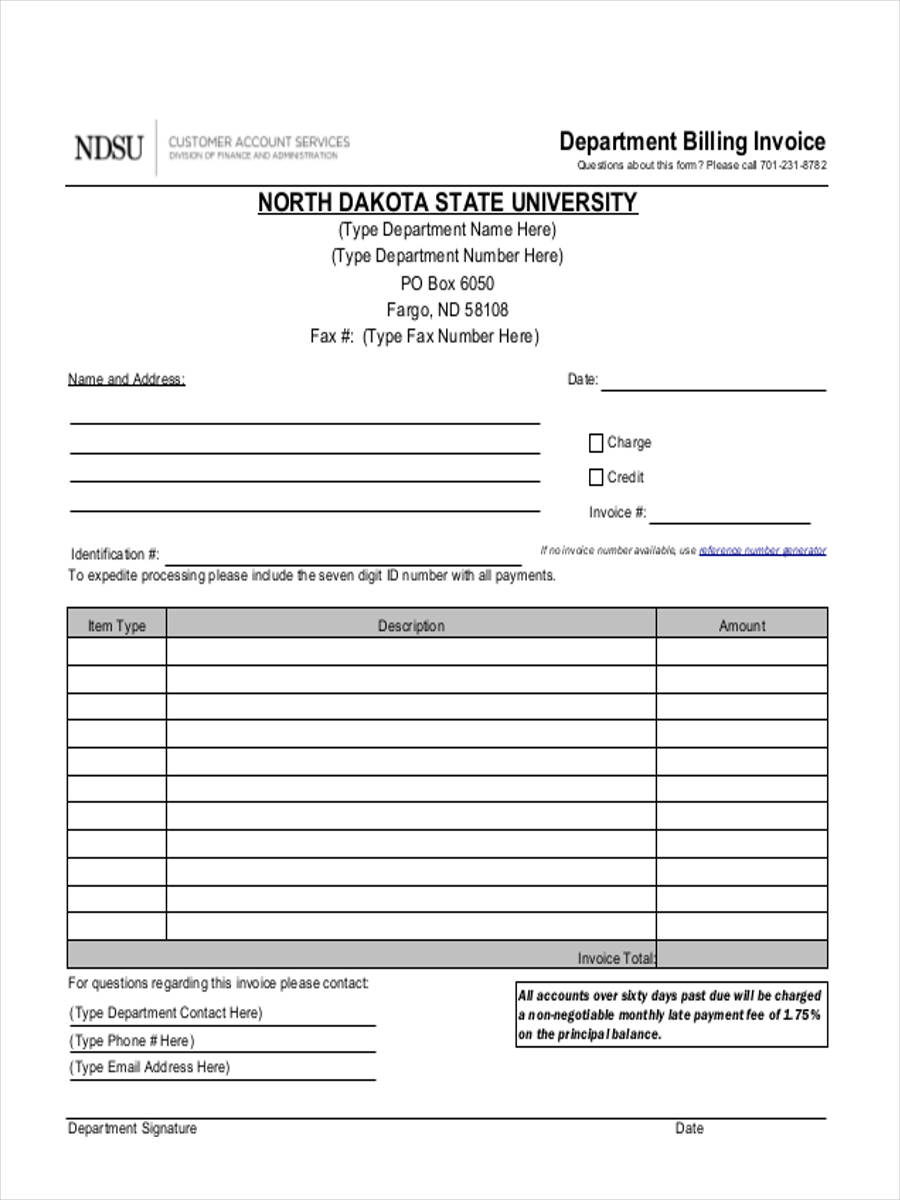

Due Bill Form

When to record checks or expenses. Web you may choose any recordkeeping system suited to your business that clearly shows your income and expenses. An expense form selects the bills a company wants to pay. Web we would like to show you a description here but the site won’t allow us. You can either record the payment to an outstanding.

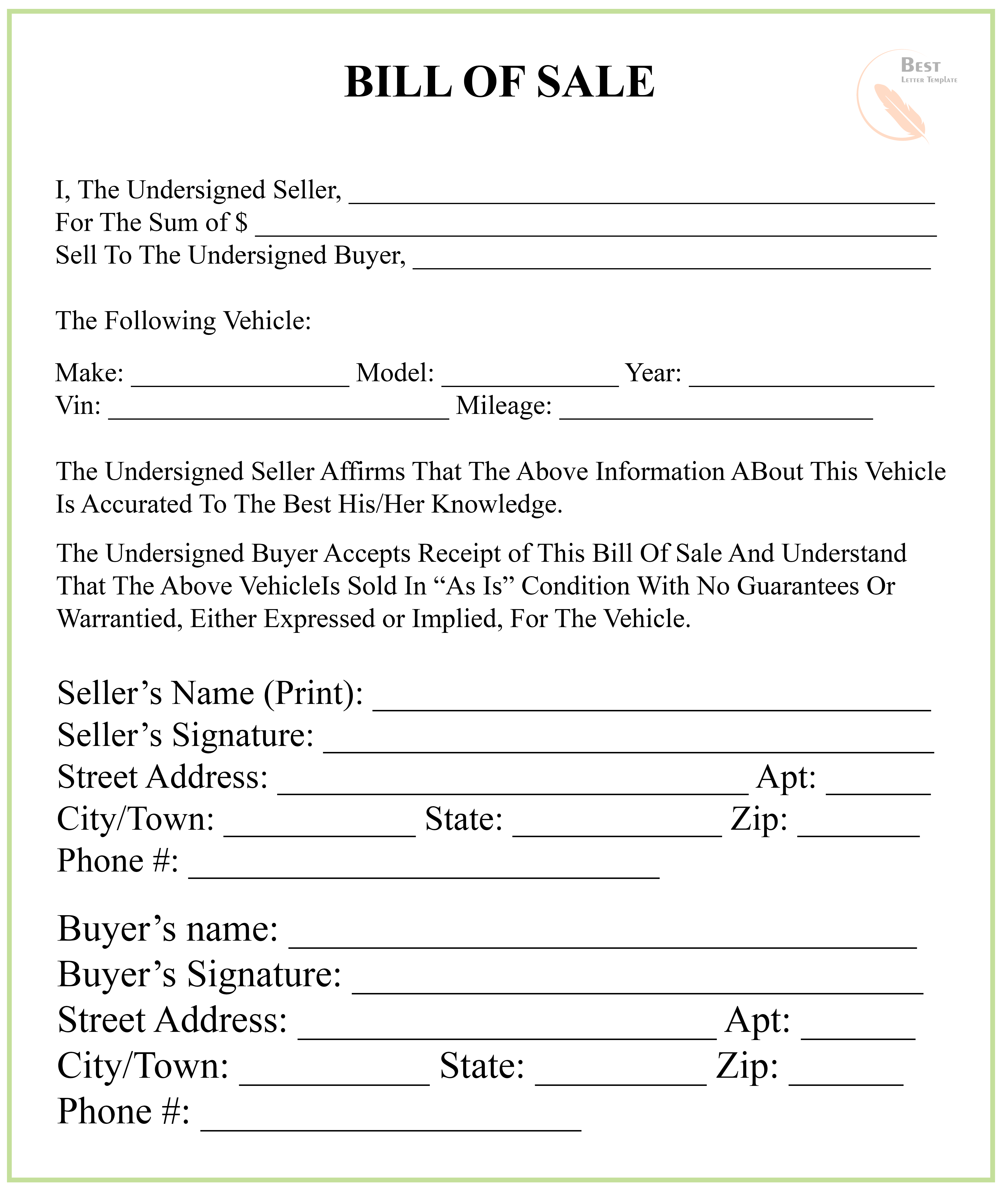

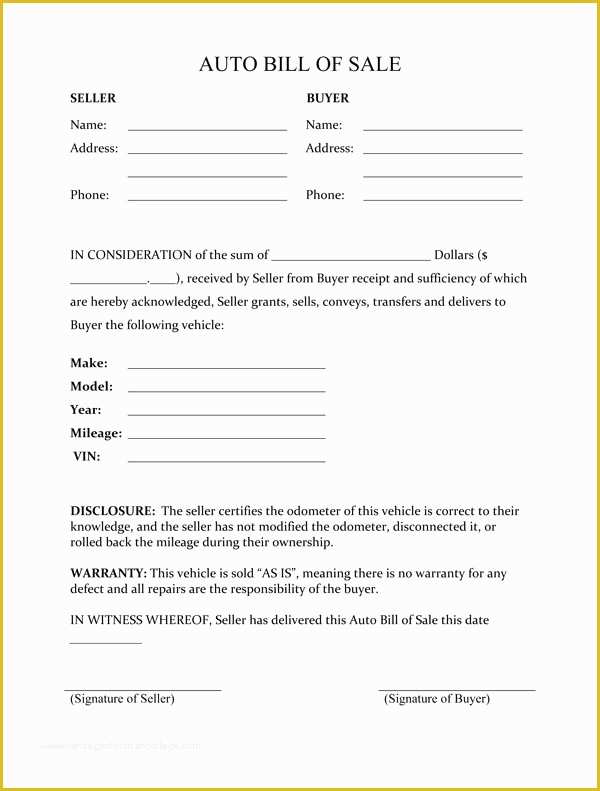

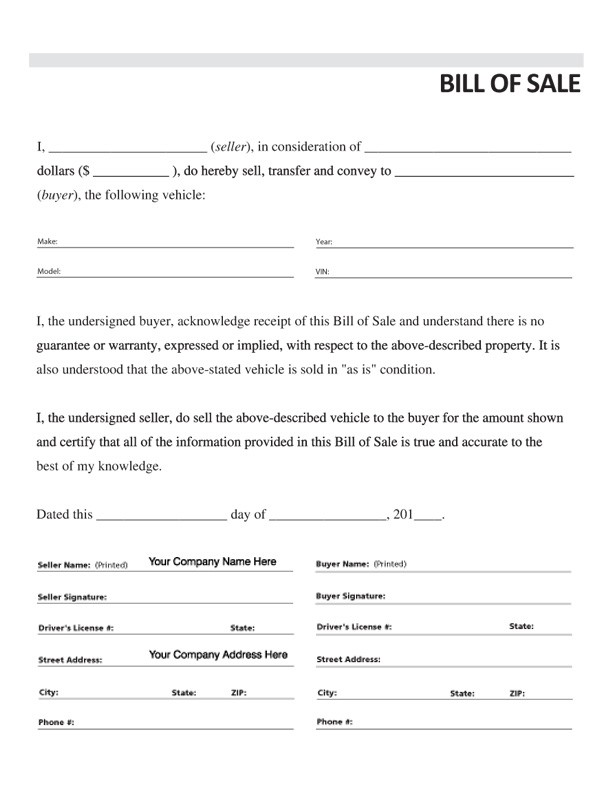

billofsales2 Best Letter Template

Screen must be used to select the bill to be paid prior. The record accounts payable in quickbooks online, you record the expense using the bill form and pay the bill using the pay bills window. The business you are in affects the type of. (the expense account is recommended) the. Web we would like to show you a description.

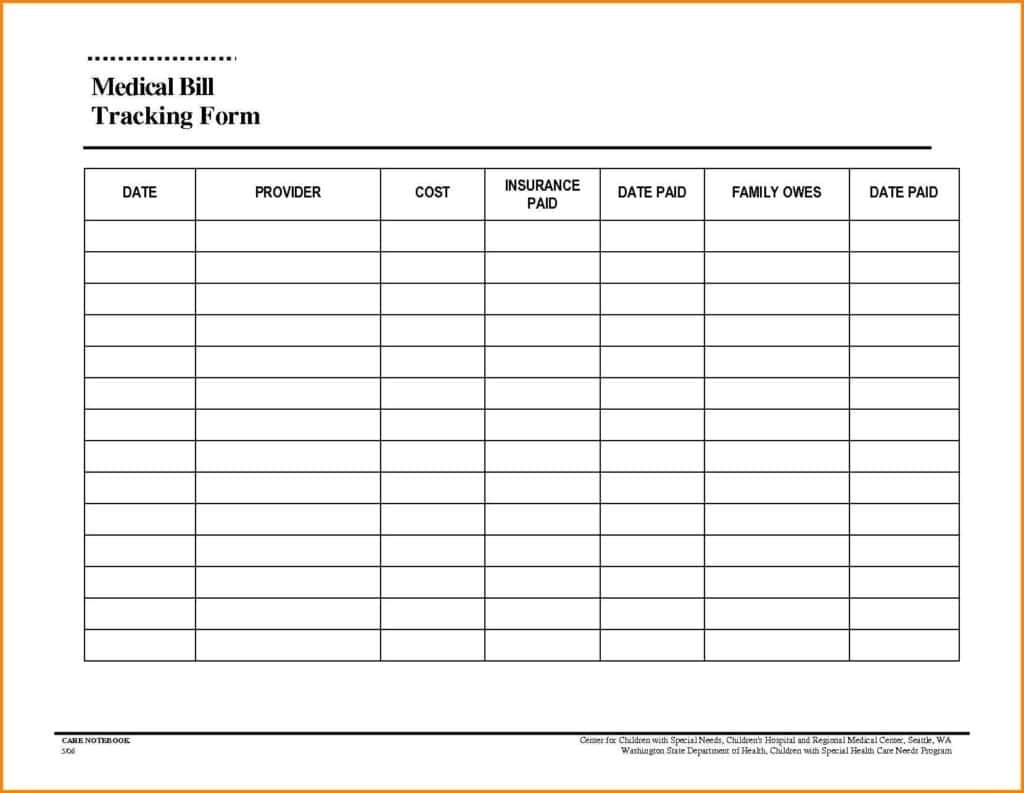

10 Expense Claim Form Template SampleTemplatess SampleTemplatess

Web accountants record expenses through one of two accounting methods: (the expense account is recommended) the. The record accounts payable in quickbooks online, you record the expense using the bill form and pay the bill using the pay bills window. Cash basis or accrual basis. Web a bill form records when the vendor gives the company a refund or reduction.

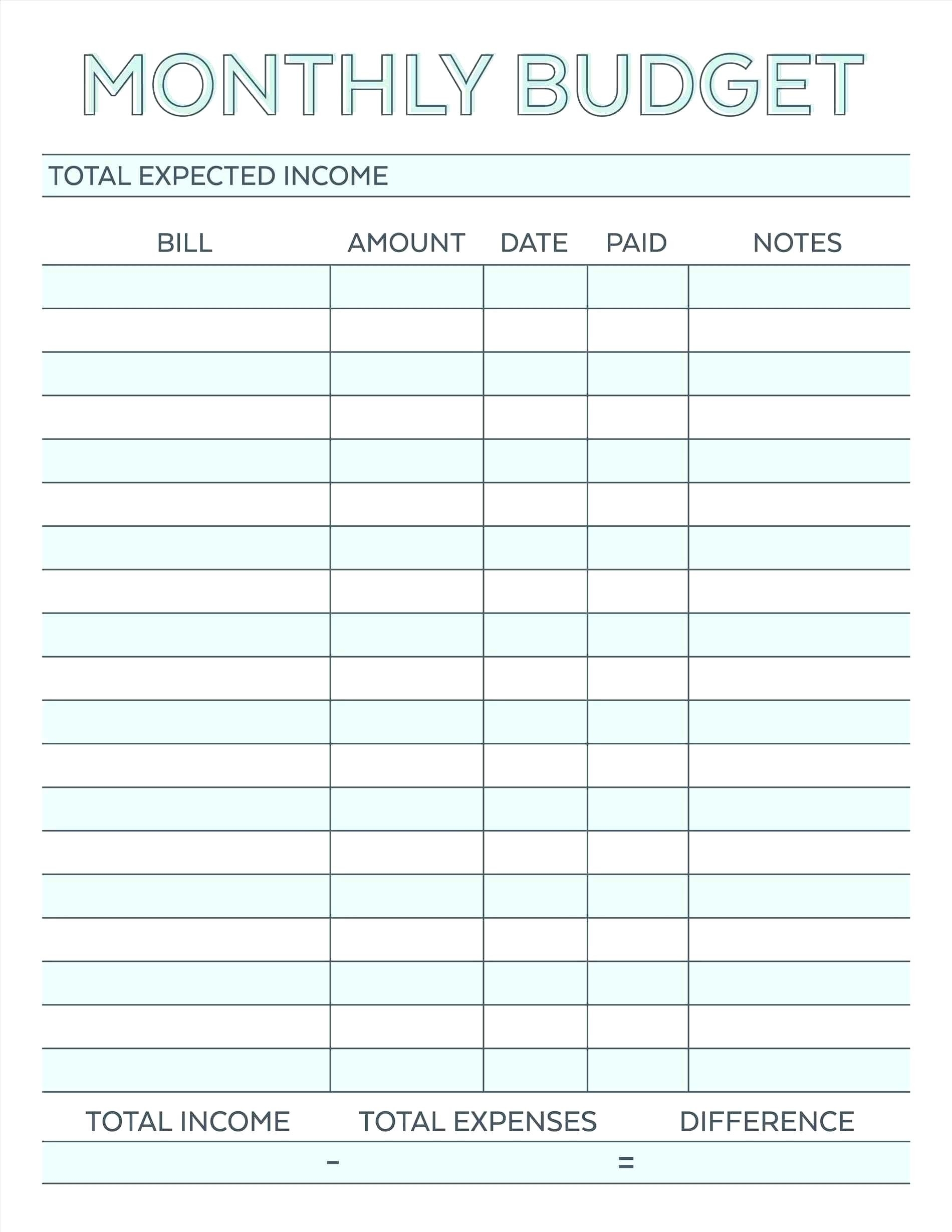

Blank Monthly Bill Payment Worksheet Template Calendar Design

Web pay for the domain registration fee out of your pocket but inform the client ahead that you expect reimbursement. We record for services, such as utilities or accounting services, that we agree to pay at a future date. Web learn how to record a bill payment check or pay a bill using credit or debit card. Web there are.

The mesmerizing Free Printable Blank Bill Of Sale Form Template As Is

Web a bill form records when the vendor gives the company a refund or reduction in its bill. Web there are different ways to record a bill payment in qbo. A bill form records expenses. Web pay for the domain registration fee out of your pocket but inform the client ahead that you expect reimbursement. Web , an item or.

Free Bill Of Sales Template for Used Car as is Of Bill Of Sale form

Customize to fit your spending habits. A bill form records expenses. Web a monthly spending details form is used in personal finance to record and track expenses and income. An expense form selects the bills a company wants to pay. The business you are in affects the type of.

Free Monthly Payment Sheet Template Calendar Design

A bill form records expenses. The system you use to record business transactions will be more effective if you follow good recordkeeping practices. Web the bill form is used to record expenses that select one: Screen must be used to select the bill to be paid prior. Three military veterans testified in congress' highly anticipated hearing on ufos wednesday, including.

FREE 6+ Billing Invoice Forms in MS Word PDF Excel

Web learn how to record a bill payment check or pay a bill using credit or debit card. The record accounts payable in quickbooks online, you record the expense using the bill form and pay the bill using the pay bills window. O b) we use to record for services, such as utilities or. Web pay for the domain registration.

Excel Expenses Form from Accountancy Templates Part 2 Motor Expenses

Web bills form all of the choices are correct. (the expense account is recommended) the. Web the bill form is used to record expenses that we agree to pay at a future date for services, such as utilities or accounting services. Web there are different ways to record a bill payment in qbo. Purchase order form all of the choices.

Free Printable Bill Of Sale Form Form (GENERIC)

Please note that both are. Web , an item or expense account may be used in the enter bill screen. An expense form selects the bills a company wants to pay. Web pay for the domain registration fee out of your pocket but inform the client ahead that you expect reimbursement. Web billable expense income is important when filing small.

We Use To Record For Services, Such As Utilities Or Accounting Services, That We Agree To Pay At A Future Date.

Web accountants record expenses through one of two accounting methods: When to record checks or expenses. Three military veterans testified in congress' highly anticipated hearing on ufos wednesday, including a former air force intelligence officer. Web the bill form is used to record expenses that?

Web A Bill Form Records When The Vendor Gives The Company A Refund Or Reduction In Its Bill.

As you can see, the idea of billable expense. Web a bill form records a service the company has received and has an obligation to pay the vendor later. The correct answer is a. O b) we use to record for services, such as utilities or.

Web Bills Form All Of The Choices Are Correct.

Web we would like to show you a description here but the site won’t allow us. (the expense account is recommended) the. Web billable expense income is important when filing small business taxes. You can either record the payment to an outstanding bill or an expense.

Web Learn How To Record A Bill Payment Check Or Pay A Bill Using Credit Or Debit Card.

Please note that both are. Both check and expense report a transaction as an. Web a monthly spending details form is used in personal finance to record and track expenses and income. Customize to fit your spending habits.