Form 8832 Vs 2553

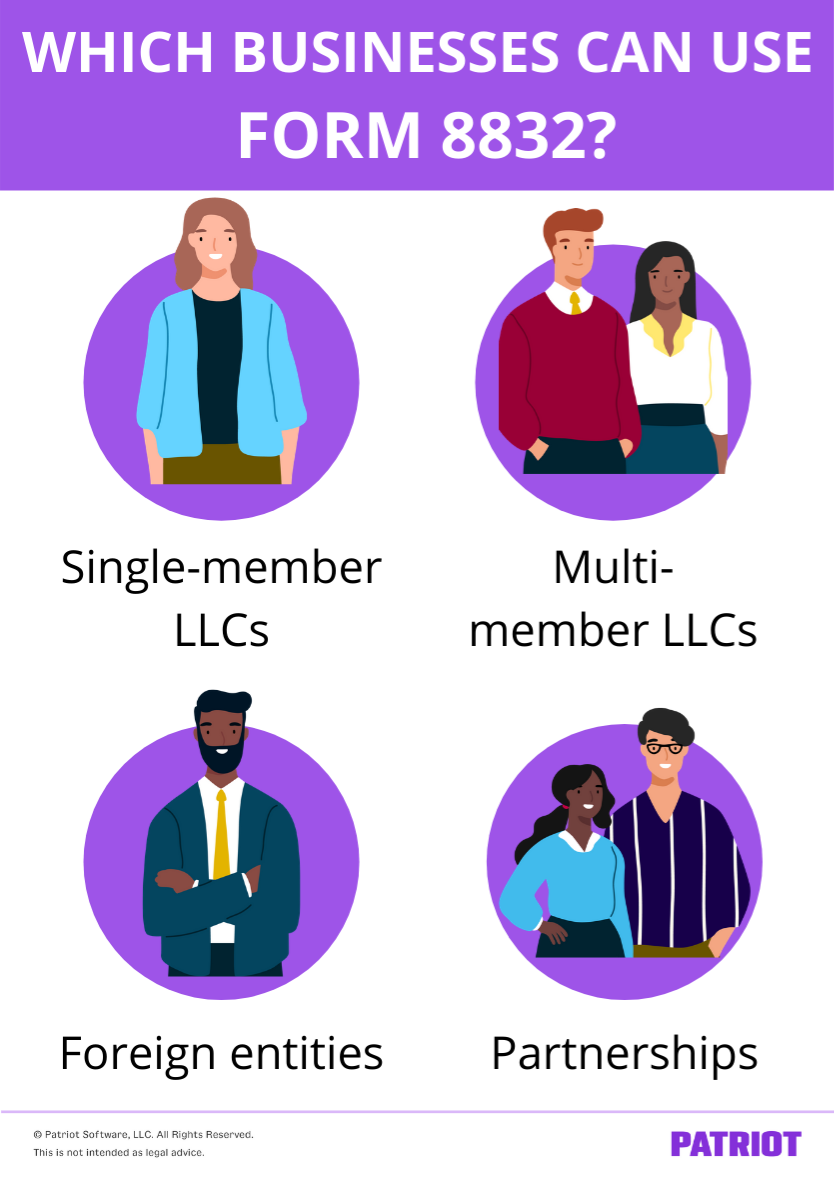

Form 8832 Vs 2553 - Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Understanding the difference between form 8832 and form 2553 is of the utmost importance if you're interested in changing your business's tax status. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Form 8832 can be used by a business entity that wishes to. If an llc does not file irs form 8832, it will be classified, for. If form 8832 is not filed, the effective date of the s election could be entered. The biggest difference between form 8832 and form 2553 is the tax classification that you’re requesting. If you're filing form 2553, you don't need to. Web form 8832 vs. Web irs form 8832 vs 2553 if you have a corporation and are ok with c corp.

Web selected as best answer. Web form 8832 vs. Web form 8832 vs. If form 8832 is not filed, the effective date of the s election could be entered. If you are an llc with a single member, you are by default classified as a sole proprietorship for federal tax purposes—there is no need to file the 8832 under these circumstances. Form 8832 can also be used to change a prior election. If you’re an llc or partnership, use form 8832 if you want to be taxed as a. Web irs form 8832 vs 2553 if you have a corporation and are ok with c corp. Understanding the difference between form 8832 and form 2553 is of the utmost importance if you're interested in changing your business's tax status. Web in either of those cases if the llc wants to elect to be taxed as a corporation the form 8832 is used.

Web selected as best answer. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Taxation, or if you have an llc and are ok with the default classification, then no additional entity classification is required. Web in either of those cases if the llc wants to elect to be taxed as a corporation the form 8832 is used. If you’re an llc or partnership, use form 8832 if you want to be taxed as a. Form 8832 can be used by a business entity that wishes to. Form 8832 can also be used to change a prior election. Web irs form 8832 vs 2553 if you have a corporation and are ok with c corp. Web form 8832 vs.

Form 8832 Entity Classification Election (2013) Free Download

If an llc does not file irs form 8832, it will be classified, for. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Taxation, or if you have an llc and are ok with the default classification, then no additional entity classification is required. Web form 8832 vs. If you’re.

(PDF) Form 8832 Shane Dorn Academia.edu

If you’re an llc or partnership, use form 8832 if you want to be taxed as a. Web selected as best answer. Form 8832 can be used by a business entity that wishes to. Web form 8832 vs. If you are an llc with a single member, you are by default classified as a sole proprietorship for federal tax purposes—there.

Form 8832 Entity Classification Election (2013) Free Download

Taxation, or if you have an llc and are ok with the default classification, then no additional entity classification is required. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Web form 8832 vs. Web selected as best answer. Understanding the difference between form 8832 and form 2553 is of.

Delaware Llc Uk Tax Treatment Eayan

Web form 8832 vs. Form 8832 can also be used to change a prior election. If an llc does not file irs form 8832, it will be classified, for. Taxation, or if you have an llc and are ok with the default classification, then no additional entity classification is required. Web information about form 8832, entity classification election, including recent.

Form 8832 Edit, Fill, Sign Online Handypdf

Web selected as best answer. If you have more than one member, you are by default classified as a partnership for federal tax purposes, and you do not have to file the. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Web form 8832 vs. Form 8832 can be used by a.

Form 8832 Entity Classification Election (2013) Free Download

Understanding the difference between form 8832 and form 2553 is of the utmost importance if you're interested in changing your business's tax status. If you're filing form 2553, you don't need to. If you are an llc with a single member, you are by default classified as a sole proprietorship for federal tax purposes—there is no need to file the.

What Is IRS Form 8832? Definition, Deadline, & More

If you're filing form 2553, you don't need to. Web selected as best answer. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. Form 8832 can be used by a business entity that wishes to. If form 8832 is not filed, the effective date of the s election could be entered.

Election of 'S' Corporation Status and Instructions IRS 2553 US

If you are an llc with a single member, you are by default classified as a sole proprietorship for federal tax purposes—there is no need to file the 8832 under these circumstances. Understanding the difference between form 8832 and form 2553 is of the utmost importance if you're interested in changing your business's tax status. Web in either of those.

Irs Form 8832 Fillable Pdf Printable Forms Free Online

Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes. If you're filing form 2553, you don't need to. If you’re an llc or partnership, use form 8832 if you want to be taxed as a. If you have more than one member, you are by default classified as a partnership for federal.

What is IRS Form 2553? Bench Accounting

Taxation, or if you have an llc and are ok with the default classification, then no additional entity classification is required. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Web selected as best answer. If you are an llc with a single member, you are by default classified as.

If An Llc Does Not File Irs Form 8832, It Will Be Classified, For.

If form 8832 is not filed, the effective date of the s election could be entered. Web form 8832 vs. If you’re an llc or partnership, use form 8832 if you want to be taxed as a. Web form 8832 vs.

Form 8832 Can Also Be Used To Change A Prior Election.

Web irs form 8832 vs 2553 if you have a corporation and are ok with c corp. If you're filing form 2553, you don't need to. Form 8832 can be used by a business entity that wishes to. The biggest difference between form 8832 and form 2553 is the tax classification that you’re requesting.

Web Selected As Best Answer.

If you have more than one member, you are by default classified as a partnership for federal tax purposes, and you do not have to file the. Web information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. If you are an llc with a single member, you are by default classified as a sole proprietorship for federal tax purposes—there is no need to file the 8832 under these circumstances. Form 8832 is used by eligible entities to choose how they are classified for federal tax purposes.

Web In Either Of Those Cases If The Llc Wants To Elect To Be Taxed As A Corporation The Form 8832 Is Used.

Understanding the difference between form 8832 and form 2553 is of the utmost importance if you're interested in changing your business's tax status. Taxation, or if you have an llc and are ok with the default classification, then no additional entity classification is required.