8915-F Form

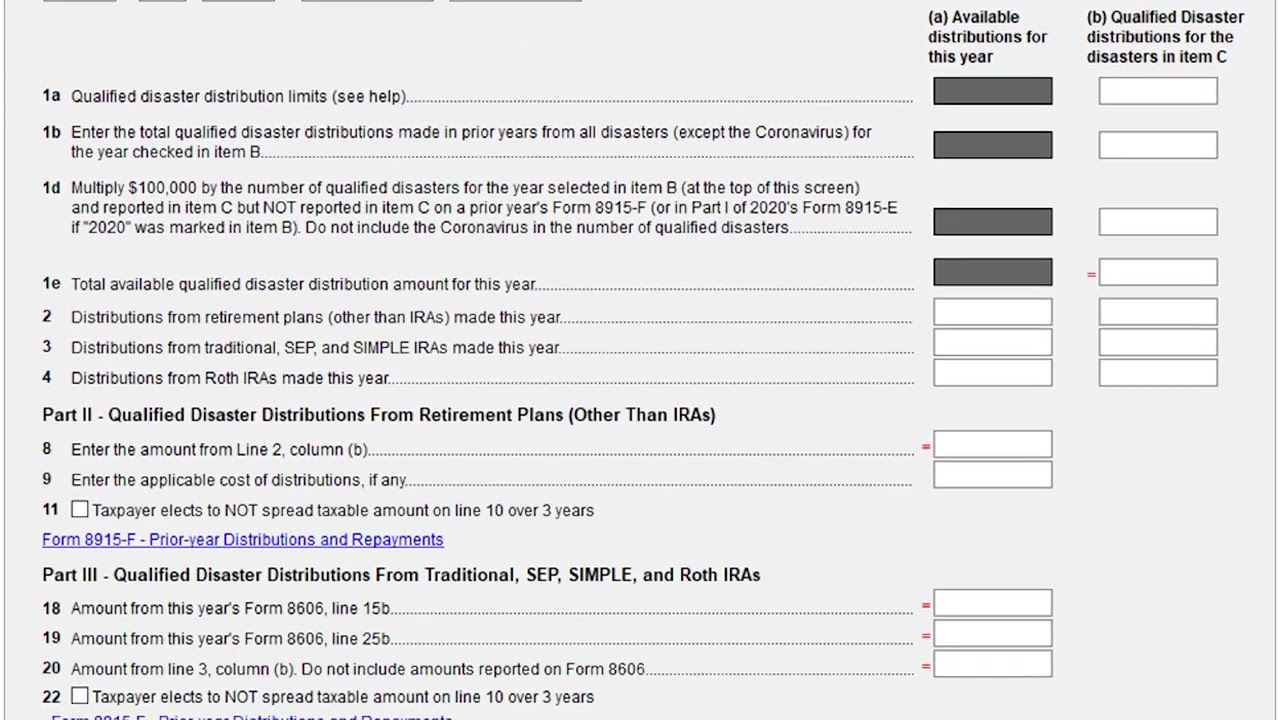

8915-F Form - Repayments of current and prior year qualified disaster distributions. The taxpayer made a repayment of a qualified disaster. You can choose to use worksheet 1b even if you are not required to do so. Qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. (january 2022) qualified disaster retirement plan distributions and repayments. Department of the treasury internal revenue service. See worksheet 1b, later, to determine whether you must use worksheet 1b. For instructions and the latest. Web how do i enter qualified disaster retirement plan distributions and repayments in drake21? Your social security number before you begin (see instructions for details):

I cannot sit in limbo. The taxpayer made a repayment of a qualified disaster. Repayments of current and prior year qualified disaster distributions. This distribution schedule is an option. See worksheet 1b, later, to determine whether you must use worksheet 1b. Your social security number before you begin (see instructions for details): Get ready for tax season deadlines by completing any required tax forms today. I apparently jinks thing welcome back! Ask questions, get answers, and join our. You can choose to use worksheet 1b even if you are not required to do so.

(january 2022) qualified disaster retirement plan distributions and repayments. You can choose to use worksheet 1b even if you are not required to do so. The taxpayer made a repayment of a qualified disaster. I apparently jinks thing welcome back! Qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. Repayments of current and prior year qualified disaster distributions. Department of the treasury internal revenue service. For instructions and the latest. Ad edit, sign and print tax forms on any device with uslegalforms. This distribution schedule is an option.

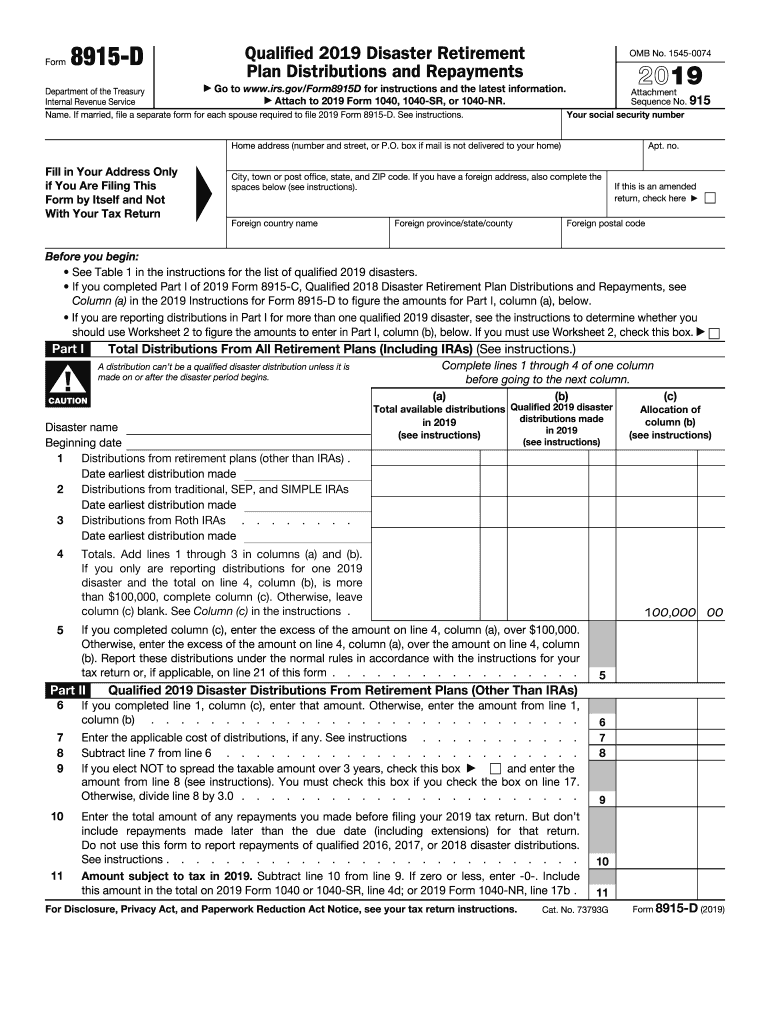

8915 D Form Fill Out and Sign Printable PDF Template signNow

The taxpayer made a repayment of a qualified disaster. Your social security number before you begin (see instructions for details): I cannot sit in limbo. You can choose to use worksheet 1b even if you are not required to do so. Web how do i enter qualified disaster retirement plan distributions and repayments in drake21?

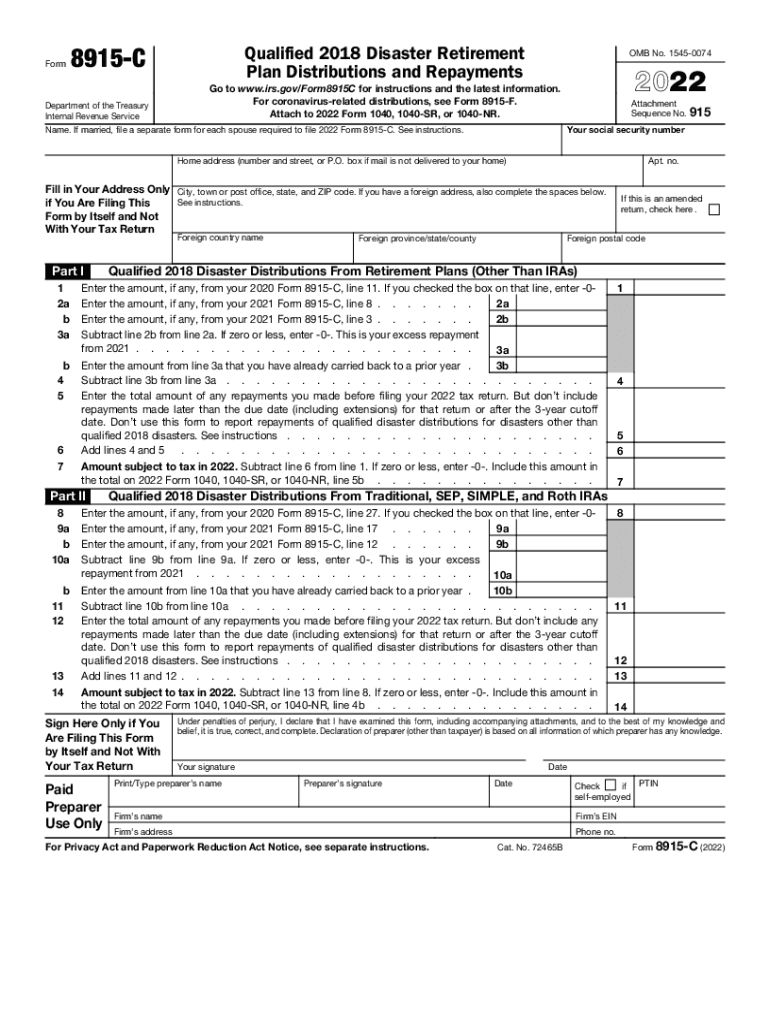

2022 Form IRS 8915C Fill Online, Printable, Fillable, Blank pdfFiller

The taxpayer made a repayment of a qualified disaster. Department of the treasury internal revenue service. See worksheet 1b, later, to determine whether you must use worksheet 1b. For instructions and the latest. You can choose to use worksheet 1b even if you are not required to do so.

Fill Free fillable Form 8915F Qualified Disaster Retirement Plan

Qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. Ask questions, get answers, and join our. The taxpayer made a repayment of a qualified disaster. This distribution schedule is an option. (january 2022) qualified disaster retirement plan distributions and repayments.

8915 F 2020 Coronavirus Distributions for 2021 Tax Returns YouTube

This distribution schedule is an option. Qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. Get ready for tax season deadlines by completing any required tax forms today. I cannot sit in limbo. Your social security number before you begin (see instructions for details):

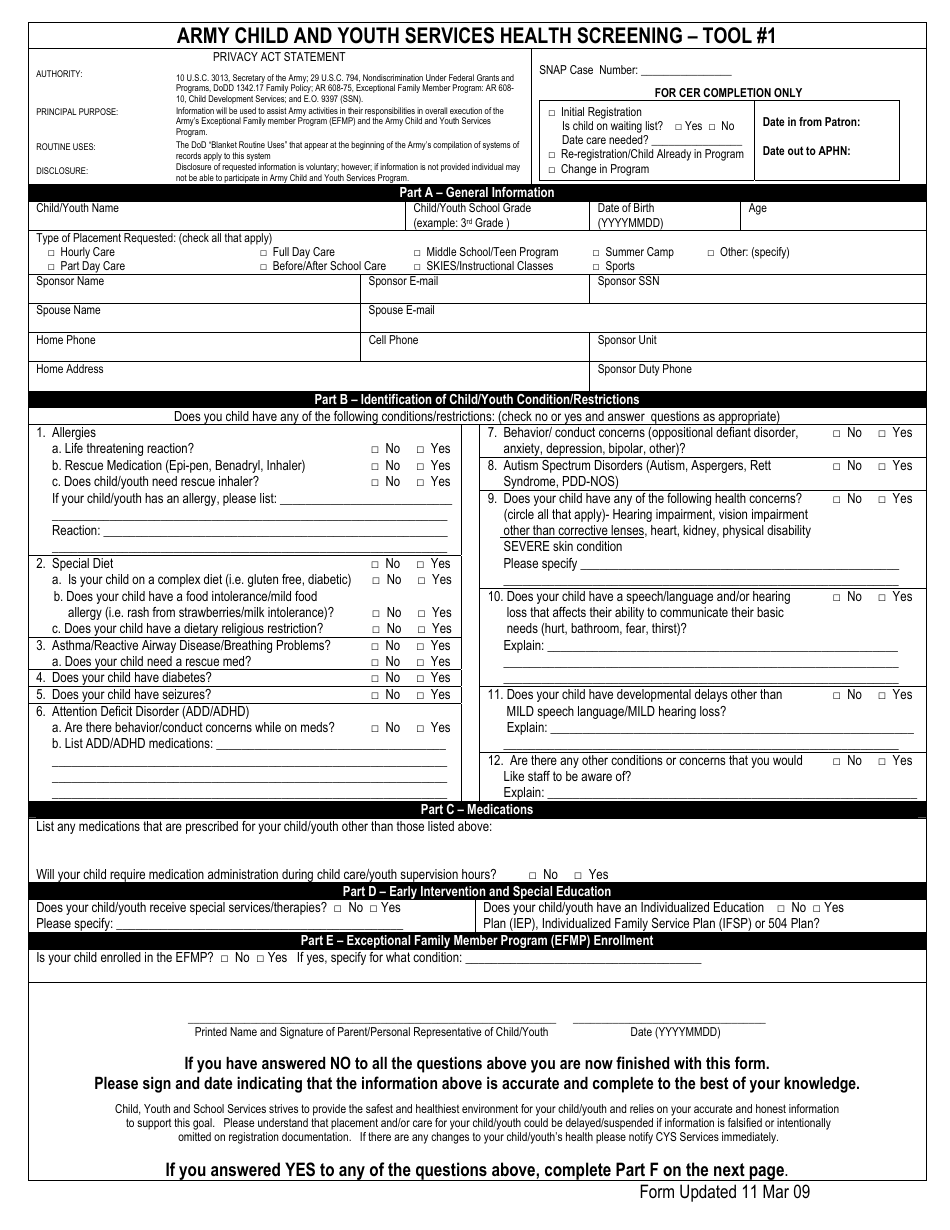

Army Child and Youth Services Health Screening Tool 1 Download

Repayments of current and prior year qualified disaster distributions. The taxpayer made a repayment of a qualified disaster. Department of the treasury internal revenue service. Your social security number before you begin (see instructions for details): I apparently jinks thing welcome back!

IRS Issues 'Forever' Form 8915F For Retirement Distributions The

Repayments of current and prior year qualified disaster distributions. Qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. The timing of your distributions and repayments will determine whether you need to file an amended return to claim them. (january 2022) qualified disaster retirement plan distributions and repayments. I apparently jinks thing welcome back!

Form 8915 Qualified Hurricane Retirement Plan Distributions and

The taxpayer made a repayment of a qualified disaster. Your social security number before you begin (see instructions for details): See worksheet 1b, later, to determine whether you must use worksheet 1b. Qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. I apparently jinks thing welcome back!

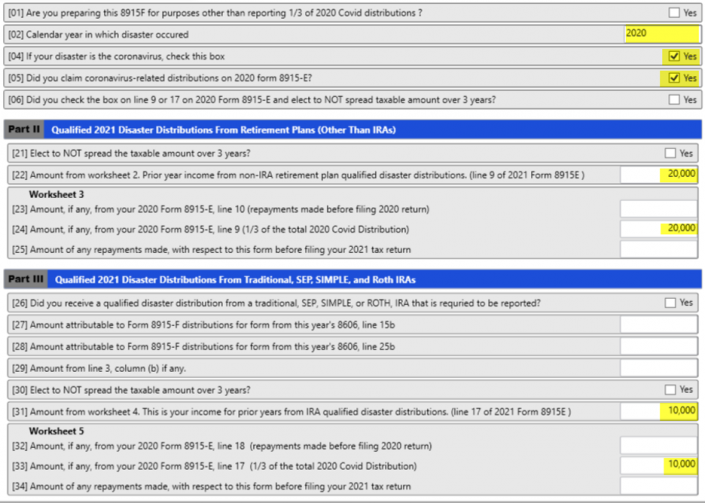

Basic 8915F Instructions for 2021 Taxware Systems

I apparently jinks thing welcome back! Repayments of current and prior year qualified disaster distributions. Your social security number before you begin (see instructions for details): See worksheet 1b, later, to determine whether you must use worksheet 1b. The timing of your distributions and repayments will determine whether you need to file an amended return to claim them.

Where can I find the 8915 F form on the TurboTax app?

This distribution schedule is an option. Ask questions, get answers, and join our. The taxpayer made a repayment of a qualified disaster. You can choose to use worksheet 1b even if you are not required to do so. Qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax.

'Forever' form 8915F issued by IRS for retirement distributions Newsday

Department of the treasury internal revenue service. (january 2022) qualified disaster retirement plan distributions and repayments. You can choose to use worksheet 1b even if you are not required to do so. Get ready for tax season deadlines by completing any required tax forms today. See worksheet 1b, later, to determine whether you must use worksheet 1b.

Web How Do I Enter Qualified Disaster Retirement Plan Distributions And Repayments In Drake21?

Get ready for tax season deadlines by completing any required tax forms today. Repayments of current and prior year qualified disaster distributions. For instructions and the latest. See worksheet 1b, later, to determine whether you must use worksheet 1b.

This Distribution Schedule Is An Option.

(january 2022) qualified disaster retirement plan distributions and repayments. Ask questions, get answers, and join our. The timing of your distributions and repayments will determine whether you need to file an amended return to claim them. Your social security number before you begin (see instructions for details):

Department Of The Treasury Internal Revenue Service.

Ad edit, sign and print tax forms on any device with uslegalforms. I cannot sit in limbo. The taxpayer made a repayment of a qualified disaster. Qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax.

You Can Choose To Use Worksheet 1B Even If You Are Not Required To Do So.

I apparently jinks thing welcome back!