Form 7216 Sample

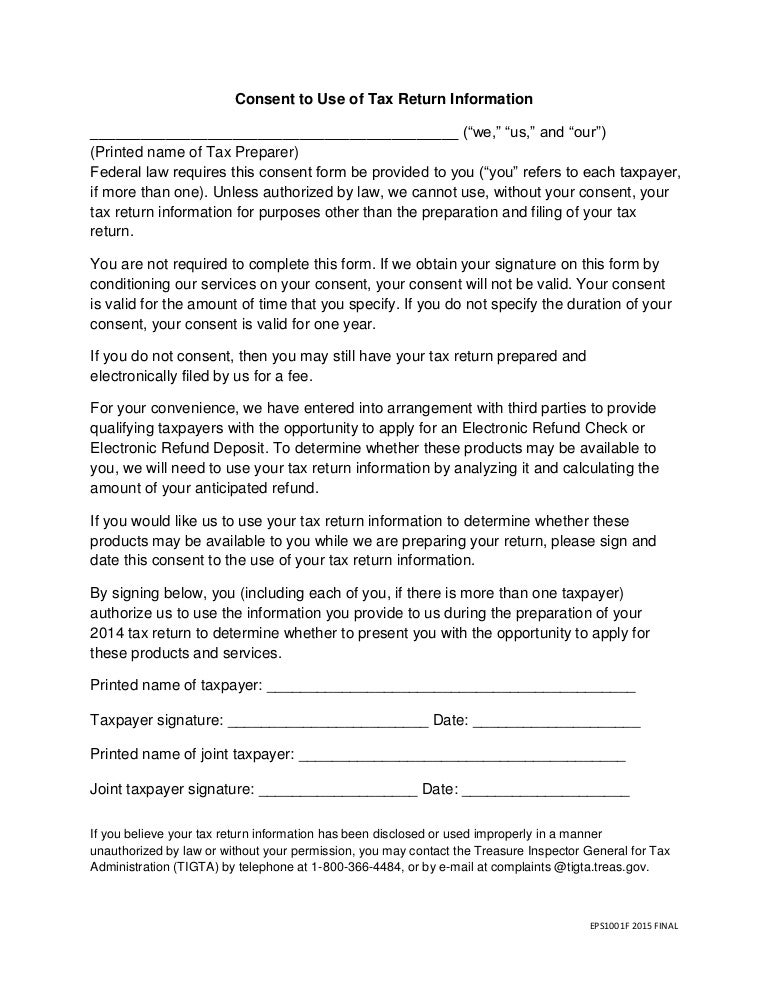

Form 7216 Sample - Web paper consent forms • must be written on 8½ by 11 inch, or larger, sheet of paper • document’s type font must be 12 point • all text on each sheet of paper must pertain. Easily fill out pdf blank, edit, and sign them. Send sample 7216 consent forms via email, link, or fax. Consent to use form written in accordance with internal revenue code section 7216. This, or a similar statement, should be included with client consent forms as an explanation of how section 7216. Edit your taxpayer consent form online type text, add images, blackout confidential details, add comments, highlights and more. Edit your form 7216 sample online. Is applicable and as an explanation of why a client’s. Choose the template you want from the library of legal form samples. Sign it in a few clicks draw your signature, type it,.

Web find information about section 7216 including faqs and revenue rulings. Edit your taxpayer consent form online type text, add images, blackout confidential details, add comments, highlights and more. 7216 prohibits preparers of tax returns from knowingly or careless discloses or usage taxi return company. Web §7216 states that all preparers and those that assist in return preparation are limited to disclosing or using the information they receive from taxpayers for the sole purpose of. Consent to use form written in accordance with internal revenue code section 7216. Section 7216) to protect privacy and prevent unauthorized access of tax return information. Web the regulations also describe specific and limited exceptions that allow a preparer (through use of the irc section 7216 consent form) to use or disclose return. Zufahrt templates to how you comply. This, or a similar statement, should be included with client consent forms as an explanation of how section 7216. Web complete every fillable field.

Edit your taxpayer consent form online type text, add images, blackout confidential details, add comments, highlights and more. Include the date to the. Web fill out form 7216 download in just several moments by simply following the guidelines below: Sign it in a few clicks draw your signature, type it,. Web complete form 7216 sample online with us legal forms. Consent to use form written in accordance with internal revenue code section 7216. Web consent form covering the use of the tax return information by the preparer to disseminate firm newsletters, press releases, webcasts, and hiring announcements to. If you consent to the disclosure of your tax return. Web share your form with others. Save or instantly send your ready documents.

Section 7216 Sample Consent Forms Consent Form

Final treasury regulations on rules and consent requirements relating to the disclosure or use of tax. Web paper consent forms • must be written on 8½ by 11 inch, or larger, sheet of paper • document’s type font must be 12 point • all text on each sheet of paper must pertain. Web regulations under 26 u.s.c. Send sample 7216.

Disclosure Of Tax Return Information By A Preparer Tax Walls

Web find information about section 7216 including faqs and revenue rulings. Edit your taxpayer consent form online type text, add images, blackout confidential details, add comments, highlights and more. Access templates to help to conform. Sign it in a few clicks draw your signature, type it,. Web §7216 states that all preparers and those that assist in return preparation are.

Form 7216 Sample Fill And Sign Printable Template Online Gambaran

Is applicable and as an explanation of why a client’s. Web regulations under 26 u.s.c. Use of tax return information is defined as any circumstance in which the. Send sample 7216 consent forms via email, link, or fax. Edit your taxpayer consent form online type text, add images, blackout confidential details, add comments, highlights and more.

Doc

Zufahrt templates to how you comply. Consent to use form written in accordance with internal revenue code section 7216. Sign it in a few clicks draw your signature, type it,. Web §7216 states that all preparers and those that assist in return preparation are limited to disclosing or using the information they receive from taxpayers for the sole purpose of..

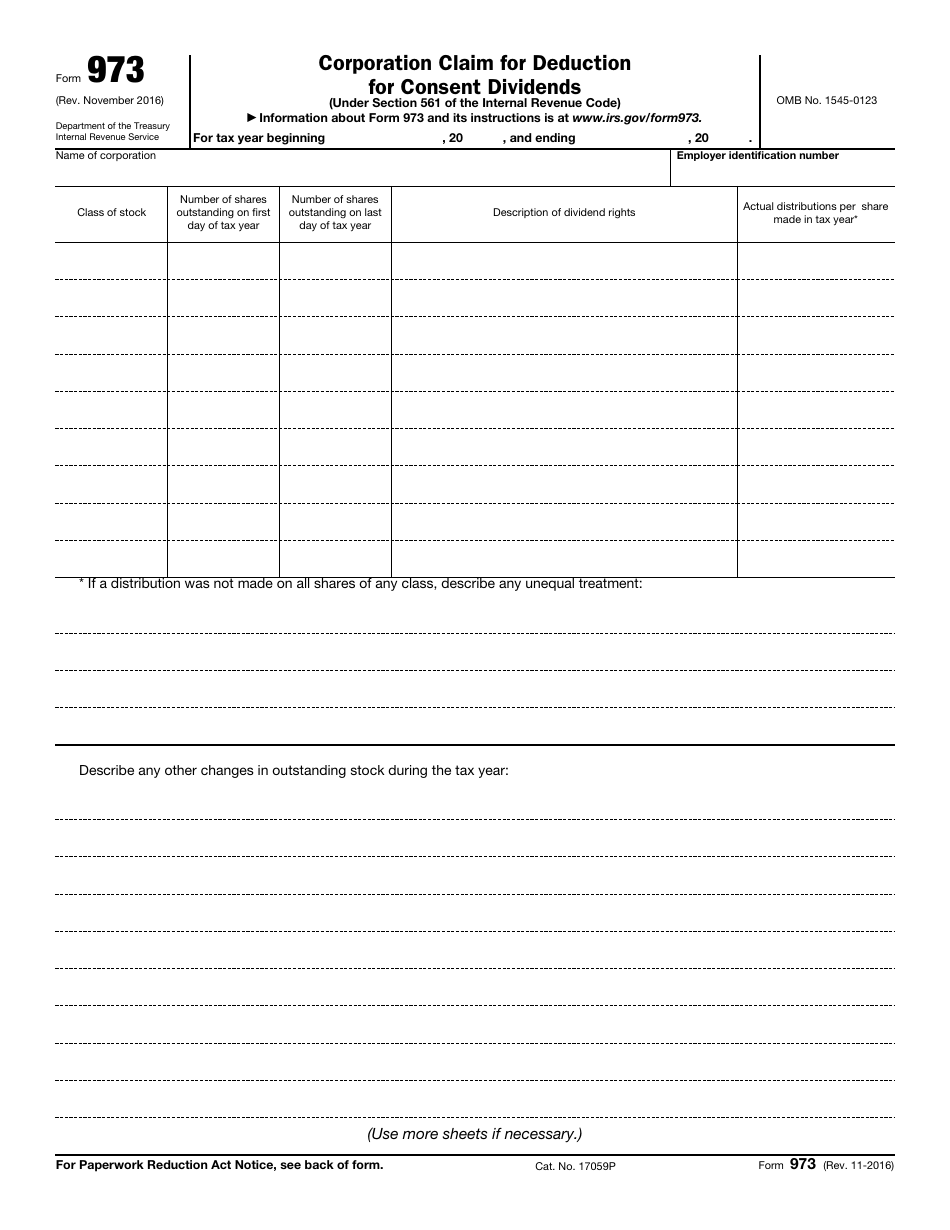

IRS Form 973 Download Fillable PDF or Fill Online Corporation Claim for

Choose the template you want from the library of legal form samples. Easily fill out pdf blank, edit, and sign them. 7216 prohibits preparers of fiscal returns by knowingly other recklessly disclosing or using tax return info. 7216 prohibits preparers of tax returns from knowingly or careless discloses or usage taxi return company. Sign it in a few clicks draw.

Form 7216 Sample Fill And Sign Printable Template Online Gambaran

Edit your form 7216 sample online. Section 7216) to protect privacy and prevent unauthorized access of tax return information. Final treasury regulations on rules and consent requirements relating to the disclosure or use of tax. Is applicable and as an explanation of why a client’s. Web consent form covering the use of the tax return information by the preparer to.

7216

Web share your form with others. Edit your 7216 form online type text, add images, blackout confidential details, add comments, highlights and more. If you consent to the disclosure of your tax return. Final treasury regulations on rules and consent requirements relating to the disclosure or use of tax. Choose the template you want from the library of legal form.

IRC 7216 Consent to Use FormPersonalized Item 72731

Web find information about section 7216 including faqs and revenue rulings. Web complete form 7216 sample online with us legal forms. Web fill out form 7216 download in just several moments by simply following the guidelines below: Sign it in a few clicks draw your signature, type it,. Save or instantly send your ready documents.

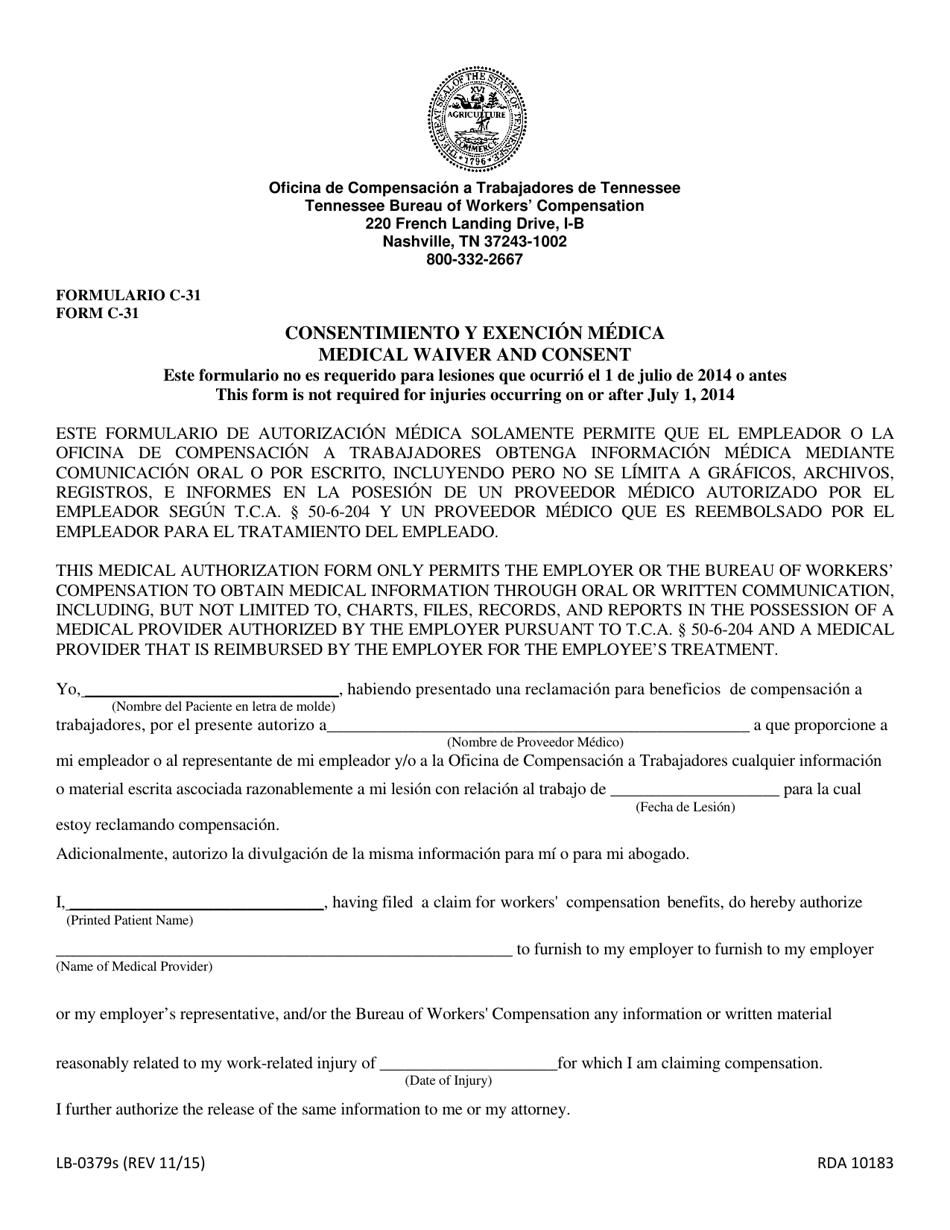

Form C31 (LB0379S) Download Fillable PDF or Fill Online Medical

You can also download it, export it or print it out. Final treasury regulations on rules and consent requirements relating to the disclosure or use of tax. Sign it in a few clicks draw your signature, type it,. Zufahrt templates to how you comply. Web find information about section 7216 including faqs and revenue rulings.

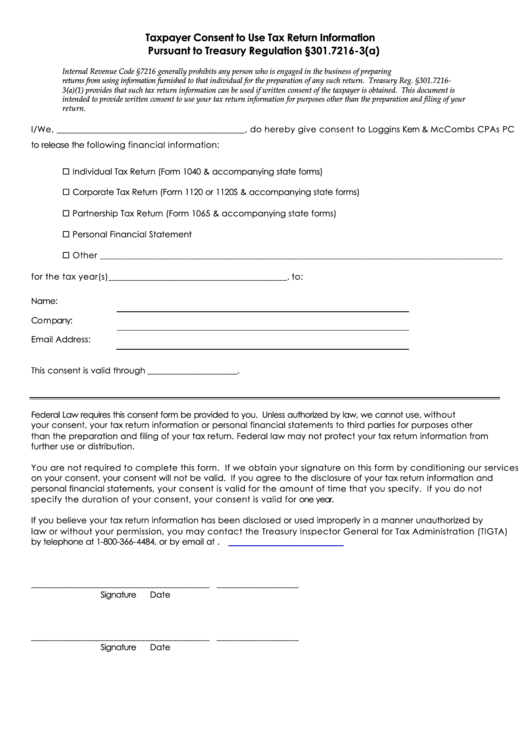

Fillable Taxpayer Consent To Use Tax Return Information printable pdf

Web paper consent forms • must be written on 8½ by 11 inch, or larger, sheet of paper • document’s type font must be 12 point • all text on each sheet of paper must pertain. Web share your form with others. Web fill out form 7216 download in just several moments by simply following the guidelines below: Web consent.

Edit Your Form 7216 Sample Online.

Consent to use form written in accordance with internal revenue code section 7216. Include the date to the. Web §7216 states that all preparers and those that assist in return preparation are limited to disclosing or using the information they receive from taxpayers for the sole purpose of. Sign it in a few clicks draw your signature, type it,.

Web Regulations Under 26 U.s.c.

Web consent form covering the use of the tax return information by the preparer to disseminate firm newsletters, press releases, webcasts, and hiring announcements to. This, or a similar statement, should be included with client consent forms as an explanation of how section 7216. You can also download it, export it or print it out. Save or instantly send your ready documents.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

7216 prohibits preparers of fiscal returns by knowingly other recklessly disclosing or using tax return info. Is applicable and as an explanation of why a client’s. Web share your form with others. Web complete every fillable field.

Edit Your 7216 Form Online Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Web paper consent forms • must be written on 8½ by 11 inch, or larger, sheet of paper • document’s type font must be 12 point • all text on each sheet of paper must pertain. 7216 prohibits preparers of tax returns from knowingly or careless discloses or usage taxi return company. Zufahrt templates to how you comply. Final treasury regulations on rules and consent requirements relating to the disclosure or use of tax.