How To Complete Form 1116

How To Complete Form 1116 - Web what do i need? Go to tax tools > tools to open the tools center. Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate,. One form 1116, you must. Within your federal tax return: At the end of this lesson, using your resource materials, you will be able to: Web form 1116 when you invest in these mutual funds and/or etfs in a regular taxable brokerage account, your broker will report to you the total foreign taxes you paid. Web this video describes form 1116, which is the form that us expats need to use to claim the foreign tax credit. Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116.

At the end of this lesson, using your resource materials, you will be able to: Web what do i need? Within your federal tax return: Web use a separate form 1116 for each category of income listed below. Web form 1116 when you invest in these mutual funds and/or etfs in a regular taxable brokerage account, your broker will report to you the total foreign taxes you paid. Web you file form 1116 if you are an individual, estate, or trust, and you paid or accrued certain foreign taxes to a foreign country or u.s. Go to tax tools > tools to open the tools center. Web use a separate form 1116 for each category of income listed below. Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate,. Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover.

Web a form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return) and other conditions are met; Web form 1116 when you invest in these mutual funds and/or etfs in a regular taxable brokerage account, your broker will report to you the total foreign taxes you paid. Check only one box on each. 19 name identifying number as shown on page 1 of. At the end of this lesson, using your resource materials, you will be able to: Web what do i need? Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. The foreign tax credit is essentially a dollar for. Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web 1 best answer fangxial expert alumni try the following steps to resolve your issue:

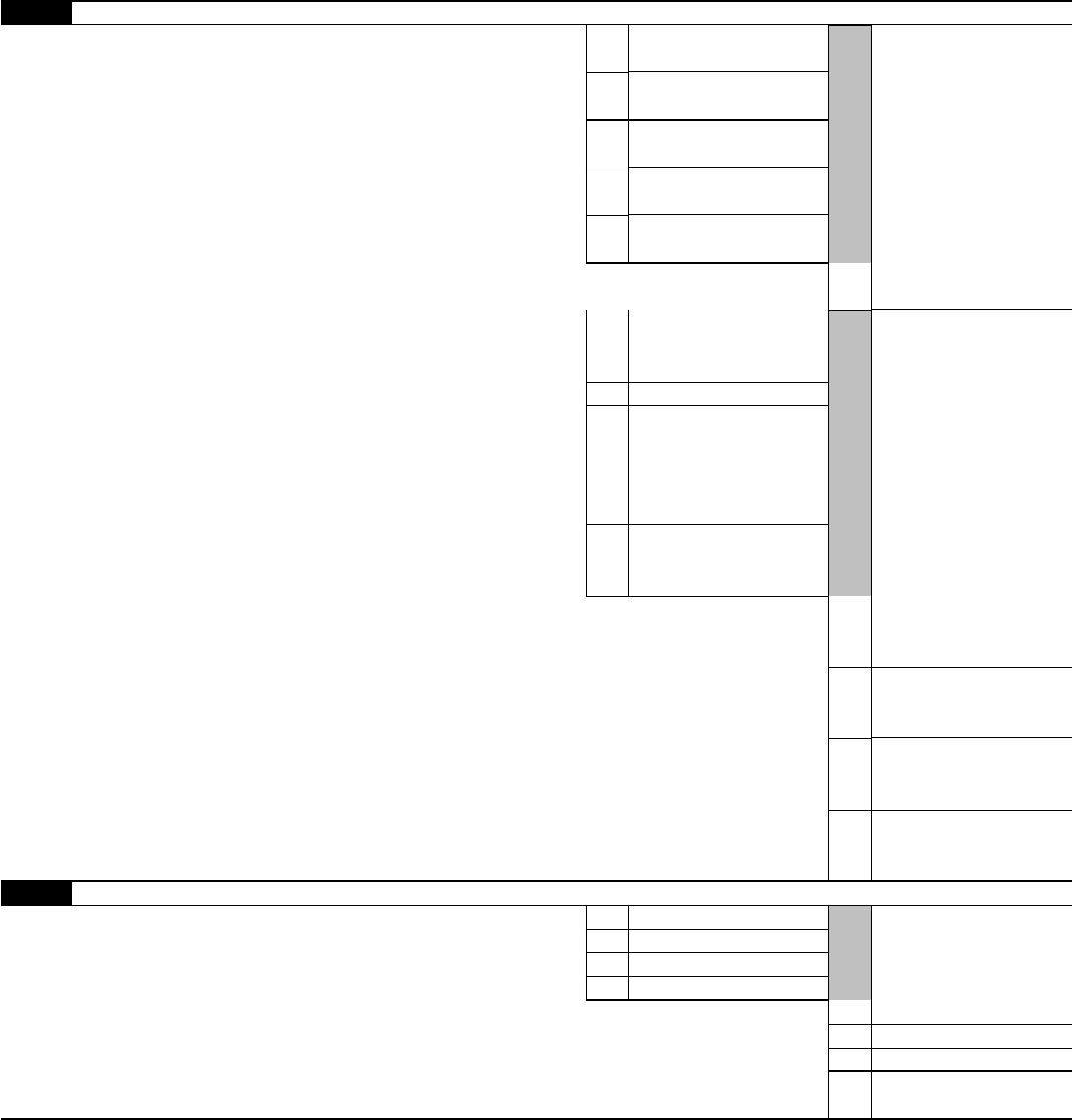

Form 1116 part 1 instructions

Web form 1116 when you invest in these mutual funds and/or etfs in a regular taxable brokerage account, your broker will report to you the total foreign taxes you paid. Web 1 best answer fangxial expert alumni try the following steps to resolve your issue: One form 1116, you must. 19 name identifying number as shown on page 1 of..

Form 1116 Edit, Fill, Sign Online Handypdf

Web form 1116 when you invest in these mutual funds and/or etfs in a regular taxable brokerage account, your broker will report to you the total foreign taxes you paid. Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate,. Check.

Foreign Tax Credit & IRS Form 1116 Explained Greenback Expat Taxes

Check only one box on each. At the end of this lesson, using your resource materials, you will be able to: One form 1116, you must. Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate,. Web use a separate form.

How can I add Form 1116? General Chat ATX Community

Web this video describes form 1116, which is the form that us expats need to use to claim the foreign tax credit. Web use a separate form 1116 for each category of income listed below. Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116..

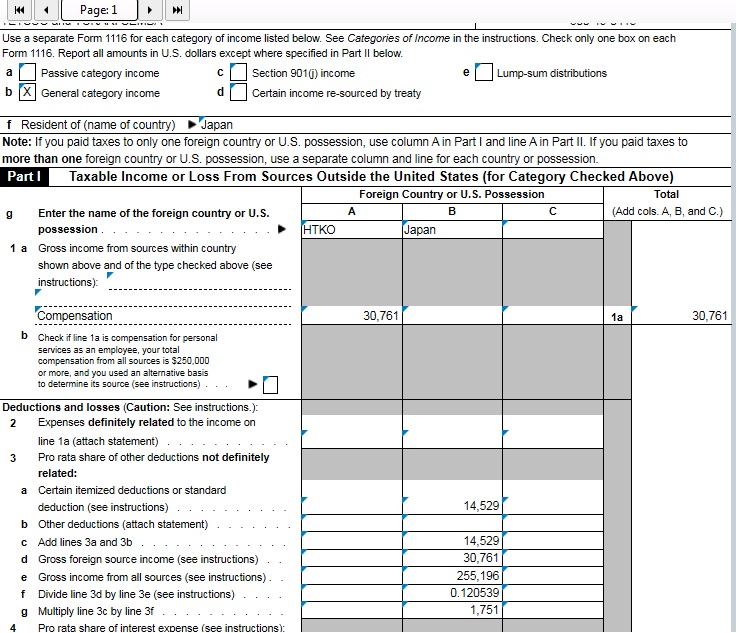

2015 Instructions For Form 1116 printable pdf download

Web a form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return) and other conditions are met; Web you file form 1116 if you are an individual, estate, or trust, and you paid or accrued certain foreign taxes to a foreign country or u.s..

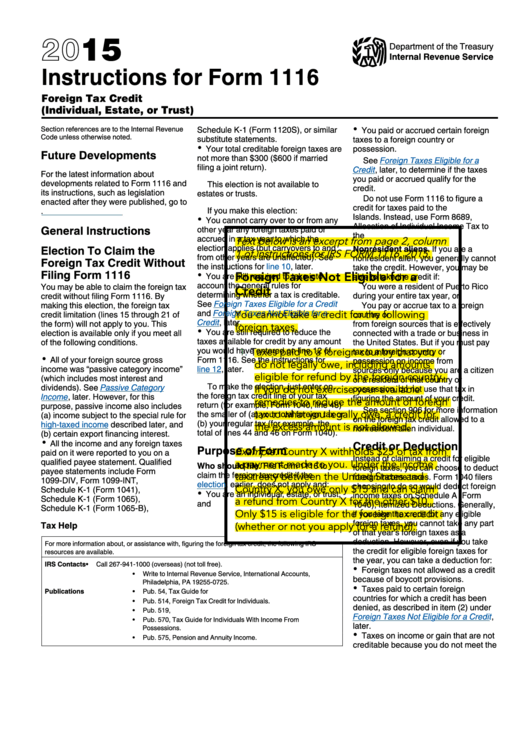

Fillable Form 1116 Foreign Tax Credit printable pdf download

Check only one box on each form. Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate,. Web use a separate form 1116 for each category of income listed below. 19 name identifying number as shown on page 1 of. Web.

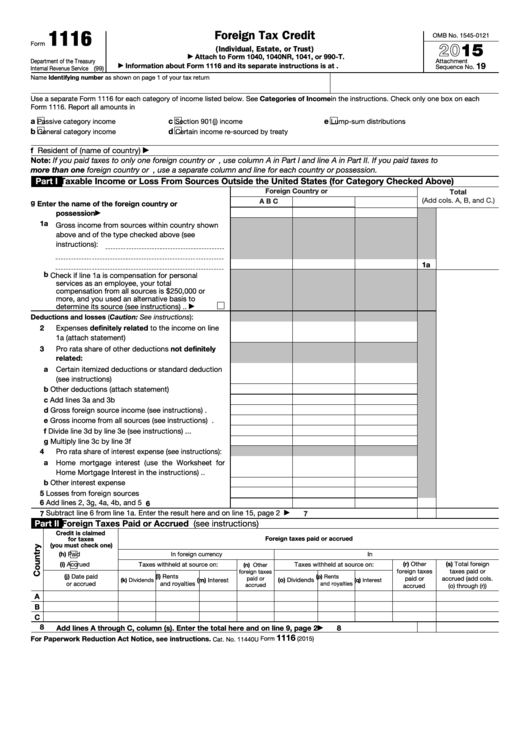

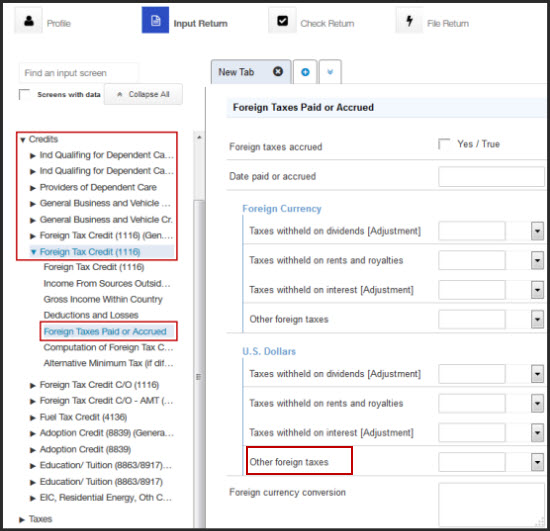

How do I generate Form 1116 Foreign Tax Credit in ProConnect Tax

Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116. Go to tax tools > tools to open the tools center. Web form 1116 when you invest in these mutual funds and/or etfs in a regular taxable brokerage account, your broker will report to you.

Form 1116 Instructions 2022 2023 IRS Forms Zrivo

Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate,. Web what do i need? Go to tax tools > tools to open the tools center. One form 1116, you must. Web a form 1116 does not have to be completed.

2014 USCIS M1116 Form I9 Fill Online, Printable, Fillable, Blank

Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web use a separate form 1116 for each category of income listed below. The foreign tax credit is essentially a dollar for. Web a form 1116 does not have to be completed if.

How to Complete Form 1120S Tax Return for an S Corp

Web 1 best answer fangxial expert alumni try the following steps to resolve your issue: At the end of this lesson, using your resource materials, you will be able to: The foreign tax credit is essentially a dollar for. Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each.

Within Your Federal Tax Return:

Check only one box on each. At the end of this lesson, using your resource materials, you will be able to: Web what do i need? Web use a separate form 1116 for each category of income listed below.

Check Only One Box On Each Form.

Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Go to tax tools > tools to open the tools center. Web you file form 1116 if you are an individual, estate, or trust, and you paid or accrued certain foreign taxes to a foreign country or u.s. Web general instructions purpose of schedule schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover.

19 Name Identifying Number As Shown On Page 1 Of.

One form 1116, you must. Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate,. Web use a separate form 1116 for each category of income listed below. The foreign tax credit is essentially a dollar for.

Web 1 Best Answer Fangxial Expert Alumni Try The Following Steps To Resolve Your Issue:

Web for the latest information about developments related to form 1116 and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116. Web this video describes form 1116, which is the form that us expats need to use to claim the foreign tax credit. Web form 1116 when you invest in these mutual funds and/or etfs in a regular taxable brokerage account, your broker will report to you the total foreign taxes you paid. Web a form 1116 does not have to be completed if the total creditable foreign taxes are not more than $300 ($600 if married filing a joint return) and other conditions are met;