Form 433 Oic

Form 433 Oic - Web up to two forms 656 can calculate for tax liabilities where one taxpayer or spouse are liable for some tax years and the couple is jointly liable for other tax years. The irs uses this form to determine. Get ready for tax season deadlines by completing any required tax forms today. This form is also about eight pages long. Ad access irs tax forms. An individual who owes income. Use this form if you are y. Form 433 must be included with the offer in compromise application packet. Web to be eligible for an oic, the taxpayer must have filed all tax returns and made all tax payments for the current year. In order to file for an offer in compromise settlement to.

This form is also about eight pages long. In order to file for an offer in compromise settlement to. This form is also about eight pages long. An individual who owes income. Get ready for tax season deadlines by completing any required tax forms today. Web to be eligible for an oic, the taxpayer must have filed all tax returns and made all tax payments for the current year. Web • offer in compromise: Form 433 must be included with the offer in compromise application packet. The irs uses this form to determine. Web we would like to show you a description here but the site won’t allow us.

This form is also about eight pages long. Complete, edit or print tax forms instantly. Web • offer in compromise: This form is also about eight pages long. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. An individual who owes income. Web we would like to show you a description here but the site won’t allow us. Web up to two forms 656 can calculate for tax liabilities where one taxpayer or spouse are liable for some tax years and the couple is jointly liable for other tax years. Use this form if you are y.

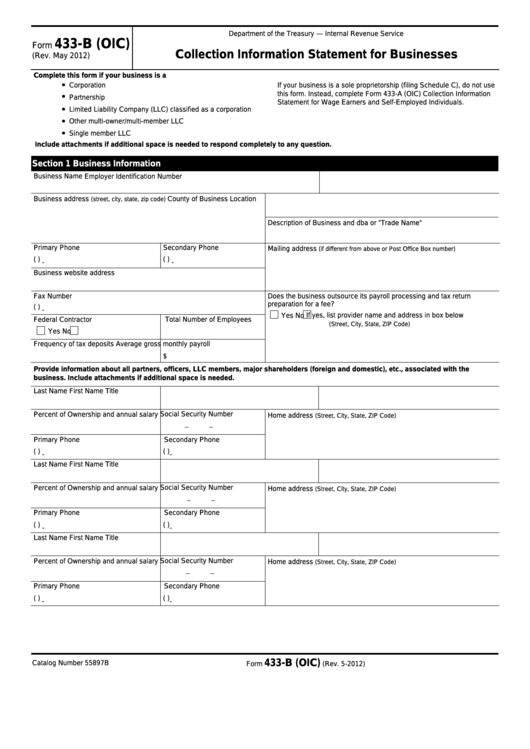

Fillable Form 433B (Oic) Collection Information Statement For

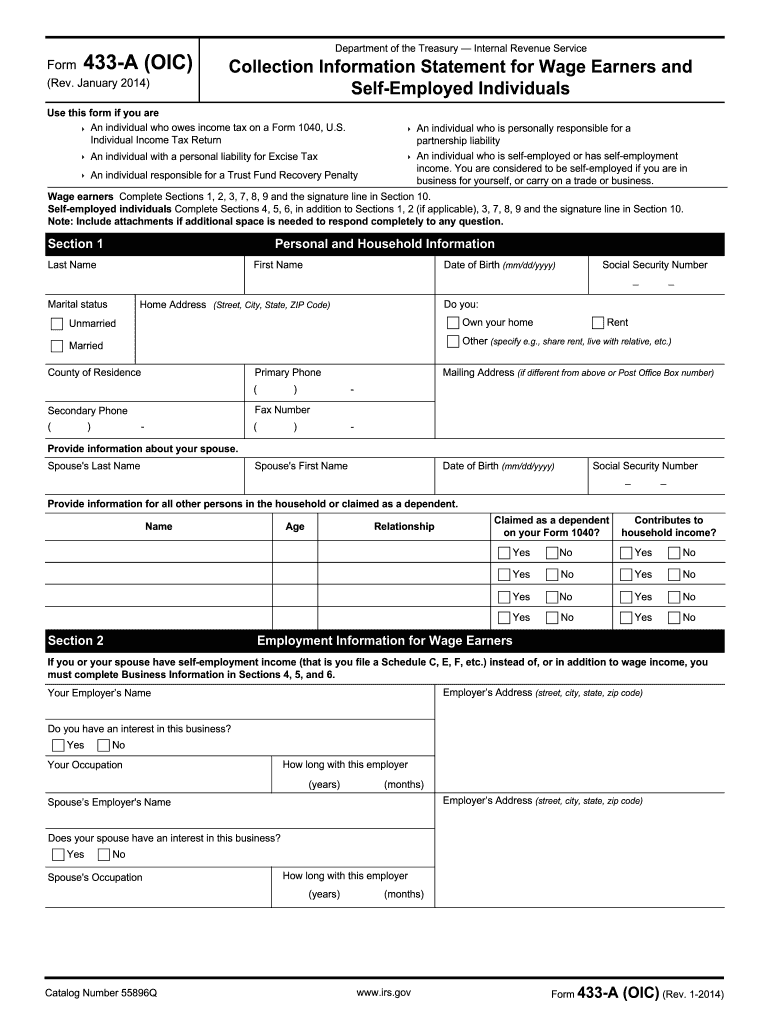

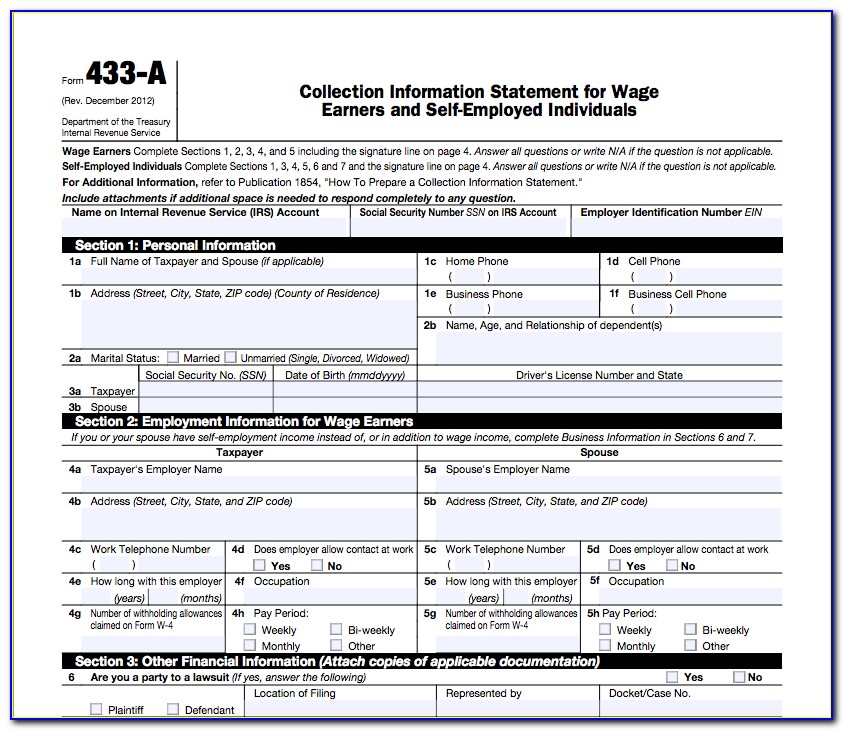

Collection information statement for wage earners. Complete, edit or print tax forms instantly. Web we would like to show you a description here but the site won’t allow us. Use this form if you are y. Form 433 must be included with the offer in compromise application packet.

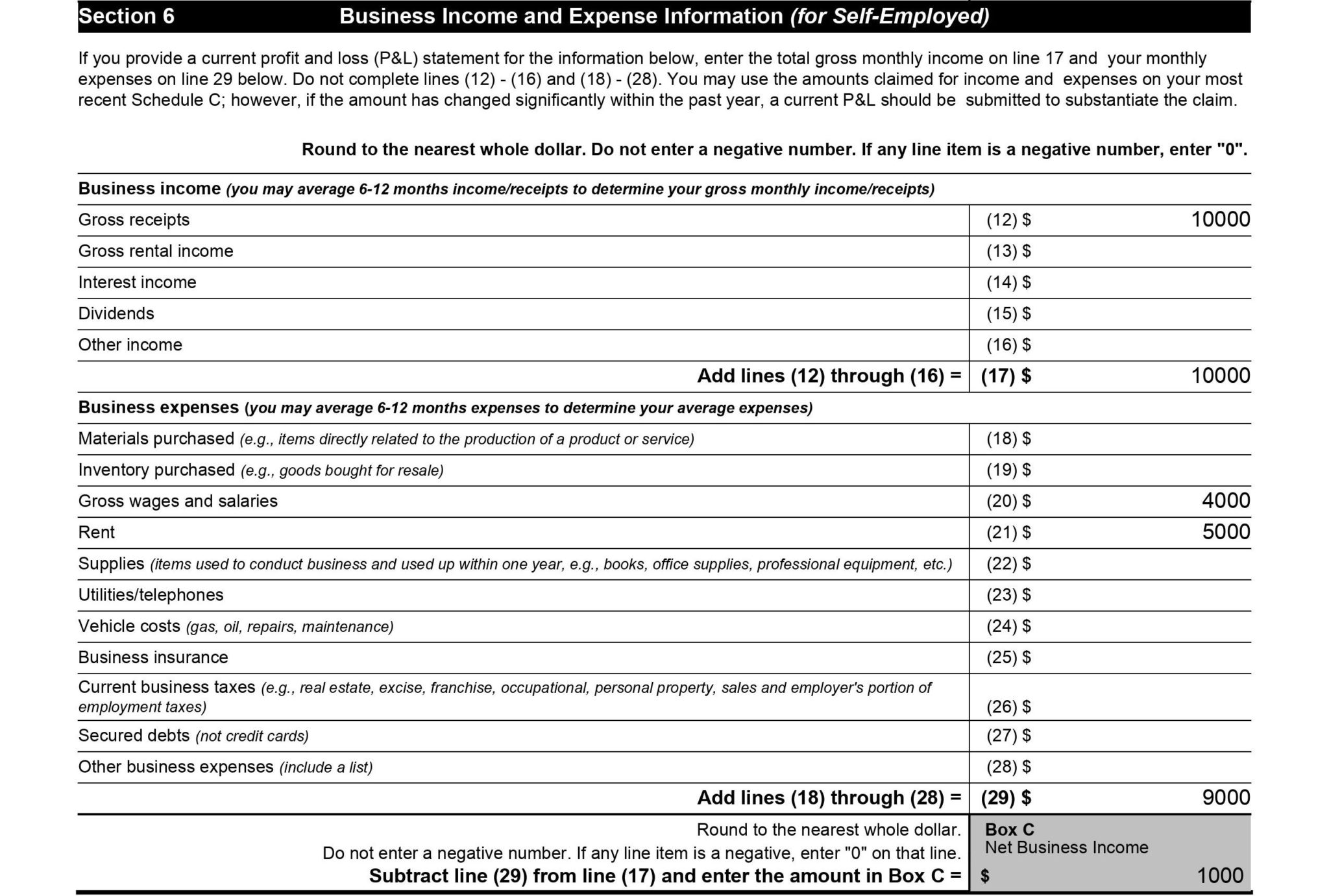

IRS Form 433B (OIC) 2018 Version Instructions Business Offer In

This form is also about eight pages long. Use this form if you are y. Get ready for tax season deadlines by completing any required tax forms today. Web to be eligible for an oic, the taxpayer must have filed all tax returns and made all tax payments for the current year. Get ready for tax season deadlines by completing.

2014 Form IRS 433A (OIC) Fill Online, Printable, Fillable, Blank

The irs uses this form to determine. Collection information statement for wage earners. Web up to two forms 656 can calculate for tax liabilities where one taxpayer or spouse are liable for some tax years and the couple is jointly liable for other tax years. Complete, edit or print tax forms instantly. An individual who owes income.

IRS Form 433A (OIC) 2018 2019 Fill out and Edit Online PDF Template

This form is also about eight pages long. Get ready for tax season deadlines by completing any required tax forms today. Web • offer in compromise: Form 433 must be included with the offer in compromise application packet. Web we would like to show you a description here but the site won’t allow us.

How To Fill Out Form 433A (OIC) (2019 Version), Detailed Instructions

Web up to two forms 656 can calculate for tax liabilities where one taxpayer or spouse are liable for some tax years and the couple is jointly liable for other tax years. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web • offer in compromise: Get ready for.

How to complete IRS form 433A OIC YouTube

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web we would like to show you a description here but the site won’t allow us. Form 433 must be included with the offer in compromise application packet. Use this form if you are y.

How To Fill Out Form 433A (OIC) (2019 Version), Detailed Instructions

Use this form if you are y. Get ready for tax season deadlines by completing any required tax forms today. Web we would like to show you a description here but the site won’t allow us. Ad access irs tax forms. This form is also about eight pages long.

IRS Form 433B (OIC) 2018 2019 Printable & Fillable Sample in PDF

An individual who owes income. Use this form if you are y. Ad access irs tax forms. In order to file for an offer in compromise settlement to. Complete, edit or print tax forms instantly.

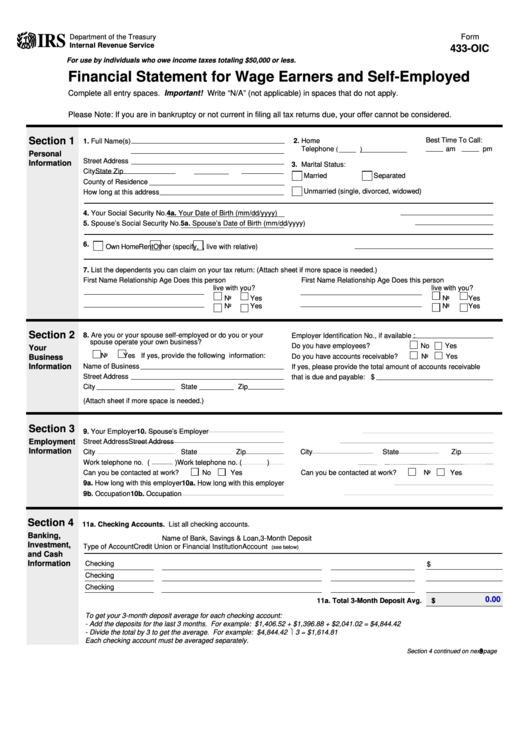

Form 433Oic Financial Statement For Wage Earners And SelfEmployed

Web • offer in compromise: This form is also about eight pages long. An individual who owes income. Web we would like to show you a description here but the site won’t allow us. Web to be eligible for an oic, the taxpayer must have filed all tax returns and made all tax payments for the current year.

New Eeo 1 Form 2017 Form Resume Examples aZDYGa3O79

In order to file for an offer in compromise settlement to. Collection information statement for wage earners. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. An individual who owes income.

Complete, Edit Or Print Tax Forms Instantly.

Ad access irs tax forms. Form 433 must be included with the offer in compromise application packet. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today.

This Form Is Also About Eight Pages Long.

In order to file for an offer in compromise settlement to. Collection information statement for wage earners. An individual who owes income. Web up to two forms 656 can calculate for tax liabilities where one taxpayer or spouse are liable for some tax years and the couple is jointly liable for other tax years.

Web • Offer In Compromise:

Web we would like to show you a description here but the site won’t allow us. Web to be eligible for an oic, the taxpayer must have filed all tax returns and made all tax payments for the current year. The irs uses this form to determine. This form is also about eight pages long.