Empower 401K Rollover Form

Empower 401K Rollover Form - Open an ira if you don’t have one. Web complete the participant information section of the incoming rollover election form. Web an empower 401(k) rollover lets you move, or roll, your existing empower retirement funds to a new retirement plan. Please send a copy of the check stub, showing the amount of the distribution and withholding, from the previous provider. Let the experts at capitalize handle your 401(k) rollover, for free! Our online process and team of experts make it easy to roll over your 401(k) fast. Web determine if a rollover is the right option for you. Web rollover to roth accounts (if applicable) before submitting a direct rollover request, you need to verify that the new plan provides for a designated roth account and can accept rollovers. Eligible rollover distributions are made payable directly to your new employer’s roth plan or to a roth ira. Web rollover is a transaction used to transfer eligible assets from one qualified retirement plan to another.

Explore the options for rolling over your retirement account to another qualified account or cashing out your retirement savings. Let the experts at capitalize handle your 401(k) rollover, for free! Eligible rollover distributions are made payable directly to your new employer’s roth plan or to a roth ira. Our online process and team of experts make it easy to roll over your 401(k) fast. Please send a copy of the check stub, showing the amount of the distribution and withholding, from the previous provider. Make sure the check is payable to the financial services company, instead of you personally — this is referred to as a direct. To rollover your 401(k) to an ira, follow these steps: Web complete the participant information section of the incoming rollover election form. Web rollover to roth accounts (if applicable) before submitting a direct rollover request, you need to verify that the new plan provides for a designated roth account and can accept rollovers. Web determine if a rollover is the right option for you.

Open an ira if you don’t have one. Make sure the check is payable to the financial services company, instead of you personally — this is referred to as a direct. Web easily manage your assets and reduce the need for multiple accounts. Explore the options for rolling over your retirement account to another qualified account or cashing out your retirement savings. For more details, review the important information associated with the acquisition pdf file opens in a new window. Our online process and team of experts make it easy to roll over your 401(k) fast. Please send a copy of the check stub, showing the amount of the distribution and withholding, from the previous provider. To rollover your 401(k) to an ira, follow these steps: Web complete the participant information section of the incoming rollover election form. Web rollover to roth accounts (if applicable) before submitting a direct rollover request, you need to verify that the new plan provides for a designated roth account and can accept rollovers.

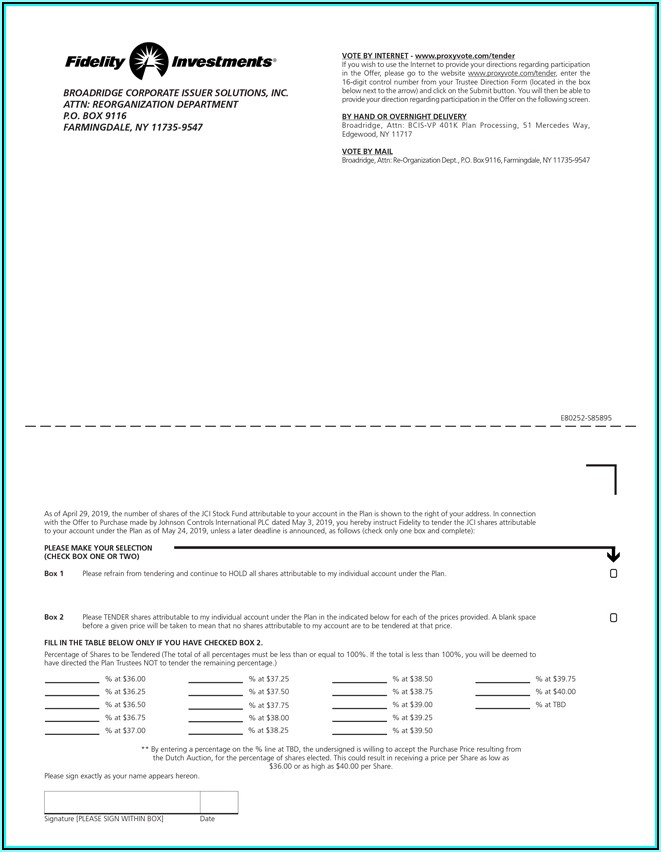

How To Rollover 401k From Empower To Fidelity

If a plan allows incoming rollovers, participants may generally contribute a eligible rollover from their previous employer’s retirement plan or from their individual retirement account (ira) into their current employer’s retirement plan. Web how to roll over your 401(k) to an ira. Inform your former employer that you want to roll over your 401(k) funds into an ira. Our online.

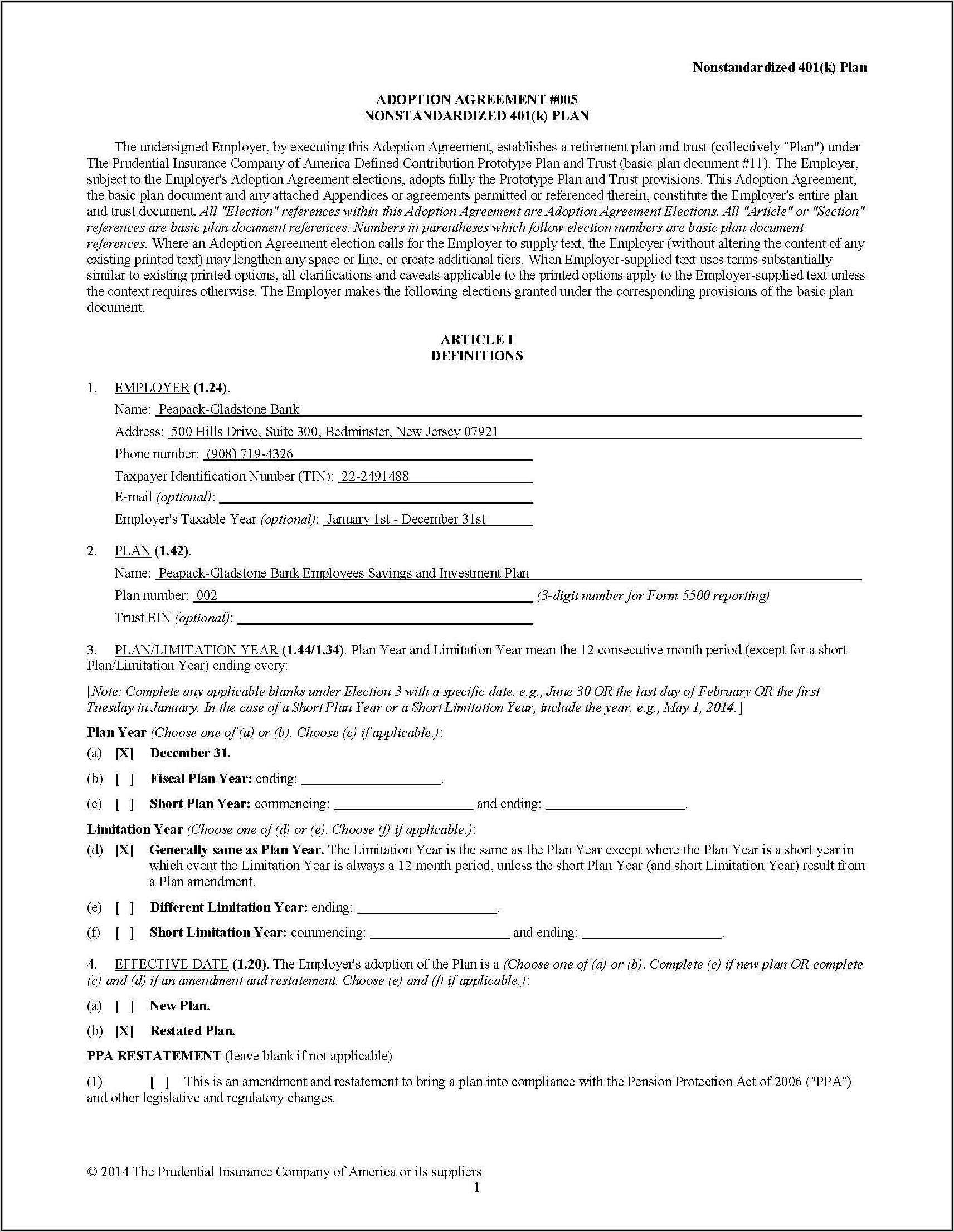

401k Enrollment Form Examples Form Resume Examples E4Y4ybxVlB

For more details, review the important information associated with the acquisition pdf file opens in a new window. If a plan allows incoming rollovers, participants may generally contribute a eligible rollover from their previous employer’s retirement plan or from their individual retirement account (ira) into their current employer’s retirement plan. Open an ira if you don’t have one. Inform your.

401k Rollover Form Voya Universal Network

Web easily manage your assets and reduce the need for multiple accounts. Web how to roll over your 401(k) to an ira. Our online process and team of experts make it easy to roll over your 401(k) fast. Inform your former employer that you want to roll over your 401(k) funds into an ira. Web rollover to roth accounts (if.

401k Rollover Form 5498 Universal Network

Web an empower 401(k) rollover lets you move, or roll, your existing empower retirement funds to a new retirement plan. Web determine if a rollover is the right option for you. As with any financial decision, you are encouraged to discuss moving money between accounts, including rollovers, with a financial advisor and to consider costs, risks, investment options and limitations.

401k Rollover Tax Form Universal Network

Make sure the check is payable to the financial services company, instead of you personally — this is referred to as a direct. Web determine if a rollover is the right option for you. Eligible rollover distributions are made payable directly to your new employer’s roth plan or to a roth ira. Our online process and team of experts make.

Empower Retirement 401k Rollover Form Fill Online, Printable

Explore the options for rolling over your retirement account to another qualified account or cashing out your retirement savings. Please send a copy of the check stub, showing the amount of the distribution and withholding, from the previous provider. To rollover your 401(k) to an ira, follow these steps: Eligible rollover distributions are made payable directly to your new employer’s.

Transamerica 401k Rollover Form Universal Network

Open an ira if you don’t have one. Web an empower 401(k) rollover lets you move, or roll, your existing empower retirement funds to a new retirement plan. If a plan allows incoming rollovers, participants may generally contribute a eligible rollover from their previous employer’s retirement plan or from their individual retirement account (ira) into their current employer’s retirement plan..

401k Rollover Tax Form Universal Network

Web complete the participant information section of the incoming rollover election form. Our online process and team of experts make it easy to roll over your 401(k) fast. To rollover your 401(k) to an ira, follow these steps: For more details, review the important information associated with the acquisition pdf file opens in a new window. Web determine if a.

401k Rollover Form Fidelity Investments Form Resume Examples

To rollover your 401(k) to an ira, follow these steps: Open an ira if you don’t have one. Web an empower 401(k) rollover lets you move, or roll, your existing empower retirement funds to a new retirement plan. Please send a copy of the check stub, showing the amount of the distribution and withholding, from the previous provider. Eligible rollover.

Home Depot 401k Rollover Form Form Resume Examples Rg8Dk7w3Mq

As with any financial decision, you are encouraged to discuss moving money between accounts, including rollovers, with a financial advisor and to consider costs, risks, investment options and limitations prior to investing. Inform your former employer that you want to roll over your 401(k) funds into an ira. Web complete the participant information section of the incoming rollover election form..

Web Determine If A Rollover Is The Right Option For You.

Web rollover to roth accounts (if applicable) before submitting a direct rollover request, you need to verify that the new plan provides for a designated roth account and can accept rollovers. Please send a copy of the check stub, showing the amount of the distribution and withholding, from the previous provider. As with any financial decision, you are encouraged to discuss moving money between accounts, including rollovers, with a financial advisor and to consider costs, risks, investment options and limitations prior to investing. Web an empower 401(k) rollover lets you move, or roll, your existing empower retirement funds to a new retirement plan.

Make Sure The Check Is Payable To The Financial Services Company, Instead Of You Personally — This Is Referred To As A Direct.

Let the experts at capitalize handle your 401(k) rollover, for free! Our online process and team of experts make it easy to roll over your 401(k) fast. Inform your former employer that you want to roll over your 401(k) funds into an ira. If a plan allows incoming rollovers, participants may generally contribute a eligible rollover from their previous employer’s retirement plan or from their individual retirement account (ira) into their current employer’s retirement plan.

Web How To Roll Over Your 401(K) To An Ira.

To rollover your 401(k) to an ira, follow these steps: Web complete the participant information section of the incoming rollover election form. Web easily manage your assets and reduce the need for multiple accounts. Eligible rollover distributions are made payable directly to your new employer’s roth plan or to a roth ira.

For More Details, Review The Important Information Associated With The Acquisition Pdf File Opens In A New Window.

Explore the options for rolling over your retirement account to another qualified account or cashing out your retirement savings. Web rollover is a transaction used to transfer eligible assets from one qualified retirement plan to another. Open an ira if you don’t have one.