Form 3804-Cr Instructions 2021

Form 3804-Cr Instructions 2021 - The pte elective tax credit will flow to form. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Web 2021 instructions for form ftb 3804; Attach the completed form ftb 3804. A tax form distributed by the internal revenue service (irs) used to report casualties and thefts of personal property. Web 1 citylegislation,§380.4 380.4 majorityrequirement—tievote—conflictsofinterest. 2021 instructions for form ftb 3893. If this does not apply you will have to delete the state tax form. This is only available by request. Web information, get form ftb 3804.

Web instructions below on where to file. It contains schedules to help. Please provide your email address and it will be emailed to. Use form 4804 when submitting the following types of. Web for business filers: Attach to your california tax return. Web 2021 instructions for form ftb 3804; If this does not apply you will have to delete the state tax form. When completing this form, please type or print clearly in black ink. When will the elective tax expire?

2021 instructions for form ftb 3893. The pte elective tax credit will flow to form. Can i calculate late payment interest and. Web for business filers: Form ftb 3804 also includes a schedule of qualified taxpayers that requires. A tax form distributed by the internal revenue service (irs) used to report casualties and thefts of personal property. Web 2021 instructions for form ftb 3804; In addition to entering the current year credit. Business name (as shown on tax return) fein. If this does not apply you will have to delete the state tax form.

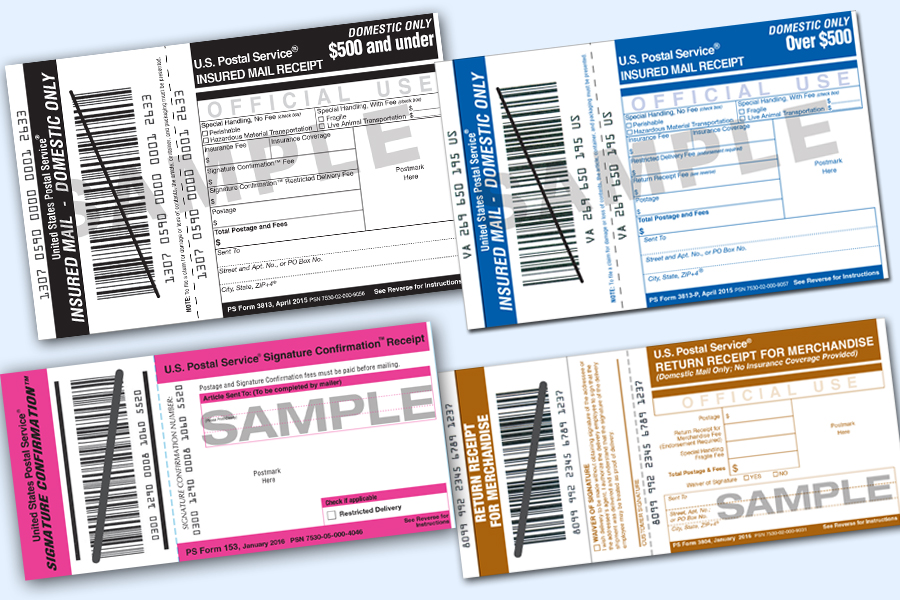

In retirement USPS News Link

Use form 4804 when submitting the following types of. Web for business filers: Form ftb 3804 also includes a schedule of qualified taxpayers that requires. If this does not apply you will have to delete the state tax form. Attach to form 100s, form 565, or form 568.

Irs W 9 Form 2021 Printable Pdf Calendar Printable Free

This is only available by request. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. When completing this form, please type or print clearly in black ink. Web instructions below on where to file. Attach to your california tax return.

39 capital gain worksheet 2015 Worksheet Master

Business name (as shown on tax return) fein. Please provide your email address and it will be emailed to. Web 1 citylegislation,§380.4 380.4 majorityrequirement—tievote—conflictsofinterest. Use form 4804 when submitting the following types of. Attach the completed form ftb 3804.

3801 activity Fill out & sign online DocHub

Attach to your california tax return. Web 2021 instructions for form ftb 3804; Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Web information, get form ftb 3804. The pte elective tax credit will flow to form.

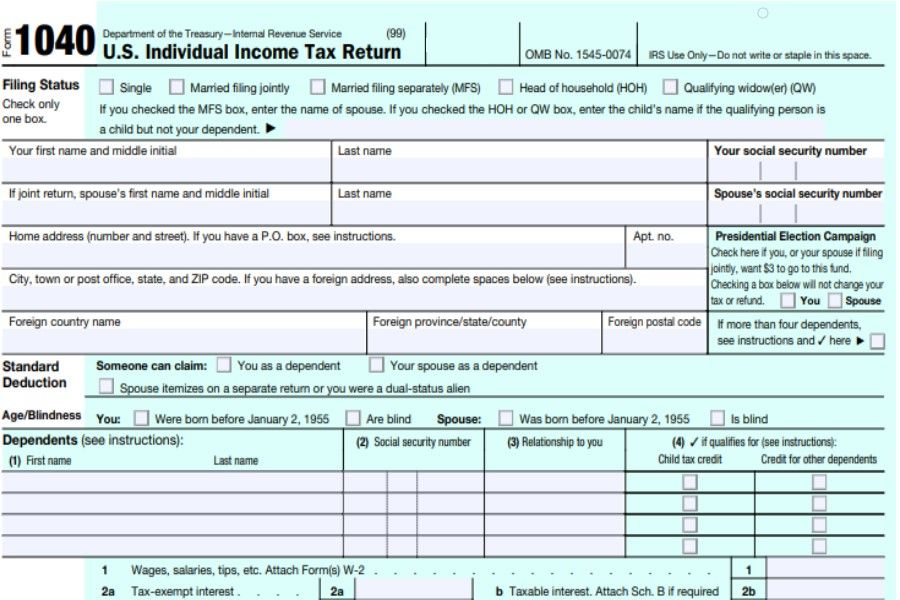

2021 Federal Tax Forms Printable 2022 W4 Form

Can i calculate late payment interest and. The pte elective tax credit will flow to form. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. When completing this form, please type or print clearly in black ink. Please provide your email address and it will be emailed to.

8949 Form 2021

Business name (as shown on tax return) fein. Please provide your email address and it will be emailed to. A tax form distributed by the internal revenue service (irs) used to report casualties and thefts of personal property. Web for business filers: Can i calculate late payment interest and.

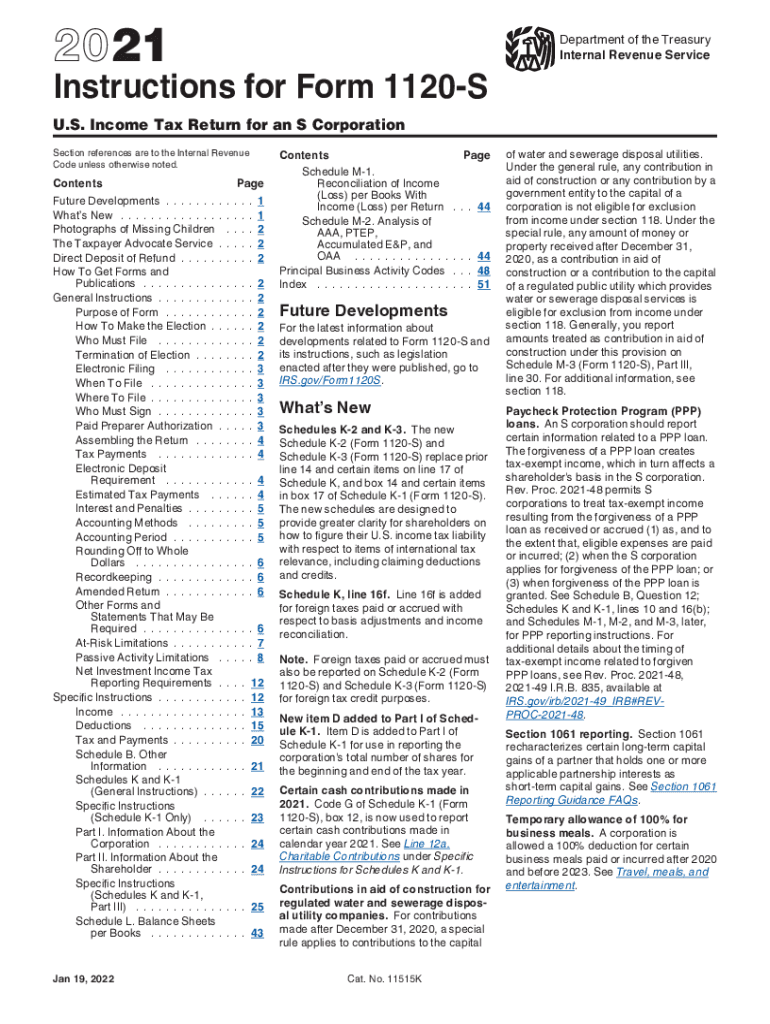

2021 Form IRS Instructions 1120S Fill Online, Printable, Fillable

Web 1 citylegislation,§380.4 380.4 majorityrequirement—tievote—conflictsofinterest. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. 2021 instructions for form ftb 3893. Web for business filers: Web information, get form ftb 3804.

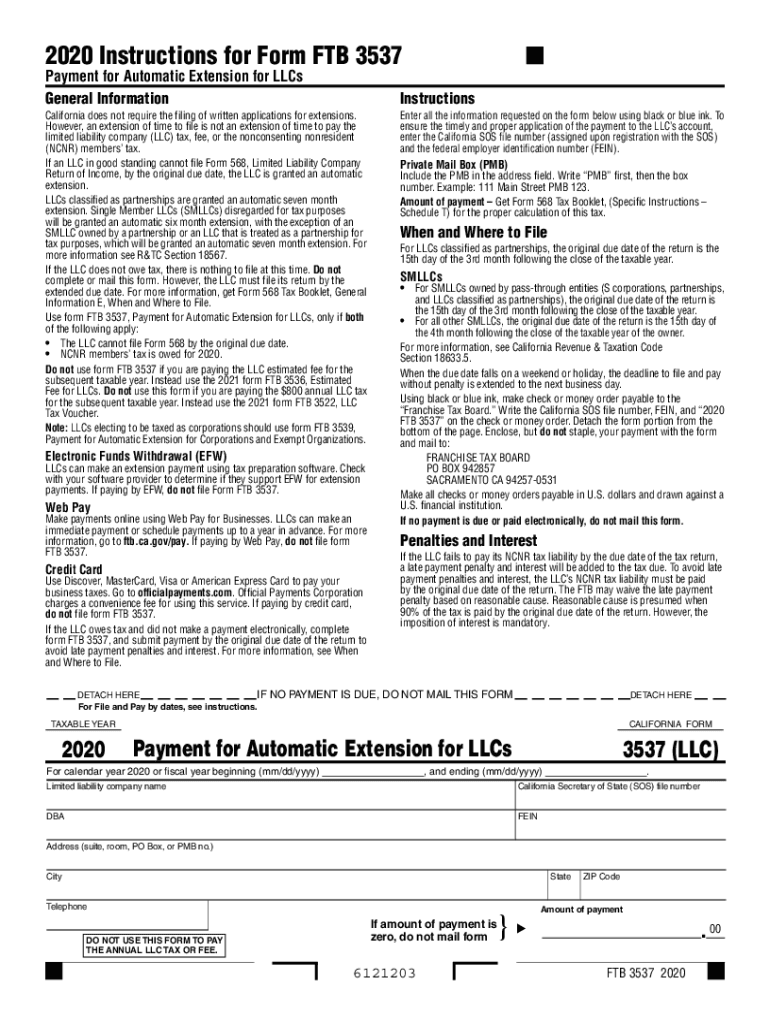

Form 3537 California Fill Out and Sign Printable PDF Template signNow

Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. It contains schedules to help. When will the elective tax expire? Web information, get form ftb 3804. Web 1 citylegislation,§380.4 380.4 majorityrequirement—tievote—conflictsofinterest.

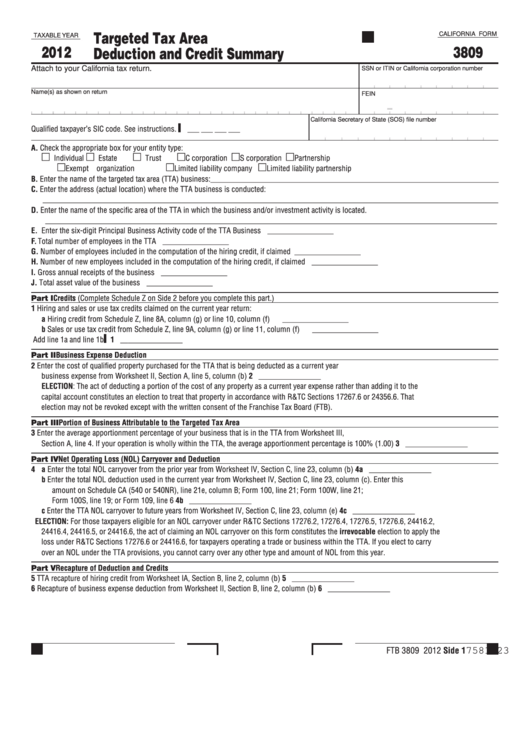

Fillable California Form 3809 Targeted Tax Area Deduction And Credit

Attach to form 100s, form 565, or form 568. Web 2021 instructions for form ftb 3804; Business name (as shown on tax return) fein. I elective tax credit amount. The pte elective tax credit will flow to form.

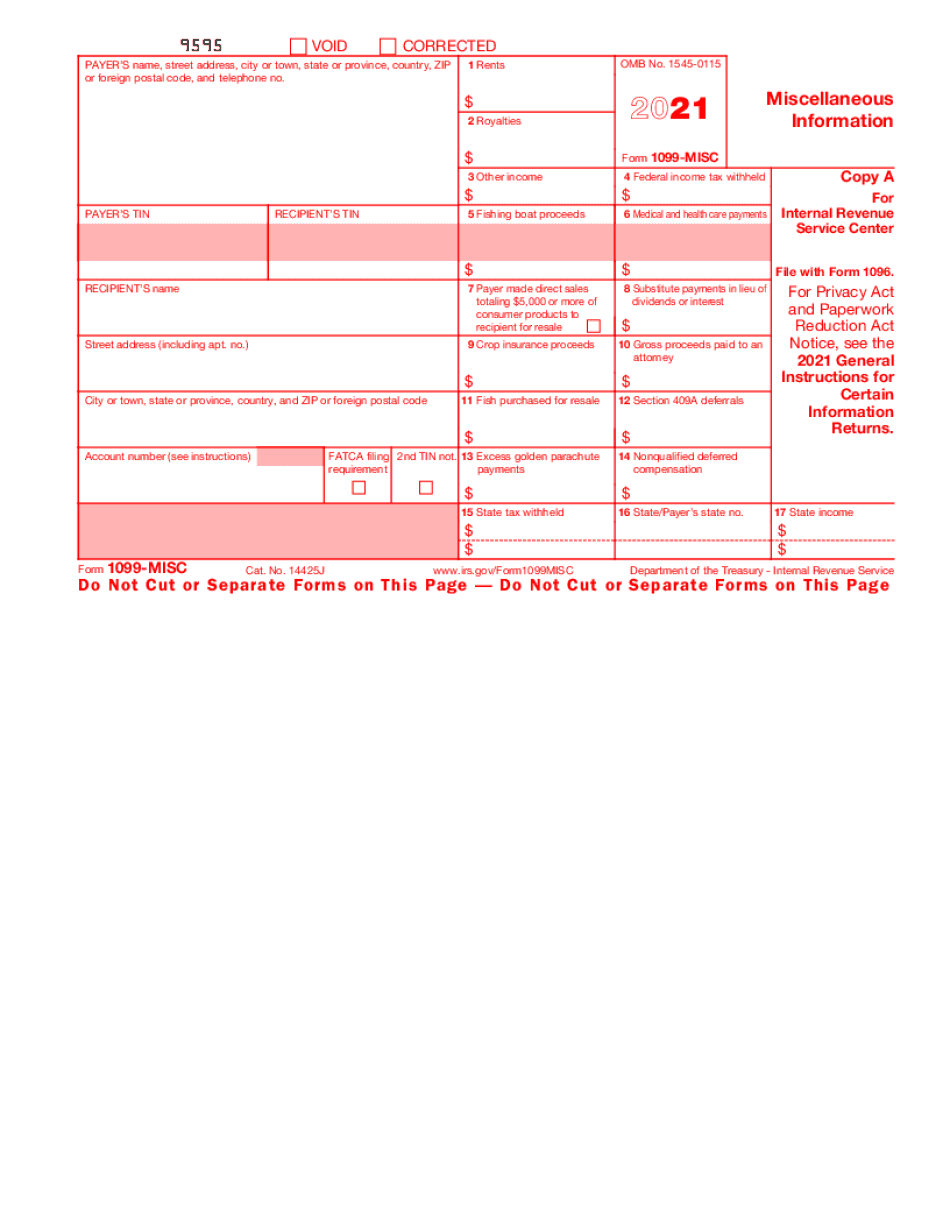

How to Blackout In Form 1099MISC

Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Web 1 citylegislation,§380.4 380.4 majorityrequirement—tievote—conflictsofinterest. When will the elective tax expire? Can i calculate late payment interest and. 2021 instructions for form ftb 3893.

Web For Business Filers:

Web 1 citylegislation,§380.4 380.4 majorityrequirement—tievote—conflictsofinterest. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. It contains schedules to help. Attach the completed form ftb 3804.

2021 Instructions For Form Ftb 3893.

Form ftb 3804 also includes a schedule of qualified taxpayers that requires. When completing this form, please type or print clearly in black ink. Web 2021 instructions for form ftb 3804; Web information, get form ftb 3804.

If This Does Not Apply You Will Have To Delete The State Tax Form.

I elective tax credit amount. Business name (as shown on tax return) fein. Use form 4804 when submitting the following types of. This is only available by request.

Can I Calculate Late Payment Interest And.

The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. The pte elective tax credit will flow to form. Web instructions below on where to file. Attach to form 100s, form 565, or form 568.