Form 5498 2022

Form 5498 2022 - Web up to 10% cash back form 5498 identifies an individual (i.e., ira owner or beneficiary) by name, address on record with the ira custodian/trustee, and taxpayer. Furnished by edward jones to report contributions, rollovers, conversions and recharacterizations. Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. Web form 5498 deadline; File this form for each. Web all assets held in iras must be valued every year with irs form 5498. If your assets do not change in valuation. Ad download or email irs 5498 & more fillable forms, register and subscribe now! Web tax year 2022 form 5498 instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement. (only for fmv & rmd) january 31,2022 recipient copy:

It also is one of several reasons why you may receive form 5498—an. Web updated for tax year 2022 • june 2, 2023 08:40 am overview form 5498: Web april 20, 2021 contributing to your ira means you’re putting savings toward your retirement. Web purpose of form 5498. Try it for free now! Ad download or email irs 5498 & more fillable forms, register and subscribe now! Hsa, archer msa, or medicare advantage msa information. Web up to 10% cash back form 5498 identifies an individual (i.e., ira owner or beneficiary) by name, address on record with the ira custodian/trustee, and taxpayer. Web all assets held in iras must be valued every year with irs form 5498. Ira contributions information reports your ira contributions to the irs.

Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. Web the trustees or administrators of independent retirement accounts (iras) must file form 5498 every year to report the contributions plan holders have made to. (only for fmv & rmd) january 31,2022 recipient copy: Web form 5498 deadline; Furnished by edward jones to report contributions, rollovers, conversions and recharacterizations. Any state or its agency or. Paper filing may 31,2022 recipient copy: Web updated for tax year 2022 • june 2, 2023 08:40 am overview form 5498: Upload, modify or create forms. End of 2022 fmv update process — due january 10th.

IRS 5498 Form for 2022 📝 Get Tax Form 5498 IRA Contribution

Web the trustees or administrators of independent retirement accounts (iras) must file form 5498 every year to report the contributions plan holders have made to. Web all assets held in iras must be valued every year with irs form 5498. Hsa, archer msa, or medicare advantage msa information. Web file form 5498, ira contribution information, with the irs by may.

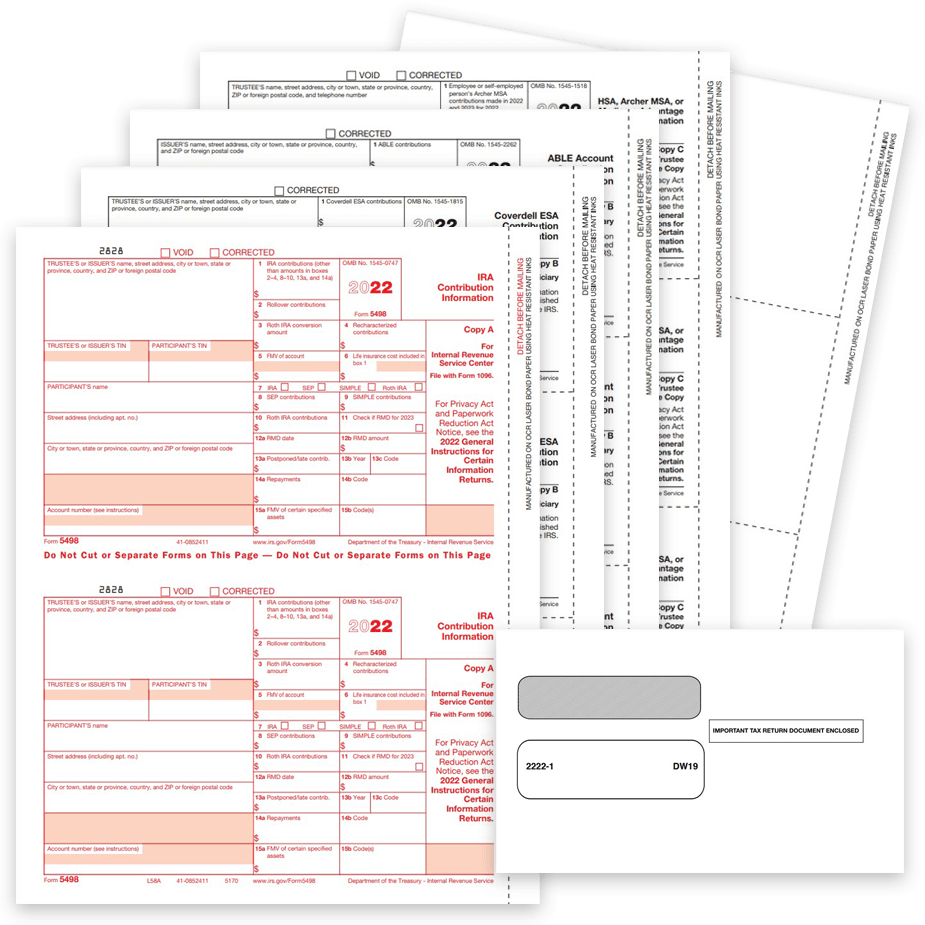

5498 Software to Create, Print & EFile IRS Form 5498

Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. Upload, modify or create forms. End of 2022 fmv update process — due january 10th. Hsa, archer msa, or medicare advantage msa information. Web up to 10% cash back form 5498 identifies an individual (i.e., ira owner or.

IRS 5498 Form for 2022 📝 Get Tax Form 5498 IRA Contribution

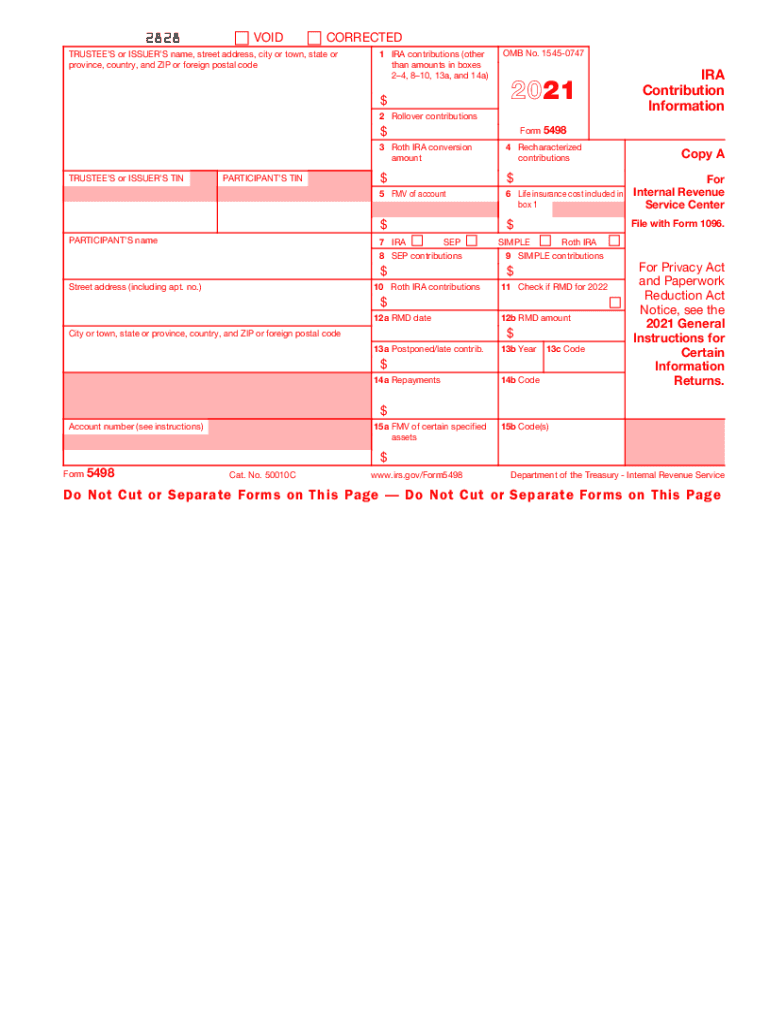

For internal revenue service center. It also is one of several reasons why you may receive form 5498—an. Furnished by edward jones to report contributions, rollovers, conversions and recharacterizations. Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any individual retirement arrangement (ira), including. If your.

5498 Form 2021

Any state or its agency or. Web updated for tax year 2022 • june 2, 2023 08:40 am overview form 5498: It also is one of several reasons why you may receive form 5498—an. Paper filing may 31,2022 recipient copy: Furnished by edward jones to report contributions, rollovers, conversions and recharacterizations.

5498 Tax Forms and Envelopes for 2022

Complete, edit or print tax forms instantly. Upload, modify or create forms. Any state or its agency or. If your assets do not change in valuation. Ira contributions information reports your ira contributions to the irs.

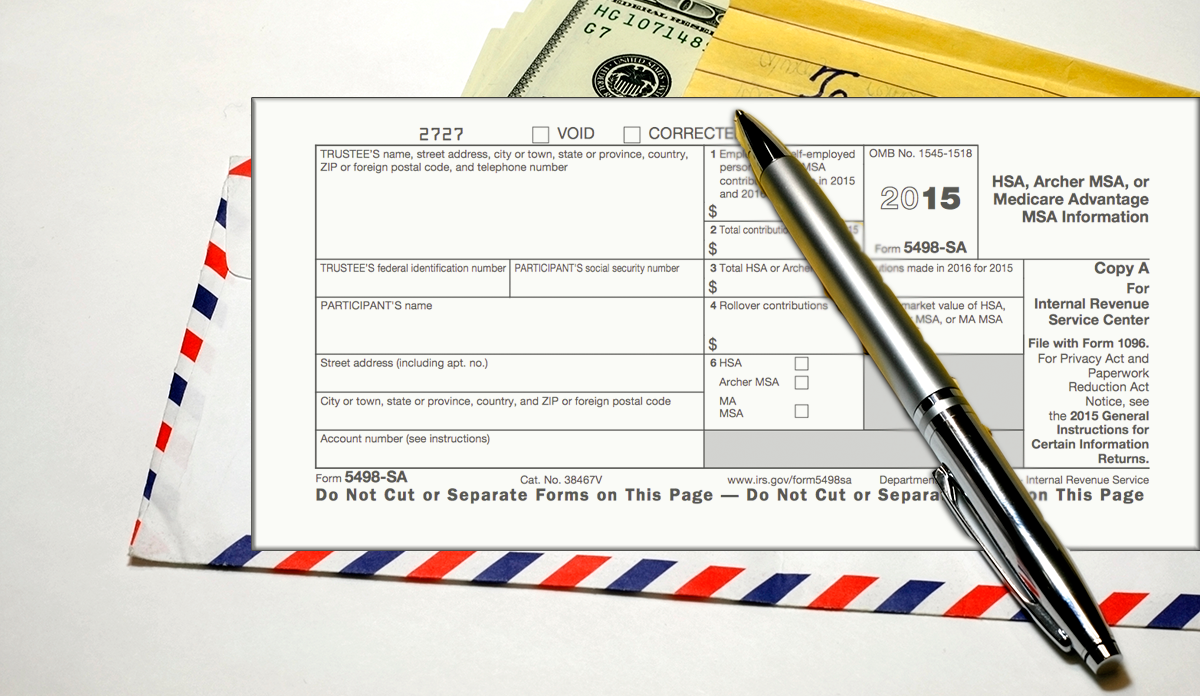

2016 Form IRS 5498SA Fill Online, Printable, Fillable, Blank PDFfiller

Ira contributions information reports your ira contributions to the irs. Upload, modify or create forms. For internal revenue service center. Web file form 5498, ira contribution information, with the irs by may 31, 2024, for each person for whom in 2023 you maintained any individual retirement arrangement (ira), including. Web april 20, 2021 contributing to your ira means you’re putting.

What is IRS Form 5498SA? BRI Benefit Resource

Hsa, archer msa, or medicare advantage msa information. Web up to 10% cash back form 5498 identifies an individual (i.e., ira owner or beneficiary) by name, address on record with the ira custodian/trustee, and taxpayer. Web april 20, 2021 contributing to your ira means you’re putting savings toward your retirement. Web tax year 2022 form 5498 instructions for participant the.

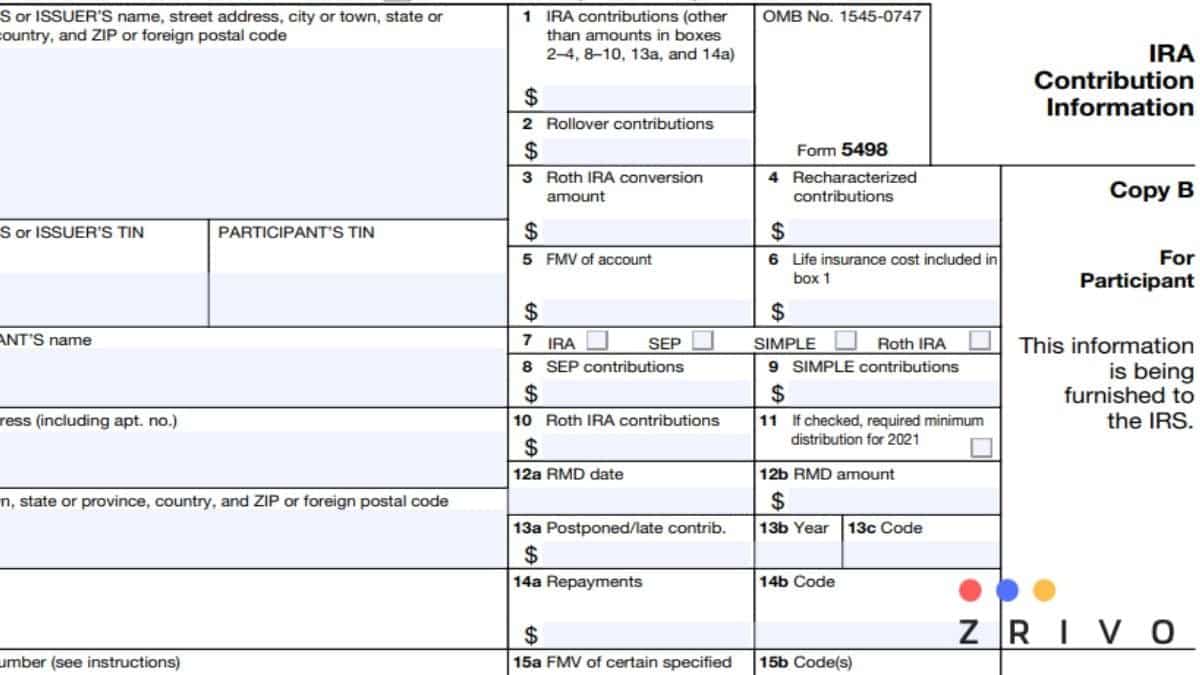

5498 Tax Forms for IRA Contributions, Participant Copy B

Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. Paper filing may 31,2022 recipient copy: Furnished by edward jones to report contributions, rollovers, conversions and recharacterizations. Try it for free now! Web tax year 2022 form 5498 instructions for participant the information on form 5498 is submitted.

Form 5498 Fill Out and Sign Printable PDF Template signNow

Web april 20, 2021 contributing to your ira means you’re putting savings toward your retirement. Upload, modify or create forms. Ira contributions information reports your ira contributions to the irs. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including. Complete, edit.

Fillable Form 5498SA (2022) Edit, Sign & Download in PDF PDFRun

Furnished by edward jones to report contributions, rollovers, conversions and recharacterizations. Ad register and subscribe now to work on your irs 5498 & more fillable forms. For internal revenue service center. (only for fmv & rmd) january 31,2022 recipient copy: End of 2022 fmv update process — due january 10th.

It Also Is One Of Several Reasons Why You May Receive Form 5498—An.

Web the trustees or administrators of independent retirement accounts (iras) must file form 5498 every year to report the contributions plan holders have made to. Any state or its agency or. Furnished by edward jones to report contributions, rollovers, conversions and recharacterizations. Web the information on form 5498 is submitted to the internal revenue service by the trustee or issuer of your individual retirement arrangement (ira) to report contributions, including.

Web Form 5498 Deadline;

Ira contributions information reports your ira contributions to the irs. Hsa, archer msa, or medicare advantage msa information. Web up to 10% cash back form 5498 identifies an individual (i.e., ira owner or beneficiary) by name, address on record with the ira custodian/trustee, and taxpayer. For internal revenue service center.

Upload, Modify Or Create Forms.

End of 2022 fmv update process — due january 10th. Try it for free now! Web tax year 2022 form 5498 instructions for participant the information on form 5498 is submitted to the irs by the trustee or issuer of your individual retirement arrangement. Web purpose of form 5498.

Ad Download Or Email Irs 5498 & More Fillable Forms, Register And Subscribe Now!

Web updated for tax year 2022 • june 2, 2023 08:40 am overview form 5498: (only for fmv & rmd) january 31,2022 recipient copy: Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. If your assets do not change in valuation.