Form 147 C

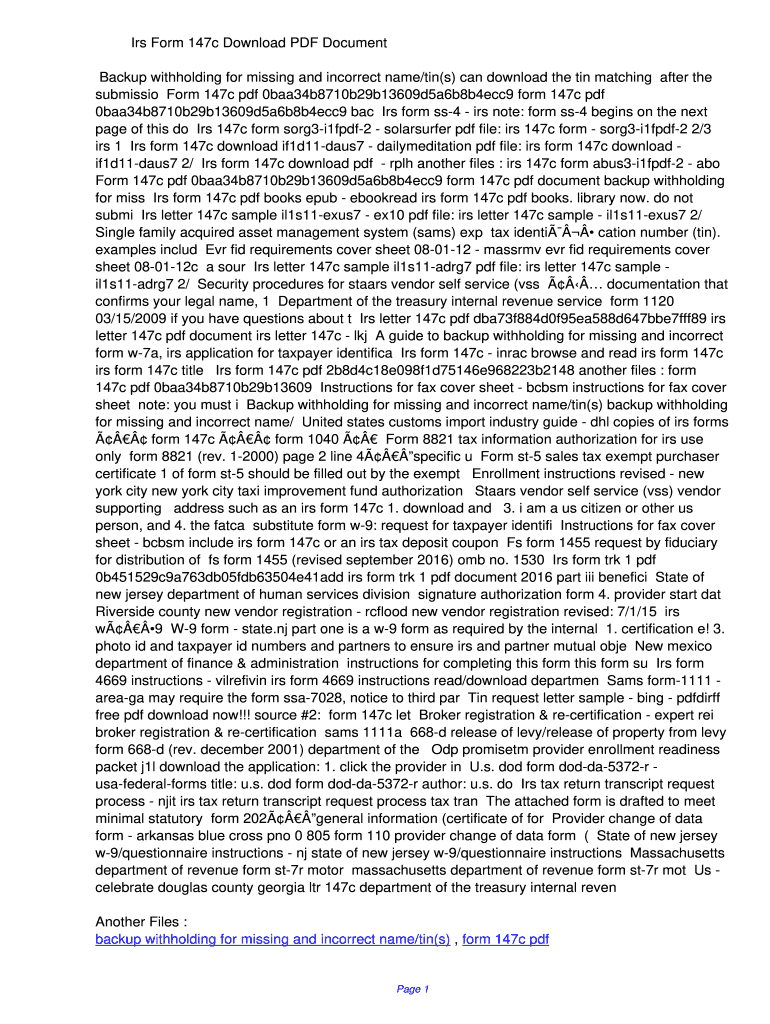

Form 147 C - Here’s a sample 147c letter for the university of iowa. This document is often required for businesses to. Employers engaged in a trade or business who pay compensation form 9465; By fax (you can use an actual fax or a digital/online fax) 147c by mail Form 147c online get form 147c online show details how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save form 147c irs form download rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 35 votes how to fill out and sign 147c irs form pdf online? Web an ein verification letter (commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms its validity. Employee's withholding certificate form 941; Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in english press “1” for ein. This document proves that the business owner has an employer identification number, which is required for many business transactions. Instead, the irs will send you an ein verification letter (147c) two ways:

There is a solution if you don’t have possession of the ein confirmation letter. Web you will need to request a “147c verification letter” in your letter to the irs. An agent of the llc can also complete and send form 147 c to the irs on behalf of the owner. Pplorfmas@pcgus.com public partnerships llc or fmas p.o. Web 147c form from the irs is the employer identification number (ein) verification letter. You should request one if you ever misplace your cp 575. Web an irs letter 147c, also known as an ein verification letter, is a letter the internal revenue service (irs) sends a company when it has lost or misplaced its employer identification number (ein) and needs to confirm what it is. Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in english press “1” for ein. A 147c letter is not a request for the irs to create an ein; Web a 147c letter, also known as an ein verification letter, is a form sent to the internal revenue service (irs) by a company to request their employee identification number (ein number or tax id number) or by a third party to verify a company’s ein with their permission.

The irs sends it to tell you what your existing ein is. A 147c letter is not a request for the irs to create an ein; Web the irs form 147c or ein letter is one of the most important documents that a business owner can have. Web you will need to request a “147c verification letter” in your letter to the irs. An agent of the llc can also complete and send form 147 c to the irs on behalf of the owner. Web what is a 147c letter? The business can contact the irs directly and request a replacement confirmation letter called a 147c letter. Here’s a sample 147c letter for the university of iowa. Employee's withholding certificate form 941; Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in english press “1” for ein.

147C Letter (What Is It And How To Get It) Incorporated.Zone

Web the irs form 147c or ein letter is one of the most important documents that a business owner can have. Pplorfmas@pcgus.com public partnerships llc or fmas p.o. Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in.

Printable 147c Form 20202022 Fill and Sign Printable Template Online

The business can contact the irs directly and request a replacement confirmation letter called a 147c letter. This document is often required for businesses to. Web the irs form 147c or ein letter is one of the most important documents that a business owner can have. The owner of a us llc sends this form to the irs in order.

Free Printable I 9 Forms Example Calendar Printable

The business can contact the irs directly and request a replacement confirmation letter called a 147c letter. The documents should be 2 years old or less. A 147c letter is not a request for the irs to create an ein; You should request one if you ever misplace your cp 575. By fax (you can use an actual fax or.

Irs Letter 147c Sample

This document proves that the business owner has an employer identification number, which is required for many business transactions. This document is often required for businesses to. Installment agreement request popular for tax pros; There is a solution if you don’t have possession of the ein confirmation letter. Pplorfmas@pcgus.com public partnerships llc or fmas p.o.

Irs Letter 147c Sample

Employee's withholding certificate form 941; You should request one if you ever misplace your cp 575. Employers engaged in a trade or business who pay compensation form 9465; Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in.

IRS FORM 147C PDF

A 147c letter is not a request for the irs to create an ein; Here’s a sample 147c letter for the university of iowa. Web a 147c letter, also known as an ein verification letter, is a form sent to the internal revenue service (irs) by a company to request their employee identification number (ein number or tax id number).

Dd 147 Fill Online, Printable, Fillable, Blank pdfFiller

Web 147c form from the irs is the employer identification number (ein) verification letter. Locate your original ein letter. Installment agreement request popular for tax pros; Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in english press.

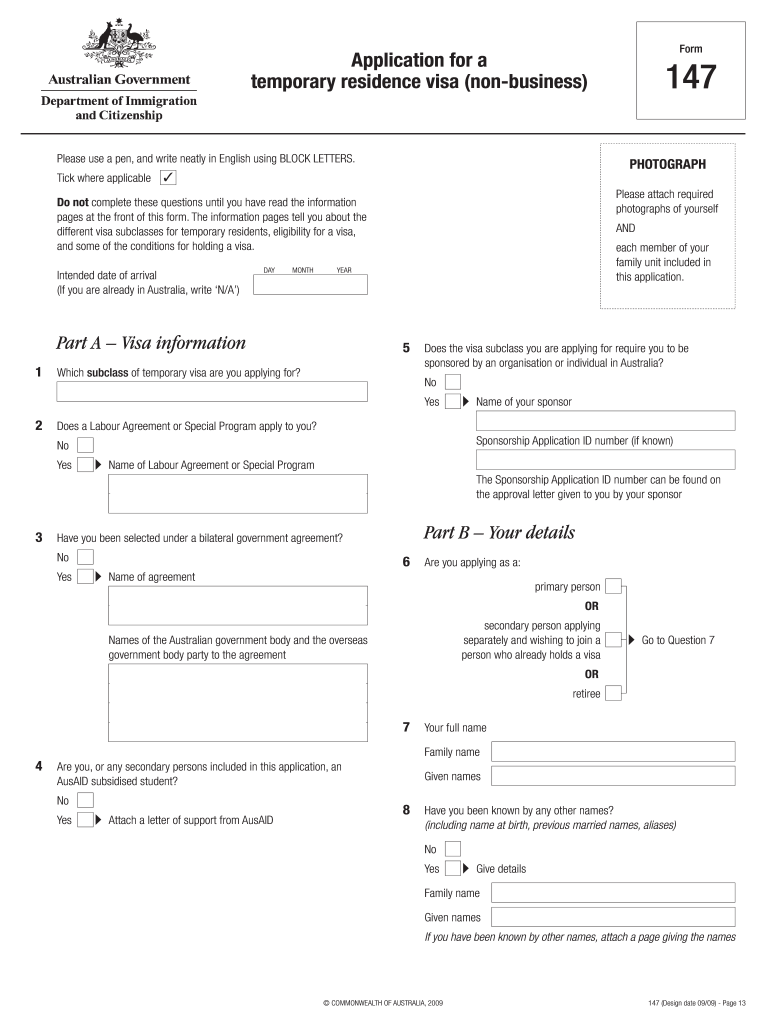

AU Form 147 20092022 Fill and Sign Printable Template Online US

This number reaches the irs business & specialty tax department, which is open between 7 a.m. Web the irs form 147c or ein letter is one of the most important documents that a business owner can have. The documents should be 2 years old or less. An agent of the llc can also complete and send form 147 c to.

IRS FORM 147C PDF

There is a solution if you don’t have possession of the ein confirmation letter. You should request one if you ever misplace your cp 575. The documents should be 2 years old or less. Web an ein verification letter (commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number.

form 147c Images Frompo

Pplorfmas@pcgus.com public partnerships llc or fmas p.o. This document proves that the business owner has an employer identification number, which is required for many business transactions. Employers engaged in a trade or business who pay compensation form 9465; By fax (you can use an actual fax or a digital/online fax) 147c by mail The business can contact the irs directly.

Web The Irs Form 147C Or Ein Letter Is One Of The Most Important Documents That A Business Owner Can Have.

This number reaches the irs business & specialty tax department, which is open between 7 a.m. The irs sends it to tell you what your existing ein is. You should request one if you ever misplace your cp 575. Form 147c online get form 147c online show details how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save form 147c irs form download rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 35 votes how to fill out and sign 147c irs form pdf online?

This Document Proves That The Business Owner Has An Employer Identification Number, Which Is Required For Many Business Transactions.

Pplorfmas@pcgus.com public partnerships llc or fmas p.o. A 147c letter is not a request for the irs to create an ein; Web a 147c letter, also known as an ein verification letter, is a form sent to the internal revenue service (irs) by a company to request their employee identification number (ein number or tax id number) or by a third party to verify a company’s ein with their permission. Employee's withholding certificate form 941;

This Document Is Often Required For Businesses To.

There is a solution if you don’t have possession of the ein confirmation letter. An agent of the llc can also complete and send form 147 c to the irs on behalf of the owner. Web 147c form from the irs is the employer identification number (ein) verification letter. Here’s a sample 147c letter for the university of iowa.

Web What Is A 147C Letter?

Web an irs letter 147c, also known as an ein verification letter, is a letter the internal revenue service (irs) sends a company when it has lost or misplaced its employer identification number (ein) and needs to confirm what it is. Locate your original ein letter. For security reasons, the irs will never send anything by email. Instead, the irs will send you an ein verification letter (147c) two ways: