Schedule F Form

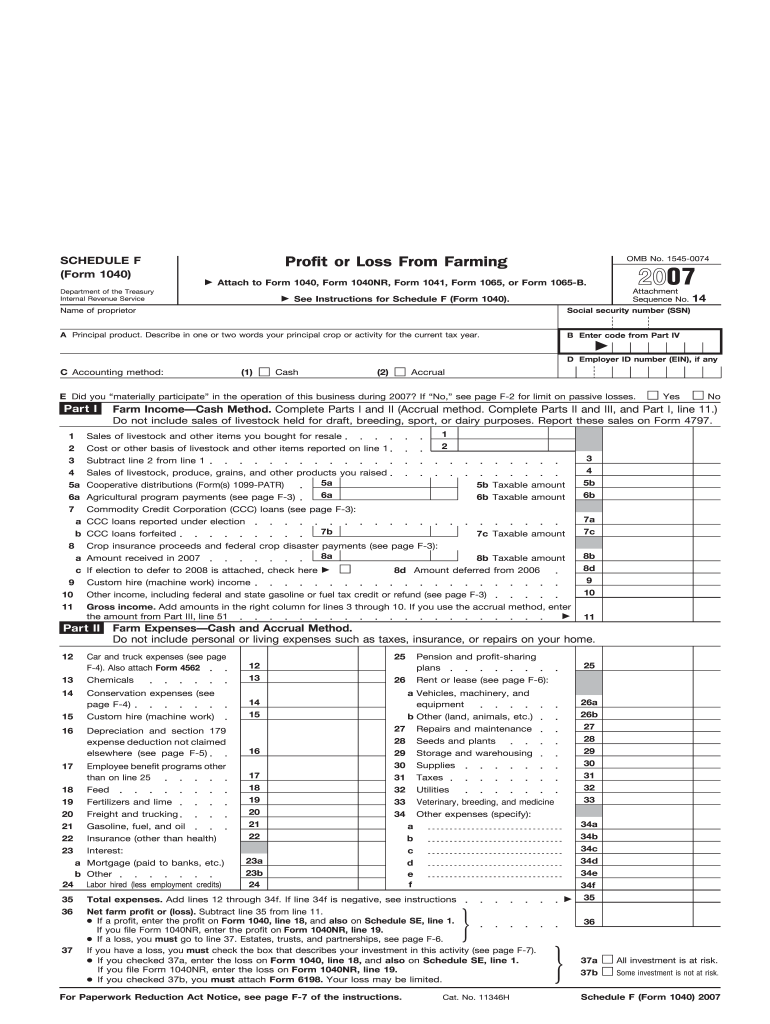

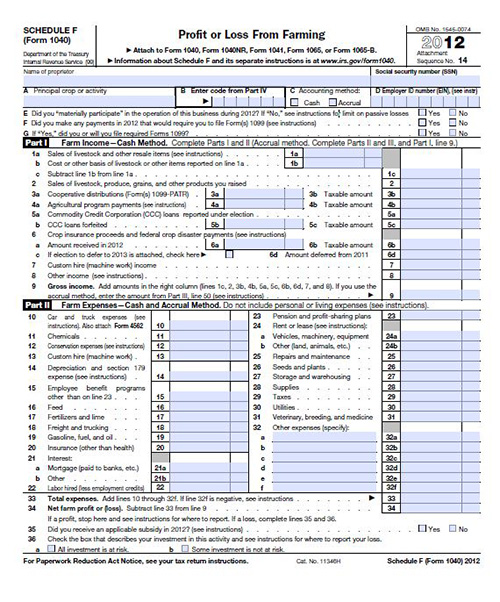

Schedule F Form - Web recorded on a form 1040 schedule f: Profit or loss from farming. Web taxes can be complicated. Assumed and ceded remsurance by company: F1 academy has five teams — art grand prix,. Web use irs schedule f to report farm income and expenses. Your farming activity may subject you to state and. Get ready for tax season deadlines by completing any required tax forms today. For individuals, it is included with your. Web a schedule f appointment was a job classification in the excepted service of the united states federal civil service that existed briefly at the end of the trump administration.

Use schedule f (form 1040) to report farm income and expenses. Ad access irs tax forms. Web who files a schedule f? Your farming activity may subject you to state and. Argentina, italy, south africa, sweden: Web recorded on a form 1040 schedule f: Web 2022 instructions for schedule fprofit or loss from farming use schedule f (form 1040) to report farm income and expenses. Net profits are subject to self. Web use irs schedule f to report farm income and expenses. Someone may have a farm and produce farm income, but not qualify as a farmer under a specific tax provision.

Argentina, italy, south africa, sweden: Get ready for tax season deadlines by completing any required tax forms today. When you sell livestock, produce, grains, or other products, the entire amount you receive and the costs associated with its purchase and production should be. Ad access irs tax forms. Web a schedule f appointment was a job classification in the excepted service of the united states federal civil service that existed briefly at the end of the trump administration. Complete, edit or print tax forms instantly. Web recorded on a form 1040 schedule f: Web who files a schedule f? Part 1 shows assumed premiums and. Schedule f is due when personal income taxes are due, on tax day.

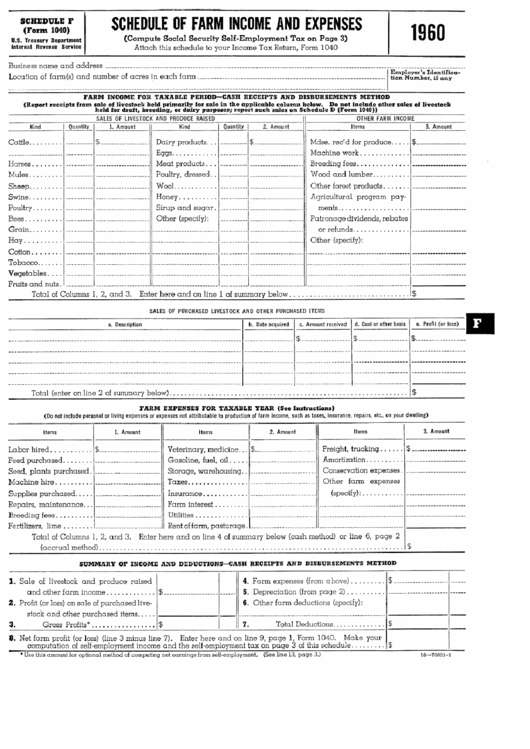

Schedule F (Form 1040) Schedule Of Farm And Expenses 1960

Web 2021 instructions for schedule fprofit or loss from farming. Schedule j (form 1040) income averaging for farmers and. Get ready for tax season deadlines by completing any required tax forms today. When you sell livestock, produce, grains, or other products, the entire amount you receive and the costs associated with its purchase and production should be. Fifa women's world.

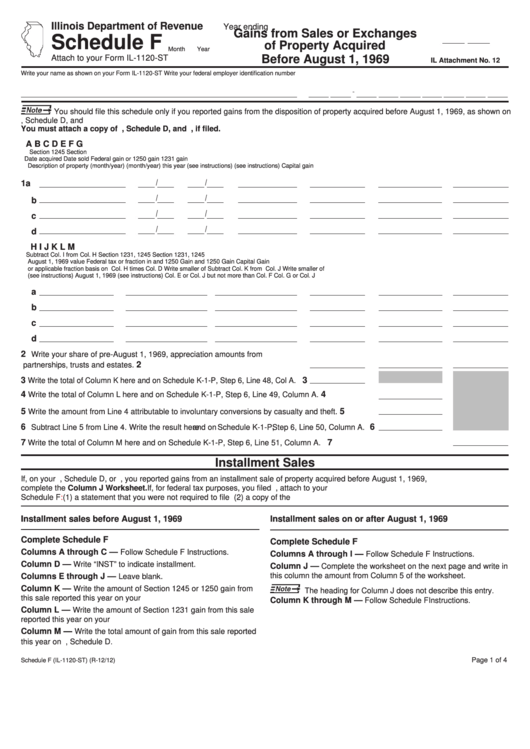

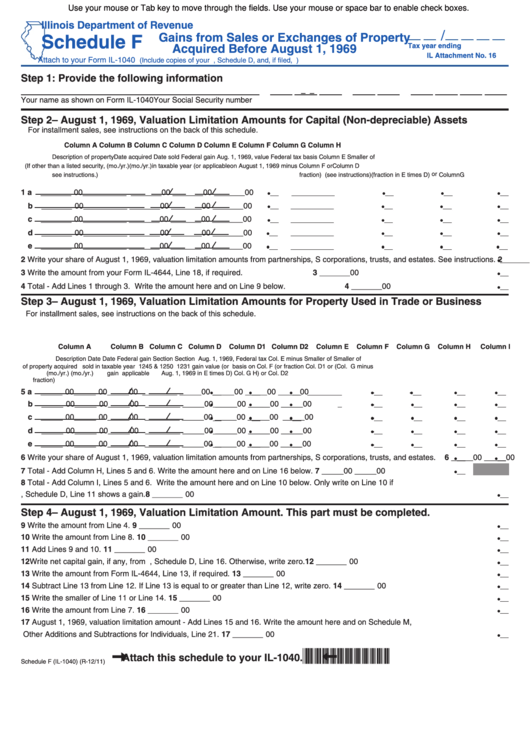

Schedule F Attach To Your Form Il1120St Gains From Sales Or

Schedule f is due when personal income taxes are due, on tax day. Part 1 shows assumed premiums and. Web 2021 instructions for schedule fprofit or loss from farming. Your farming activity may subject you to state and. Web who files a schedule f?

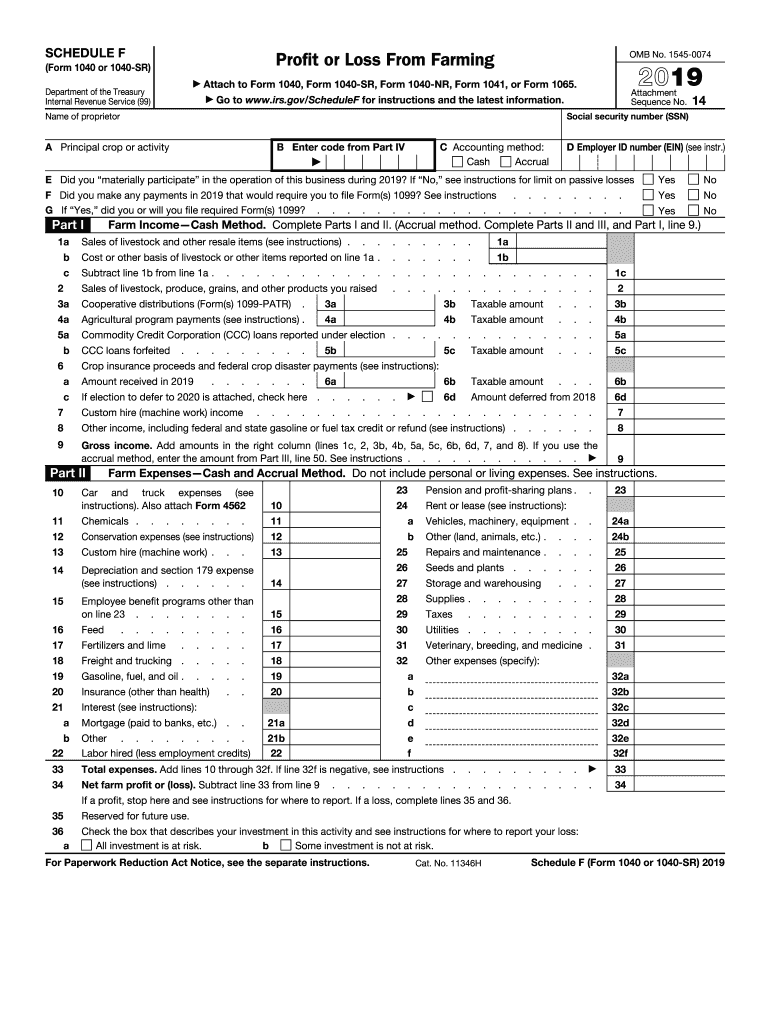

2019 Form IRS 1040 Schedule F Fill Online, Printable, Fillable, Blank

Web the women's world cup is underway and australia faces a tough battle to make it out of group b. Ad irs schedule f form 1040 & more fillable forms, register and subscribe now! Web schedule f (form 1040) profit or loss from farming. Adding in a schedule f is necessary for tax purposes if you are claiming income from.

Form 1040 Schedule F Edit, Fill, Sign Online Handypdf

F1 academy has five teams — art grand prix,. Complete, edit or print tax forms instantly. Keep track of all the latest moves in the standings here. When you sell livestock, produce, grains, or other products, the entire amount you receive and the costs associated with its purchase and production should be. Web use irs schedule f to report farm.

Form 1040 (Schedule F) Profit or Loss From Farming (2014) Free Download

Your farming activity may subject you to state and. Fifa women's world cup 2023 round of 16 schedule and results. Web a schedule f appointment was a job classification in the excepted service of the united states federal civil service that existed briefly at the end of the trump administration. Use schedule f (form 1040) to report farm income and.

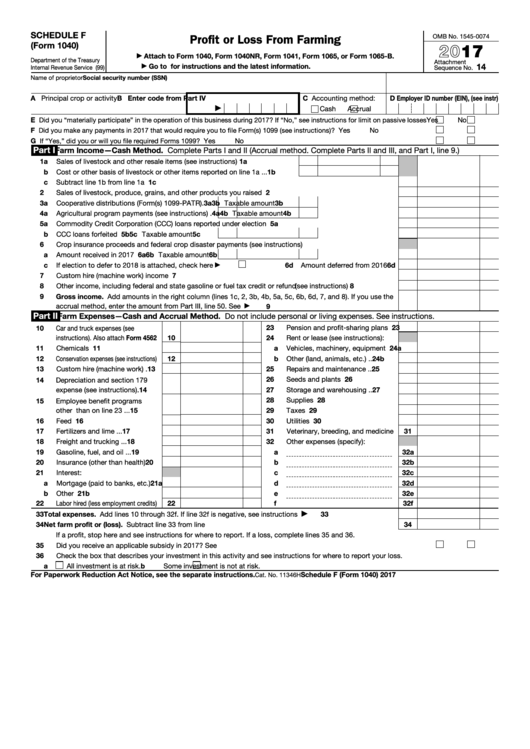

Fillable Schedule F (Form 1040) Profit Or Loss From Farming 2017

Web recorded on a form 1040 schedule f: Web 2021 instructions for schedule fprofit or loss from farming. Web structure of schedule f schedule f serves three primary purposes: Someone may have a farm and produce farm income, but not qualify as a farmer under a specific tax provision. Net profits are subject to self.

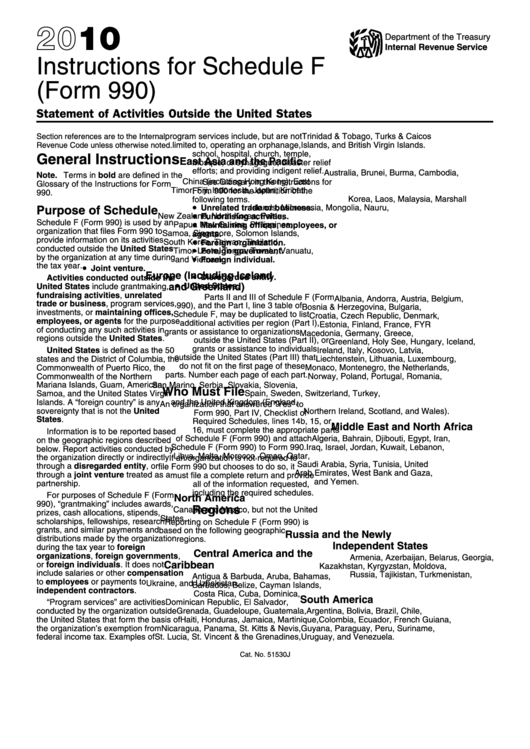

Instructions For Schedule F (Form 990) 2010 printable pdf download

Web recorded on a form 1040 schedule f: Web the women's world cup is underway and australia faces a tough battle to make it out of group b. Schedule f is due when personal income taxes are due, on tax day. Net profits are subject to self. Web 2022 instructions for schedule fprofit or loss from farming use schedule f.

Form 1040 Schedule F Fill in Capable Profit or Loss from Farming Fill

Part 1 shows assumed premiums and. Web use schedule f (form 1040) to report farm income and expenses. Web schedule f (form 1040) profit or loss from farming. Web the women's world cup is underway and australia faces a tough battle to make it out of group b. Net profits are subject to self.

Fillable Schedule F (Form Il1040) Gains From Sales Or Exchanges Of

Web 2021 instructions for schedule fprofit or loss from farming. Fifa women's world cup 2023 round of 16 schedule and results. Web structure of schedule f schedule f serves three primary purposes: Use schedule f (form 1040) to report farm income and expenses. Someone may have a farm and produce farm income, but not qualify as a farmer under a.

Register Now for Farm Tax NC State Extension

Get ready for tax season deadlines by completing any required tax forms today. Assumed and ceded remsurance by company: Profit or loss from farming. Web use irs schedule f to report farm income and expenses. Web use schedule f (form 1040) to report farm income and expenses.

Web 2021 Instructions For Schedule Fprofit Or Loss From Farming.

Ad access irs tax forms. Web schedule f (form 1040) profit or loss from farming. Keep track of all the latest moves in the standings here. Part 1 shows assumed premiums and.

Web The Women's World Cup Is Underway And Australia Faces A Tough Battle To Make It Out Of Group B.

Ad irs schedule f form 1040 & more fillable forms, register and subscribe now! For individuals, it is included with your. Web use irs schedule f to report farm income and expenses. When you sell livestock, produce, grains, or other products, the entire amount you receive and the costs associated with its purchase and production should be.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Net profits are subject to self. Fifa women's world cup 2023 round of 16 schedule and results. Web structure of schedule f schedule f serves three primary purposes: Schedule h (form 1040) household employment taxes.

The Decedent Held An Interest As Joint Tenants With Rights Of.

Someone may have a farm and produce farm income, but not qualify as a farmer under a specific tax provision. Use schedule f (form 1040) to report farm income and expenses. Web 2022 instructions for schedule fprofit or loss from farming use schedule f (form 1040) to report farm income and expenses. Adding in a schedule f is necessary for tax purposes if you are claiming income from your farming operation, no matter how small.this article provides a.