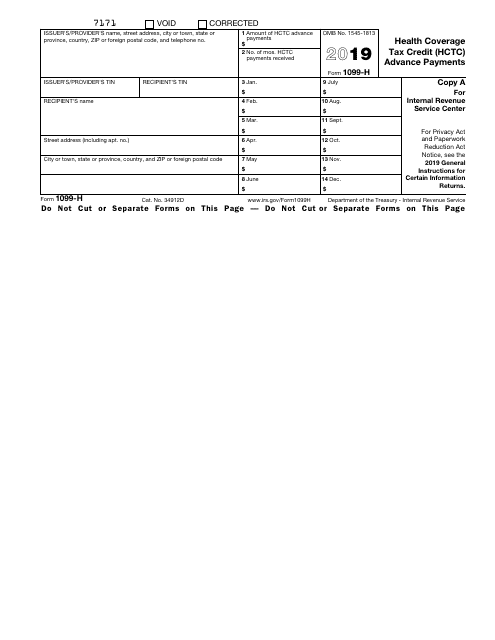

Form 1099 H

Form 1099 H - Web you need to fill this form if your account has the interest more than $10 that you should pay during the financial year; Web report rents from real estate on schedule e (form 1040). This irs form is used to report advanced. Three basic areas determine if you’re an employee: Taxpayer's information (the issuer/provider, recipient) number of hctc advance payment hctc advance payments (paid for. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Web form 1099 is a type of tax form that records payments received that don't come from salary or wages. Income you receive from any sources other than an. Learn more about how to simplify your businesses 1099 reporting. The hctc is a tax credit that pays a percentage of health.

(basis is usually the amount of cost incurred by. Web a 1099 tax form is a statement generated by any entity or person — excluding your employer — that details an amount of money that you were paid. Web you need to fill this form if your account has the interest more than $10 that you should pay during the financial year; Taxpayer's information (the issuer/provider, recipient) number of hctc advance payment hctc advance payments (paid for. Health coverage tax credit (hctc). The hctc is a tax credit that pays a percentage of health. Per irs publication 17, page 246: Api client id (a2a filers only) sign in to iris for system. Web form 1099 is a type of tax form that records payments received that don't come from salary or wages. Instructions for recipient recipient's identification number.

Health coverage tax credit (hctc). Web what you need employer identification number (ein) iris transmitter control code (tcc). For your protection, this form may show only the last four digits of. Income you receive from any sources other than an. Instructions for recipient recipient's identification number. This irs form is used to report advanced. Learn more about how to simplify your businesses 1099 reporting. Web form 1099 is a type of tax form that records payments received that don't come from salary or wages. At least $10 in royalties or broker. Web you need to fill this form if your account has the interest more than $10 that you should pay during the financial year;

IRS Approved 1099H Copy C Laser Tax Form 100 Recipients

This irs form is used to report advanced. For your protection, this form may show only the last four digits of. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. However, report rents on schedule c (form 1040) if you provided significant services to the tenant, sold.

IRS Approved 1099H Tax Forms File Form 1099H, Health Coverage Tax

Web form 1099 is a type of tax form that records payments received that don't come from salary or wages. Three basic areas determine if you’re an employee: For your protection, this form may show only the last four digits of. Web this form is for your information only. Learn more about how to simplify your businesses 1099 reporting.

Electronic IRS Form 1099H 2018 2019 Printable PDF Sample

Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Web report rents from real estate on schedule e (form 1040). Certificate of deposits, treasury bonds,. Only certain taxpayers are eligible. Web what you need employer identification number (ein) iris transmitter control code (tcc).

Form 1099H Definition

Web form 1099 is a type of tax form that records payments received that don't come from salary or wages. Taxpayer's information (the issuer/provider, recipient) number of hctc advance payment hctc advance payments (paid for. (basis is usually the amount of cost incurred by. Per irs publication 17, page 246: Instructions for recipient recipient's identification number.

Form 1099H HCTC Advance Payments (2012) Free Download

This irs form is used to report advanced. At least $10 in royalties or broker. Web this form is for your information only. The hctc is a tax credit that pays a percentage of health. Learn more about how to simplify your businesses 1099 reporting.

IRS Form 1099H Download Fillable PDF or Fill Online Health Coverage

Instructions for recipient recipient's identification number. For your protection, this form may show only the last four digits of. (basis is usually the amount of cost incurred by. Health coverage tax credit (hctc). The hctc is a tax credit that pays a percentage of health.

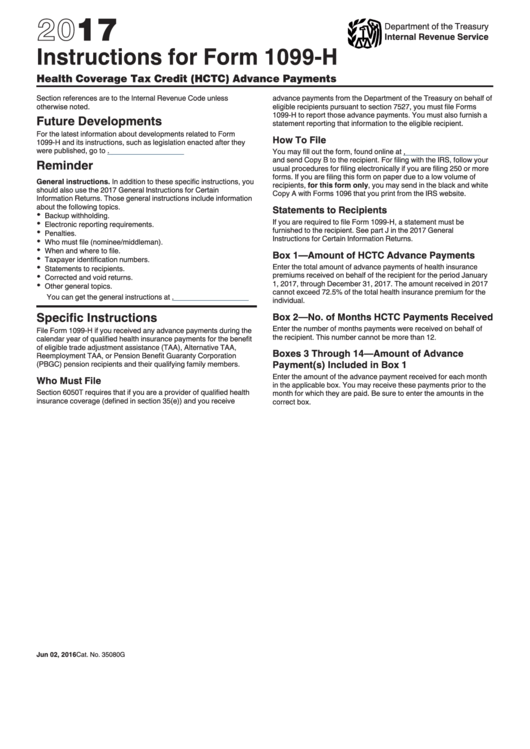

Instructions For Form 1099H 2017 printable pdf download

Web this form is for your information only. (basis is usually the amount of cost incurred by. The hctc is a tax credit that pays a percentage of health. Learn more about how to simplify your businesses 1099 reporting. Certificate of deposits, treasury bonds,.

Form 1099HHealth Coverage Tax Credit (HCTC) Advance Payments

However, report rents on schedule c (form 1040) if you provided significant services to the tenant, sold real. Taxpayer's information (the issuer/provider, recipient) number of hctc advance payment hctc advance payments (paid for. This irs form is used to report advanced. (basis is usually the amount of cost incurred by. Web you need to fill this form if your account.

Form 1099H Health Coverage Tax Credit Advance Payments Definition

Web report rents from real estate on schedule e (form 1040). Certificate of deposits, treasury bonds,. Api client id (a2a filers only) sign in to iris for system. Per irs publication 17, page 246: Web a 1099 tax form is a statement generated by any entity or person — excluding your employer — that details an amount of money that.

Form 1099H HCTC Advance Payments (2012) Free Download

Web you need to fill this form if your account has the interest more than $10 that you should pay during the financial year; Web this form is for your information only. (basis is usually the amount of cost incurred by. Learn more about how to simplify your businesses 1099 reporting. However, report rents on schedule c (form 1040) if.

Web Form 1099 Is A Type Of Tax Form That Records Payments Received That Don't Come From Salary Or Wages.

Web a 1099 tax form is a statement generated by any entity or person — excluding your employer — that details an amount of money that you were paid. Certificate of deposits, treasury bonds,. At least $10 in royalties or broker. Web what you need employer identification number (ein) iris transmitter control code (tcc).

Income You Receive From Any Sources Other Than An.

Taxpayer's information (the issuer/provider, recipient) number of hctc advance payment hctc advance payments (paid for. Instructions for recipient recipient's identification number. Learn more about how to simplify your businesses 1099 reporting. This irs form is used to report advanced.

Web This Form Is For Your Information Only.

However, report rents on schedule c (form 1040) if you provided significant services to the tenant, sold real. Three basic areas determine if you’re an employee: (basis is usually the amount of cost incurred by. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules.

Only Certain Taxpayers Are Eligible.

The hctc is a tax credit that pays a percentage of health. Web report rents from real estate on schedule e (form 1040). Api client id (a2a filers only) sign in to iris for system. Per irs publication 17, page 246:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.38.17AM-5b9ac2ed428744dd97b99ff97cf60bba.png)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at11.48.59AM-e4b3de27a8544337b02af39530d548d6.png)