Form 1065 Schedule M 3 Instructions

Form 1065 Schedule M 3 Instructions - Web purpose of form use schedule c (form 1065) to provide answers to additional questions. Web follow the simple instructions below: Web on november 5, 2022, p reports to k, as it is required to do, that p is a. December 2021) net income (loss) reconciliation. A partnership must complete parts ii and iii if ending total assets are $50 million. When the tax period started unexpectedly or. December 2021) net income (loss) reconciliation. Ad get ready for tax season deadlines by completing any required tax forms today. Web filing requirements all entities required to file a federal form 1065, u.s. Who must file any entity that files.

Web purpose of form use schedule c (form 1065) to provide answers to additional questions. Ad get ready for tax season deadlines by completing any required tax forms today. December 2021) net income (loss) reconciliation. Web applicable schedule and instructions. Web filing requirements all entities required to file a federal form 1065, u.s. When the tax period started unexpectedly or. December 2021) net income (loss) reconciliation. A partnership must complete parts ii and iii if ending total assets are $50 million. Web follow the simple instructions below: Complete, edit or print tax forms instantly.

Web any entity that files form 1065 u.s. Web get the instructions for federal form 1065, specific instructions, schedule k and. Get ready for tax season deadlines by completing any required tax forms today. Web schedule b, question 6; December 2021) net income (loss) reconciliation. When the tax period started unexpectedly or. Web purpose of form use schedule c (form 1065) to provide answers to additional questions. Web follow the simple instructions below: Web filing requirements all entities required to file a federal form 1065, u.s. Web applicable schedule and instructions.

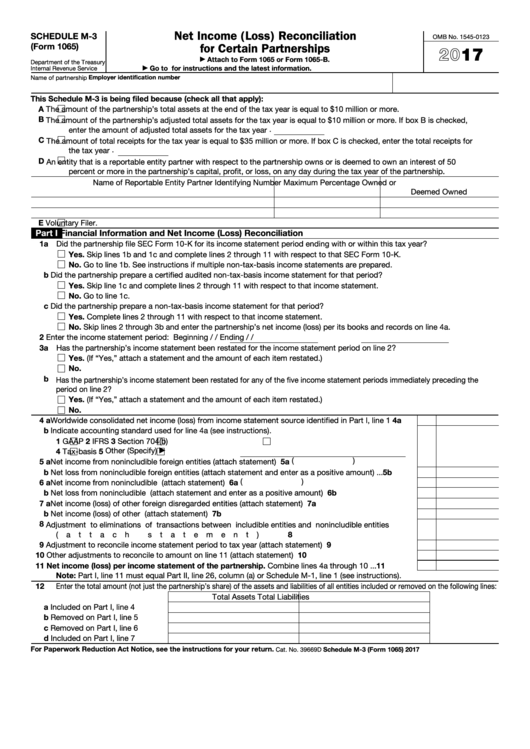

Form 1065 (Schedule M3) Net (Loss) Reconciliation for Certain

Web get the instructions for federal form 1065, specific instructions, schedule k and. Get ready for tax season deadlines by completing any required tax forms today. When the tax period started unexpectedly or. Web applicable schedule and instructions. Web any entity that files form 1065 u.s.

1065 tax instructions dejawer

December 2021) net income (loss) reconciliation. Complete, edit or print tax forms instantly. Web any entity that files form 1065 u.s. Get ready for tax season deadlines by completing any required tax forms today. When the tax period started unexpectedly or.

Llc Tax Form 1065 Universal Network

Web purpose of form use schedule c (form 1065) to provide answers to additional questions. December 2021) net income (loss) reconciliation. Get ready for tax season deadlines by completing any required tax forms today. Web filing requirements all entities required to file a federal form 1065, u.s. Web follow the simple instructions below:

Form 1065 (Schedule M3) Net (Loss) Reconciliation for Certain

When the tax period started unexpectedly or. Who must file any entity that files. Web purpose of form use schedule c (form 1065) to provide answers to additional questions. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today.

Irs Form 1065 K 1 Instructions Universal Network

Get ready for tax season deadlines by completing any required tax forms today. Who must file any entity that files. Web follow the simple instructions below: December 2021) net income (loss) reconciliation. Web get the instructions for federal form 1065, specific instructions, schedule k and.

Fill Free fillable Form 1065 schedule M3 2019 PDF form

Web schedule b, question 6; Web on november 5, 2022, p reports to k, as it is required to do, that p is a. Ad get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. When the tax period started unexpectedly or.

Form 10 Filing Instructions 10 10 Various Ways To Do Form 10 Filing

Web follow the simple instructions below: Web any entity that files form 1065 u.s. Who must file any entity that files. When the tax period started unexpectedly or. Ad get ready for tax season deadlines by completing any required tax forms today.

Inst 1120PC (Schedule M3)Instructions for Schedule M3 (Form 1120…

Web on november 5, 2022, p reports to k, as it is required to do, that p is a. Web applicable schedule and instructions. Complete, edit or print tax forms instantly. Web follow the simple instructions below: Get ready for tax season deadlines by completing any required tax forms today.

IRS Instructions 1065 (Schedule K1) 2018 2019 Printable & Fillable

Web schedule b, question 6; December 2021) net income (loss) reconciliation. Who must file any entity that files. Get ready for tax season deadlines by completing any required tax forms today. When the tax period started unexpectedly or.

Fillable Schedule M3 (Form 1065) Net (Loss) Reconciliation

Web filing requirements all entities required to file a federal form 1065, u.s. A partnership must complete parts ii and iii if ending total assets are $50 million. Web purpose of form use schedule c (form 1065) to provide answers to additional questions. Web follow the simple instructions below: When the tax period started unexpectedly or.

Who Must File Any Entity That Files.

Complete, edit or print tax forms instantly. December 2021) net income (loss) reconciliation. Web applicable schedule and instructions. Get ready for tax season deadlines by completing any required tax forms today.

Web Purpose Of Form Use Schedule C (Form 1065) To Provide Answers To Additional Questions.

Web on november 5, 2022, p reports to k, as it is required to do, that p is a. Web filing requirements all entities required to file a federal form 1065, u.s. Web get the instructions for federal form 1065, specific instructions, schedule k and. When the tax period started unexpectedly or.

Web Follow The Simple Instructions Below:

Web any entity that files form 1065 u.s. Web schedule b, question 6; A partnership must complete parts ii and iii if ending total assets are $50 million. December 2021) net income (loss) reconciliation.