Form 1120S Schedule K-1 Instructions

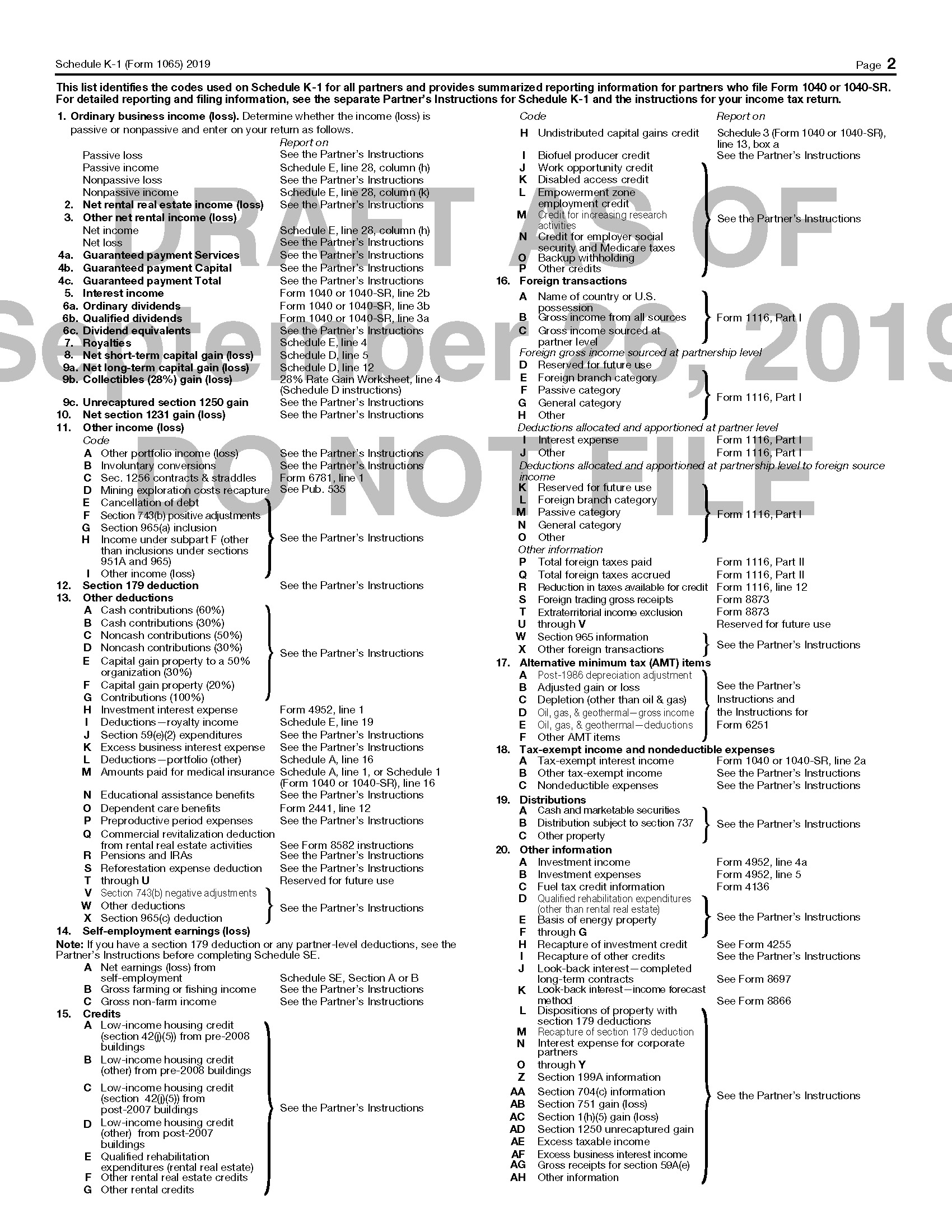

Form 1120S Schedule K-1 Instructions - Fill in all required fields in the doc with our convenient. Click the button get form to open it and start editing. This code will let you know if you should. 4 digit code used to identify the software developer whose application produced the bar code. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Web federal form 1120s, schedule k, lines 12a, 12b, 12c(2) and 12d or federal form 1065, schedule k, line 13a, 13b, 13c(2) and 13d. Get ready for this year's tax season quickly and safely with pdffiller! Information from the schedule k. Department of the treasury internal revenue service for calendar year 2022, or tax year. This article focuses solely on the entry of the credit and foreign transaction items which are found on boxes.

This article focuses solely on the entry of the credit and foreign transaction items which are found on boxes. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for. This code will let you know if you should. Click the button get form to open it and start editing. Some items reported on your schedule k. Get ready for this year's tax season quickly and safely with pdffiller! Web federal form 1120s, schedule k, lines 12a, 12b, 12c(2) and 12d or federal form 1065, schedule k, line 13a, 13b, 13c(2) and 13d. Information from the schedule k. Fill in all required fields in the doc with our convenient.

This article focuses solely on the entry of the credit and foreign transaction items which are found on boxes. 4 digit code used to identify the software developer whose application produced the bar code. Get ready for this year's tax season quickly and safely with pdffiller! Web federal form 1120s, schedule k, lines 12a, 12b, 12c(2) and 12d or federal form 1065, schedule k, line 13a, 13b, 13c(2) and 13d. This code will let you know if you should. Click the button get form to open it and start editing. Department of the treasury internal revenue service for calendar year 2022, or tax year. Fill in all required fields in the doc with our convenient. Some items reported on your schedule k. Information from the schedule k.

Drafts of 2019 Forms 1065 and 1120S, As Well As K1s, Issued by IRS

Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. This article focuses solely on the entry of the credit and foreign transaction items which are found on boxes. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in.

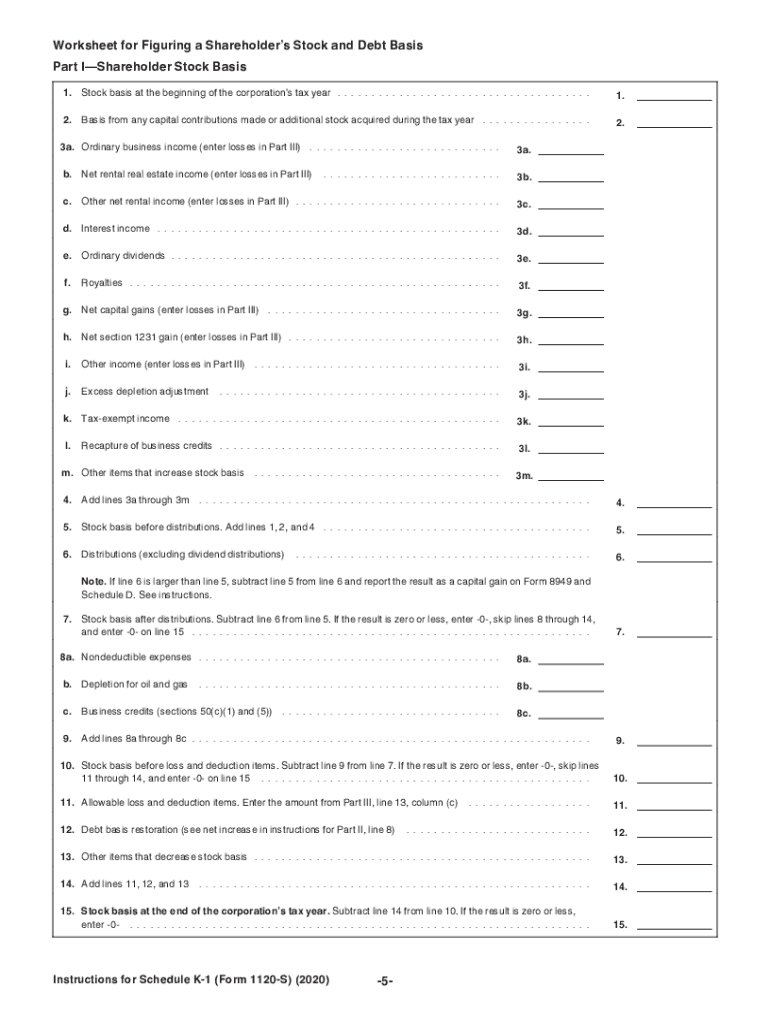

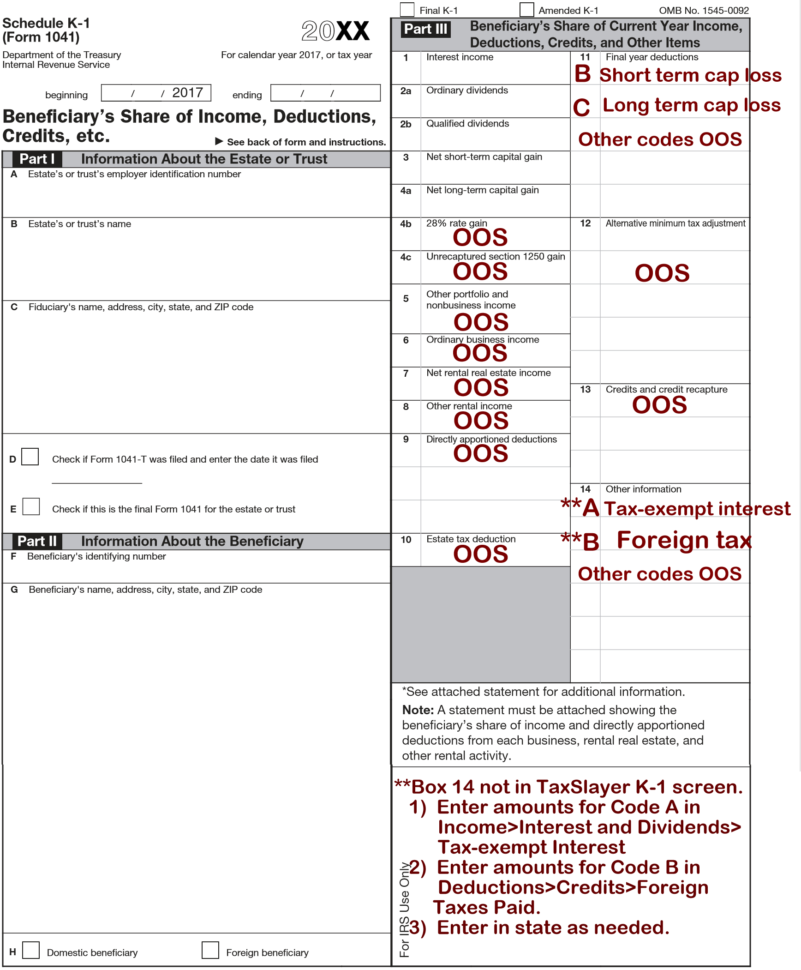

IRS Instruction 1120S Schedule K1 2020 Fill out Tax Template

Information from the schedule k. 4 digit code used to identify the software developer whose application produced the bar code. Web federal form 1120s, schedule k, lines 12a, 12b, 12c(2) and 12d or federal form 1065, schedule k, line 13a, 13b, 13c(2) and 13d. Click the button get form to open it and start editing. Get ready for this year's.

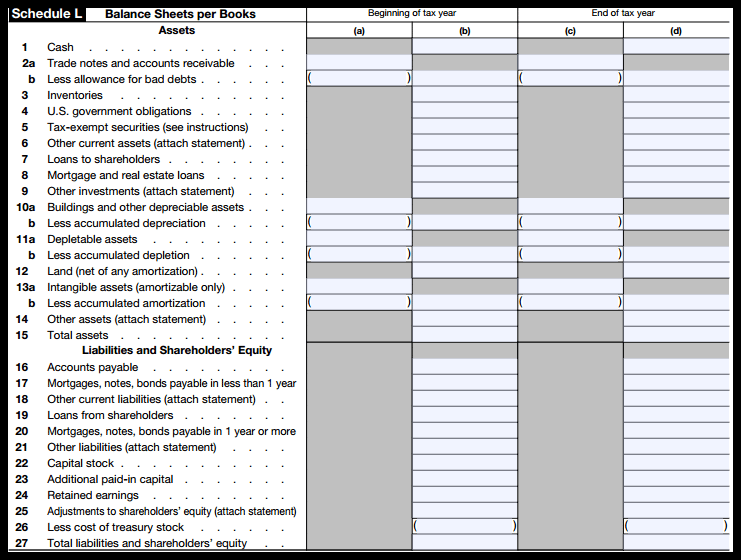

What is Form 1120S and How Do I File It? Ask Gusto

Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for. Web federal form 1120s, schedule k, lines 12a, 12b, 12c(2) and 12d or federal form 1065, schedule k, line 13a, 13b, 13c(2) and 13d. Click the button get form to open.

What Is K1 Form For Taxes Fill Out and Sign Printable PDF Template

Web federal form 1120s, schedule k, lines 12a, 12b, 12c(2) and 12d or federal form 1065, schedule k, line 13a, 13b, 13c(2) and 13d. 4 digit code used to identify the software developer whose application produced the bar code. This code will let you know if you should. Click the button get form to open it and start editing. Information.

IRS Form 1120S Definition, Download, & 1120S Instructions

Web federal form 1120s, schedule k, lines 12a, 12b, 12c(2) and 12d or federal form 1065, schedule k, line 13a, 13b, 13c(2) and 13d. 4 digit code used to identify the software developer whose application produced the bar code. Get ready for this year's tax season quickly and safely with pdffiller! Information from the schedule k. Web the partnership should.

3.12.217 Error Resolution Instructions for Form 1120S Internal

Get ready for this year's tax season quickly and safely with pdffiller! Department of the treasury internal revenue service for calendar year 2022, or tax year. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Information from the schedule k. Fill in all required fields.

41 1120s other deductions worksheet Worksheet Works

Fill in all required fields in the doc with our convenient. Some items reported on your schedule k. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for. This article focuses solely on the entry of the credit and foreign transaction.

Form 1120S K 1 Instructions 2016 2018 Codes Line 17 —

This code will let you know if you should. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for. Web federal form 1120s, schedule k, lines 12a, 12b, 12c(2) and 12d or federal form 1065, schedule k, line 13a, 13b, 13c(2).

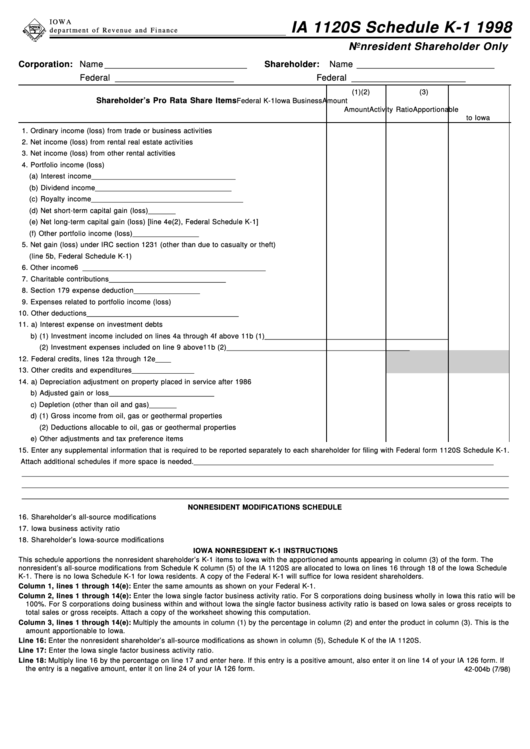

Fillable Form 1120s Schedule K1 Nonresident Shareholder Only 1998

Some items reported on your schedule k. This article focuses solely on the entry of the credit and foreign transaction items which are found on boxes. Click the button get form to open it and start editing. Web federal form 1120s, schedule k, lines 12a, 12b, 12c(2) and 12d or federal form 1065, schedule k, line 13a, 13b, 13c(2) and.

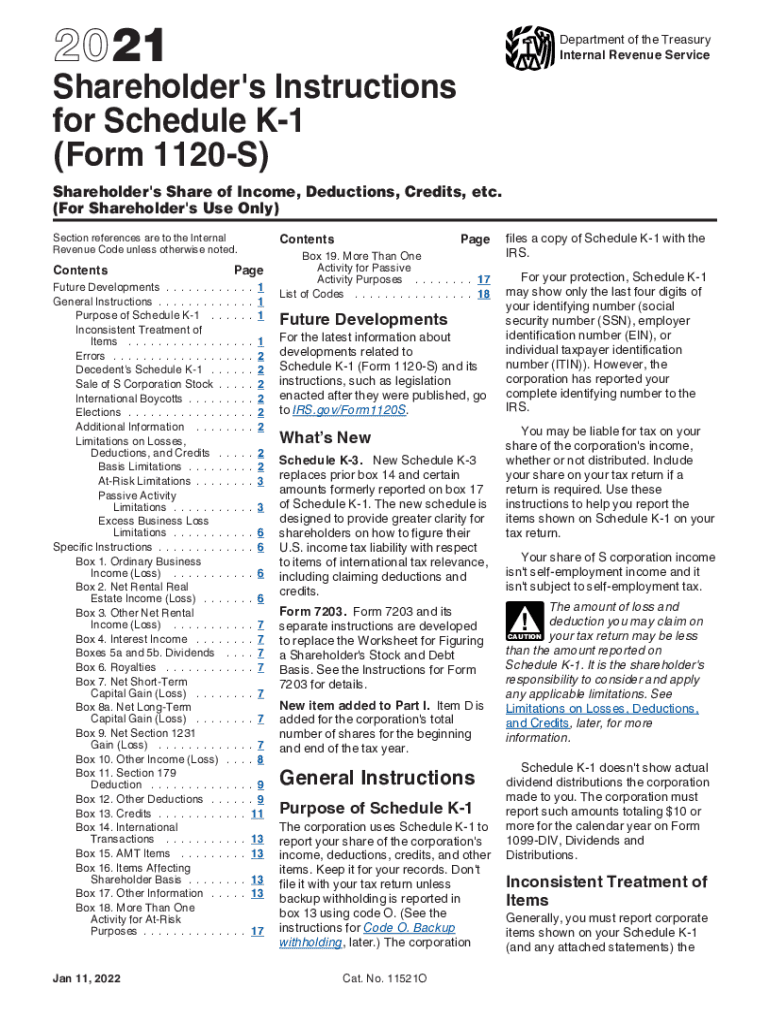

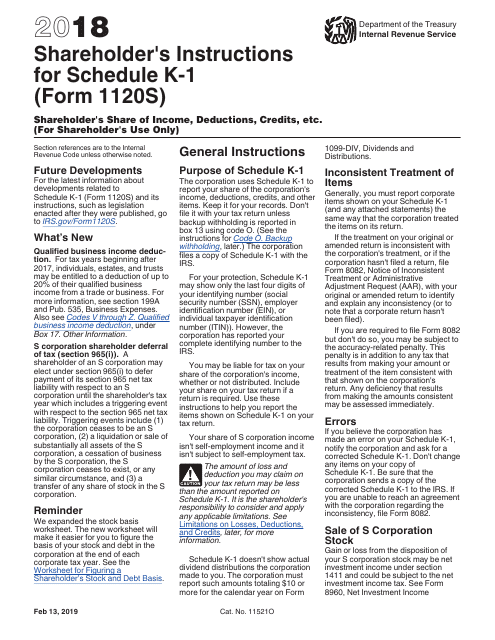

Download Instructions for IRS Form 1120S Schedule K1 Shareholder's

Department of the treasury internal revenue service for calendar year 2022, or tax year. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. This article focuses solely on the entry of the credit and foreign transaction items which are found on boxes. 4 digit code.

Web A Corporation That Held A Qualified Investment In An Advanced Manufacturing Facility That Is Placed In Service After December 31, 2022, Can Elect To Treat The Credit For.

Fill in all required fields in the doc with our convenient. Web federal form 1120s, schedule k, lines 12a, 12b, 12c(2) and 12d or federal form 1065, schedule k, line 13a, 13b, 13c(2) and 13d. This code will let you know if you should. Get ready for this year's tax season quickly and safely with pdffiller!

This Article Focuses Solely On The Entry Of The Credit And Foreign Transaction Items Which Are Found On Boxes.

4 digit code used to identify the software developer whose application produced the bar code. Information from the schedule k. Click the button get form to open it and start editing. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments.

Some Items Reported On Your Schedule K.

Department of the treasury internal revenue service for calendar year 2022, or tax year.