Filing Form 1120

Filing Form 1120 - Web how do i file form 1120? Corporation income tax return, form 1120 is a formal document created by the internal revenue service (irs) that corporations and. You can file this form electronically using irs free file or a tax software if you feel comfortable filling out and. It can also be used to report income for other. Any organization taxed as a c corporation must file form 1120. Web how do you file form 1120? If you decide to file the form via mail, you must fill out the form and mail it to the. Corporation income tax return, is the central filing document for incorporated businesses, like corporations and llcs. Complete, edit or print tax forms instantly. Corporation income tax return, is used to report corporate income taxes to the irs.

You can either file form 1120 electronically or by mail. Web mailing addresses for forms 1120. Web do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of. Web form 1120 must be completed and filed no later than the 15 th day of the 3 rd month following the close of your corporate tax year. Web form 1120, also known as the u.s. And the total assets at the end of the tax year are: For calendar year corporations, the due date is march 15, 2023. When you use a schedule c with form 1040, or file form 1120 for a corporation, you usually need to file your return by the april 15 deadline. Form 1120 can be filed online or by mail.

And the total assets at the end of the tax year are: Complete, edit or print tax forms instantly. For filing deadlines and other information related to. Web form 1120, also known as the u.s. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of. Web irs form 1120, the u.s. Person filing form 8865, any required statements to qualify for the. It can also be used to report income for other. For 2022, the corporation's total. Web how do i file form 1120?

Filing Corporation Tax Return Form 1120 Stock Photo Download

Corporation income tax return, form 1120 is a formal document created by the internal revenue service (irs) that corporations and. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! For 2022, the corporation's total. Web 7 rows this topic provides electronic filing opening day information and information about relevant due dates for 1120 returns. Web.

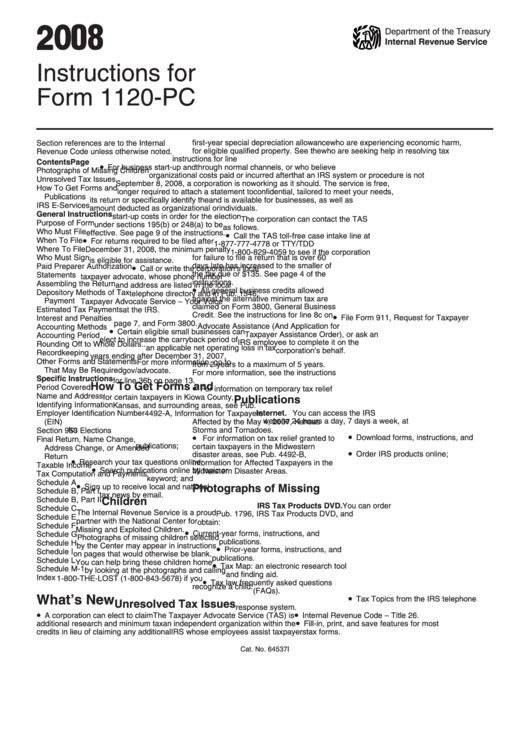

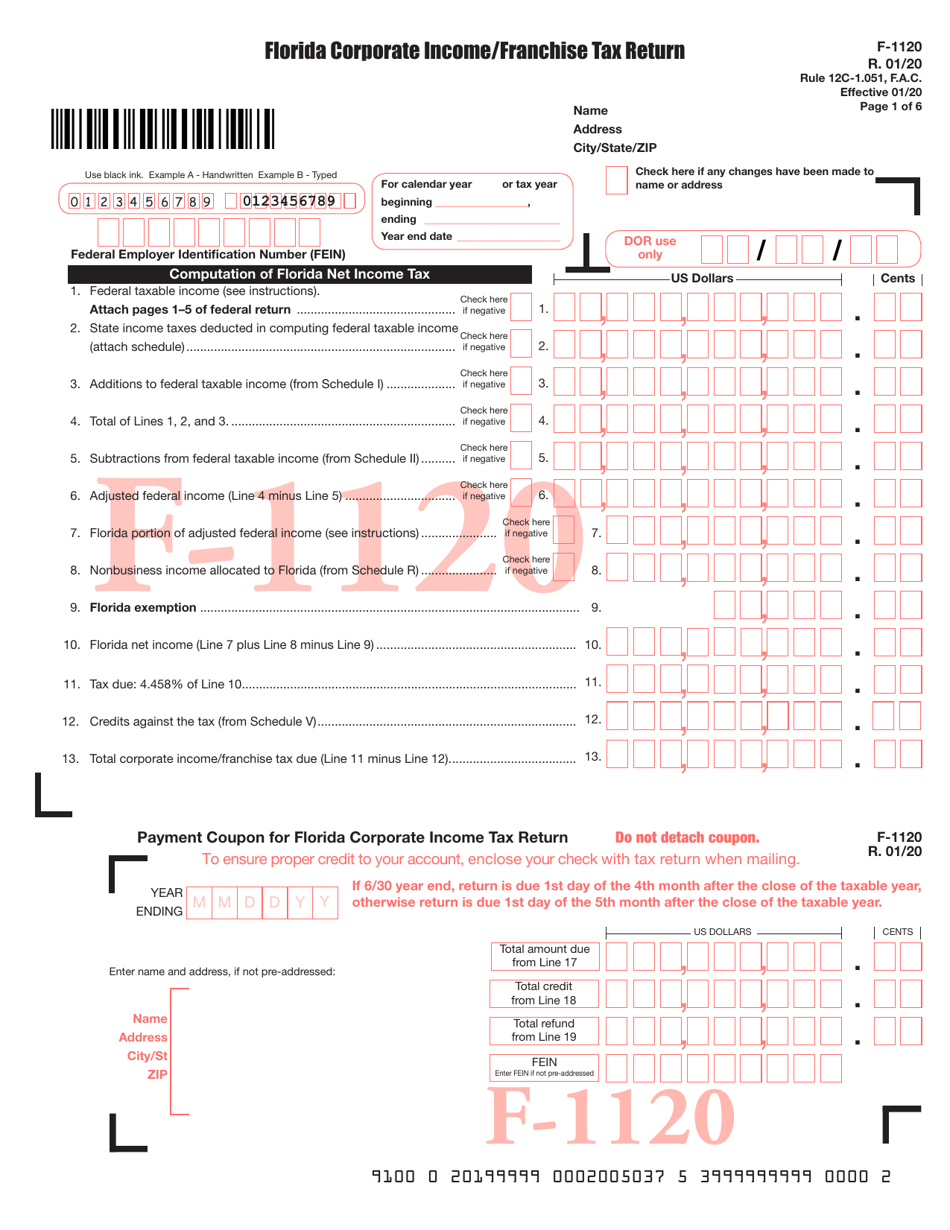

Form F1120 Download Printable PDF or Fill Online Florida Corporate

Edit, sign and save irs instruct 1120 form. Income tax return for an s corporation do not file this form unless the corporation has filed or. Corporation income tax return, is the annual tax form used by c corporations to report their income, gains, losses, deductions,. Web how do i file form 1120? Download or email 1120 1120a & more.

Form 1120S U.S. Tax Return for an S Corporation

It can also be used to report income for other. For 2022, the corporation's total. Corporation income tax return, is the central filing document for incorporated businesses, like corporations and llcs. Web a corporation that files form 1120 must file schedule utp (form 1120), uncertain tax position statement, with its 2022 income tax return if: Web who has to file.

What Is a 1120 Tax Form? Facts and Filing Tips for Small Businesses (2023)

Web irs form 1120, the u.s. And the total assets at the end of the tax year are: Web also known as the u.s. Web do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Web how do i file form 1120?

What Is the LateFiling Penalty for Form 1120?

You can file this form electronically using irs free file or a tax software if you feel comfortable filling out and. When you use a schedule c with form 1040, or file form 1120 for a corporation, you usually need to file your return by the april 15 deadline. Person filing form 8865, any required statements to qualify for the..

Form 1120S Tax Return for an S Corporation (2013) Free Download

Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of. Web also known as the u.s. Person filing form 8865, any required statements to qualify for the. Web how do i file form 1120? Corporation income tax return, form 1120 is a formal document created by the internal revenue service.

Corporation return due date is March 16, 2015Cary NC CPA

When you use a schedule c with form 1040, or file form 1120 for a corporation, you usually need to file your return by the april 15 deadline. Web a corporation that files form 1120 must file schedule utp (form 1120), uncertain tax position statement, with its 2022 income tax return if: Corporation income tax return, form 1120 is a.

IRS Form 1120 Schedule UTP Download Fillable PDF or Fill Online

Web form 1120 must be completed and filed no later than the 15 th day of the 3 rd month following the close of your corporate tax year. Complete, edit or print tax forms instantly. Person filing form 8865, any required statements to qualify for the. For filing deadlines and other information related to. Corporation income tax return, to report.

Instructions For Form 1120Pc 2008 printable pdf download

You can either file form 1120 electronically or by mail. Web mailing addresses for forms 1120. Edit, sign and save irs instruct 1120 form. If you decide to file the form via mail, you must fill out the form and mail it to the. Web who has to file form 1120?

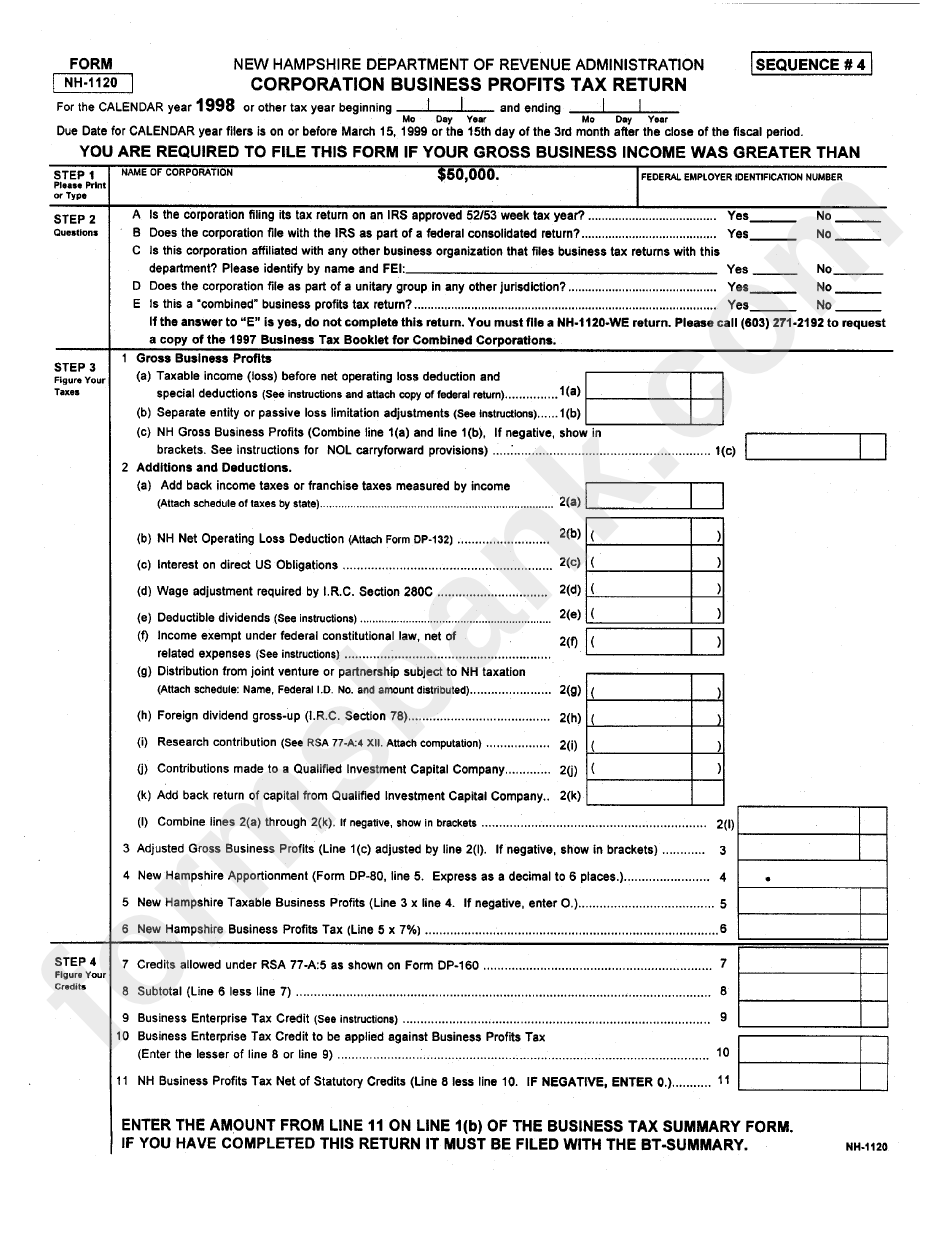

Fillable Form Nh1120 Corporation Business Profits Tax Return

Ad complete irs tax forms online or print government tax documents. You can file this form electronically using irs free file or a tax software if you feel comfortable filling out and. You can either file form 1120 electronically or by mail. Web a corporation that files form 1120 must file schedule utp (form 1120), uncertain tax position statement, with.

For Filing Deadlines And Other Information Related To.

Corporation income tax return, form 1120 is a formal document created by the internal revenue service (irs) that corporations and. Web also known as the u.s. Web form 1120 must be completed and filed no later than the 15 th day of the 3 rd month following the close of your corporate tax year. Corporation income tax return, is the annual tax form used by c corporations to report their income, gains, losses, deductions,.

And The Total Assets At The End Of The Tax Year Are:

Any organization taxed as a c corporation must file form 1120. If you registered your business as a c corporation or limited liability. Form 1120 can be filed online or by mail. You can either file form 1120 electronically or by mail.

When You Use A Schedule C With Form 1040, Or File Form 1120 For A Corporation, You Usually Need To File Your Return By The April 15 Deadline.

Person filing form 8865, any required statements to qualify for the. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! For 2022, the corporation's total. Web how do i file form 1120?

Web Irs Form 1120, The U.s.

Web who has to file form 1120? Web irs form 1120, the u.s. Complete, edit or print tax forms instantly. Download or email 1120 1120a & more fillable forms, register and subscribe now!

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)