Ca Form 541

Ca Form 541 - In this case, estimated tax payments are not due for. Edit your california franchise tax board form 541 online type text, add images, blackout confidential details, add comments, highlights and more. Part i fiduciary’s share of alternative. Web we last updated california form 541 in february 2023 from the california franchise tax board. Web code section 17951 et seq. Schedule b income distribution deduction. Attach this schedule to form 541. Schedule g california source income and deduction apportionment. Sign it in a few clicks draw. Web form 541, california fiduciary income tax return.

You can use turbotax business to prepare california fiduciary returns, but they are print. Web a form created for income tax returns for fiduciary relationships in the state of california. Part i fiduciary’s share of alternative. Schedule g california source income and deduction apportionment. Sign it in a few clicks draw. It requires information about income, deductions, tax and payment, and other general. Web form 541, california fiduciary income tax return. 19 *if the taxpayer is subject to the business credit limitation, the total of the business credits in part iv, sections a and b,. Attach this schedule to form 541. Used to report a charitable or other deduction under irc section.

Attach this schedule to form 541. You can use turbotax business to prepare california fiduciary returns, but they are print. Web schedule g california source income and deduction apportionment. Web ca form 541 filing requirement for non ca sourced income i am the trustee/fiduciary of a trust that has a single beneficiary. Part i fiduciary’s share of alternative. Complete line 1a through line 1f before. Complete line 1a through line 1f before part ii. Web schedule g california source income and deduction apportionment. Edit your california franchise tax board form 541 online type text, add images, blackout confidential details, add comments, highlights and more. Used to report a charitable or other deduction under irc section.

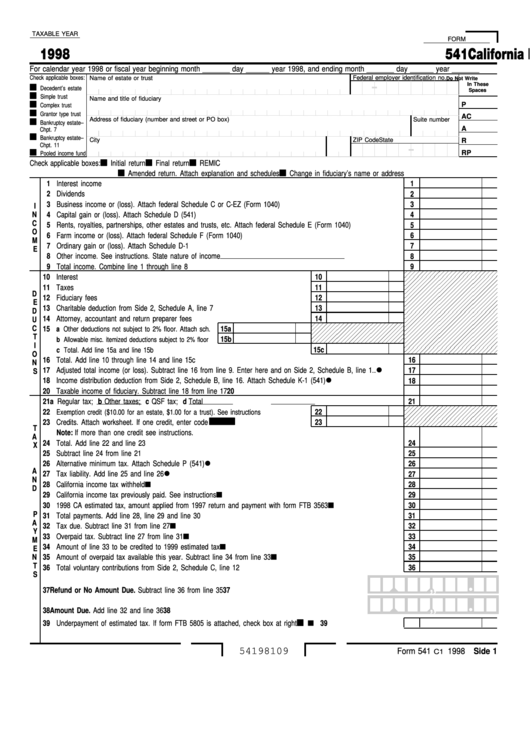

Fillable Form 541 California Fiduciary Tax Return 1998

You can use turbotax business to prepare california fiduciary returns, but they are print. Web the fiduciary (or one of the fiduciaries) must file form 541 for a trust if any of the following apply: It requires information about income, deductions, tax and payment, and other general. If a trust, enter the number of: Schedule g california source income and.

Forms and Publications Search Search Results California Franchise

Web schedule g california source income and deduction apportionment. Web a form created for income tax returns for fiduciary relationships in the state of california. Web the fiduciary (or one of the joint fiduciaries) must file form 541 and pay an annual tax of $800 for a remic that is governed by california law, qualified to do. Web schedule g.

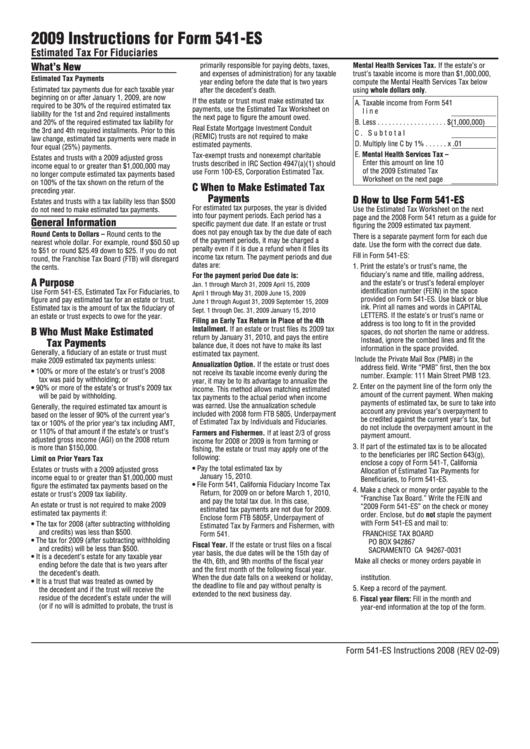

Fillable California Form 541Es Estimated Tax For Fiduciaries 2009

Part i fiduciary’s share of alternative. Web ca form 541 filing requirement for non ca sourced income i am the trustee/fiduciary of a trust that has a single beneficiary. Web form 541, california fiduciary income tax return. Your name, address, and tax identification. Web the fiduciary (or one of the joint fiduciaries) must file form 541 and pay an annual.

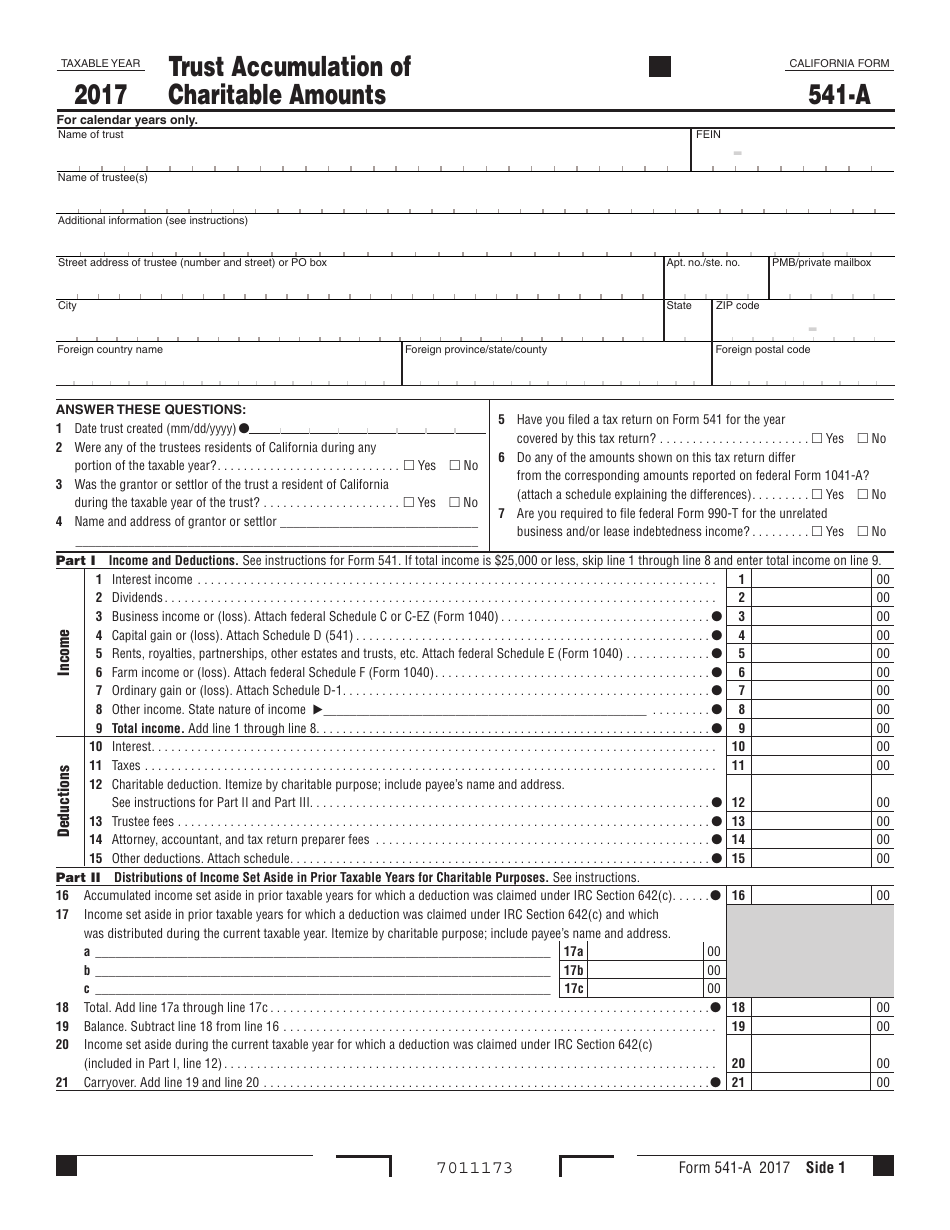

Form 541A Download Printable PDF or Fill Online Trust Accumulation of

Web 2020 california fiduciary income tax return form 541 for calendar year 2020 or fiscal year beginning (mm/dd/yyyy) _____, and ending (mm/dd/yyyy) _____ • type of entity. Web the fiduciary (or one of the joint fiduciaries) must file form 541 and pay an annual tax of $800 for a remic that is governed by california law, qualified to do. You.

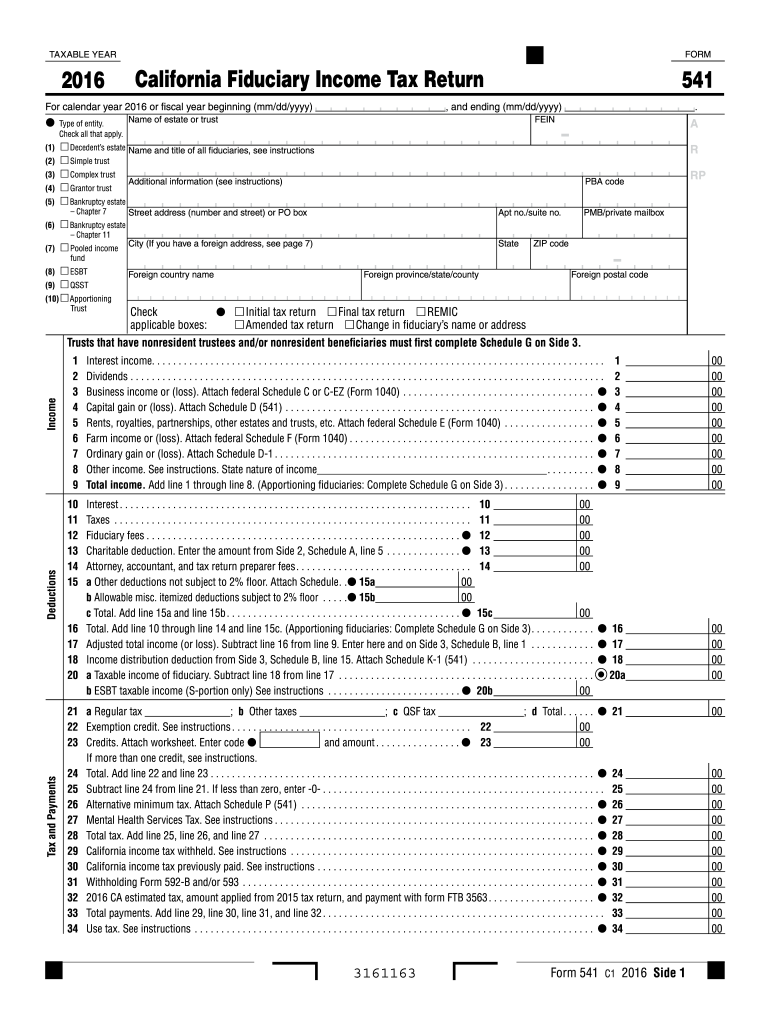

2016 Form CA FTB 541 Fill Online, Printable, Fillable, Blank pdfFiller

Your name, address, and tax identification. Used to report a charitable or other deduction under irc section. Complete line 1a through line 1f before. Web the fiduciary (or one of the fiduciaries) must file form 541 for a trust if any of the following apply: Alternative minimum tax and credit limitations — fiduciaries.

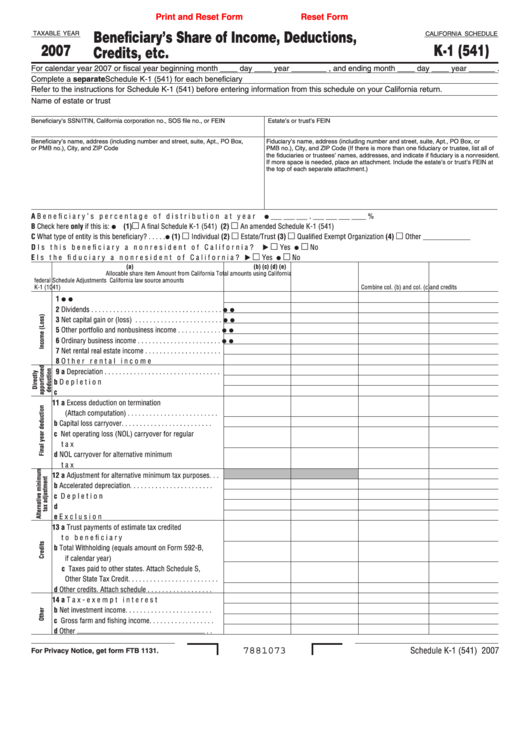

Fillable California Schedule K1 (541) Beneficiary'S Share Of

Alternative minimum tax and credit limitations — fiduciaries. It requires information about income, deductions, tax and payment, and other general. Used to report a charitable or other deduction under irc section. If a trust, enter the number of: Web file form 541, california fiduciary income tax return, for 2021 on or before march 1, 2022, and pay the total tax.

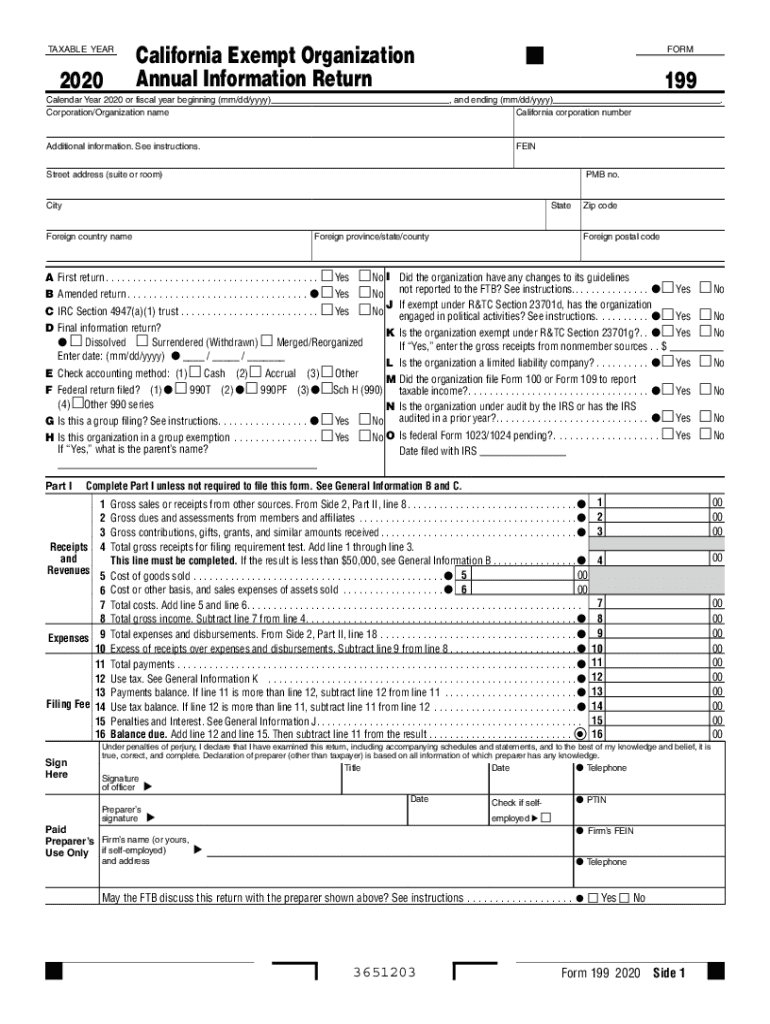

California form 199 Fill out & sign online DocHub

Web schedule g california source income and deduction apportionment. Alternative minimum tax and credit limitations — fiduciaries. Web ca form 541 filing requirement for non ca sourced income i am the trustee/fiduciary of a trust that has a single beneficiary. Web 1 best answer davidd66 expert alumni february 25, 2020 5:34 pm no. Web file form 541, california fiduciary income.

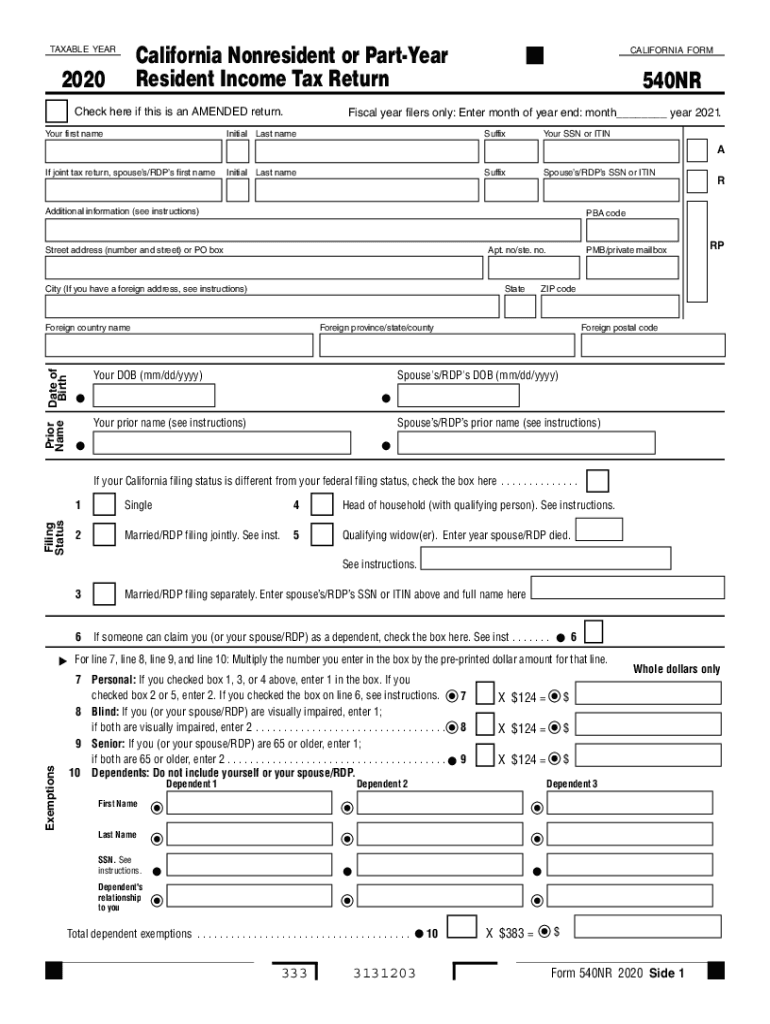

CA FTB 540NR 20202021 Fill out Tax Template Online US Legal Forms

Complete line 1a through line 1f before. Alternative minimum tax and credit limitations — fiduciaries. Web and on form 541, line 26, or form 109, line 13. Your name, address, and tax identification. In this case, estimated tax payments are not due for.

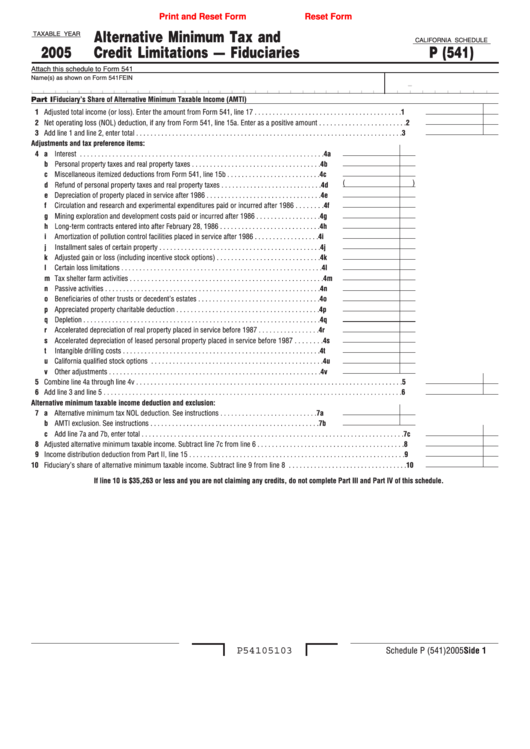

Fillable California Schedule P (541) Alternative Minimum Tax And

Web a form created for income tax returns for fiduciary relationships in the state of california. Web 7991213schedule p (541) 2021 side 1. Web schedule g california source income and deduction apportionment. Edit your california franchise tax board form 541 online type text, add images, blackout confidential details, add comments, highlights and more. Gross income for the taxable year of.

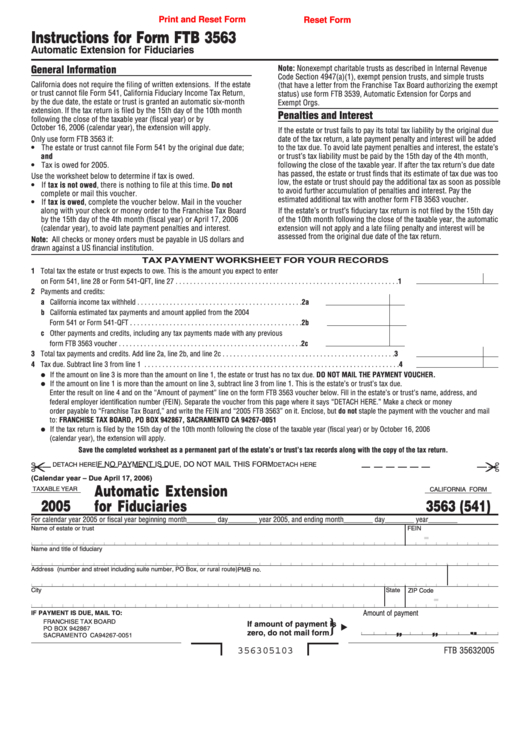

Fillable California Form 3563 (541) Automatic Extension For

Web schedule g california source income and deduction apportionment. Gross income for the taxable year of more than $10,000 (regardless. Web the fiduciary (or one of the joint fiduciaries) must file form 541 and pay an annual tax of $800 for a remic that is governed by california law, qualified to do. Part i fiduciary’s share of alternative. Sign it.

Part I Fiduciary’s Share Of Alternative.

It requires information about income, deductions, tax and payment, and other general. Attach this schedule to form 541. This form is for income earned in tax year 2022, with tax returns due in april. Schedule g california source income and deduction apportionment.

You Can Use Turbotax Business To Prepare California Fiduciary Returns, But They Are Print.

Web the fiduciary (or one of the joint fiduciaries) must file form 541 and pay an annual tax of $800 for a remic that is governed by california law, qualified to do. Web form 541, california fiduciary income tax return. Your name, address, and tax identification. Web schedule g california source income and deduction apportionment.

19 *If The Taxpayer Is Subject To The Business Credit Limitation, The Total Of The Business Credits In Part Iv, Sections A And B,.

Web 7991213schedule p (541) 2021 side 1. Used to report a charitable or other deduction under irc section. Web ca form 541 filing requirement for non ca sourced income i am the trustee/fiduciary of a trust that has a single beneficiary. Web we last updated california form 541 in february 2023 from the california franchise tax board.

Alternative Minimum Tax And Credit Limitations — Fiduciaries.

Sign it in a few clicks draw. If a trust, enter the number of: In this case, estimated tax payments are not due for. Schedule b income distribution deduction.