Arkansas State Withholding Form 2022

Arkansas State Withholding Form 2022 - Web handy tips for filling out arkansas employee withholding online. Web about us forms budget bursar contracts general accounting human resources mail services payroll procurement travel vcfa employee’s state withholding exemption. There is a very simple form to help each employer determine that. Web to change your address or to close your business for withholding purposes, please complete and submit the appropriate forms. Complete, edit or print tax forms instantly. These forms can be found on our. Enter the date the business closed or stopped withholding arkansas taxes. Complete, edit or print tax forms instantly. Web 42 rows name/address change, penalty waiver request, and request for copies of. Multiply the period gross pay by the number of periods per year to arrive at annual gross pay.

Complete, edit or print tax forms instantly. Updated versions of arkansas’ withholding certificates, which make annual adjustments to the thresholds used for exemption from withholding. Go digital and save time with signnow,. In addition to the federal income tax withholding form, w4, each employee needs. If you make $70,000 a year living in arkansas you will be taxed $11,683. Quarterly payroll and excise tax returns normally due on may 1. Ar1155 extension of time to file request: These forms can be found on our. Other parameters of the formula were unchanged. Web about us forms budget bursar contracts general accounting human resources mail services payroll procurement travel vcfa employee’s state withholding exemption.

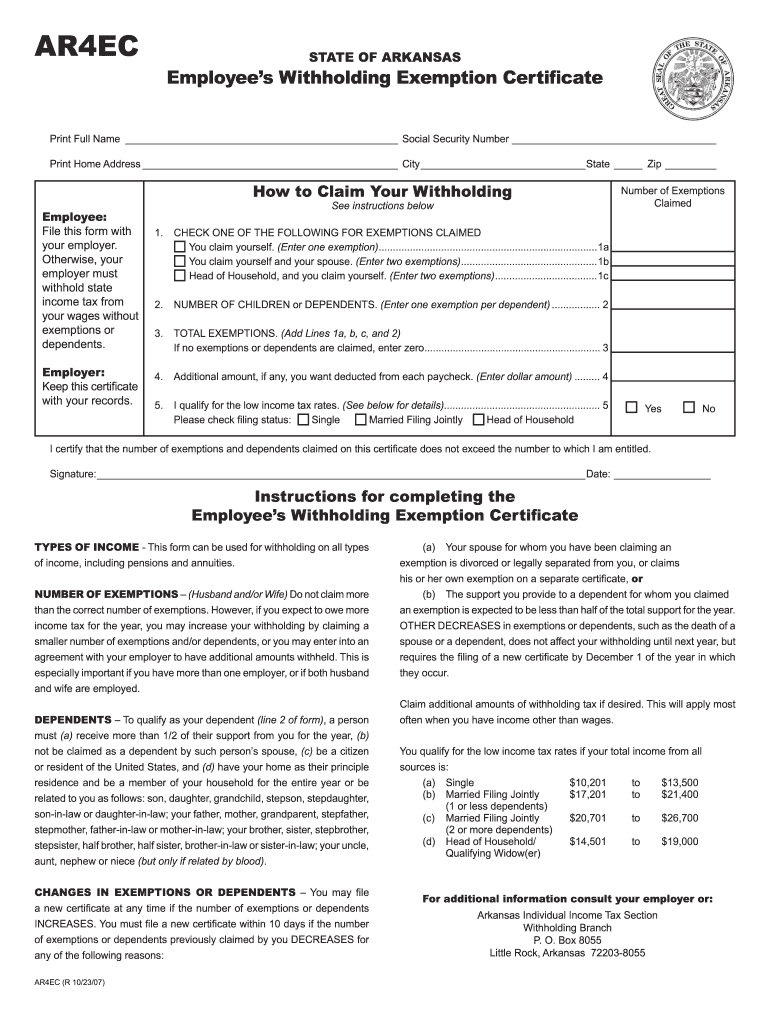

Ar1155 extension of time to file request: Web $5 (& 67$7( 2) $5.$16$6 (psor\hh·v :lwkkroglqj ([hpswlrq &huwlilfdwh 3ulqw )xoo 1dph 6rfldo 6hfxulw\ 1xpehu 3ulqw +rph $gguhvv &lw\ 6wdwh =ls (psor\hh Web arkansas’s 2022 withholding formula decreases the highest tax rate used. Web handy tips for filling out arkansas employee withholding online. Web 42 rows name/address change, penalty waiver request, and request for copies of. If too little is withheld, you will generally owe tax when. These forms can be found on our. If you make $70,000 a year living in arkansas you will be taxed $11,683. Web you can download pdfs of the new forms from the following links: Complete, edit or print tax forms instantly.

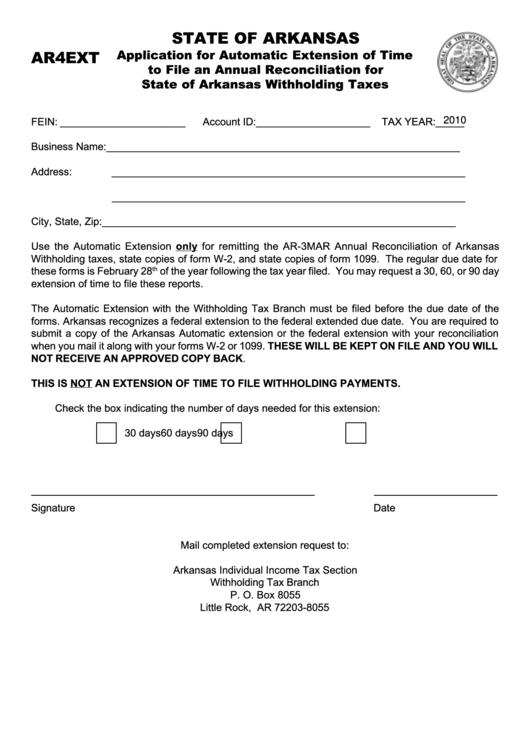

Fillable Form Ar4ext Application For Automatic Extension Of Time To

Download or email ar ar4ec & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. If too little is withheld, you will generally owe tax when. Go digital and save time with signnow,. There is a very simple form to help each employer determine that.

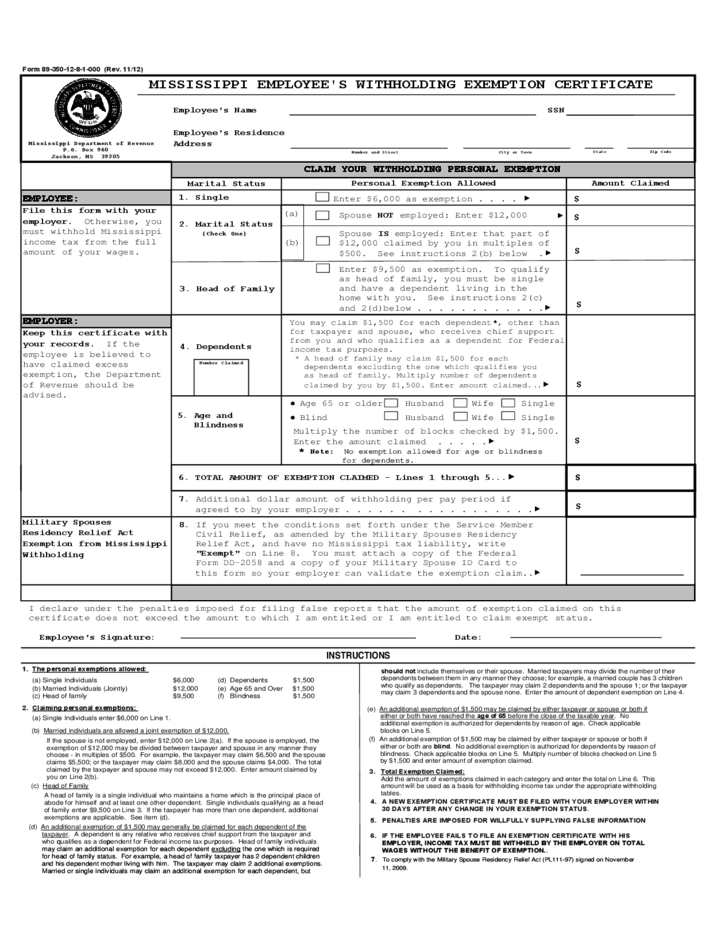

Mississippi Employee Withholding Form 2021 2022 W4 Form

Web you can download pdfs of the new forms from the following links: Multiply the period gross pay by the number of periods per year to arrive at annual gross pay. Printing and scanning is no longer the best way to manage documents. This will close your withholding account with the state of arkansas until you re. Web however, if.

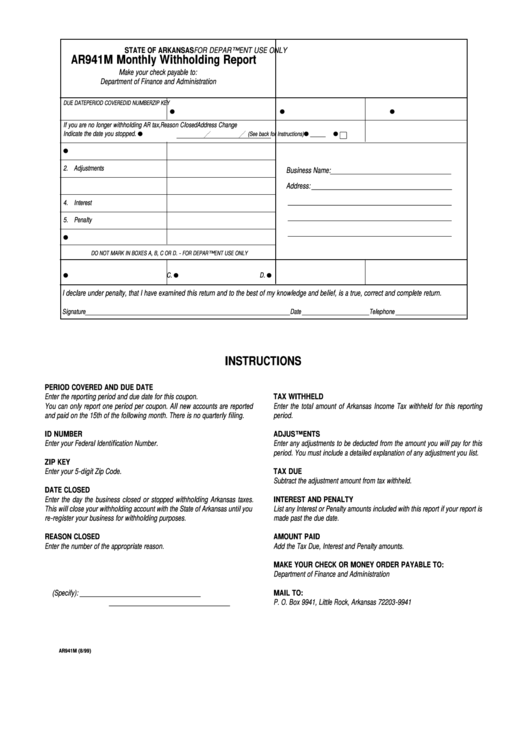

Form Ar941m State Of Arkansas Monthly Withholding Report 1999

Web however, if you expect to owe more income tax for the year, you may increase your withholding by claiming a smaller number of exemptions and/or dependents, or you. Other parameters of the formula were unchanged. Web amount of withholding rather than use the withholding tables. Quarterly payroll and excise tax returns normally due on may 1. If you make.

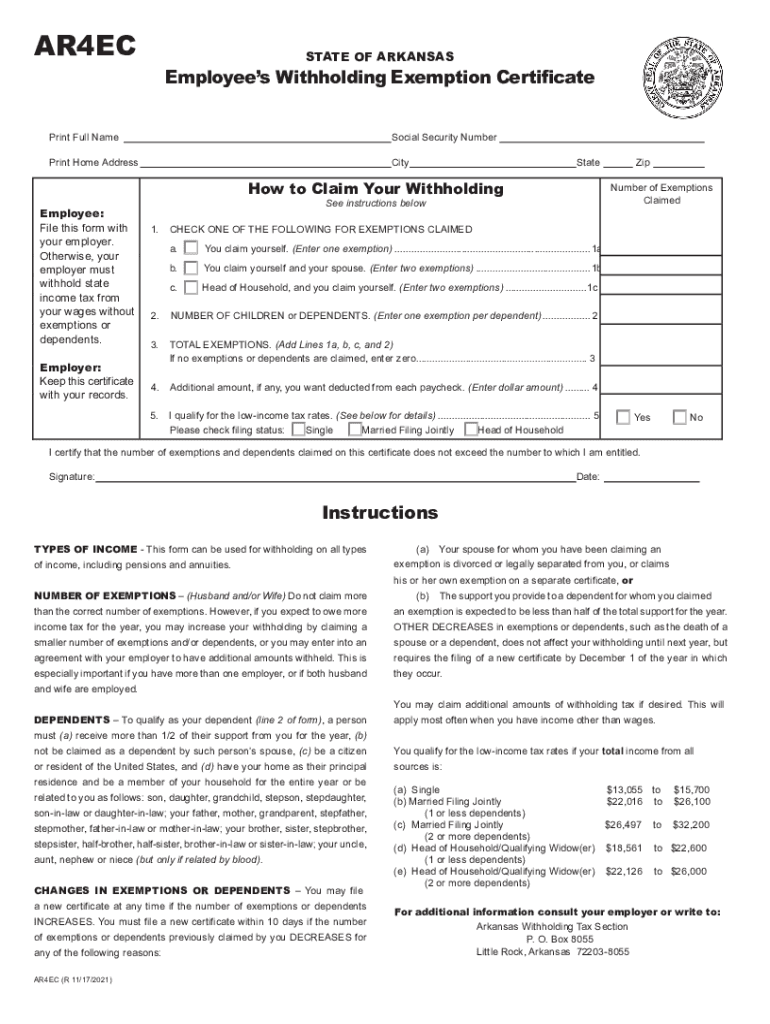

Arkansas Employee Withholding Form Fill Out and Sign Printable PDF

Printing and scanning is no longer the best way to manage documents. Web arkansas’s 2022 withholding formula decreases the highest tax rate used. Go digital and save time with signnow,. The new state laws will reduce the top income tax rate for. Web $5 (& 67$7( 2) $5.$16$6 (psor\hh·v :lwkkroglqj ([hpswlrq &huwlilfdwh 3ulqw )xoo 1dph 6rfldo 6hfxulw\ 1xpehu 3ulqw +rph.

Fillable State Of Arkansas Employee's Withholding Exemption Certificate

Web about us forms budget bursar contracts general accounting human resources mail services payroll procurement travel vcfa employee’s state withholding exemption. Go digital and save time with signnow,. In addition to the federal income tax withholding form, w4, each employee needs. These forms can be found on our. Quarterly payroll and excise tax returns normally due on may 1.

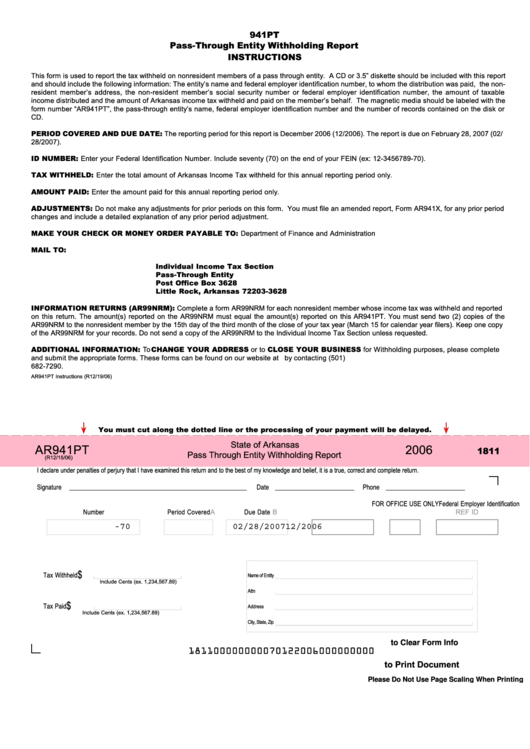

Fillable Form Ar941pt State Of Arkansas Pass Through Entity

If you make $70,000 a year living in arkansas you will be taxed $11,683. Web arkansas’s 2022 withholding formula decreases the highest tax rate used. Printing and scanning is no longer the best way to manage documents. Download or email ar1000f & more fillable forms, register and subscribe now! This will close your withholding account with the state of arkansas.

Where Can I Find Tax Tables? mutualgreget

Download or email ar ar4ec & more fillable forms, register and subscribe now! These forms can be found on our. Web however, when the clock strikes midnight, january 1, 2022 will mark the first day of the new tax legislation. Enter the date the business closed or stopped withholding arkansas taxes. Quarterly payroll and excise tax returns normally due on.

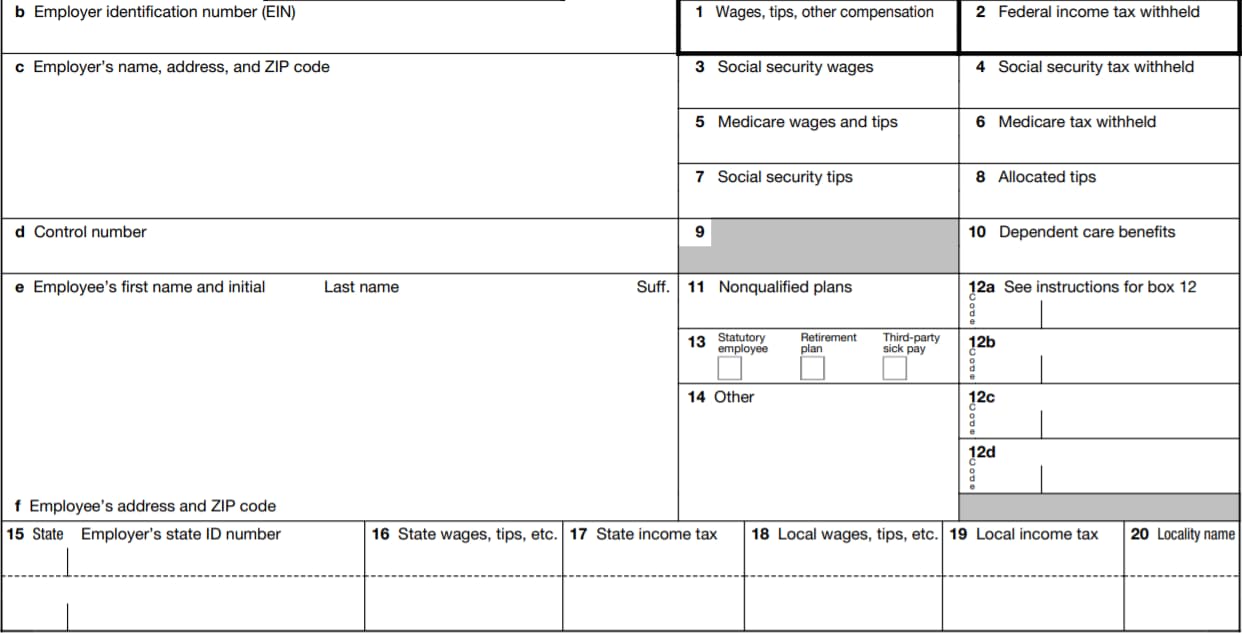

W2 Form 2022 Fillable PDF

Download or email ar ar4ec & more fillable forms, register and subscribe now! Go digital and save time with signnow,. Ar1155 extension of time to file request: Multiply the period gross pay by the number of periods per year to arrive at annual gross pay. Complete, edit or print tax forms instantly.

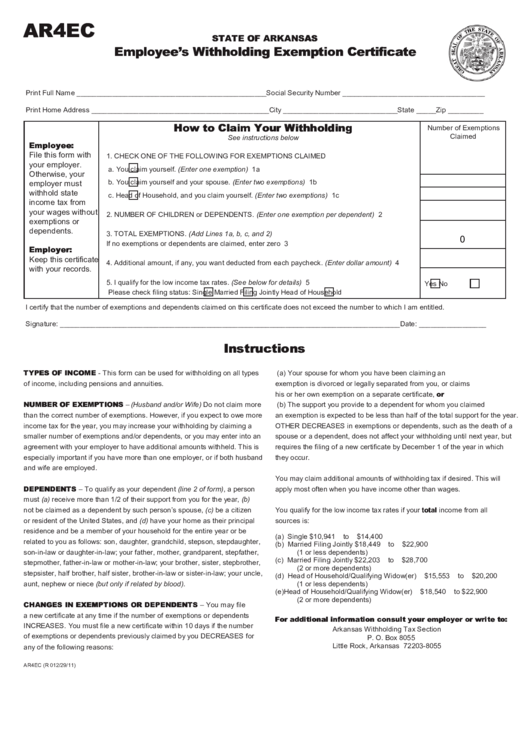

Ar4ec Form Fill Online, Printable, Fillable, Blank pdfFiller

These forms can be found on our. Web about us forms budget bursar contracts general accounting human resources mail services payroll procurement travel vcfa employee’s state withholding exemption. Web amount of withholding rather than use the withholding tables. Complete, edit or print tax forms instantly. Quarterly payroll and excise tax returns normally due on may 1.

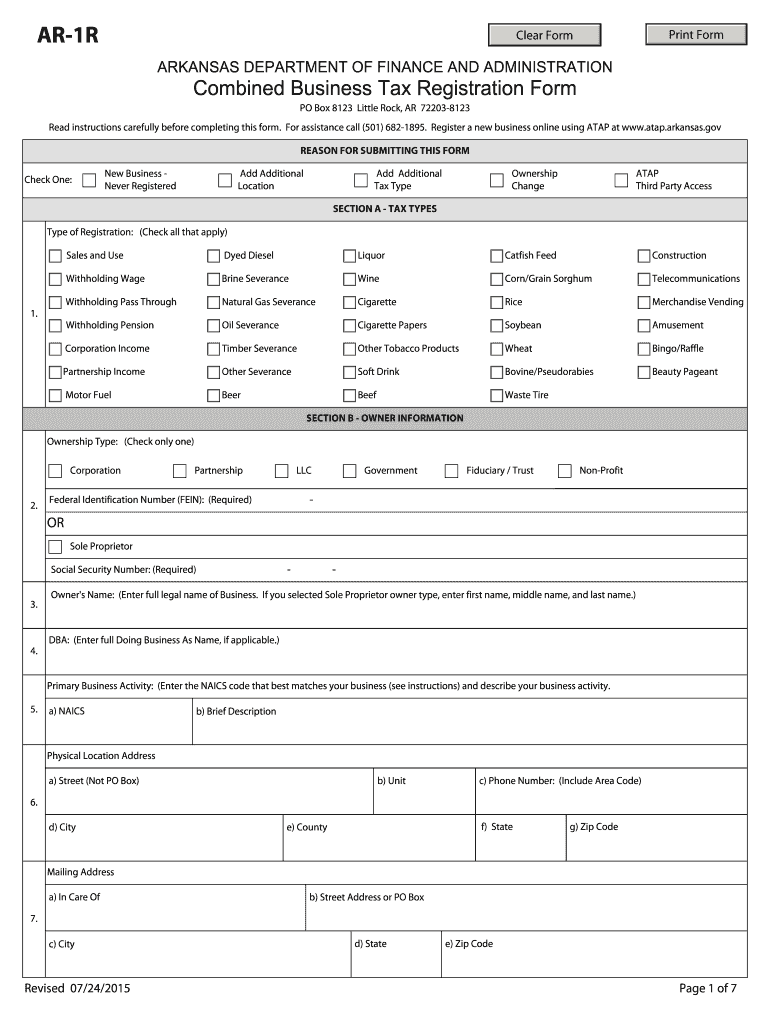

20152022 Form AR DFA AR1R Fill Online, Printable, Fillable, Blank

This will close your withholding account with the state of arkansas until you re. Printing and scanning is no longer the best way to manage documents. Download or email ar ar4ec & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Web about us forms budget bursar contracts general accounting human resources mail services payroll.

Printing And Scanning Is No Longer The Best Way To Manage Documents.

Complete, edit or print tax forms instantly. Web arkansas’s 2022 withholding formula decreases the highest tax rate used. Web $5 (& 67$7( 2) $5.$16$6 (psor\hh·v :lwkkroglqj ([hpswlrq &huwlilfdwh 3ulqw )xoo 1dph 6rfldo 6hfxulw\ 1xpehu 3ulqw +rph $gguhvv &lw\ 6wdwh =ls (psor\hh This will close your withholding account with the state of arkansas until you re.

These Forms Can Be Found On Our.

Web you can download pdfs of the new forms from the following links: If you make $70,000 a year living in arkansas you will be taxed $11,683. Web however, when the clock strikes midnight, january 1, 2022 will mark the first day of the new tax legislation. Updated versions of arkansas’ withholding certificates, which make annual adjustments to the thresholds used for exemption from withholding.

Other Parameters Of The Formula Were Unchanged.

Download or email ar ar4ec & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. There is a very simple form to help each employer determine that. Web about us forms budget bursar contracts general accounting human resources mail services payroll procurement travel vcfa employee’s state withholding exemption.

Ar1155 Extension Of Time To File Request:

Quarterly payroll and excise tax returns normally due on may 1. Web 42 rows name/address change, penalty waiver request, and request for copies of. The new state laws will reduce the top income tax rate for. Download or email ar1000f & more fillable forms, register and subscribe now!

:max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg)