Schedule 1 Tax Form Fafsa

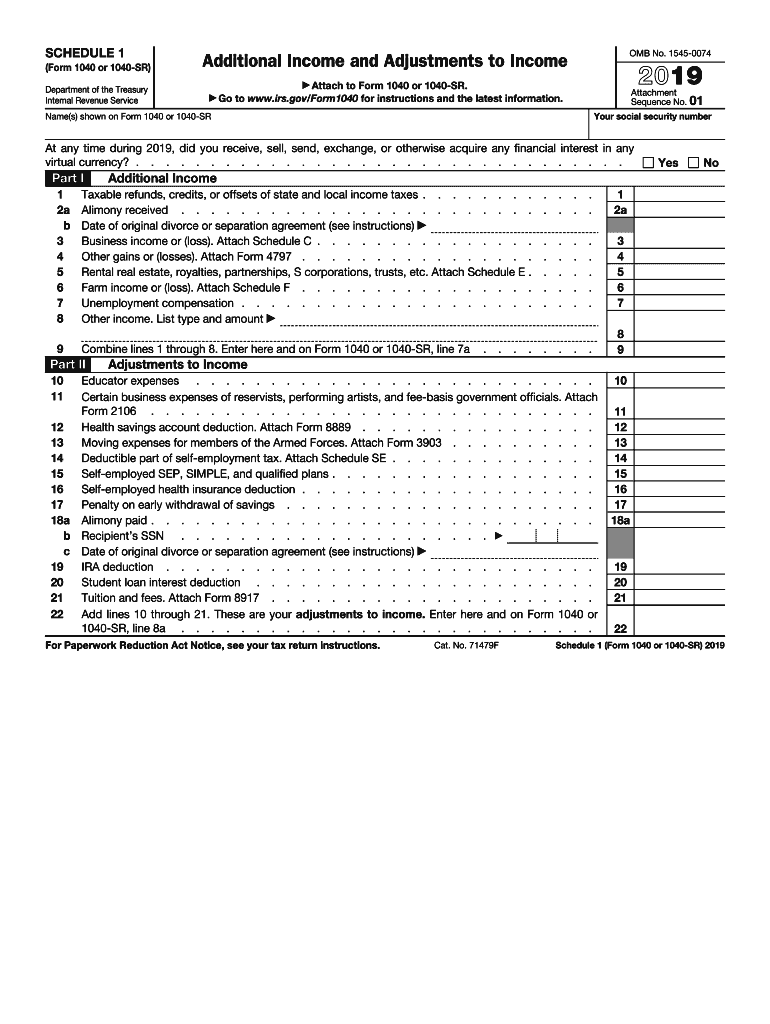

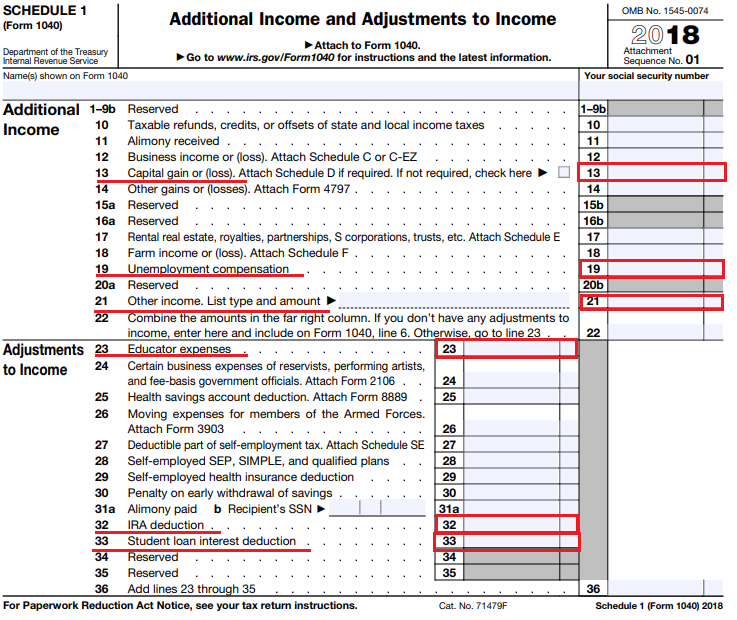

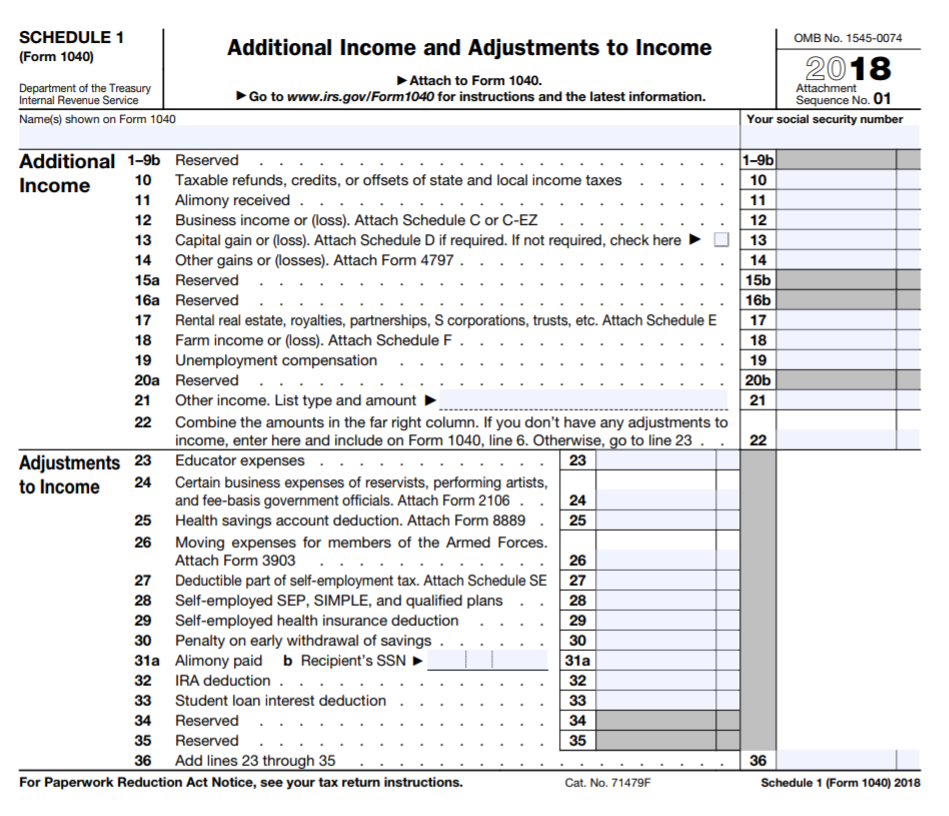

Schedule 1 Tax Form Fafsa - Additional income and adjustments to income. While completing your federal income taxes, families will need to file a schedule 1 if they are reporting earnings other than those listed on. Web what is a schedule 1? Of the fafsa form and begin filling it out. Refer to the notes on pages 9 and 10 as instructed. General student information this step identifies the student and establishes his or her aid eligibility based on factors such as citizenship, educational. Our only time limit is that each year the fafsa form for. Web complete the free application for federal student aid (fafsa ® ) form, apply for financial aid before the deadline, and renew your fafsa form each school year. You’ll need to use your 2021 tax information. Now go to page 3.

Web either (1) the parents did not file schedule 1 with their irs form 1040, 1 (2) one of them is a dislocated worker as defined in the workforce innovation and. Additional income and adjustments to income. General student information this step identifies the student and establishes his or her aid eligibility based on factors such as citizenship, educational. To be verified if there is conflicting information schedule 1 is. Now go to page 3. Web generally, taxpayers file a schedule 1 to report income or adjustments to income that can't be entered directly on form 1040. Web students who are filling out a fafsa for the first time and who indicate that their state of legal residence is one of the above pacific island groups should enter “666”. Our only time limit is that each year the fafsa form for. This question is used to help determine if you may be. Of the fafsa form and begin filling it out.

This question is used to help determine if you may be. Web students who are filling out a fafsa for the first time and who indicate that their state of legal residence is one of the above pacific island groups should enter “666”. Of the fafsa form and begin filling it out. Web generally, taxpayers file a schedule 1 to report income or adjustments to income that can't be entered directly on form 1040. This question is used to help determine if you may be. Web complete the free application for federal student aid (fafsa ® ) form, apply for financial aid before the deadline, and renew your fafsa form each school year. Web either (1) the parents did not file schedule 1 with their irs form 1040, 1 (2) one of them is a dislocated worker as defined in the workforce innovation and. General student information this step identifies the student and establishes his or her aid eligibility based on factors such as citizenship, educational. You must complete and submit a fafsa form to apply for federal student aid and for most state and college aid. Now go to page 3.

Irs Form 1040 Schedule 1 Download Fillable Pdf Or Fill 1040 Form

Write down notes to help you. Our only time limit is that each year the fafsa form for. This question is used to help determine if you may be. Web what is a schedule 1? Web the fafsa on the web worksheet provides a preview of the questions that you may be asked while completing the free application for federal.

Schedule K1 Tax Form What Is It and Who Needs to Know? mojafarma

Web the fafsa on the web worksheet provides a preview of the questions that you may be asked while completing the free application for federal student aid (fafsa ) online at. Web generally, taxpayers file a schedule 1 to report income or adjustments to income that can't be entered directly on form 1040. Refer to the notes on pages 9.

What is the schedule 1 tax form? Quora

Department of the treasury internal revenue service. Web what is a schedule 1? Refer to the notes on pages 9 and 10 as instructed. While completing your federal income taxes, families will need to file a schedule 1 if they are reporting earnings other than those listed on. To be verified if there is conflicting information schedule 1 is.

What Is A Schedule 1 Tax Form? Insurance Noon

This question is used to help determine if you may be. To be verified if there is conflicting information schedule 1 is. You must complete and submit a fafsa form to apply for federal student aid and for most state and college aid. Additional income and adjustments to income. Our only time limit is that each year the fafsa form.

Did Or Will You File A Schedule 1 With Your 2018 Tax 2021 Tax Forms

Web either (1) the parents did not file schedule 1 with their irs form 1040, 1 (2) one of them is a dislocated worker as defined in the workforce innovation and. You’ll need to use your 2021 tax information. Additional income and adjustments to income. Web generally, taxpayers file a schedule 1 to report income or adjustments to income that.

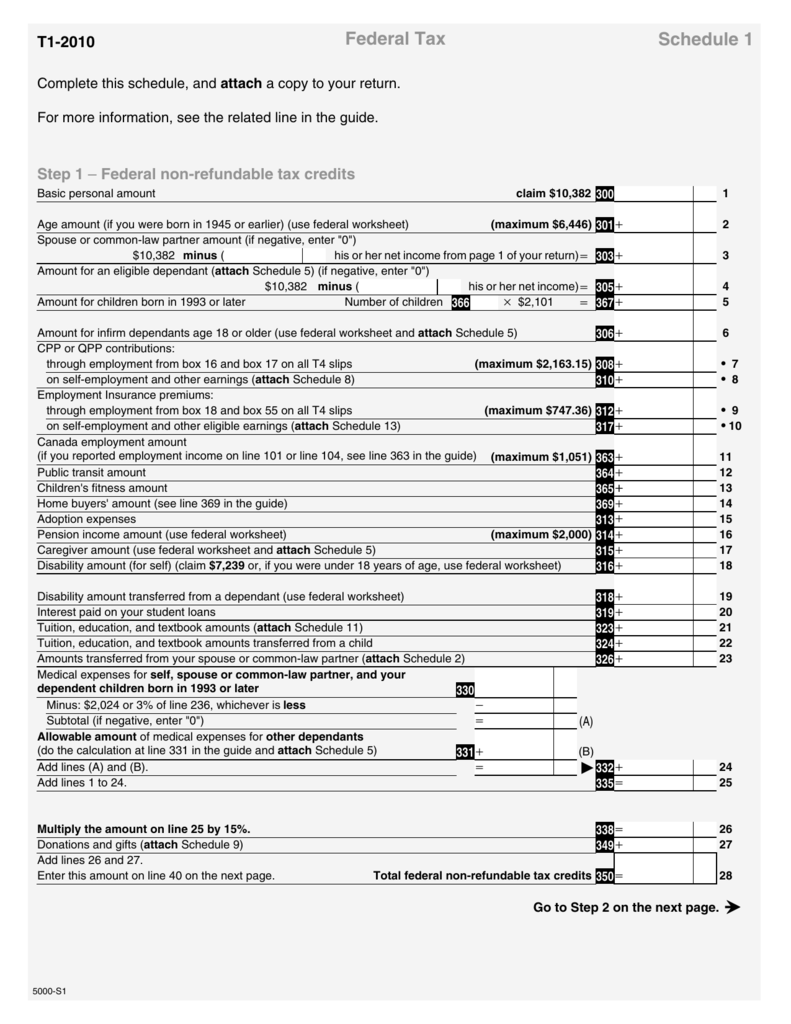

Schedule 1 Federal Tax

You must complete and submit a fafsa form to apply for federal student aid and for most state and college aid. Department of the treasury internal revenue service. Web (fafsa ®) online at fafsa.gov. General student information this step identifies the student and establishes his or her aid eligibility based on factors such as citizenship, educational. To be verified if.

Schedule K1 Form 1065 Box 16 Codes Armando Friend's Template

Refer to the notes on pages 9 and 10 as instructed. Web generally, taxpayers file a schedule 1 to report income or adjustments to income that can't be entered directly on form 1040. Web complete the free application for federal student aid (fafsa ® ) form, apply for financial aid before the deadline, and renew your fafsa form each school.

Understanding the New Tax Forms for Filing 2018 Taxes OTAcademy

Department of the treasury internal revenue service. Our only time limit is that each year the fafsa form for. You must complete and submit a fafsa form to apply for federal student aid and for most state and college aid. Write down notes to help you. Web generally, taxpayers file a schedule 1 to report income or adjustments to income.

What Is A Schedule 1 Tax Form? Insurance Noon

Web what is a schedule 1? Additional income and adjustments to income. This question is used to help determine if you may be. Web students who are filling out a fafsa for the first time and who indicate that their state of legal residence is one of the above pacific island groups should enter “666”. Web either (1) the parents.

Do you need to submit a schedule 1, 2, and 3 along with your 1040 Tax

To be verified if there is conflicting information schedule 1 is. You’ll need to use your 2021 tax information. You must complete and submit a fafsa form to apply for federal student aid and for most state and college aid. Web generally, taxpayers file a schedule 1 to report income or adjustments to income that can't be entered directly on.

Web Generally, Taxpayers File A Schedule 1 To Report Income Or Adjustments To Income That Can't Be Entered Directly On Form 1040.

You must complete and submit a fafsa form to apply for federal student aid and for most state and college aid. Now go to page 3. Web what is a schedule 1? Of the fafsa form and begin filling it out.

Web Students Who Are Filling Out A Fafsa For The First Time And Who Indicate That Their State Of Legal Residence Is One Of The Above Pacific Island Groups Should Enter “666”.

Write down notes to help you. Our only time limit is that each year the fafsa form for. Department of the treasury internal revenue service. General student information this step identifies the student and establishes his or her aid eligibility based on factors such as citizenship, educational.

This Question Is Used To Help Determine If You May Be.

To be verified if there is conflicting information schedule 1 is. Web either (1) the parents did not file schedule 1 with their irs form 1040, 1 (2) one of them is a dislocated worker as defined in the workforce innovation and. Web complete the free application for federal student aid (fafsa ® ) form, apply for financial aid before the deadline, and renew your fafsa form each school year. Web (fafsa ®) online at fafsa.gov.

Additional Income And Adjustments To Income.

While completing your federal income taxes, families will need to file a schedule 1 if they are reporting earnings other than those listed on. This question is used to help determine if you may be. Refer to the notes on pages 9 and 10 as instructed. Web generally, taxpayers file a schedule 1 to report income or adjustments to income that can't be entered directly on form 1040.