2022 Oregon State Tax Form

2022 Oregon State Tax Form - Web oregon has a state income tax that ranges between 5% and 9.9%. Web up to $40 cash back submit the completed oregon oq form 2022 as instructed, either by mail, email, or through an online submission portal, if available. 01) • use uppercase letters. Web start federal and oregon tax returns. • print actual size (100%). Web all oregon resident taxpayers preparing their own returns in 2023 can file electronically at no cost using one of oregon’s free file options, the oregon department. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Form 132 is filed with form oq on a quarterly basis. Web we last updated the resident individual income tax return in january 2023, so this is the latest version of form 40, fully updated for tax year 2022. Be sure to verify that the form you are.

Taxformfinder provides printable pdf copies. Amount applied from your prior year’s tax refund. We will update this page with a new version of the form for 2024 as soon as it is made available. • use blue or black ink. • print actual size (100%). View all of the current year's forms and publications by popularity or program area. Form 132 is filed with form oq on a quarterly basis. Web up to $40 cash back submit the completed oregon oq form 2022 as instructed, either by mail, email, or through an online submission portal, if available. 01) • use uppercase letters. • don’ t submit photocopies or.

• use blue or black ink. Web all oregon resident taxpayers preparing their own returns in 2023 can file electronically at no cost using one of oregon’s free file options, the oregon department. Ne suite 180 salem or 97310. You can download or print. Web oregon has a state income tax that ranges between 5% and 9.9% , which is administered by the oregon department of revenue. Web oregon has a state income tax that ranges between 5% and 9.9%. 01) • use uppercase letters. Web start federal and oregon tax returns. Web we last updated the resident individual income tax return in january 2023, so this is the latest version of form 40, fully updated for tax year 2022. Web 1099 form 2023 online oregon:

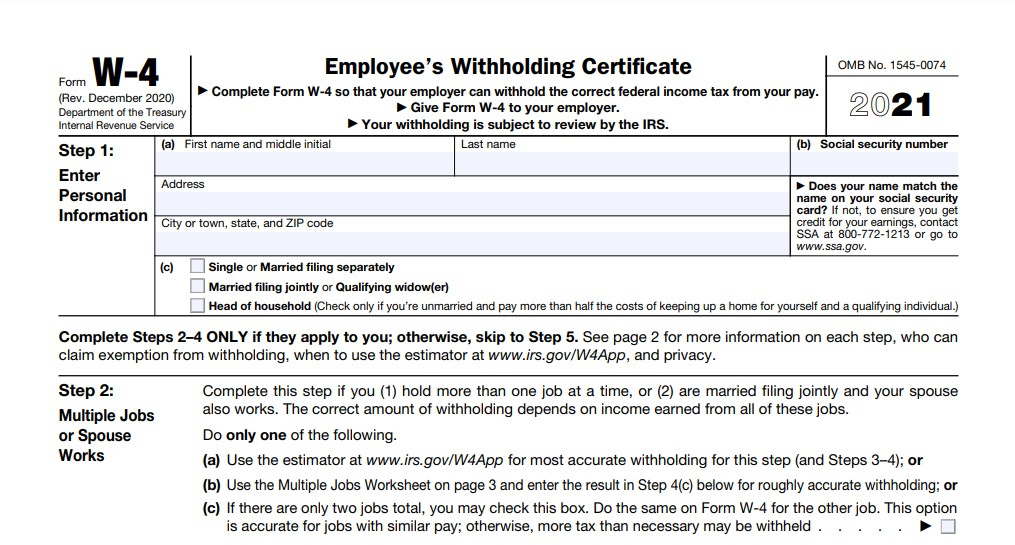

Oregon W4 2021 Form Printable 2022 W4 Form

• print actual size (100%). Amount applied from your prior year’s tax refund. You can download or print. • don’ t submit photocopies or. Taxformfinder provides printable pdf copies.

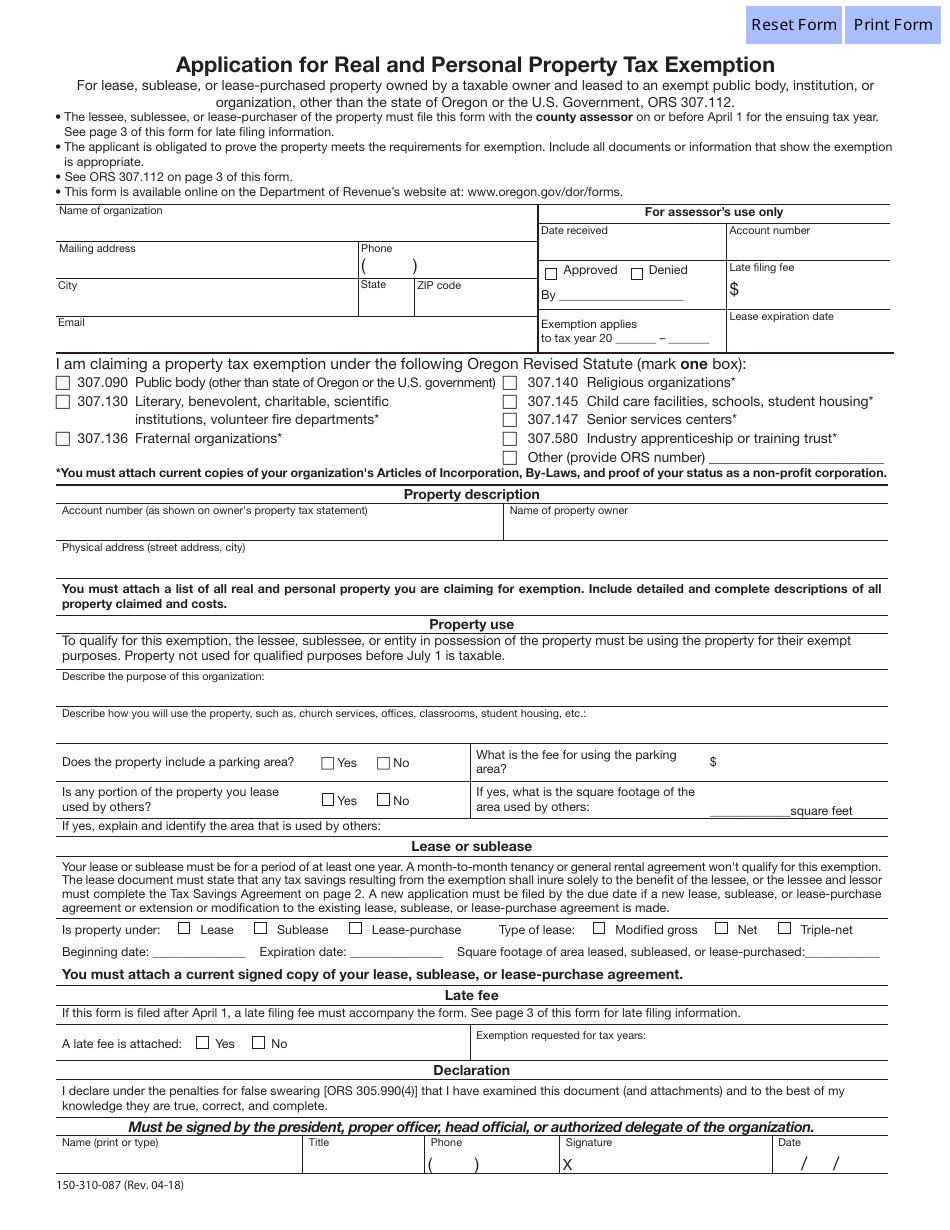

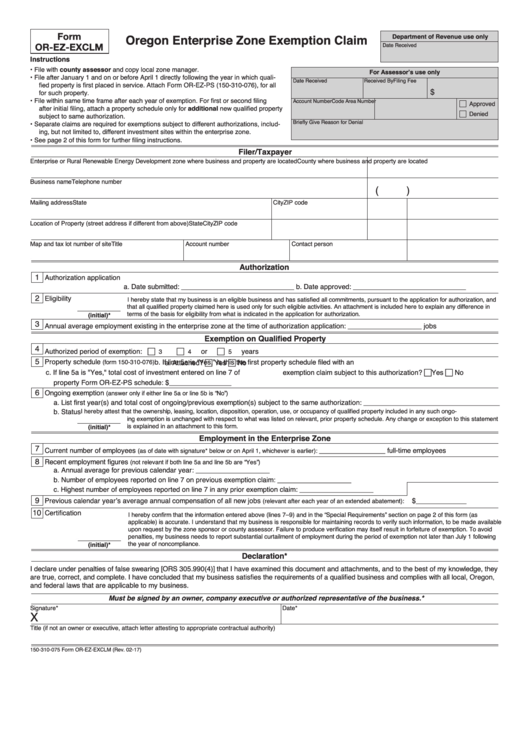

Form 150310087 Download Fillable PDF or Fill Online Application for

Web all oregon resident taxpayers preparing their own returns in 2023 can file electronically at no cost using one of oregon’s free file options, the oregon department. Web current forms and publications. • print actual size (100%). Web oregon has a state income tax that ranges between 5% and 9.9% , which is administered by the oregon department of revenue..

2014 Form OR DoR 40 Fill Online, Printable, Fillable, Blank PDFfiller

Taxformfinder provides printable pdf copies. Web start federal and oregon tax returns. Web the oregon tax forms are listed by tax year below and all or back taxes for previous years would have to be mailed in. Web oregon has a state income tax that ranges between 5% and 9.9% , which is administered by the oregon department of revenue..

Oregon State Tax Fill Online, Printable, Fillable, Blank pdfFiller

Web start federal and oregon tax returns. Web 1099 form 2023 online oregon: You can download or print. Be sure to verify that the form you are. Taxformfinder provides printable pdf copies.

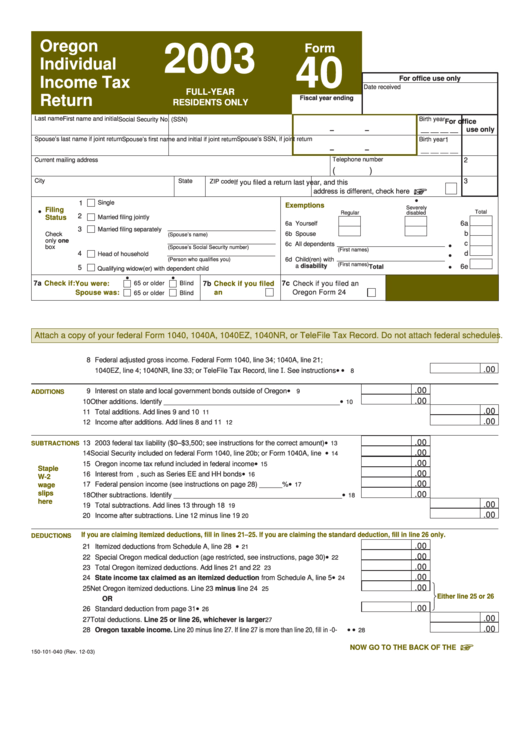

Form 40 Oregon Individual Tax Return (FullYear Residents Only

You can complete the forms with the help of efile.com free. Amount applied from your prior year’s tax refund. Web start federal and oregon tax returns. Taxformfinder provides printable pdf copies. Web up to $40 cash back submit the completed oregon oq form 2022 as instructed, either by mail, email, or through an online submission portal, if available.

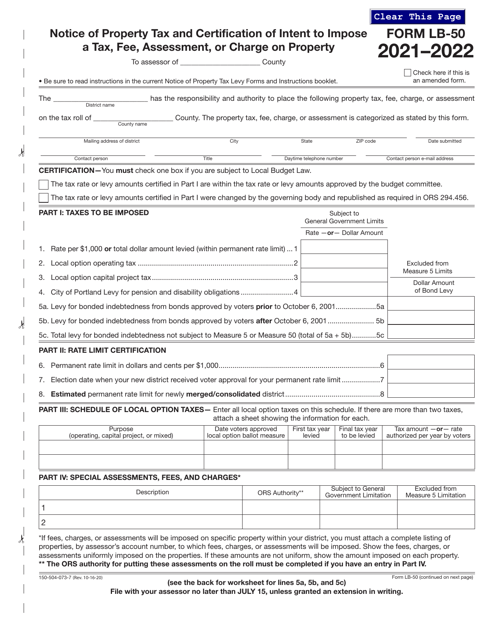

Fire Inspection Cards 20212022 Template / 4 Year Metal Fire

Web oregon has a state income tax that ranges between 5% and 9.9% , which is administered by the oregon department of revenue. We will update this page with a new version of the form for 2024 as soon as it is made available. Web current forms and publications. Taxformfinder provides printable pdf copies. Web city _____ state _____ zip.

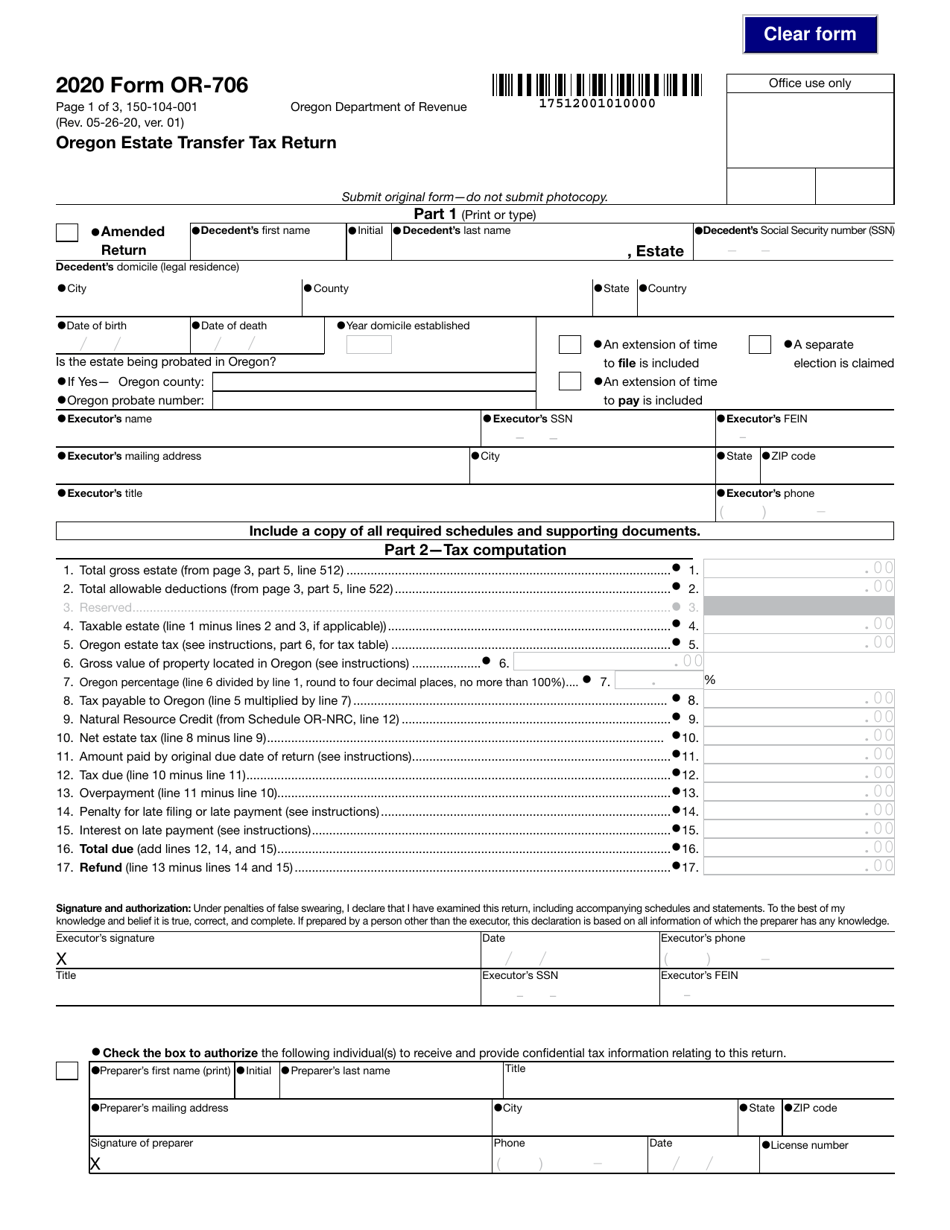

Form OR706 (150104001) Download Fillable PDF or Fill Online Oregon

Web 1099 form 2023 online oregon: Ne suite 180 salem or 97310. • print actual size (100%). Taxformfinder provides printable pdf copies. Web start federal and oregon tax returns.

1108 Oregon Tax Forms And Templates free to download in PDF

Web oregon has a state income tax that ranges between 5% and 9.9%. You can download or print. Web city _____ state _____ zip code _____ date moved in or out of the city of oregon _____ documents to include: Form 132 is filed with form oq on a quarterly basis. • print actual size (100%).

Oregon form 40 v Fill out & sign online DocHub

• don’ t submit photocopies or. Web oregon has a state income tax that ranges between 5% and 9.9% , which is administered by the oregon department of revenue. Web all oregon resident taxpayers preparing their own returns in 2023 can file electronically at no cost using one of oregon’s free file options, the oregon department. Form 132 is filed.

Oregon state and local taxes rank 16th highest in U.S. as share of

Web current forms and publications. Web we last updated the resident individual income tax return in january 2023, so this is the latest version of form 40, fully updated for tax year 2022. Web start federal and oregon tax returns. Amount applied from your prior year’s tax refund. • use blue or black ink.

Select A Heading To View Its Forms, Then U Se The Search.

Web current forms and publications. Amount applied from your prior year’s tax refund. • don’ t submit photocopies or. We will update this page with a new version of the form for 2024 as soon as it is made available.

Web 1099 Form 2023 Online Oregon:

Web we last updated the resident individual income tax return in january 2023, so this is the latest version of form 40, fully updated for tax year 2022. Edit, sign and print tax forms on any device with uslegalforms. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. 01) • use uppercase letters.

Form 132 Is Filed With Form Oq On A Quarterly Basis.

You can download or print. Taxformfinder provides printable pdf copies. Web oregon has a state income tax that ranges between 5% and 9.9%. Be sure to verify that the form you are.

• Use Blue Or Black Ink.

Web up to $40 cash back submit the completed oregon oq form 2022 as instructed, either by mail, email, or through an online submission portal, if available. Web oregon has a state income tax that ranges between 5% and 9.9% , which is administered by the oregon department of revenue. Web start federal and oregon tax returns. Web all oregon resident taxpayers preparing their own returns in 2023 can file electronically at no cost using one of oregon’s free file options, the oregon department.