Why Do I Have To File Form 8862

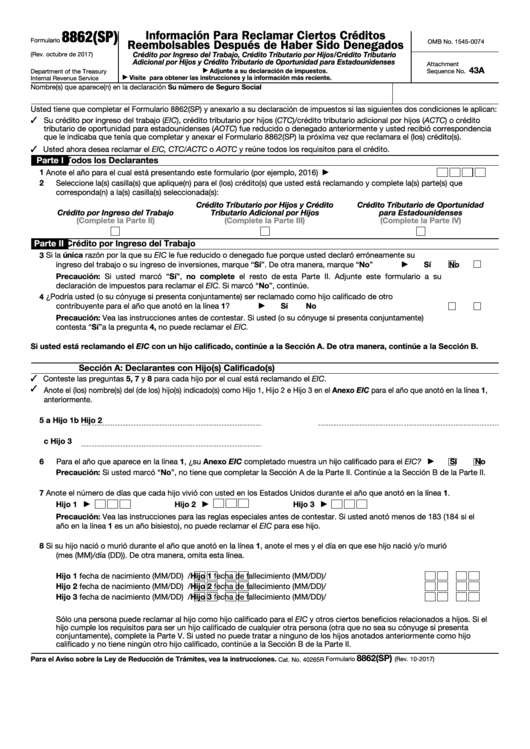

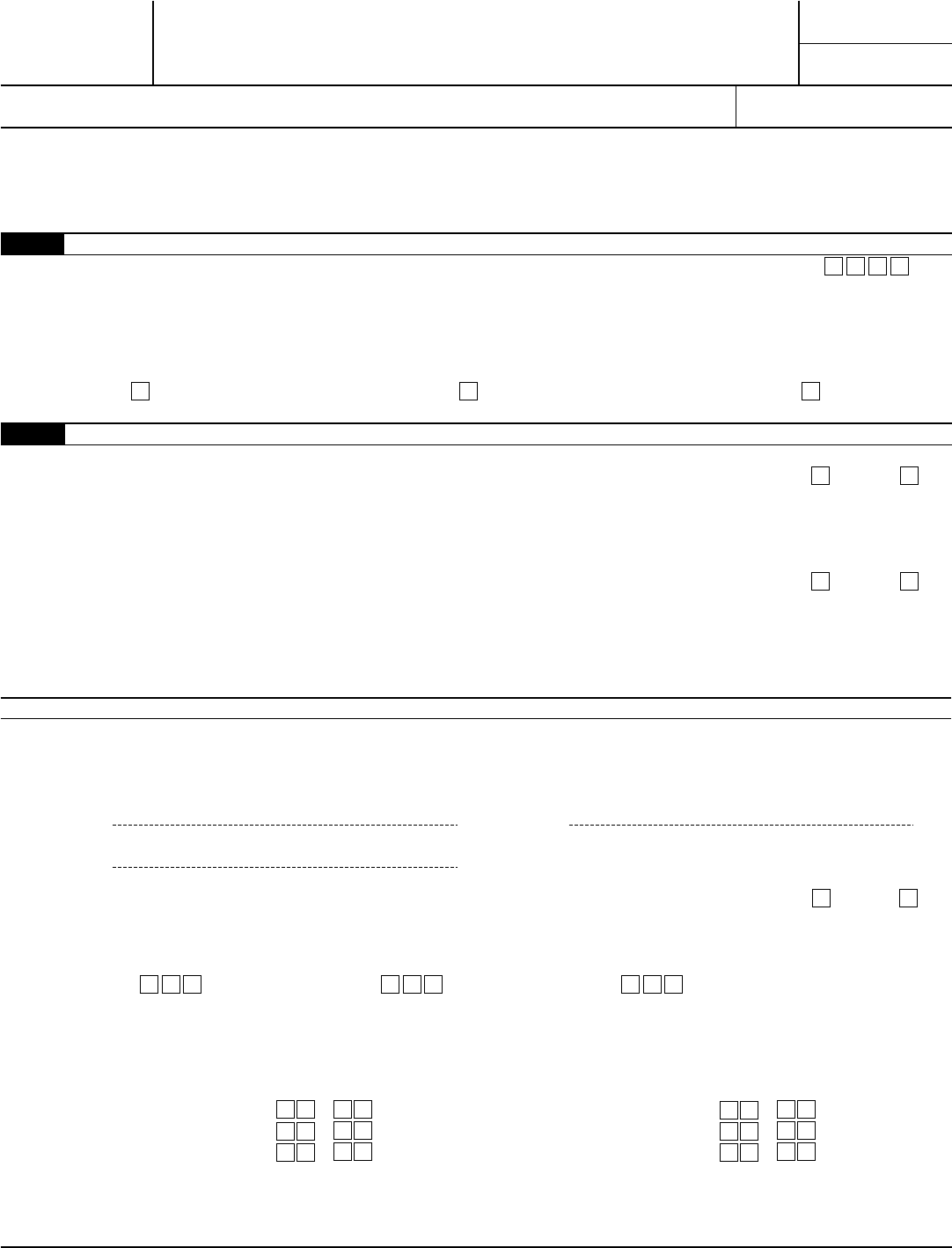

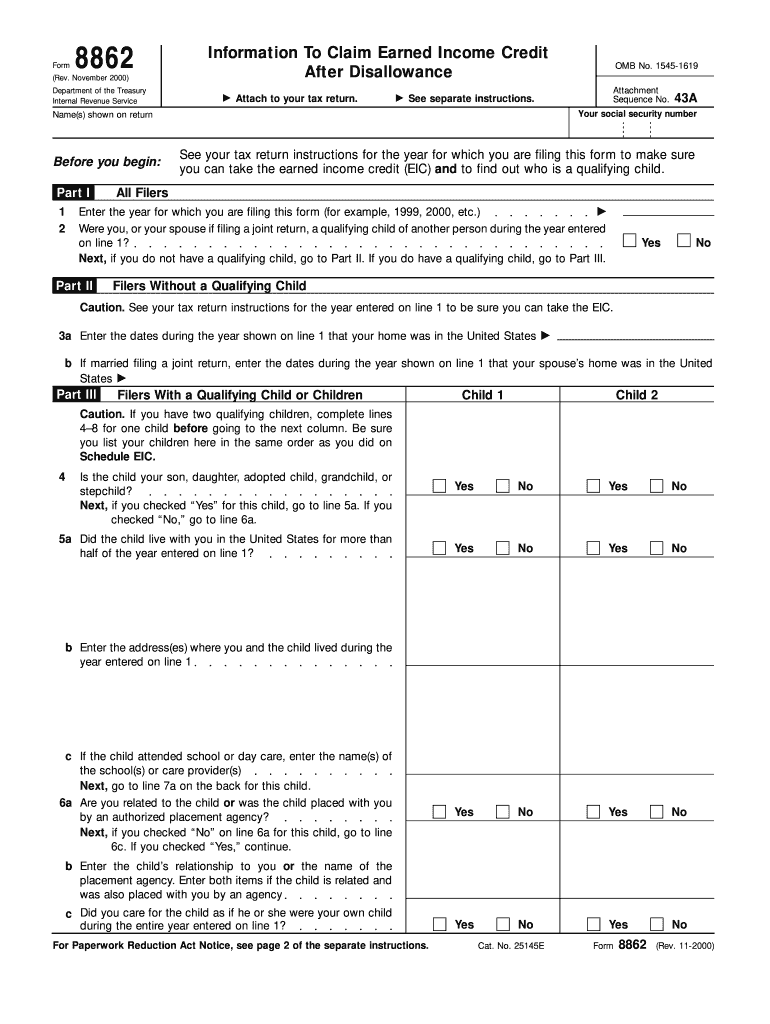

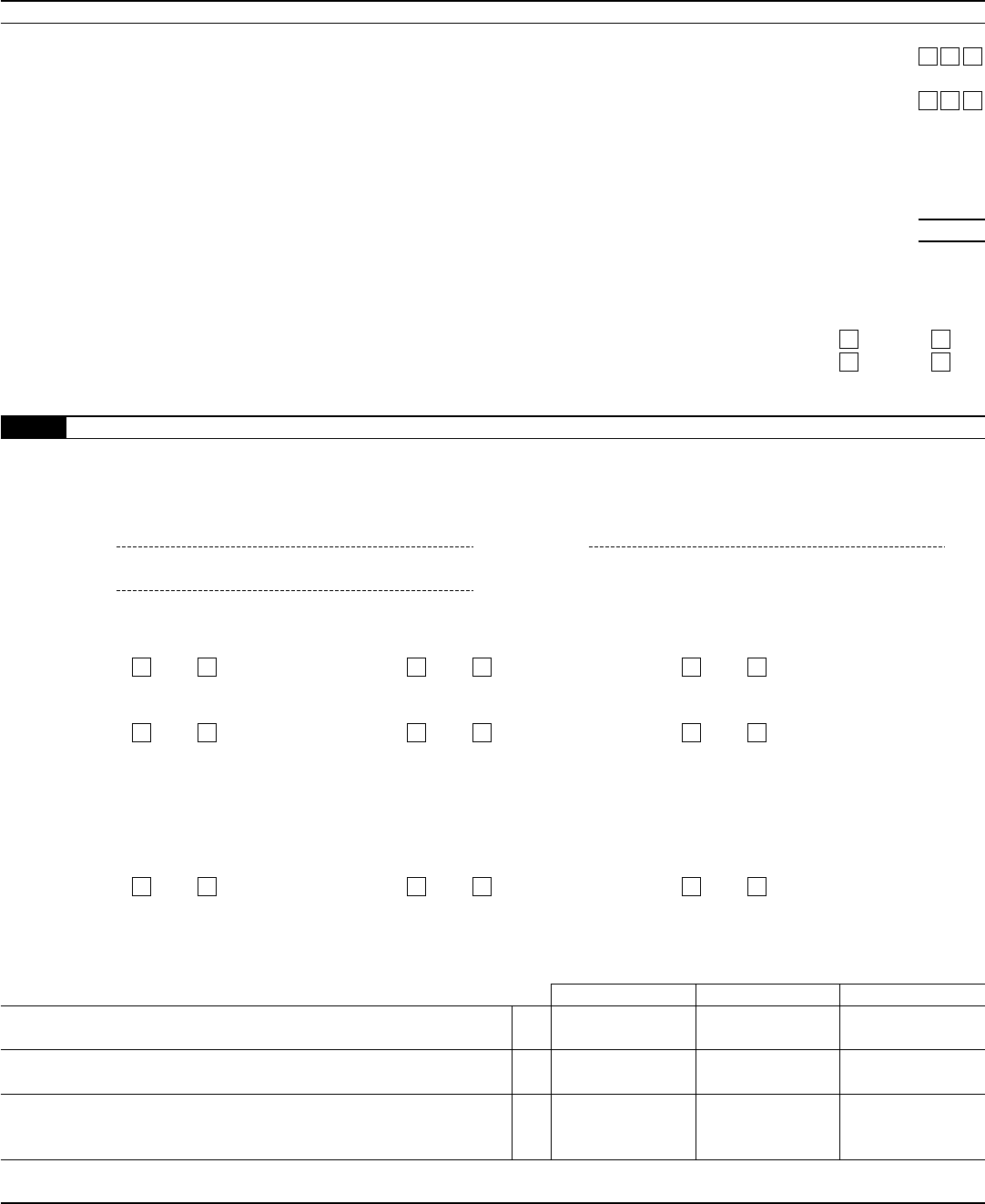

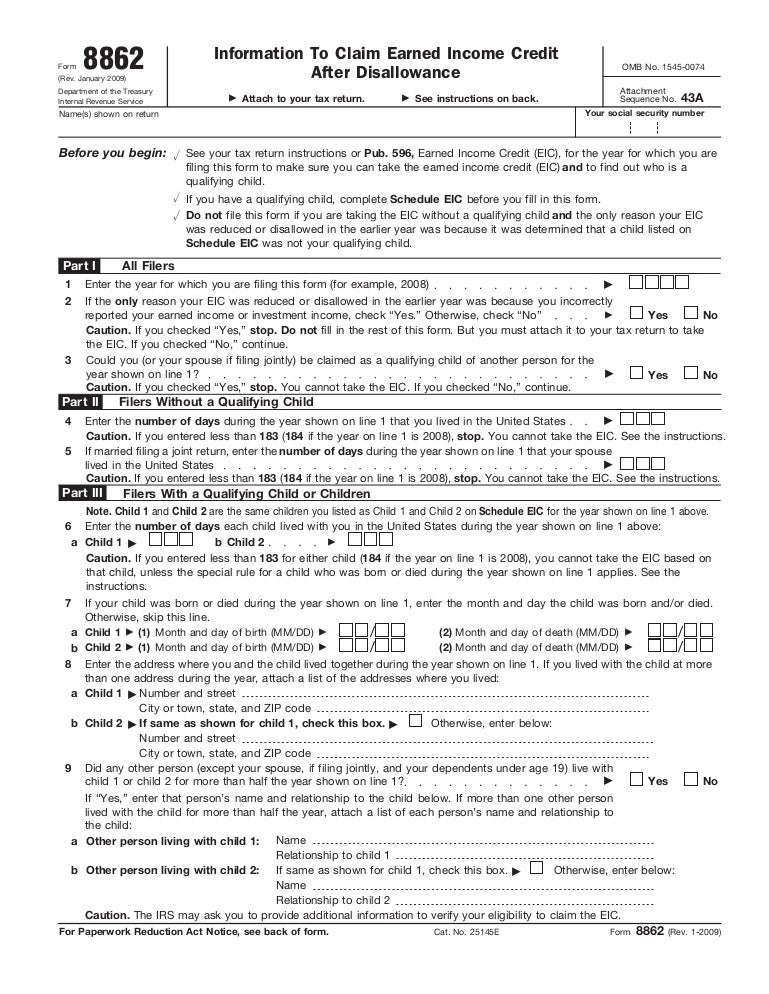

Why Do I Have To File Form 8862 - Generally, if your total income for the year doesn’t exceed the standard deduction plus one exemption and you. Form 8862 is missing from the tax return and it is required to be able to claim the earned. Web if the irs rejected one or more of these credits: Please see the faq link. Web 1 best answer christyw new member you'll need to add form 8862: Web file form 8862. Situations that qualify for the tax credit. If you wish to take the credit in a. Your ctc, rctc, actc, or odc for a year after 2015 was reduced or disallowed for any reason other than a math or clerical error: Information to claim earned income credit after disallowance to your return.

Some states offer their own version of the credit, which. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Information to claim earned income credit after disallowance to your return. Web you must file form 8862: It says taxpayers must file form 8862 because eitc has been previously disallowed. Web there are several ways to submit form 4868. Web the irs requires you to file form 8862 when you are claiming the earned income credit after being disallowed the credit in a prior year. Web if you have to file a state tax return, note that the earned income tax credit is only calculated on your federal return. Web form 8862 is the form used to provide the information that irs requires to demonstrate eligibility for these credits. Web not everyone is required to file a federal income tax return each year.

If you wish to take the credit in a. Please see the faq link. Web you must file form 8862: Web how do i enter form 8862? Information to claim earned income credit after disallowance to your return. Information to claim earned income credit after disallowance to your return. Web there are several ways to submit form 4868. Web if the irs rejected one or more of these credits: If we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a. Web when should i not file irs form 8862?

How Do I File My Form 8862? StandingCloud

Web do you need to file form 8862 because you had a credit reduced or disallowed by the irs in a prior year? Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Web not everyone is required to file a federal income tax return each year. It says taxpayers must file form.

1040 (2022) Internal Revenue Service

Form 8862 is missing from the tax return and it is required to be able to claim the earned. Web how do i add form 8862 to file taxes after credit disallowance in prior year? From 2018 to 2025, the. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web.

Form 8862 Information to Claim Earned Credit After

Web there are several ways to submit form 4868. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web if your earned income credit (eic) was disallowed or reduced for something other than a math or clerical error, you may need to file form 8862 before the irs allows. Web.

Top 14 Form 8862 Templates free to download in PDF format

Web not everyone is required to file a federal income tax return each year. Web you’ll need to complete form 8862 if your earned income credit (eic) was disallowed for any year after 1996, and permission was later restored (you'll get. Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income credit (eic) was disallowed.

Form 8862 (Rev. December 2012) Edit, Fill, Sign Online Handypdf

Web the reject notice doesn't say that the child has already been claimed. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. If you wish to take the credit in a. Web you must file form 8862: Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income.

Form 8862 Claim Earned Credit After Disallowance YouTube

Situations that qualify for the tax credit. It says taxpayers must file form 8862 because eitc has been previously disallowed. Form 8862 is missing from the tax return and it is required to be able to claim the earned. Web to resolve this rejection, you'll need to add form 8862: There are two types of situations in which a taxpayer.

8862 Form Fill Out and Sign Printable PDF Template signNow

Web you’ll need to complete form 8862 if your earned income credit (eic) was disallowed for any year after 1996, and permission was later restored (you'll get. If you wish to take the credit in a. Web form 8862 is the form used to provide the information that irs requires to demonstrate eligibility for these credits. Web you must file.

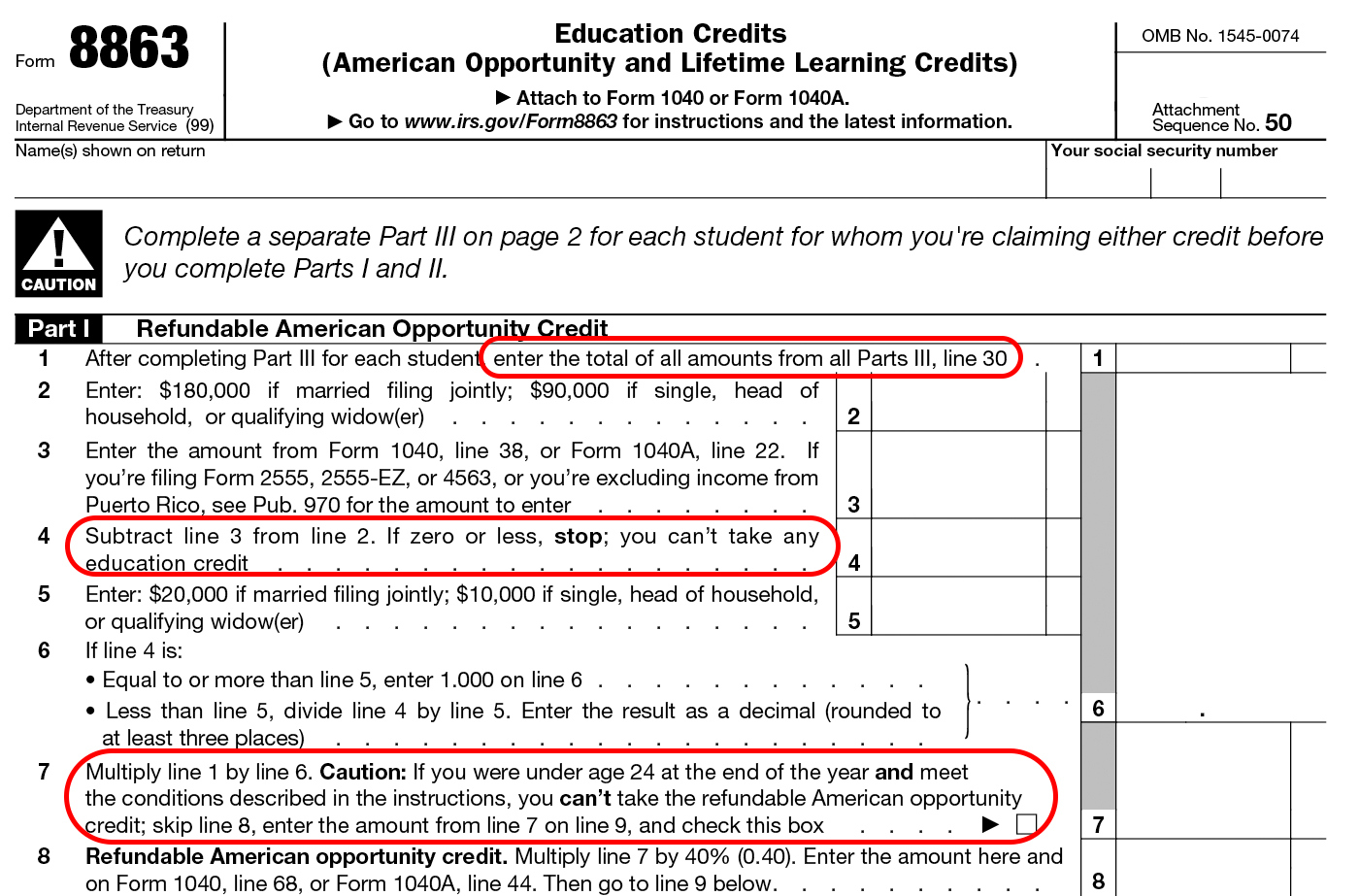

Form 8863 Instructions Information On The Education 1040 Form Printable

If we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a. Web not everyone is required to file a federal income tax return each year. Some states offer their own version of the credit, which. Taxpayers can file form 4868 by.

Form 8862 (Rev. December 2012) Edit, Fill, Sign Online Handypdf

Web form 8862 is the form used to provide the information that irs requires to demonstrate eligibility for these credits. Web the reject notice doesn't say that the child has already been claimed. Web to resolve this rejection, you'll need to add form 8862: Web andreac1 level 9 you can use the steps below to help you get to where.

Form 8862Information to Claim Earned Credit for Disallowance

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web andreac1 level 9 you can use the steps below to help you get to where to fill out information for form 8862 to add it to your tax return. Web if you have to file a state tax return, note.

If You Wish To Take The Credit In A.

Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web if the irs rejected one or more of these credits: Web you’ll need to complete form 8862 if your earned income credit (eic) was disallowed for any year after 1996, and permission was later restored (you'll get.

From 2018 To 2025, The.

Web file form 8862. Web how do i add form 8862 to file taxes after credit disallowance in prior year? Information to claim earned income credit after disallowance to your return. Web if your earned income credit (eic) was disallowed or reduced for something other than a math or clerical error, you may need to file form 8862 before the irs allows.

Web Form 8862 Is The Form Used To Provide The Information That Irs Requires To Demonstrate Eligibility For These Credits.

There are two types of situations in which a taxpayer should not file form 8862: Web you must file form 8862: If we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a. Web future developments for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to.

Web Not Everyone Is Required To File A Federal Income Tax Return Each Year.

Web to resolve this rejection, you'll need to add form 8862: Web when should i not file irs form 8862? Web the irs requires you to file form 8862 when you are claiming the earned income credit after being disallowed the credit in a prior year. Situations that qualify for the tax credit.