Who Needs To File Form 720

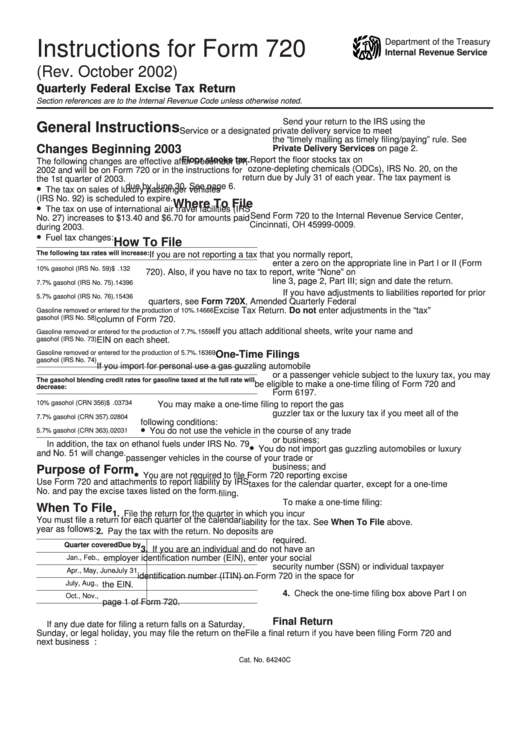

Who Needs To File Form 720 - Web depending on what type of business you’re in, you may be required to file form 720, “quarterly federal excise tax form.” here’s what you need to know about. Businesses that produce or sell goods under an excise are required to report their tax obligations using form 720. You will have to file irs form 720 if you sell products that involve excise taxes. Irs still accepts paper forms 720. This irs excise tax applies to the seller and manufacturers of coal. It should be used to accompany any payment of the 1% federal excise tax on premium payments to. A business that buys or sells specific products or services indicated in the regulations will need to pay the excise tax and fill out form 720. Web form 720 is for businesses to report excise taxes paid on goods and activities listed in parts one and two of the form. Web this form is used to report an assortment of excise taxes and is filed quarterly. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

Web who uses irs form 720? Web form 720 is for businesses to report excise taxes paid on goods and activities listed in parts one and two of the form. In general, form 720 is for businesses. It should be used to accompany any payment of the 1% federal excise tax on premium payments to. June 2023) department of the treasury internal revenue service. See the instructions for form 720. Web you must file form 720 if: This irs excise tax applies to the seller and manufacturers of coal. Web who should file form 720? Web this form is used to report an assortment of excise taxes and is filed quarterly.

Web depending on what type of business you’re in, you may be required to file form 720, “quarterly federal excise tax form.” here’s what you need to know about. Web since the cost of the excise tax is usually included in the price, the seller or manufacturer is responsible for remitting these tax payments to the federal government. It should be used to accompany any payment of the 1% federal excise tax on premium payments to. Irs still accepts paper forms 720. This irs excise tax applies to the seller and manufacturers of coal. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. June 2023) department of the treasury internal revenue service. Web this form is used to report an assortment of excise taxes and is filed quarterly. See the instructions for form 720. You will have to file irs form 720 if you sell products that involve excise taxes.

What Is IRS Form 720? Calculate, Pay Excise Tax NerdWallet

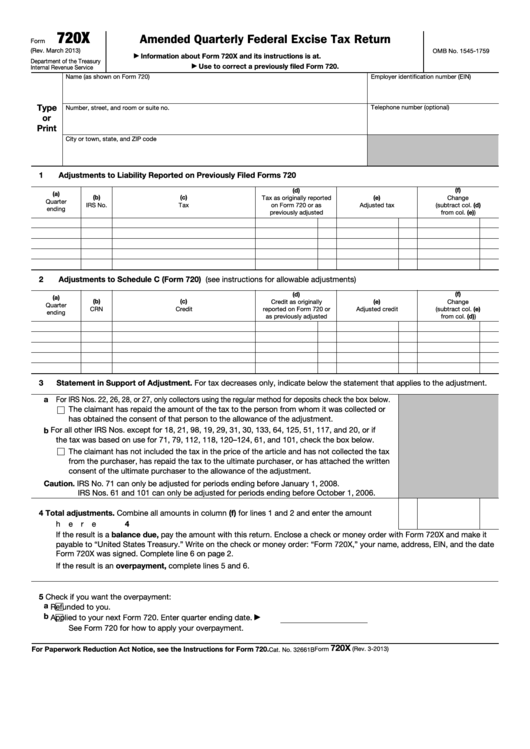

This irs excise tax applies to the seller and manufacturers of coal. Quarterly federal excise tax return. In general, form 720 is for businesses. It should be used to accompany any payment of the 1% federal excise tax on premium payments to. On the form, you will be able to find the list of all the goods or.

The deadline for filing Form 720 for the first quarter of 2021 is April

Web form 720 is for businesses to report excise taxes paid on goods and activities listed in parts one and two of the form. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. See the instructions for form 720. June 2023) department of the treasury internal revenue service. • you were.

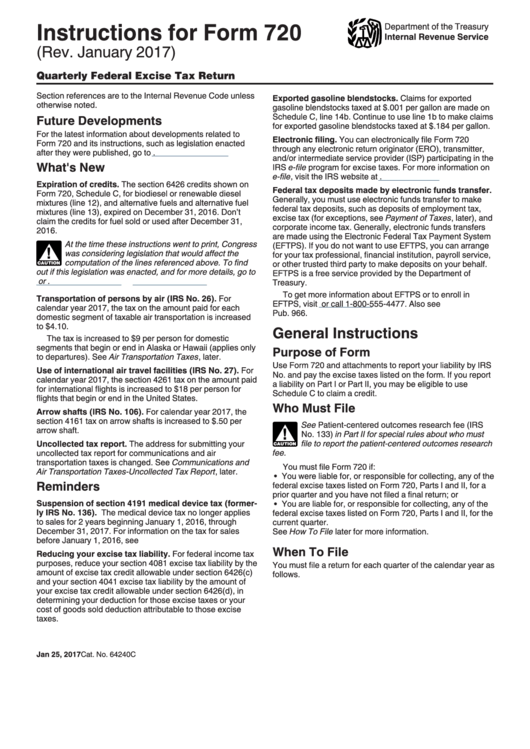

Instructions For Form 720 2017 printable pdf download

Web who uses irs form 720? Web who needs to file irs form 720? Web form 720 is for businesses to report excise taxes paid on goods and activities listed in parts one and two of the form. See the instructions for form 720. You will have to file irs form 720 if you sell products that involve excise taxes.

How to complete IRS Form 720 for the PatientCentered Research

Web since the cost of the excise tax is usually included in the price, the seller or manufacturer is responsible for remitting these tax payments to the federal government. Web depending on what type of business you’re in, you may be required to file form 720, “quarterly federal excise tax form.” here’s what you need to know about. June 2023).

How to complete IRS Form 720 for the PatientCentered Research

Web form 720 is for businesses to report excise taxes paid on goods and activities listed in parts one and two of the form. In general, form 720 is for businesses. June 2023) department of the treasury internal revenue service. The average number of covered. A business that buys or sells specific products or services indicated in the regulations will.

Fillable Form 720X Amended Quarterly Federal Excise Tax Return

On the form, you will be able to find the list of all the goods or. Web since the cost of the excise tax is usually included in the price, the seller or manufacturer is responsible for remitting these tax payments to the federal government. See the instructions for form 720. Web who needs to file irs form 720? Web.

Form 720 Quarterly Federal Excise Tax Return

Web irs form 720, quarterly excise tax return is the quarterly federal excise tax return used to report the excise tax liability and pay the taxes listed on the form. Web who should file form 720? Web form 720 is for businesses to report excise taxes paid on goods and activities listed in parts one and two of the form..

Instructions For Form 720 Quarterly Federal Excise Tax Return 2002

Web who uses irs form 720? Businesses that produce or sell goods under an excise are required to report their tax obligations using form 720. In general, form 720 is for businesses. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web this form is used to report an assortment of.

2018 Fourth Quarter Excise Tax Form 720 is DUE NOW! ThinkTrade Inc Blog

The average number of covered. Web irs form 720, quarterly excise tax return is the quarterly federal excise tax return used to report the excise tax liability and pay the taxes listed on the form. In general, form 720 is for businesses. Web you must file form 720 if: You will have to file irs form 720 if you sell.

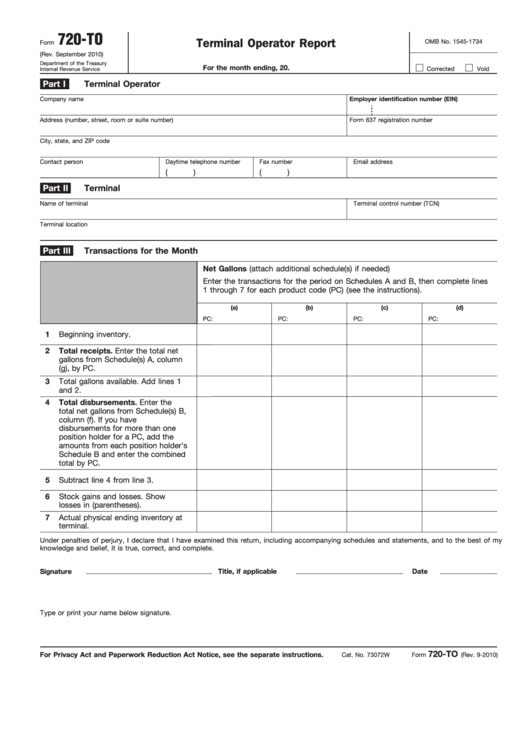

Fillable Form 720To Terminal Operator Report printable pdf download

Web form 720 is for businesses to report excise taxes paid on goods and activities listed in parts one and two of the form. Web this form is used to report an assortment of excise taxes and is filed quarterly. It should be used to accompany any payment of the 1% federal excise tax on premium payments to. Web you.

On The Form, You Will Be Able To Find The List Of All The Goods Or.

Web who uses irs form 720? This irs excise tax applies to the seller and manufacturers of coal. The average number of covered. June 2023) department of the treasury internal revenue service.

You Will Have To File Irs Form 720 If You Sell Products That Involve Excise Taxes.

Web who needs to file irs form 720? Businesses that produce or sell goods under an excise are required to report their tax obligations using form 720. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web form 720 is a tax form required of businesses that deal with the sale of certain goods (like alcohol or gasoline) and services (for instance, tanning salons).

Web This Form Is Used To Report An Assortment Of Excise Taxes And Is Filed Quarterly.

A business that buys or sells specific products or services indicated in the regulations will need to pay the excise tax and fill out form 720. Web depending on what type of business you’re in, you may be required to file form 720, “quarterly federal excise tax form.” here’s what you need to know about. • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii, for a prior quarter and you. In general, form 720 is for businesses.

Web Who Should File Form 720?

Web form 720 is for businesses to report excise taxes paid on goods and activities listed in parts one and two of the form. Quarterly federal excise tax return. See the instructions for form 720. It should be used to accompany any payment of the 1% federal excise tax on premium payments to.