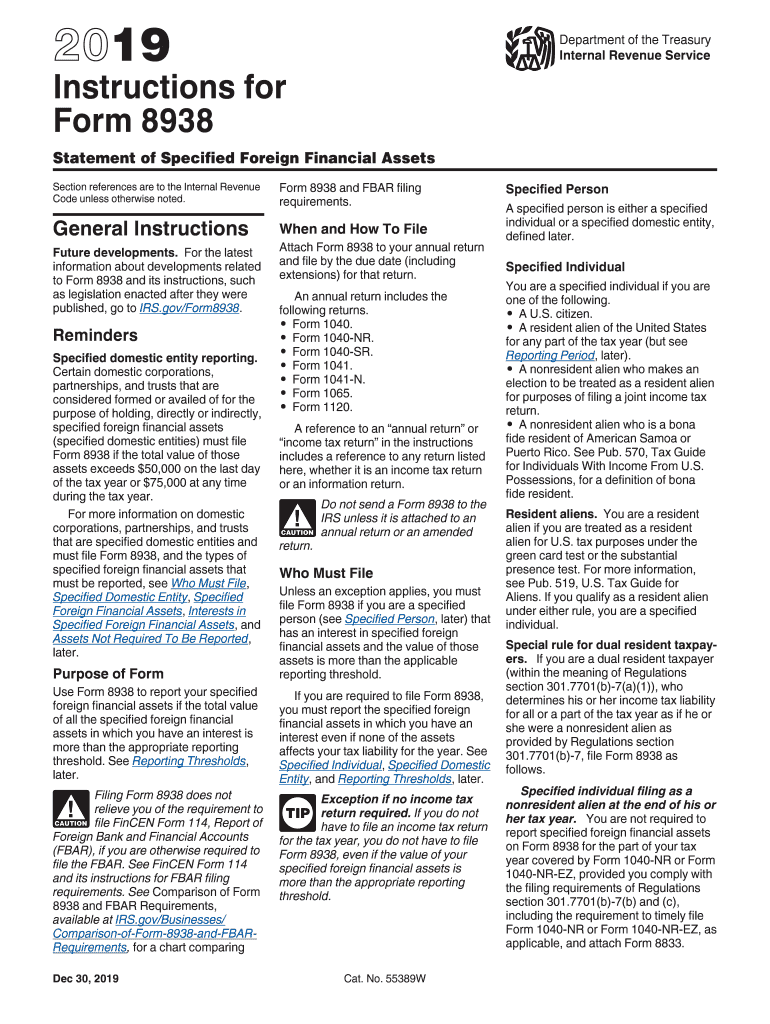

Who Must File Form 8938

Who Must File Form 8938 - Web if you need form 8938, we'll fill it out for you note: Form 8938 is used to report the taxpayer's specified foreign financial assets. Resident aliens for any part of the year, nonresident aliens who make an election to be treated as residents for joint filing. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Domestic financial institution), the foreign. Web failing to file form 8938 when required can result in severe penalties. Web if you are required to file form 8938, you do not have to report financial accounts maintained by: Taxpayer who use to reside outside of the country and has a total combined value of. Taxpayers holding financial assets outside the united states must report those assets to the irs on form 8938, statement of specified foreign. You are a specified person (either a specified.

Web specified individuals include u.s. Web individuals and domestic entities must check the requirements and relevant reporting thresholds of each form and determine if they should file form 8938 or fincen form. Domestic financial institution), the foreign. Web individuals who live in the united states are not required to disclose their foreign assets unless their total value exceeded $75,000 at any point during the year. Web who must file unless an exception applies, you must file form 8938 if you are a specified person (see specified person, later) that has an interest in specified foreign financial. Resident aliens for any part of the year, nonresident aliens who make an election to be treated as residents for joint filing. Web if you are required to file form 8938, you do not have to report financial accounts maintained by: Individuals who must file form 8938 include u.s. If the irs notifies taxpayers that they are delinquent, they. Web who must file?

Resident aliens for any part of the year, nonresident aliens who make an election to be treated as residents for joint filing. Use form 8938 to report your. Web “unless an exception applies, you must file form 8938 if you are a specified person (either a specified individual or a specified domestic entity) that has an interest in. Web under fatca, certain u.s. Web failing to file form 8938 when required can result in severe penalties. You must file form 8938 if: Payer (such as a u.s. Web if you need form 8938, we'll fill it out for you note: Web individuals who live in the united states are not required to disclose their foreign assets unless their total value exceeded $75,000 at any point during the year. Web those who must submit irs form 8938 (who needs to file?) a u.s.

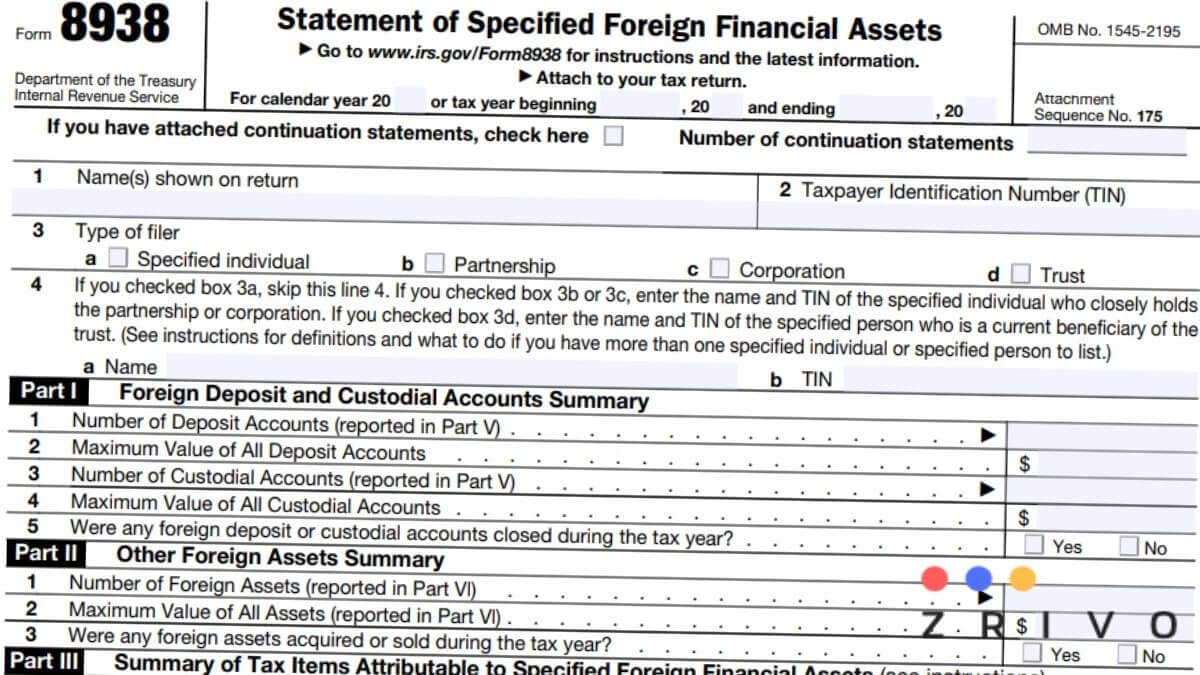

8938 Form 2021

Citizens, resident aliens and certain nonresident aliens must report specified foreign financial assets on form 8938 if the aggregate value of those. Some expatriates must file both an fbar and form 8938, while others are only. Payer (such as a u.s. Web individuals and domestic entities must check the requirements and relevant reporting thresholds of each form and determine if.

Form 8938 Who Has to Report Foreign Assets & How to File

Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Web if you are required to file form 8938, you do not have to report financial accounts maintained by: Citizens, resident aliens and certain nonresident aliens must report specified foreign financial assets on form 8938 if the aggregate value.

Irs 8938 Instructions Fill Out and Sign Printable PDF Template signNow

Taxpayer who use to reside outside of the country and has a total combined value of. If the irs notifies taxpayers that they are delinquent, they. Web if you need form 8938, we'll fill it out for you note: Web specified individuals include u.s. Web if you are required to file form 8938, you do not have to report financial.

Who is Required to File Form 8938 International Tax Lawyer New York

If the irs notifies taxpayers that they are delinquent, they. Taxpayer who use to reside outside of the country and has a total combined value of. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Web those who must submit irs form 8938 (who needs to file?) a.

Philadelphia Estate Planning, Tax, Probate Attorney Law Practice

Taxpayer who use to reside outside of the country and has a total combined value of. If the irs notifies taxpayers that they are delinquent, they. Web under fatca, certain u.s. You are a specified person (either a specified. Web if you are required to file form 8938, you do not have to report financial accounts maintained by:

Nys 2016 tax extension paper form psadovendor

Web under fatca, certain u.s. Web if you are required to file form 8938, you do not have to report financial accounts maintained by: Web those who must submit irs form 8938 (who needs to file?) a u.s. Foreign real estate isn't considered a foreign financial asset, nor are foreign investments (if owned through a u.s. Form 8938 is used.

Form 8938 Who Needs To File The Form And What's Included? Silver Tax

Form 8938 is used to report the taxpayer's specified foreign financial assets. Citizens, resident aliens and certain nonresident aliens must report specified foreign financial assets on form 8938 if the aggregate value of those. Web specified individuals include u.s. Use form 8938 to report your. Taxpayers who meet the form 8938 threshold and are required to file a tax return.

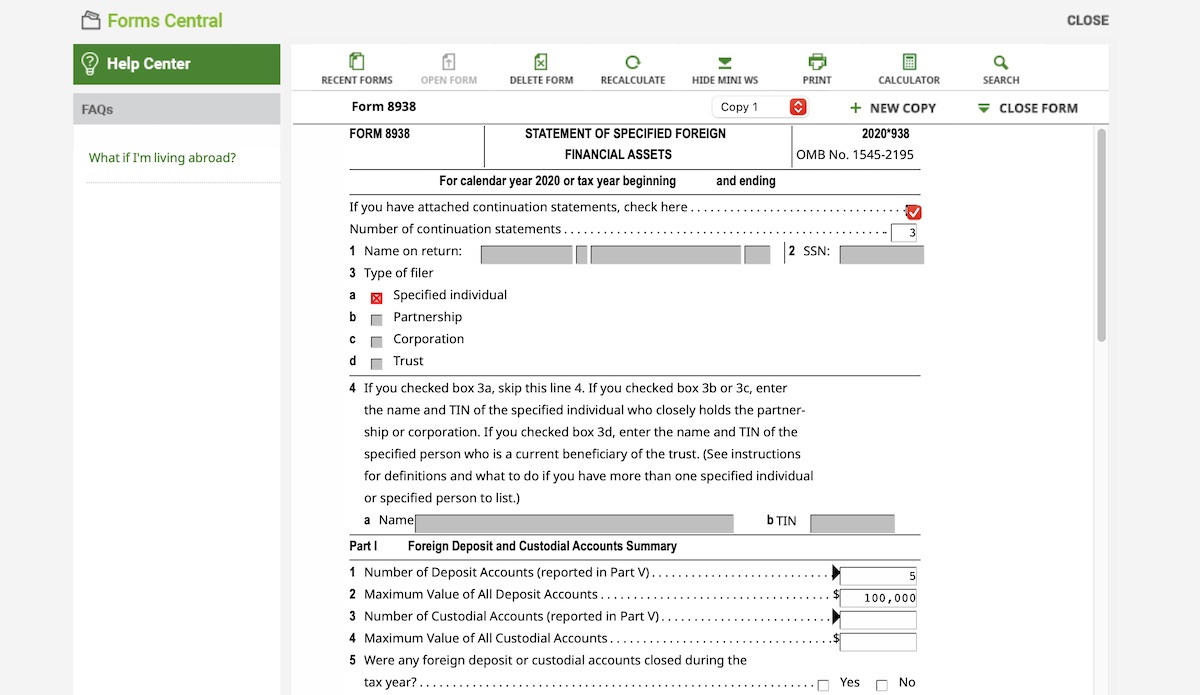

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Individuals who must file form 8938 include u.s. If the irs notifies taxpayers that they are delinquent, they. Citizens, resident aliens and certain nonresident aliens must report specified foreign financial assets on form 8938 if the aggregate value of those. Web failing to file form 8938 when required can result in severe penalties. Web who must file unless an exception.

Form 8938 Who Needs To File The Form And What's Included? Silver Tax

Foreign real estate isn't considered a foreign financial asset, nor are foreign investments (if owned through a u.s. Web “unless an exception applies, you must file form 8938 if you are a specified person (either a specified individual or a specified domestic entity) that has an interest in. Web in general, when you have to file form 8938, you will.

Form 8938 Instructions 2022 2023 IRS Forms Zrivo

Some expatriates must file both an fbar and form 8938, while others are only. Web if you need form 8938, we'll fill it out for you note: The standard penalty is a fine of $10,000 per year. Web individuals and domestic entities must check the requirements and relevant reporting thresholds of each form and determine if they should file form.

Web Individuals Who Live In The United States Are Not Required To Disclose Their Foreign Assets Unless Their Total Value Exceeded $75,000 At Any Point During The Year.

You must file form 8938 if: Resident aliens for any part of the year, nonresident aliens who make an election to be treated as residents for joint filing. Web “unless an exception applies, you must file form 8938 if you are a specified person (either a specified individual or a specified domestic entity) that has an interest in. Individuals who must file form 8938 include u.s.

Web Form 8938 Is Used By Certain U.s.

Web if you need form 8938, we'll fill it out for you note: You are a specified person (either a specified. Web individuals and domestic entities must check the requirements and relevant reporting thresholds of each form and determine if they should file form 8938 or fincen form. Payer (such as a u.s.

Some Expatriates Must File Both An Fbar And Form 8938, While Others Are Only.

Form 8938 is used to report the taxpayer's specified foreign financial assets. Taxpayers who meet the form 8938 threshold and are required to file a tax return will also be required to include specified foreign asset reporting with their tax return. Web under fatca, certain u.s. Taxpayer who use to reside outside of the country and has a total combined value of.

Web In General, When You Have To File Form 8938, You Will Almost Always Need To File An Fbar.

Web who must file? Use form 8938 to report your. Web refer to form 8938 instructions for more information on assets that do not have to be reported. Domestic financial institution), the foreign.