Who Gets Paid First In Chapter 13

Who Gets Paid First In Chapter 13 - Your disposable income first goes to your secured and priority. These must also be paid. How you pay your mortgage will depend on whether you've fallen behind and the rules of your bankruptcy court. The cost of your vehicle. To keep your home in chapter 13, you must stay current on your mortgage. The second lienholder is “junior” to the first. This must be paid off under the chapter 13 plan if you intend to keep it. Web here are a few of the most common considerations when renegotiating after filing for chapter 13 bankruptcy in kansas city: The trustee (almost) always pays these debts first. Web secured debts and priority debts are generally paid first in chapter 13 bankruptcy.

Plan payments are often used to pay for a car, house or some other important asset. Secured claim (like a mortgage. So, the first recorded mortgage has priority over the second. Your disposable income first goes to your secured and priority. Know who gets paid first under your plan by cathy moran who gets paid in chapter 13, and in what order, makes a huge different when charting your course. The cost of your vehicle. The second lienholder is “junior” to the first. Web family law chapter 13: Web there is a set waterfall in who gets paid first. Go back and spend 3 min reading the last chapter of season 1 though because it ends a little different.

Your disposable income first goes to your secured and priority. Secured creditors assume the least amount of risk because they have collateral backing. Web secured debts and priority debts are generally paid first in chapter 13 bankruptcy. Some debts like unpaid property taxes even take priority over first. Go back and spend 3 min reading the last chapter of season 1 though because it ends a little different. Other priority debts to be paid. Web in chapter 13, there are two methods by which the amount to be paid to unsecured creditors is determined. Web family law chapter 13: Secured claim (like a mortgage. Web by cara o'neill, attorney debts—or claims as they're called in bankruptcy—aren't all paid in the same way in a chapter 13 case.

High risk work licence Who gets paid first in chapter 7

Plan payments are often used to pay for a car, house or some other important asset. How you pay your mortgage will depend on whether you've fallen behind and the rules of your bankruptcy court. Web by cara o'neill, attorney debts—or claims as they're called in bankruptcy—aren't all paid in the same way in a chapter 13 case. Web when.

Which Creditors Are Paid First in a Liquidation?

If you don't mind it, i'd actually recommend reading all of. Web paying mortgage payments during chapter 13. Anyone with regular income can file for chapter 13 bankruptcy, as long as the total debt is within the threshold. Web creditor payments in chapter 13. Sometimes, we must realize that r.

Who Gets Paid First When a Company Goes Into Liquidation?

Web here are a few of the most common considerations when renegotiating after filing for chapter 13 bankruptcy in kansas city: Out of that $600 we pay the $310 filing fee to the bankruptcy court, $60 to the first and. The individual’s income level helps determine. Secured claim (like a mortgage. Web generally, the “first in time is the first.

Who gets paid first in liquidations?

This must be paid off under the chapter 13 plan if you intend to keep it. Secured claim (like a mortgage. The trustee (almost) always pays these debts first. Web family law chapter 13: Web paying mortgage payments during chapter 13.

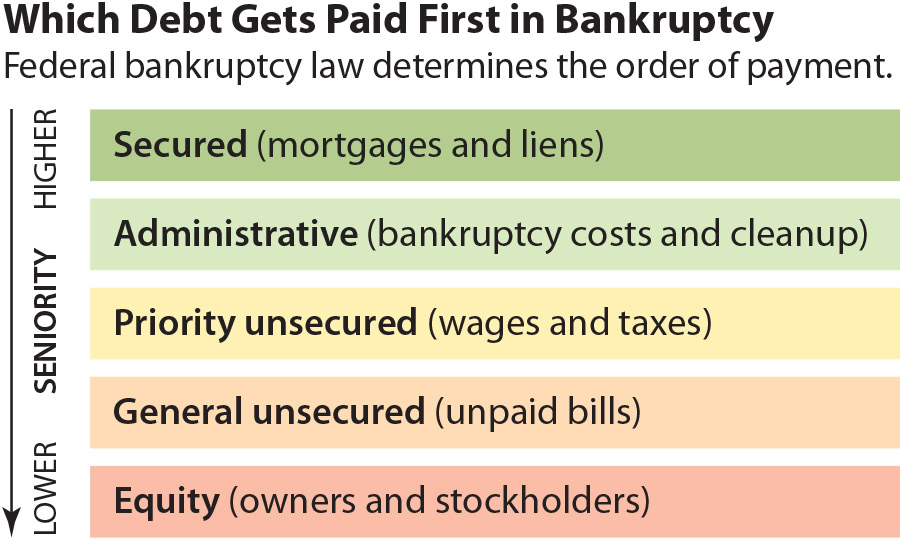

Who Gets Paid First In Bankruptcy

Web secured debts and priority debts are generally paid first in chapter 13 bankruptcy. Web family law chapter 13: First, unsecured creditors must be paid at least as much as they would have been paid if the debtor’s assets had been liquidated under chapter. The cost of your vehicle. Sometimes, we must realize that r.

Who Gets Paid First When a Company Goes Into Liquidation?

Plan payments are often used to pay for a car, house or some other important asset. Web there is a set waterfall in who gets paid first. So, the first recorded mortgage has priority over the second. This must be paid off under the chapter 13 plan if you intend to keep it. Thus, if a debtor does not make.

Who Gets Paid First in a Chapter 11 Bankruptcy? Kerkman & Dunn

These must also be paid. Web chapter 13 bankruptcy is often referred to as “wage earner’s bankruptcy” or “repayment plan bankruptcy.” it’s a type of bankruptcy used by individual consumers—specifically those who are. Web in chapter 13, there are two methods by which the amount to be paid to unsecured creditors is determined. To keep your home in chapter 13,.

IEEFA primer Cleanup costs supersede most other liabilities in oil and

First, unsecured creditors must be paid at least as much as they would have been paid if the debtor’s assets had been liquidated under chapter. Web in chapter 13, there are two methods by which the amount to be paid to unsecured creditors is determined. Web when money is available to pay creditors in your chapter 7 or chapter 13.

Who Gets Paid First In Liquidation? Oliver Elliot

Other priority debts to be paid. Out of that $600 we pay the $310 filing fee to the bankruptcy court, $60 to the first and. Web season 2 episode 0 is where the anime leaves off. Web by cara o'neill, attorney debts—or claims as they're called in bankruptcy—aren't all paid in the same way in a chapter 13 case. Web.

Who Gets Paid First In Bankruptcy

Secured creditors assume the least amount of risk because they have collateral backing. Know who gets paid first under your plan by cathy moran who gets paid in chapter 13, and in what order, makes a huge different when charting your course. However, if a tenant owes you back rent and files a chapter 13 case, you won’t have to.

Web By Cara O'neill, Attorney Debts—Or Claims As They're Called In Bankruptcy—Aren't All Paid In The Same Way In A Chapter 13 Case.

Web family law chapter 13: This must be paid off under the chapter 13 plan if you intend to keep it. Plan payments are often used to pay for a car, house or some other important asset. Web paying mortgage payments during chapter 13.

Web Season 2 Episode 0 Is Where The Anime Leaves Off.

Sometimes, we must realize that r. Know who gets paid first under your plan by cathy moran who gets paid in chapter 13, and in what order, makes a huge different when charting your course. Web there is a set waterfall in who gets paid first. Web generally, the “first in time is the first in line” to get paid if a house gets foreclosed.

Out Of That $600 We Pay The $310 Filing Fee To The Bankruptcy Court, $60 To The First And.

Web creditor payments in chapter 13. Web in chapter 13, there are two methods by which the amount to be paid to unsecured creditors is determined. Web who is eligible for chapter 13 bankruptcy? The cost of your vehicle.

Some Debts Like Unpaid Property Taxes Even Take Priority Over First.

Web in chapter 13 bankruptcy, you must devote all of your disposable income to the repayment of your debts over the life of your chapter 13 plan. What you'll have to pay will depend on whether the claim is a: How you pay your mortgage will depend on whether you've fallen behind and the rules of your bankruptcy court. Thus, if a debtor does not make the plan payment, then those creditors don’t get paid.