Where To Send Form W 4V

Where To Send Form W 4V - Web sign the document and fill out the current date. Then, find the social security office closest to your home. Type text, add images, blackout confidential details, add comments, highlights and more. There are several ways to pay the taxes throughout the year and avoid an underpayment penalty or a big bill at tax. Web 12 states that tax social security benefits. You can find the address of your local. Voluntary withholding request (for unemployment compensation and certain federal. Finally, you are ready to give. Draw your signature, type it,. This is a standard procedure for any official paper.

This is a standard procedure for any official paper. If your address is outside the. Type text, add images, blackout confidential details, add comments, highlights and more. Web if you want to have taxes withheld from unemployment compensation, you would send the form directly to the state paying the unemployment compensation. Finally, you are ready to give. Then, find the social security office closest to your home. If your address is outside the united. Web mail or fax us a request to withhold taxes. Web sign the document and fill out the current date. Enter your signature and the filing date at the end.

Enter your signature and the filing date at the end. Voluntary withholding request (for unemployment compensation and certain federal. Web 12 states that tax social security benefits. Type text, add images, blackout confidential details, add comments, highlights and more. If your address is outside the. Web if you want to have taxes withheld from unemployment compensation, you would send the form directly to the state paying the unemployment compensation. August 2014) department of the treasury internal revenue service. There are several ways to pay the taxes throughout the year and avoid an underpayment penalty or a big bill at tax. You can find the address of your local. This is a standard procedure for any official paper.

Irs Form W4V Printable Request for taxpayer identification number

Then, find the social security office closest to your home. Edit your w 4v online. Voluntary withholding request (for unemployment compensation and certain federal. Enter your signature and the filing date at the end. Voluntary withholding request from the irs' website.

Irs Form W4V Printable where do i mail my w 4v form for social

Web if you want to have taxes withheld from unemployment compensation, you would send the form directly to the state paying the unemployment compensation. This is a standard procedure for any official paper. Voluntary withholding request from the irs' website. There are several ways to pay the taxes throughout the year and avoid an underpayment penalty or a big bill.

Taxes From A To Z 2020 V Is For Voluntary Withholding Taxgirl

Edit your w 4v online. You can find the address of your local. Voluntary withholding request (for unemployment compensation and certain federal. Web if you want to have taxes withheld from unemployment compensation, you would send the form directly to the state paying the unemployment compensation. Finally, you are ready to give.

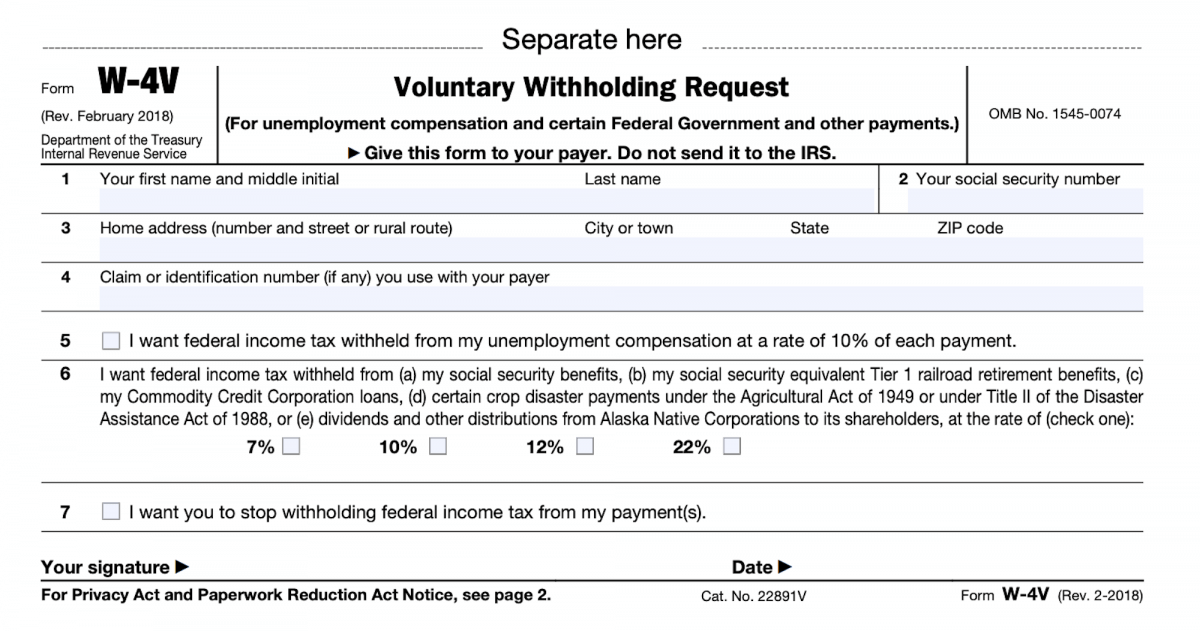

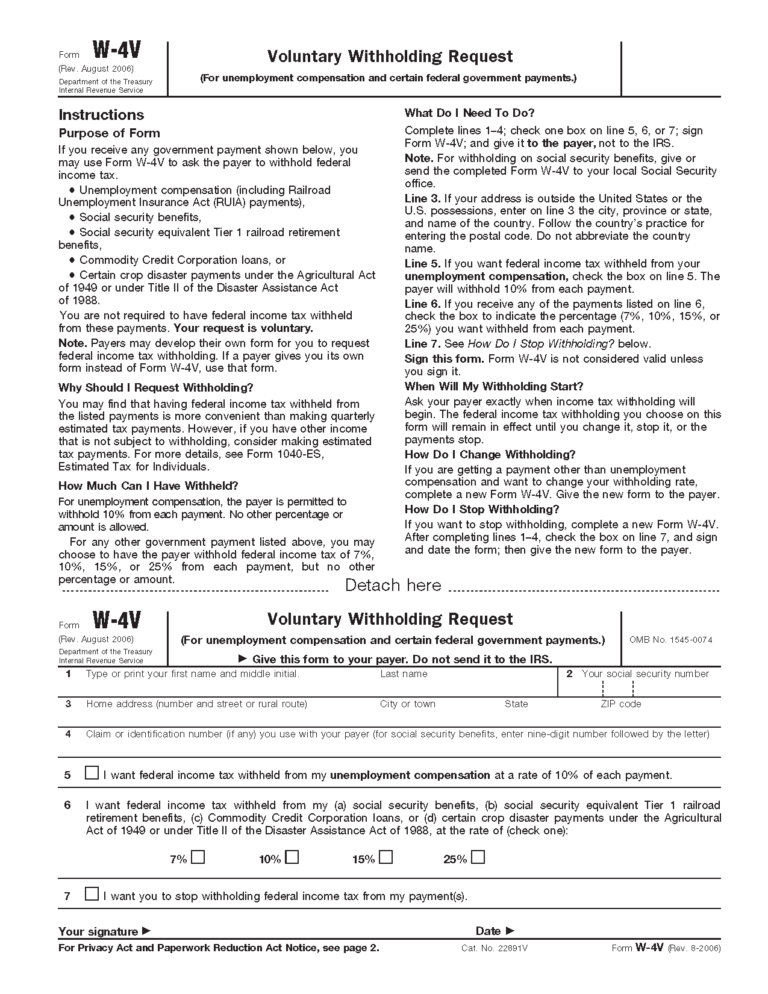

Fill Free fillable Voluntary Withholding Request 2018 FormW4V PDF form

You can find the office using the social security web site. Voluntary withholding request (for unemployment compensation and certain federal. Sign it in a few clicks. If your address is outside the. You can find the address of your local.

Irs Form W4V Printable Irs W 4p Pdffiller

Voluntary withholding request from the irs' website. If your address is outside the united states or the. Enter your signature and the filing date at the end. Then, find the social security office closest to your home. There are several ways to pay the taxes throughout the year and avoid an underpayment penalty or a big bill at tax.

Irs Form W4V Printable / W 4 V V O L U N T A R Y W I T H H O L D I N G

Voluntary withholding request from the irs' website. Draw your signature, type it,. Voluntary withholding request (for unemployment compensation and certain federal. This is a standard procedure for any official paper. If your address is outside the united.

Irs Form W4V Printable IRS Form W4V Download Printable PDF

If your address is outside the. Web if you want to have taxes withheld from unemployment compensation, you would send the form directly to the state paying the unemployment compensation. Sign it in a few clicks. You can find the office using the social security web site. You can download the form.

Can You Change Social Security Tax Withholding Online Fill Out and

There are several ways to pay the taxes throughout the year and avoid an underpayment penalty or a big bill at tax. Then, find the social security office closest to your home. This is a standard procedure for any official paper. Web mail or fax us a request to withhold taxes. Edit your w 4v online.

Form W 4V Voluntary Withholding Request W4 Form 2021 Printable

You can download the form. This is a standard procedure for any official paper. Enter your signature and the filing date at the end. Web mail or fax us a request to withhold taxes. Type text, add images, blackout confidential details, add comments, highlights and more.

This Is A Standard Procedure For Any Official Paper.

Sign it in a few clicks. You can find the address of your local. Enter your signature and the filing date at the end. You can find the office using the social security web site.

Voluntary Withholding Request (For Unemployment Compensation And Certain Federal.

Voluntary withholding request from the irs' website. If your address is outside the. Web mail or fax us a request to withhold taxes. Finally, you are ready to give.

Draw Your Signature, Type It,.

Type text, add images, blackout confidential details, add comments, highlights and more. Web sign the document and fill out the current date. If your address is outside the united states or the. August 2014) department of the treasury internal revenue service.

You Can Download The Form.

Web 12 states that tax social security benefits. Edit your w 4v online. Web if you want to have taxes withheld from unemployment compensation, you would send the form directly to the state paying the unemployment compensation. There are several ways to pay the taxes throughout the year and avoid an underpayment penalty or a big bill at tax.