Where To Send 8843 Form

Where To Send 8843 Form - Mail the tax return and the form 8843 by the due date (including extensions) to the address shown in the tax. 2021 2020 2019 enter the number of days in 2021 you claim you. Overview of form 8843 irs form 8843 is a. There is no monetary penalty for not filing form 8843. Then mail the form to… in response to an irs notice regarding a tax or fee related to certain taxes. 12/2021 general instructions future developments for the latest information about developments related to form 843 and its instructions, such as. Web if you received taxable income last year, uconn’s volunteer income tax assistance (vita ) program will create and file the 8843 along with your income tax return, as well. Web enter your passport number(s) 4a enter the actual number of days you were present in the united states during: Department of the treasury internal revenue service center austin, tx 73301. Web how do i file form 8843?

Web mailing addresses for form 843; Source income in 2022, mail. If you are filing form 843. Web mail your completed form 8843 to: Mail the form by june 15, 2022 to: Web if you received taxable income last year, uconn’s volunteer income tax assistance (vita ) program will create and file the 8843 along with your income tax return, as well. Web how to fill out the federal form 8843 all international students & scholars (including their dependents) present in the u.s. There is no monetary penalty for not filing form 8843. Web 49 rows mail your tax return, by the due date (including extensions), to. Mail the tax return and the form 8843 by the due date (including extensions) to the address shown in the tax.

Web all nonresident aliens for tax purposes exempting days of presence from the substantial presence test need to file form 8843, regardless of whether they need to. Web how to fill out the federal form 8843 all international students & scholars (including their dependents) present in the u.s. Web if you received u.s. 12/2021 general instructions future developments for the latest information about developments related to form 843 and its instructions, such as. Web if you received taxable income last year, uconn’s volunteer income tax assistance (vita ) program will create and file the 8843 along with your income tax return, as well. Do not include more than one form 8843 per envelope. The irs instructions for form 8843 summarizes who qualifies as. Department of the treasury internal revenue service center austin, tx 73301. If you are filing form 843. Mail the tax return and the form 8843 by the due date (including extensions) to the address shown in the tax.

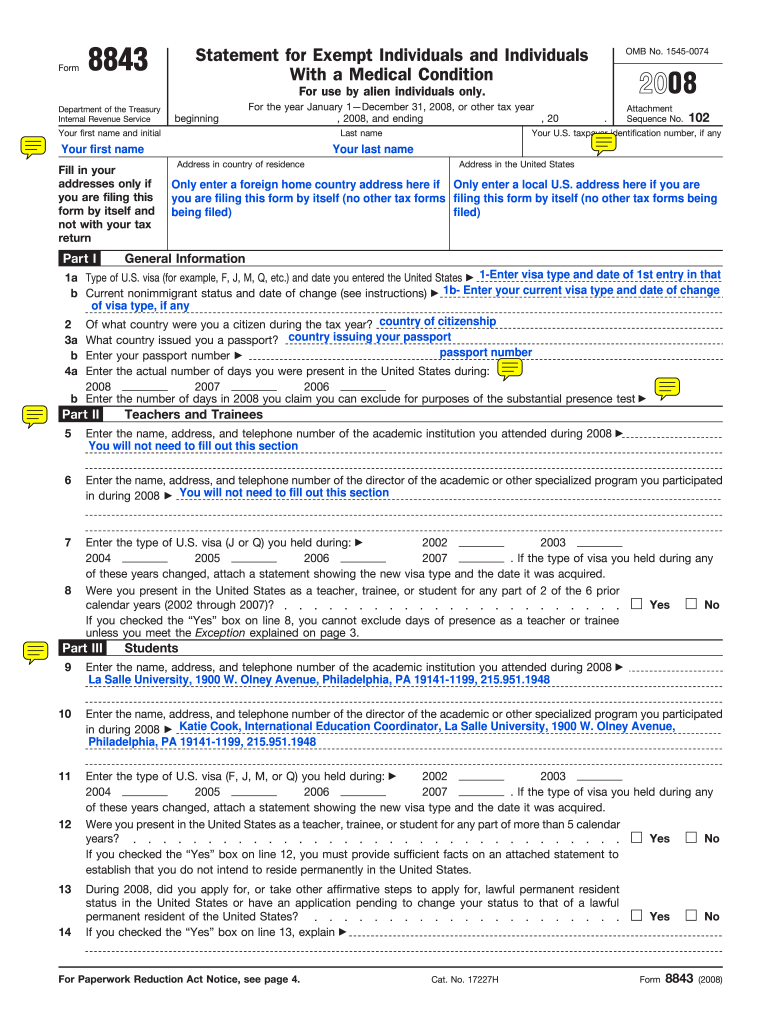

2008 Form IRS 8843 Fill Online, Printable, Fillable, Blank PDFfiller

However, days of presence that are excluded must be properly recorded by filing form. Web if you received u.s. Source income in 2022, mail form 8843 along with your tax return form 1040nr. Web if you received taxable income last year, uconn’s volunteer income tax assistance (vita ) program will create and file the 8843 along with your income tax.

1+ 8843 Form Free Download

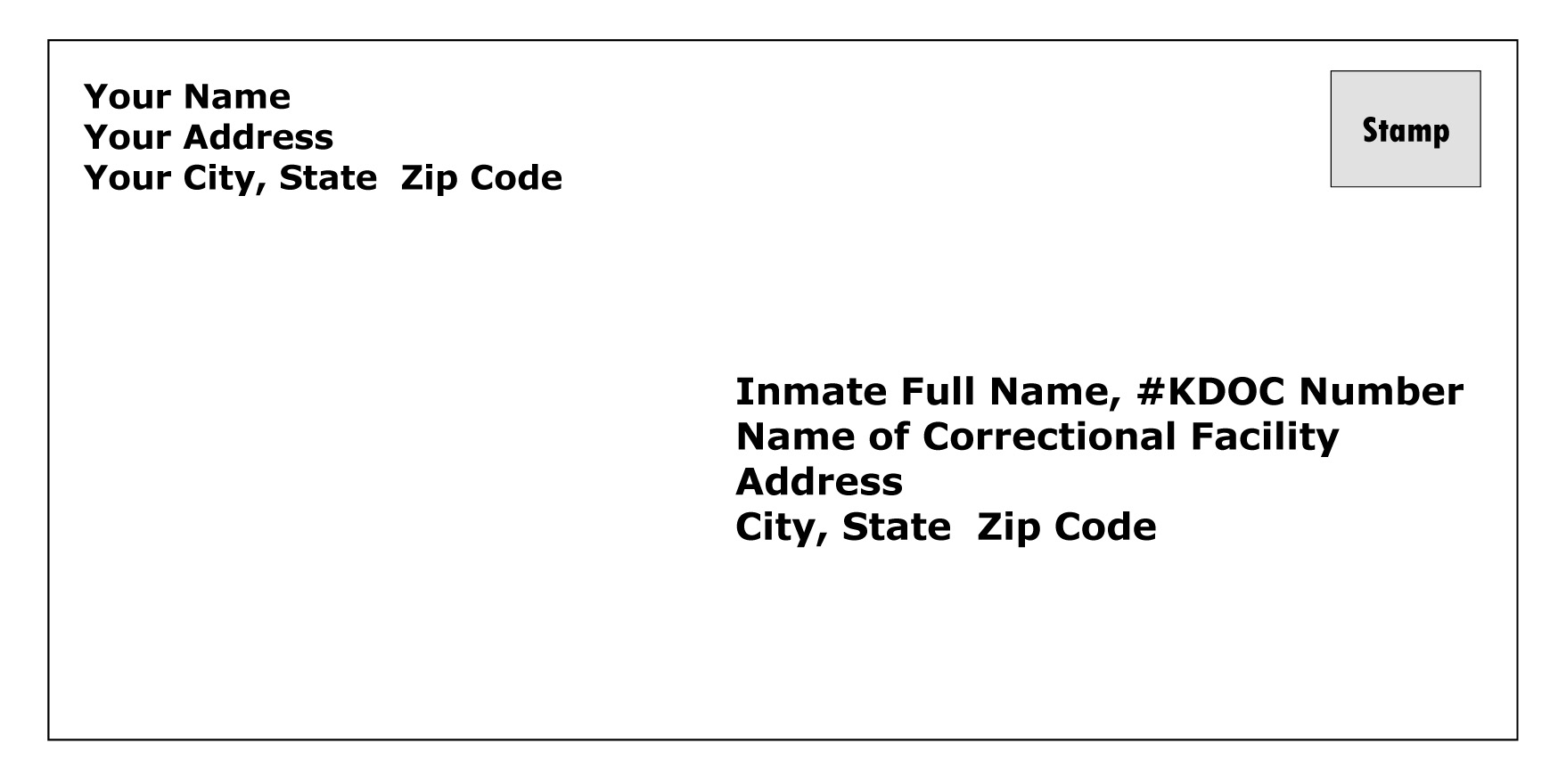

Do not include more than one form 8843 per envelope. Source income in 2022, mail. Web mailing addresses for form 843; If form 8843 is for a spouse or dependent eligible to be claimed as a dependent. Web if you received u.s.

8843 Form Tutorial YouTube

Then mail the form to… in response to an irs notice regarding a tax or fee related to certain taxes. If you have dependents, everyone must submit their form 8843 individually(in separate envelope s). In 2021, whether they worked and earned money or not,. If you did not receive any u.s. Web mail form 8843 and supporting documents in an.

IRS Form 8843 Editable and Printable Statement to Fill out

Web 49 rows mail your tax return, by the due date (including extensions), to. Source income in 2022, mail form 8843 along with your tax return form 1040nr. Department of the treasury internal revenue service center austin, tx 73301. 12/2021 general instructions future developments for the latest information about developments related to form 843 and its instructions, such as. Web.

Letter Envelope Format gplusnick

There is no monetary penalty for not filing form 8843. Department of the treasury internal revenue service center austin, tx 73301. You can not file this form electronically, you must mail the paper form. Do not include more than one form 8843 per envelope. The irs instructions for form 8843 summarizes who qualifies as.

Form 8843留学生报税必填表格 Tax Panda 美国报税大熊猫

Web how to fill out the federal form 8843 all international students & scholars (including their dependents) present in the u.s. 2021 2020 2019 enter the number of days in 2021 you claim you. However, days of presence that are excluded must be properly recorded by filing form. If you did not receive any u.s. Web if you received taxable.

form 8843 example Fill Online, Printable, Fillable Blank

There is no monetary penalty for not filing form 8843. Web the general rules for form 8843 • if you are an exempt individual, you must file form 8843 • if you have income subject to tax then you send it in with your income tax form. How can i file form 8843? Department of the treasury internal revenue service.

AnnaLeah & Mary for Truck Safety received word of IRS TaxExempt Status

Web enter your passport number(s) 4a enter the actual number of days you were present in the united states during: Web if you received taxable income last year, uconn’s volunteer income tax assistance (vita ) program will create and file the 8843 along with your income tax return, as well. Mail the tax return and the form 8843 by the.

Form 8843 YouTube

You can not file this form electronically, you must mail the paper form. If you have dependents, everyone must submit their form 8843 individually(in separate envelope s). Web if you received u.s. Department of the treasury internal revenue service center austin, tx 73301. Web mail form 8843 and supporting documents in an envelope to the following address:

Web If You Received Taxable Income Last Year, Uconn’s Volunteer Income Tax Assistance (Vita ) Program Will Create And File The 8843 Along With Your Income Tax Return, As Well.

How can i file form 8843? Then mail the form to… in response to an irs notice regarding a tax or fee related to certain taxes. There is no monetary penalty for not filing form 8843. Web 49 rows mail your tax return, by the due date (including extensions), to.

Web Mailing Addresses For Form 843;

Web mail your completed form 8843 to: The irs instructions for form 8843 summarizes who qualifies as. Web if you received u.s. Web enter your passport number(s) 4a enter the actual number of days you were present in the united states during:

If You Did Not Receive Any U.s.

Web if you are required to file an income tax return, attach form 8843 to the back of the tax return. Mail the form by june 15, 2022 to: Department of the treasury internal revenue service center austin, tx 73301. Do not include more than one form 8843 per envelope.

Web How Do I File Form 8843?

Web all nonresident aliens for tax purposes exempting days of presence from the substantial presence test need to file form 8843, regardless of whether they need to. If you have dependents, everyone must submit their form 8843 individually(in separate envelope s). If you are filing form 843. 12/2021 general instructions future developments for the latest information about developments related to form 843 and its instructions, such as.