Where To Mail Form 945

Where To Mail Form 945 - Federal income tax withheld from pensions, annuities, ira, etc.: However, if you choose or are required to file by mail, the mailing. Go to irs.gov/employmentefile for more information on electronic filing. Web form 945 deadlines for 2020. The following are the due dates for each filing type. Enter the 20% amount that was required to be withheld for the solo 401k distribution. Web how to file form 945. Know the 945 mailing address for with and without payment. You should receive an email of the status of your 945 filing on the same day it is submitted to the. Web where to mail form 945.

Addresses for sending the form by regular mail depend on your state, whether you're an exempt organization, and whether you're also. This form should be completed by semiweekly schedule depositors. However, if you choose or are required to file by mail, the mailing. If you file a paper return, where you file depends on. Federal income tax withheld from pensions, annuities, ira, etc.: Web where to mail form 945. Report the backup withholdings to the irs. Web fill out the form 945 with the line by line instructions from taxbandits. Enter the 20% amount that was required to be withheld for the solo 401k distribution. Web where to mail irs form 945?

Web where to mail irs form 945? Must be removed before printing. Web what is irs form 945? Report the backup withholdings to the irs. The following are the due dates for each filing type. Web form 945 is the annual record of federal tax liability. Web fill out the form 945 with the line by line instructions from taxbandits. Web form 945 deadlines for 2020. Complete 945 easily and in minutes. Web how to file form 945.

2016 Form IRS 945 Fill Online, Printable, Fillable, Blank pdfFiller

Federal income tax withheld from pensions, annuities, ira, etc.: Must be removed before printing. Forms must be transmitted to the irs before the deadline. Enter the 20% amount that was required to be withheld for the solo 401k distribution. Web what is irs form 945?

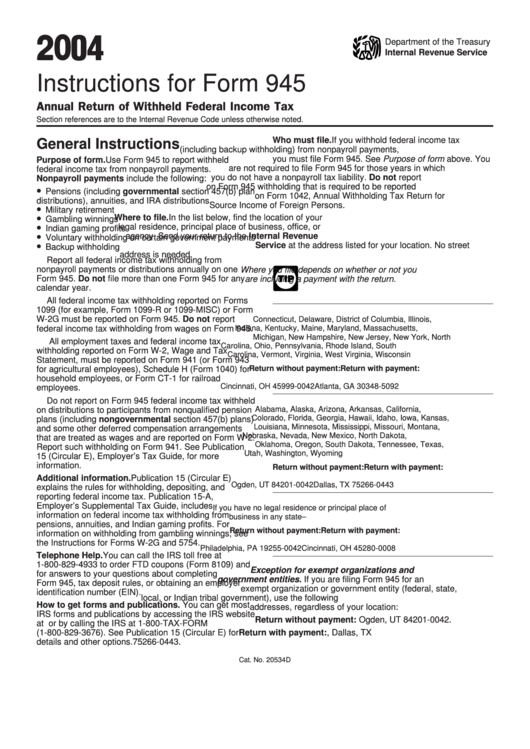

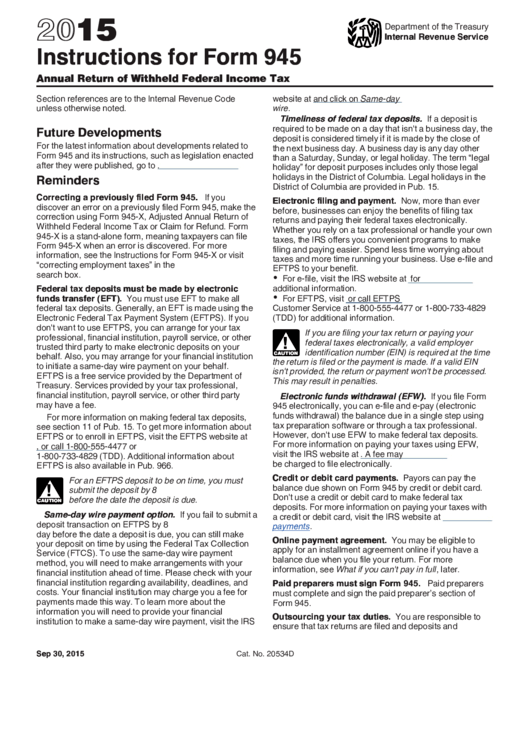

Instructions For Form 945 Annual Return Of Withheld Federal

Web form 945 deadlines for 2020. Irs efile > january 31. Click on the payroll tab and mark the 945 boxes in the tax forms. Report the backup withholdings to the irs. Addresses for sending the form by regular mail depend on your state, whether you're an exempt organization, and whether you're also.

Everything You Need To Know About Filing IRS Form 945 Silver Tax Group

Web how to file form 945. Irs efile > january 31. Web you’re encouraged to file form 945 electronically. Web where to mail form 945. You should receive an email of the status of your 945 filing on the same day it is submitted to the.

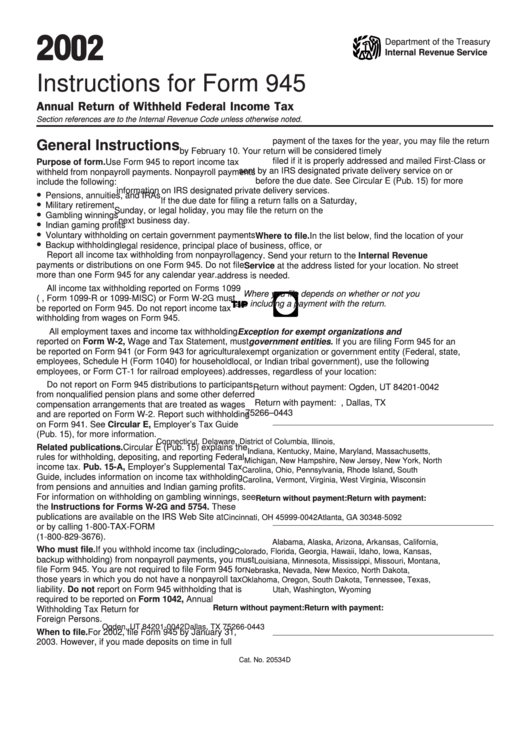

Instructions for IRS Form 945 Annual Return of Withheld Federal

This form should be completed by semiweekly schedule depositors. Web form 945 deadlines for 2020. Web what is irs form 945? Report the backup withholdings to the irs. Web how to file form 945.

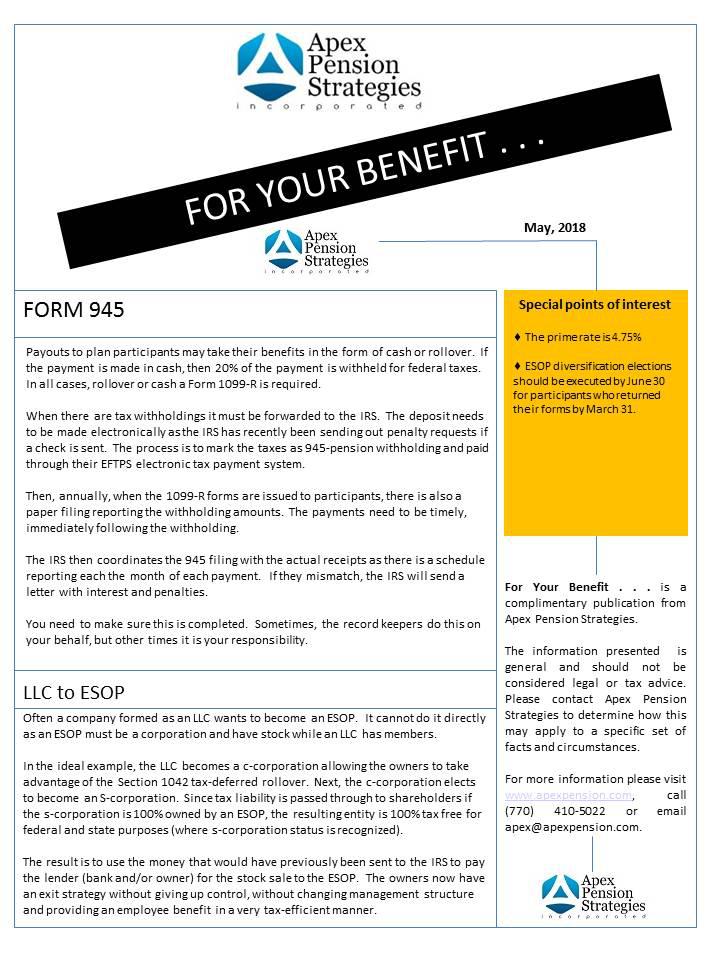

Your Retirement Specialist Form 945

When is form 945 due? Forms must be transmitted to the irs before the deadline. This guide will explain the purpose of irs. However, if you choose or are required to file by mail, the mailing. Report the backup withholdings to the irs.

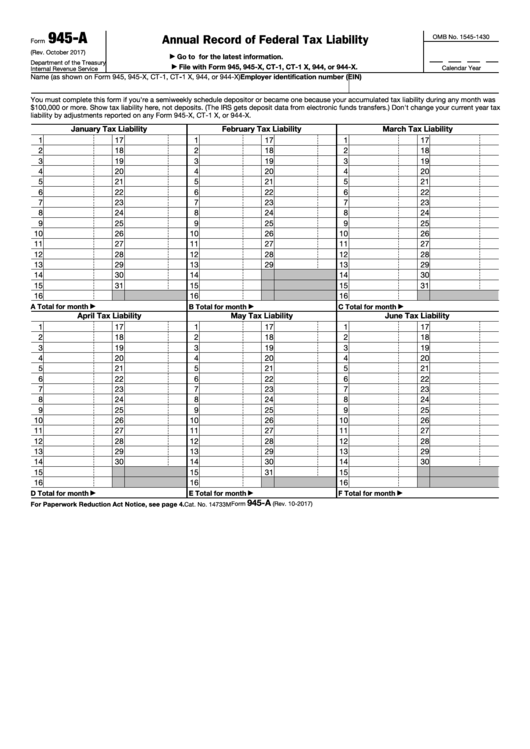

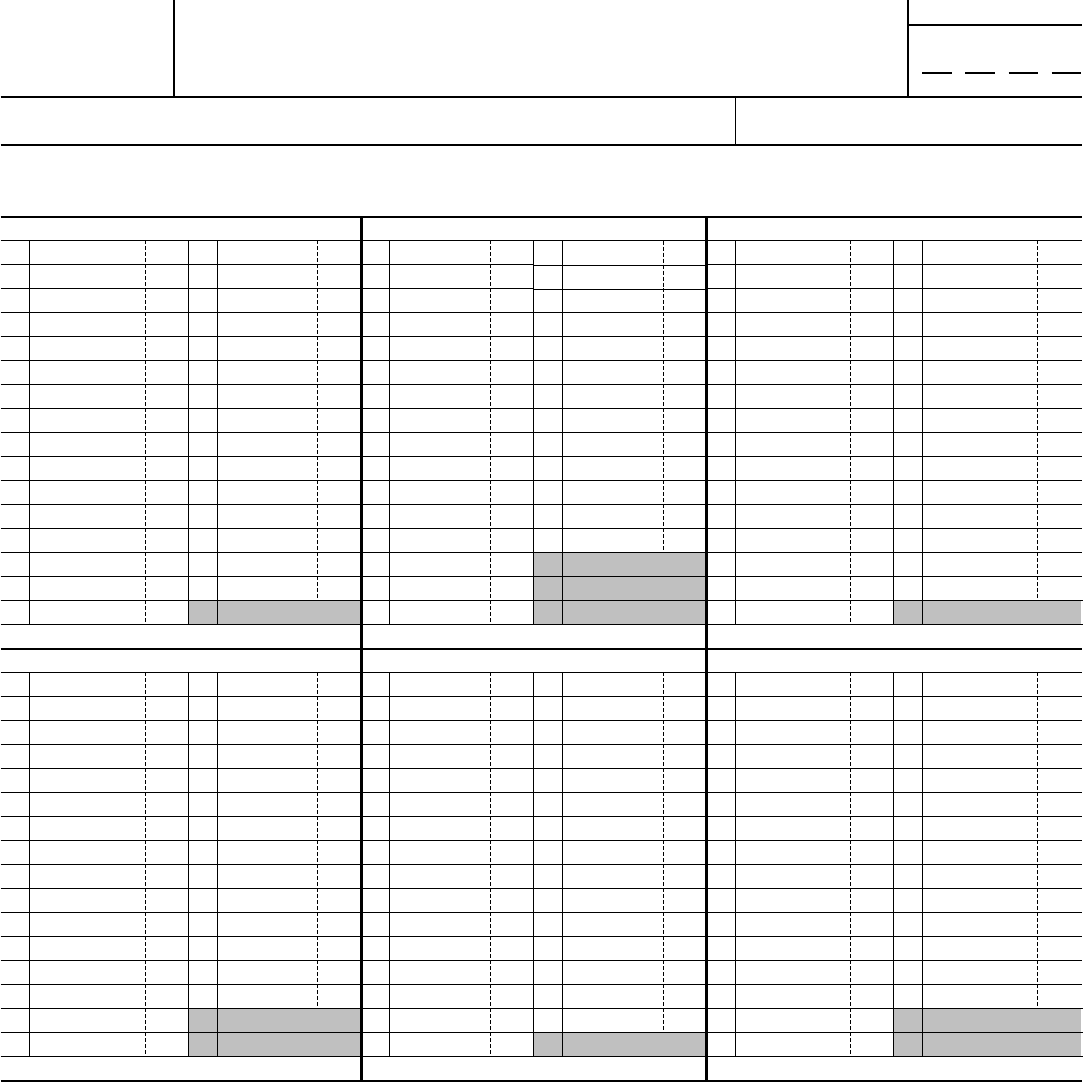

Fillable Form 945A Annual Record Of Federal Tax Liability 2017

Web form 945 is the annual record of federal tax liability. Web what is irs form 945? Web how to file form 945. Web you’re encouraged to file form 945 electronically. If you are owed a refund, you can either request a check or put it toward next year’s filing.

Instructions For Form 945 Annual Return Of Withheld Federal

Web where to mail irs form 945? If you are owed a refund, you can either request a check or put it toward next year’s filing. However, if you choose or are required to file by mail, the mailing. This guide will explain the purpose of irs. Federal income tax withheld from pensions, annuities, ira, etc.:

Form 945 Edit, Fill, Sign Online Handypdf

Click on the payroll tab and mark the 945 boxes in the tax forms. Complete 945 easily and in minutes. Web form 945 deadlines for 2020. Federal income tax withheld from pensions, annuities, ira, etc.: Web form 945 is the annual record of federal tax liability.

Instructions For Form 945 Annual Return Of Withheld Federal

Go to irs.gov/employmentefile for more information on electronic filing. This form must also be completed by. Addresses for sending the form by regular mail depend on your state, whether you're an exempt organization, and whether you're also. Web form 945 is the annual record of federal tax liability. Federal income tax withheld from pensions, annuities, ira, etc.:

Form 945A (Rev. October 2017) Edit, Fill, Sign Online Handypdf

Web form 945 is the annual record of federal tax liability. This form must also be completed by. Enter the 20% amount that was required to be withheld for the solo 401k distribution. Addresses for sending the form by regular mail depend on your state, whether you're an exempt organization, and whether you're also. Go to irs.gov/employmentefile for more information.

However, If You Choose Or Are Required To File By Mail, The Mailing.

Report the backup withholdings to the irs. Enter the 20% amount that was required to be withheld for the solo 401k distribution. Web where to mail irs form 945? When is form 945 due?

Web What Is Irs Form 945?

Must be removed before printing. Click on the payroll tab and mark the 945 boxes in the tax forms. If you are owed a refund, you can either request a check or put it toward next year’s filing. Web we last updated the annual return of withheld federal income tax in december 2022, so this is the latest version of form 945, fully updated for tax year 2022.

Web Fill Out The Form 945 With The Line By Line Instructions From Taxbandits.

Know the 945 mailing address for with and without payment. Go to irs.gov/employmentefile for more information on electronic filing. Web where to mail form 945. Web you’re encouraged to file form 945 electronically.

Web Form 945 Deadlines For 2020.

This guide will explain the purpose of irs. This form should be completed by semiweekly schedule depositors. The following are the due dates for each filing type. Irs efile > january 31.