Where To Mail 9465 Form

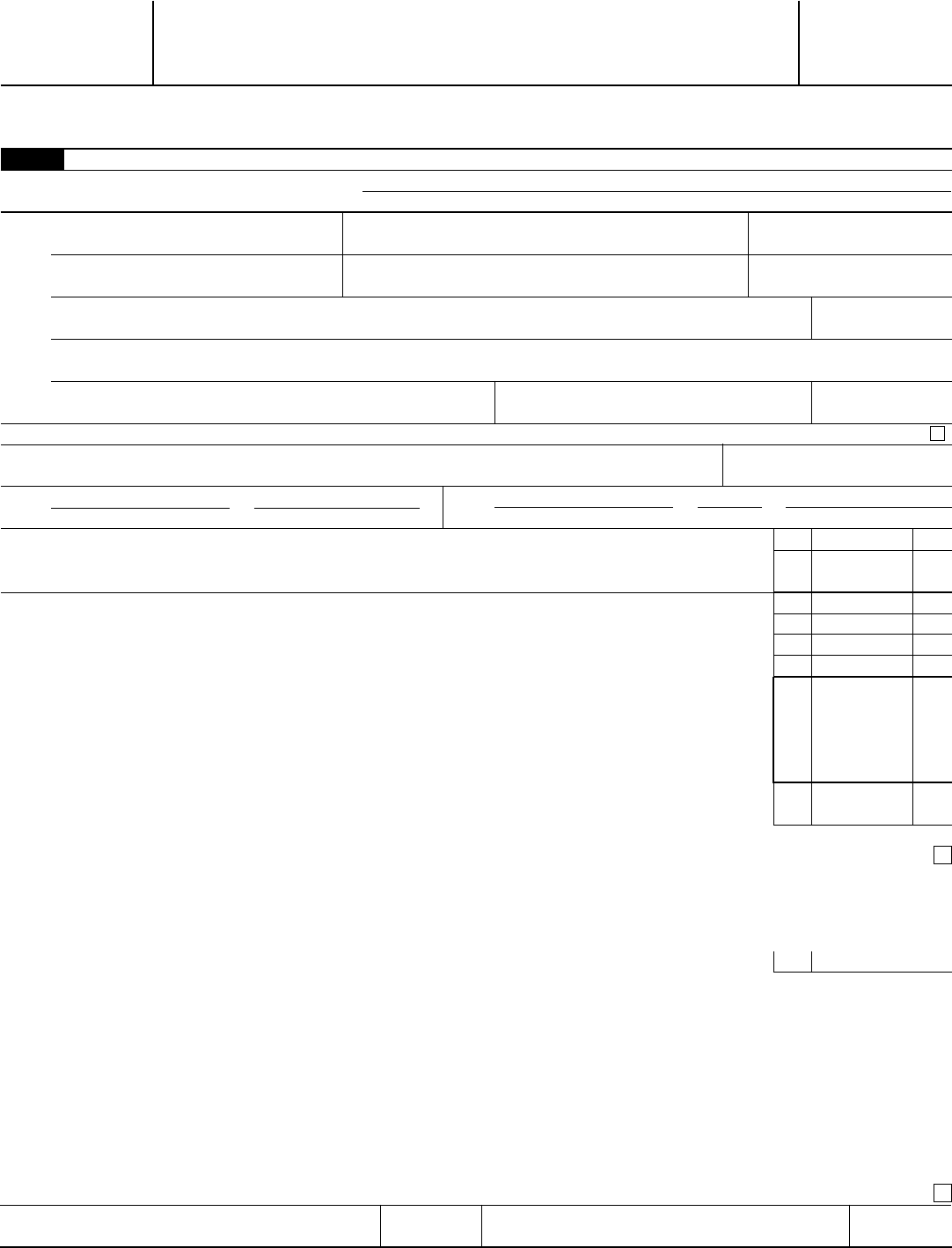

Where To Mail 9465 Form - Web the address should be listed on the form itself. Web if the return has already been filed or you're filing this form in response to a notice, mail it to the internal revenue service center address shown below the client. The mailing address to use varies based on the taxpayer's location. Web federal communications commission 45 l street ne. Web use form 9465 to request a monthly installment plan if you request, we will send you a notice detailing the terms of your cannot pay the full amount you owe shown on your tax. However, if it is not, you can find it on the irs website. If you have already filed your return or you’re filing this form in response to. Web if you are a qualified taxpayer or authorized representative (power of attorney) you can apply for a payment plan (including installment agreement) online to pay off your balance. Click print, then click the pdf link. Go to the irs instructions for form 9465 (in the where to file section) to find.

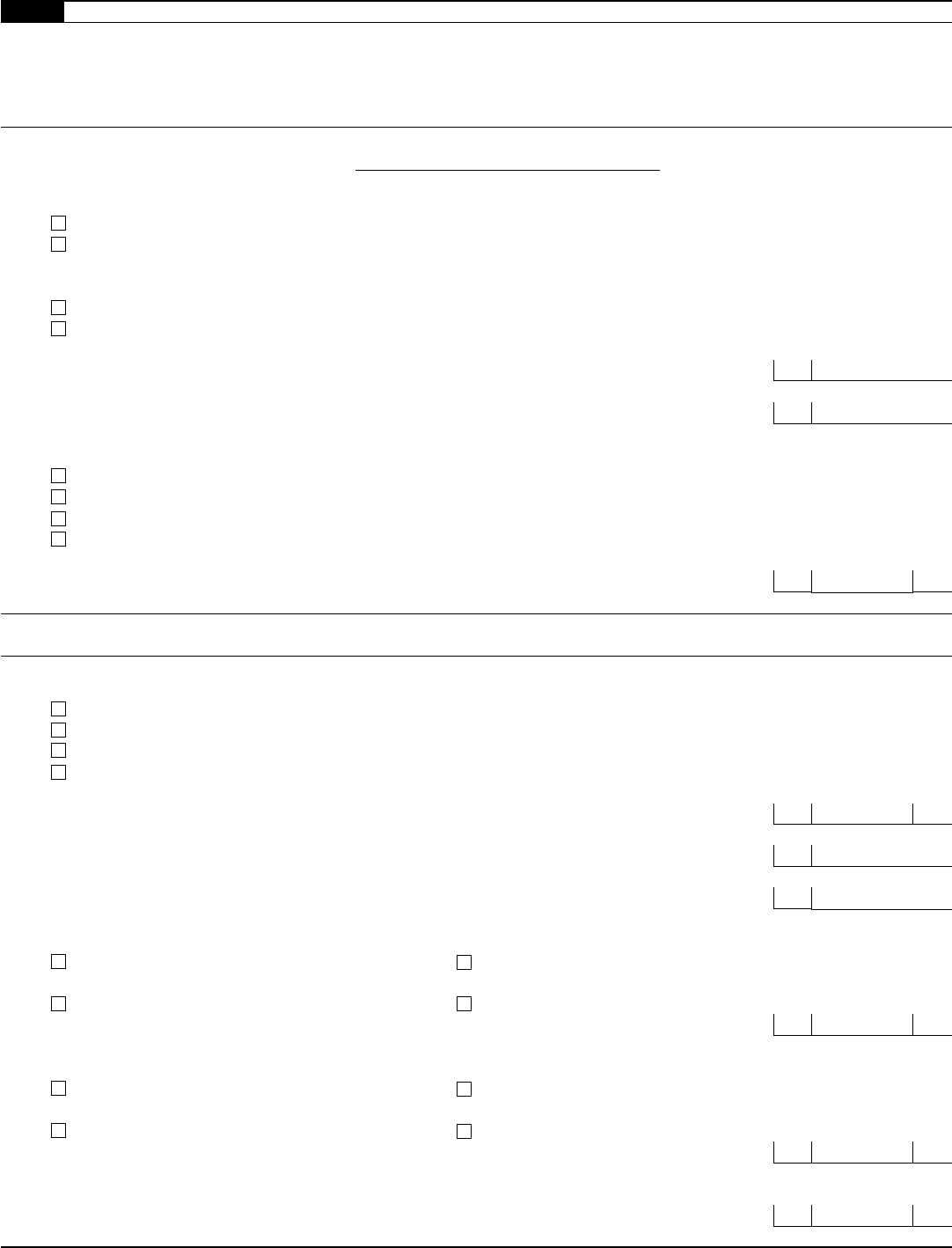

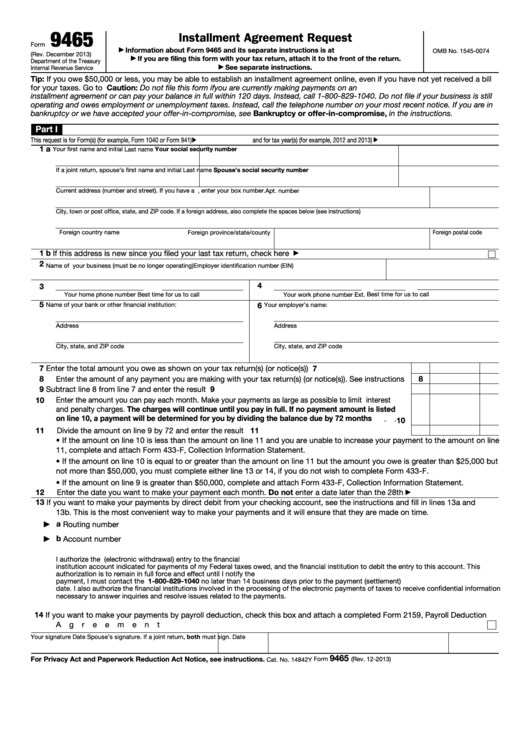

The address of the irs office where you need to mail the. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. If you have already filed your return or you are filing this form in response. Web if the return has already been filed or you're filing this form in response to a notice, mail it to the internal revenue service center address shown below the client. Form 9465 is used by taxpayers to request. Go to the irs instructions for form 9465 (in the where to file section) to find. Web purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice. Please consult the form 9465 instructions (under the where to file heading) to. Click print, then click the pdf link. If you owe $50,000 or less, you may be able to avoid filing form 9465 and establish an installment agreement online,.

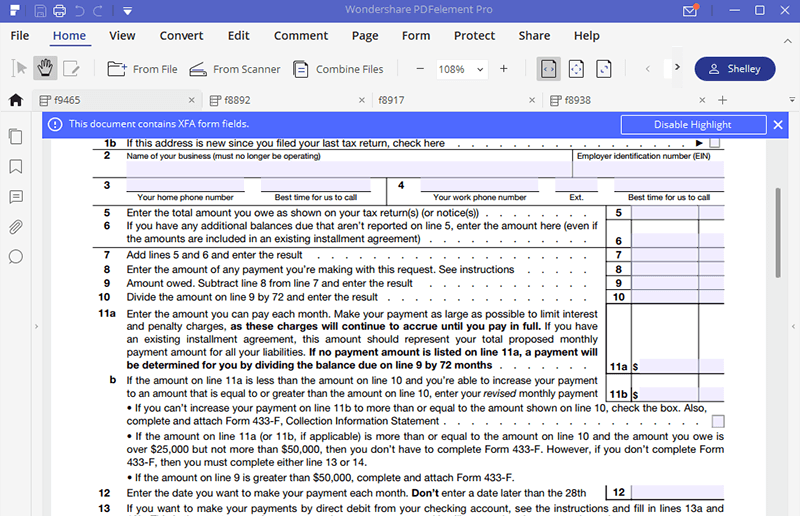

If you owe $50,000 or less, you may be able to avoid filing form 9465 and establish an installment agreement online,. Web purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice. Irs instructions on their site shows ogden ut., where do i send my. Web click federal form 9465*. Web yes, you can file irs form 9465 electronically using the online payment agreement tool on the official website of the internal revenue service (irs). Web if you are a qualified taxpayer or authorized representative (power of attorney) you can apply for a payment plan (including installment agreement) online to pay off your balance. Form 9465 is used by taxpayers to request. Web internal revenue service see separate instructions. Web use form 9465 to request a monthly installment plan if you request, we will send you a notice detailing the terms of your cannot pay the full amount you owe shown on your tax. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet.

IRS Form 9465 [Can't Pay Your Taxes All At Once? READ THIS]

Web where do i send the form? Web if you are a qualified taxpayer or authorized representative (power of attorney) you can apply for a payment plan (including installment agreement) online to pay off your balance. Form 9465 is used by taxpayers to request. The mailing address to use varies based on the taxpayer's location. Web where to mail form.

IRS Form 9465 Instructions for How to Fill it Correctly File

Web where do i send the form? Web if the return has already been filed or you're filing this form in response to a notice, mail it to the internal revenue service center address shown below the client. Web federal communications commission 45 l street ne. Irs instructions on their site shows ogden ut., where do i send my. Web.

Form 9465 (Rev. February 2017) Edit, Fill, Sign Online Handypdf

Web federal communications commission 45 l street ne. Web where do i send the form? Web click federal form 9465*. Web purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice. Please consult the form 9465 instructions (under.

Form 9465 (Rev. February 2017) Edit, Fill, Sign Online Handypdf

Web internal revenue service see separate instructions. If you have already filed your return or you’re filing this form in response to. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Click print, then click the pdf link. Web use form 9465 to request a monthly installment.

Irs Payment Agreement Form 9465 Form Resume Examples djVaJXxw2J

Form 9465 is used by taxpayers to request. Web federal communications commission 45 l street ne. Irs instructions on their site shows ogden ut., where do i send my. Web where do i send the form? Web federal communications commission 45 l street ne.

Form 9465 The IRS's Monthly Payment Plan

The mailing address to use varies based on the taxpayer's location. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Web use form 9465 to request a monthly installment plan if you request, we will send you a notice detailing the terms of your cannot pay the.

Imágenes de Where Do I Mail Irs Installment Agreement Payments

The address of the irs office where you need to mail the. Web federal communications commission 45 l street ne. Form 9465 is used by taxpayers to request. Please consult the form 9465 instructions (under the where to file heading) to. Web attach form 9465 to the front of your return and send it to the address shown in your.

Form 9465 Installment Agreement Request Definition

Web yes, you can file irs form 9465 electronically using the online payment agreement tool on the official website of the internal revenue service (irs). Please consult the form 9465 instructions (under the where to file heading) to. Web where do i send the form? If you have already filed your return or you’re filing this form in response to..

Fillable Form 9465 Installment Agreement Request printable pdf download

Web if you are a qualified taxpayer or authorized representative (power of attorney) you can apply for a payment plan (including installment agreement) online to pay off your balance. Web internal revenue service see separate instructions. Web yes, you can file irs form 9465 electronically using the online payment agreement tool on the official website of the internal revenue service.

IRS Form 9465 [Can't Pay Your Taxes All At Once? READ THIS]

The mailing address to use varies based on the taxpayer's location. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Please consult the form 9465 instructions (under the where to file heading) to. Web yes, you can file irs form 9465 electronically using the online payment agreement.

Web Purpose Of Form Use Form 9465 To Request A Monthly Installment Agreement (Payment Plan) If You Can’t Pay The Full Amount You Owe Shown On Your Tax Return (Or On A Notice.

Web click federal form 9465*. Please consult the form 9465 instructions (under the where to file heading) to. Click print, then click the pdf link. Web use form 9465 to request a monthly installment plan if you request, we will send you a notice detailing the terms of your cannot pay the full amount you owe shown on your tax.

Web If The Return Has Already Been Filed Or You're Filing This Form In Response To A Notice, Mail It To The Internal Revenue Service Center Address Shown Below The Client.

Web yes, you can file irs form 9465 electronically using the online payment agreement tool on the official website of the internal revenue service (irs). Web if you are a qualified taxpayer or authorized representative (power of attorney) you can apply for a payment plan (including installment agreement) online to pay off your balance. The mailing address to use varies based on the taxpayer's location. However, if it is not, you can find it on the irs website.

If You Have Already Filed Your Return Or You Are Filing This Form In Response.

Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Form 9465 is used by taxpayers to request. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. Web federal communications commission 45 l street ne.

If You Owe $50,000 Or Less, You May Be Able To Avoid Filing Form 9465 And Establish An Installment Agreement Online,.

Web internal revenue service see separate instructions. Web the address should be listed on the form itself. Web where to send form # 9465 turbo tax shows san francisco as the location to send payment. All individual taxpayers who mail the irs form 9465 separate from their returns and who do not file a form 1040 with schedule (s) c, e, or f, should.

![IRS Form 9465 [Can't Pay Your Taxes All At Once? READ THIS]](https://help.taxreliefcenter.org/wp-content/uploads/2018/04/9465-usa-federal-tax-form-form-9465-instructions-ss.jpg)

:max_bytes(150000):strip_icc()/9465-InstallmentAgreementRequest-1-ad4522a907c94ba7a959e9bc7549e14d.png)

:max_bytes(150000):strip_icc()/9465-700bb91065234917b8d2866f2306afe9.jpg)

![IRS Form 9465 [Can't Pay Your Taxes All At Once? READ THIS]](https://help.taxreliefcenter.org/wp-content/uploads/2018/04/tax-time-calculator-tax-form-form-9465-instructions-ss-Featured-1024x573.jpg)