When Is Form 720 Due

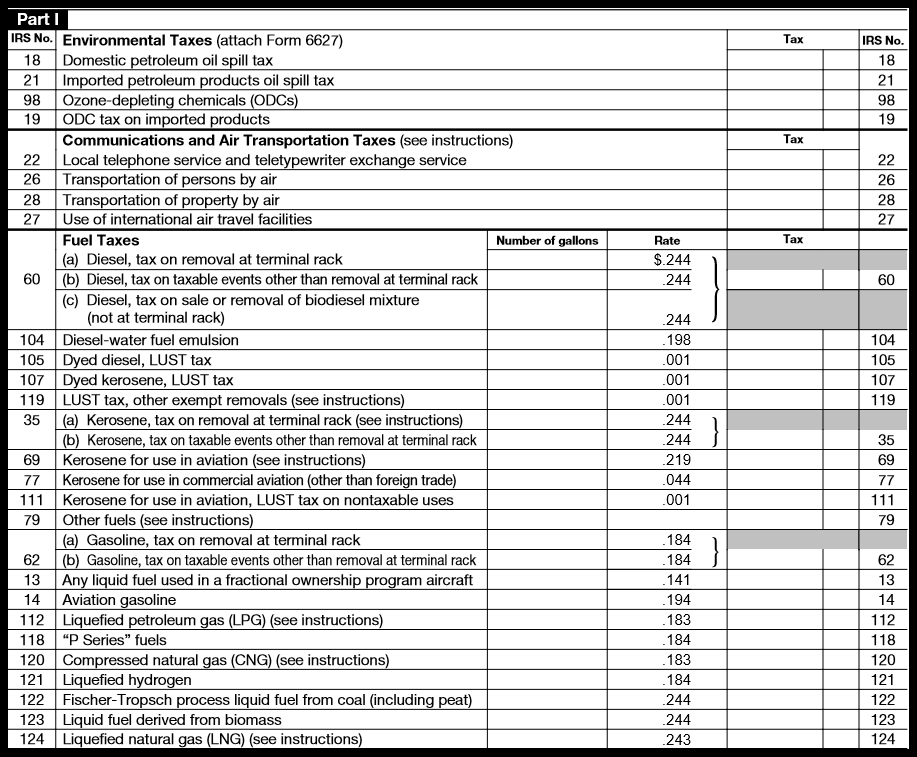

When Is Form 720 Due - June 2023) department of the treasury internal revenue service. Web dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date. Deferral until october 31, 2020, for filing and paying certain excise taxes for 1st quarter 2020. For instructions and the latest information. Deferral until october 31, 2020, for filing and paying certain excise taxes for 2nd quarter 2020. Quarterly federal excise tax return. Due dates vary for the different schedules. Form 8849 has due dates that the claim for refund must be filed by. Web the form 720 is due on the last day of the month following the end of the quarter. Web irs form 720, the quarterly federal excise tax return, is a tax form businesses complete to report and pay federal excise tax.

If the deadline is missed for a fuel tax refund, a claim for credit may June 2023) department of the treasury internal revenue service. Deferral until october 31, 2020, for filing and paying certain excise taxes for 2nd quarter 2020. Deferral until october 31, 2020, for filing and paying certain excise taxes for 1st quarter 2020. Web although form 720 is a quarterly return, for pcori, form 720 is filed annually only, by july 31. Web irs form 720, the quarterly federal excise tax return, is a tax form businesses complete to report and pay federal excise tax. For instructions and the latest information. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date. Web form 720 is a quarterly return that comes due one month after the end of the quarter for which you’re reporting excise taxes.

Form 8849 has due dates that the claim for refund must be filed by. For instructions and the latest information. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web irs form 720, the quarterly federal excise tax return, is a tax form businesses complete to report and pay federal excise tax. Deferral until october 31, 2020, for filing and paying certain excise taxes for 2nd quarter 2020. Web form 720 is a quarterly return that comes due one month after the end of the quarter for which you’re reporting excise taxes. Web although form 720 is a quarterly return, for pcori, form 720 is filed annually only, by july 31. June 2023) department of the treasury internal revenue service. See the specific schedule for the claim requirements. Web the form 720 is due on the last day of the month following the end of the quarter.

Form 720 & IFTA for Q3 due by November 2, 2020 IRS

See the instructions for form 720. Deferral until october 31, 2020, for filing and paying certain excise taxes for 2nd quarter 2020. Deferral until october 31, 2020, for filing and paying certain excise taxes for 1st quarter 2020. Form 8849 has due dates that the claim for refund must be filed by. Web although form 720 is a quarterly return,.

2018 Fourth Quarter Excise Tax Form 720 is DUE NOW! ThinkTrade Inc Blog

If the deadline is missed for a fuel tax refund, a claim for credit may Web dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date. Due dates vary for the different schedules. Aviation excise tax holiday under the cares act. Deferral until october 31, 2020, for filing and paying certain excise taxes.

Form 720 is due TODAY for second quarter of 2020 and PCORI Fee for 2019

Web dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date (weekends and holidays considered) tax year Aviation excise tax holiday under the cares act. Web irs form 720, the quarterly federal excise tax return, is a tax form businesses complete to report and pay federal excise tax. Web the form 720 is.

Form 720 and PCORI Fees Due July 31st Gilroy Kernan & Gilroy

For example, you must file a form 720 by april 30 for the quarter ending on march 31. See the instructions for form 720. Web dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date (weekends and holidays considered) tax year Web form 720 is a quarterly return that comes due one month.

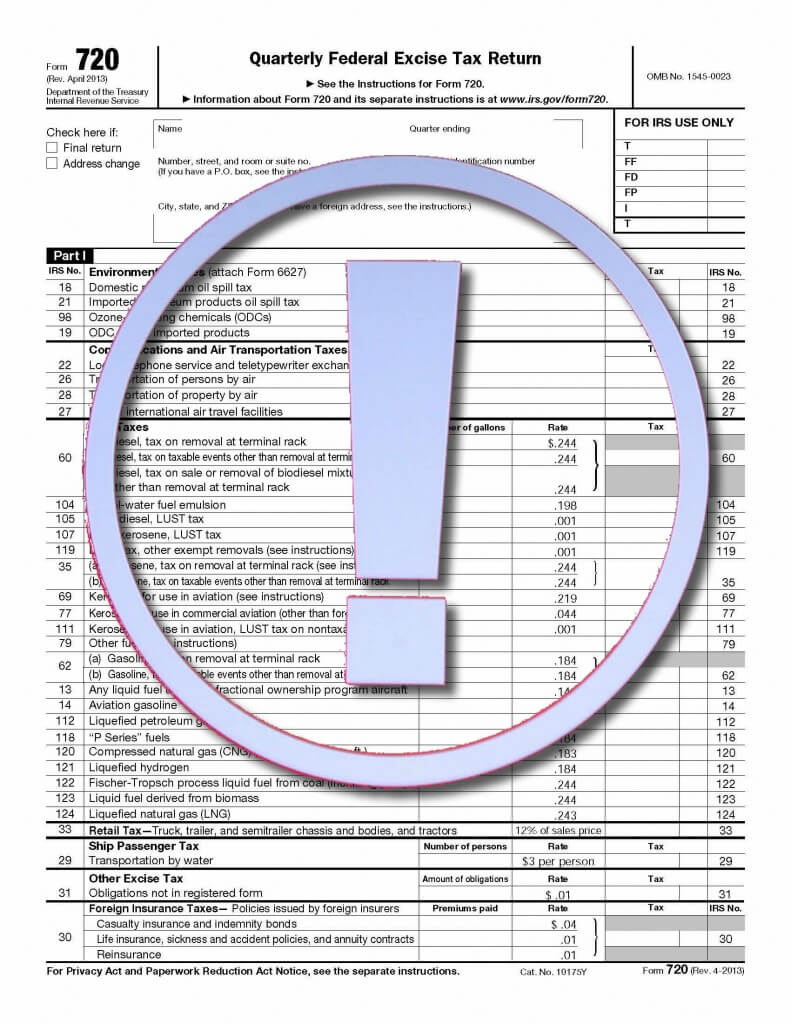

How to Complete Form 720 Quarterly Federal Excise Tax Return

Deferral until october 31, 2020, for filing and paying certain excise taxes for 1st quarter 2020. For example, you must file a form 720 by april 30 for the quarter ending on march 31. Web although form 720 is a quarterly return, for pcori, form 720 is filed annually only, by july 31. For instructions and the latest information. Quarterly.

2nd Quarter Federal IRS Authorized Electronic Filing

Deferral until october 31, 2020, for filing and paying certain excise taxes for 2nd quarter 2020. Web file form 720 annually to report and pay the fee on the second quarter form 720 no later than july 31 of the calendar year immediately following the last day of the policy year or plan year to which the fee applies. Web.

What Is IRS Form 720? Calculate, Pay Excise Tax NerdWallet

Web although form 720 is a quarterly return, for pcori, form 720 is filed annually only, by july 31. Due dates vary for the different schedules. Aviation excise tax holiday under the cares act. Web dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date (weekends and holidays considered) tax year For example,.

IRS Updates Form 720 for Reporting ACA PCOR Fees myCafeteriaPlan

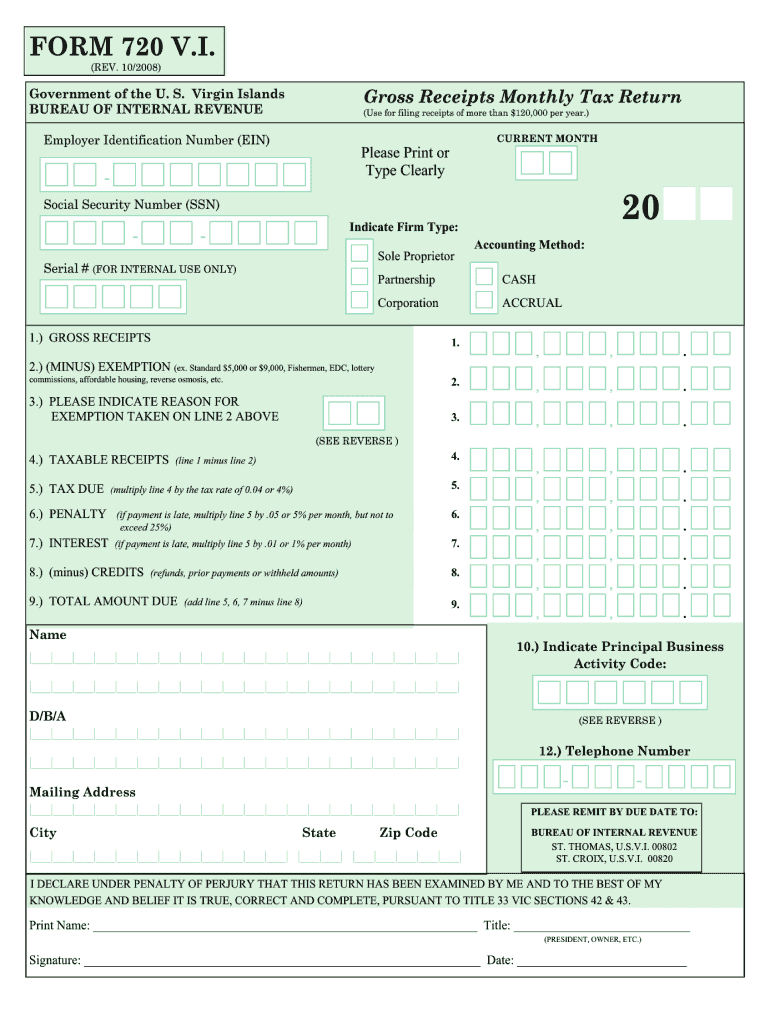

June 2023) department of the treasury internal revenue service. Due dates vary for the different schedules. Web form 720 is a quarterly return that comes due one month after the end of the quarter for which you’re reporting excise taxes. Web irs form 720, the quarterly federal excise tax return, is a tax form businesses complete to report and pay.

1st quarter federal excise tax IRS Authorized

Deferral until october 31, 2020, for filing and paying certain excise taxes for 1st quarter 2020. Web dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date. Due dates vary for the different schedules. If the deadline is missed for a fuel tax refund, a claim for credit may June 2023) department of.

20 FORM 720 VI Virgin Islands Internal Revenue Fill Out and Sign

Quarterly federal excise tax return. For example, you must file a form 720 by april 30 for the quarter ending on march 31. Aviation excise tax holiday under the cares act. Web file form 720 annually to report and pay the fee on the second quarter form 720 no later than july 31 of the calendar year immediately following the.

See The Instructions For Form 720.

Quarterly federal excise tax return. Web although form 720 is a quarterly return, for pcori, form 720 is filed annually only, by july 31. Form 8849 has due dates that the claim for refund must be filed by. If the deadline is missed for a fuel tax refund, a claim for credit may

Web The Form 720 Is Due On The Last Day Of The Month Following The End Of The Quarter.

Web irs form 720, the quarterly federal excise tax return, is a tax form businesses complete to report and pay federal excise tax. For instructions and the latest information. Deferral until october 31, 2020, for filing and paying certain excise taxes for 2nd quarter 2020. June 2023) department of the treasury internal revenue service.

For Example, You Must File A Form 720 By April 30 For The Quarter Ending On March 31.

Web file form 720 annually to report and pay the fee on the second quarter form 720 no later than july 31 of the calendar year immediately following the last day of the policy year or plan year to which the fee applies. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date. Web dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date (weekends and holidays considered) tax year

Due Dates Vary For The Different Schedules.

Web form 720 is a quarterly return that comes due one month after the end of the quarter for which you’re reporting excise taxes. Aviation excise tax holiday under the cares act. Deferral until october 31, 2020, for filing and paying certain excise taxes for 1st quarter 2020. See the specific schedule for the claim requirements.