When Is Form 3115 Due

When Is Form 3115 Due - This applies only if you. The calendar year is the most. Web in plr 202223011 [1] the irs denied the taxpayer’s request to file a form 3115 for an overall accounting method change from the cash to accrual basis it had. Web february 09, 2021 purpose (1) this transmits revised irm 4.11.6, examining officers guide (eog), changes in accounting methods. Web with the issuance of the new guidance, the procedures for filing a form 3115, application for change in accounting method, for both automatic and nonautomatic method changes. December 2022) department of the treasury internal revenue service. Accounting treatment of certain credit card fees. Web the irs will grant an extension of time to file an automatic form 3115 (i.e., beyond six months from the due date of the return for the year of change, excluding extensions) only. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Web previously, taxpayers filing form 3115 in tax years ending on or after may 31, 2014, and on or before jan.

Web with the issuance of the new guidance, the procedures for filing a form 3115, application for change in accounting method, for both automatic and nonautomatic method changes. Web in plr 202223011 [1] the irs denied the taxpayer’s request to file a form 3115 for an overall accounting method change from the cash to accrual basis it had. Accounting treatment of certain credit card fees. Web in some situations, the irs issues automatic consent procedures allowing taxpayers to voluntarily change their method of accounting without a user fee by simply. Web february 09, 2021 purpose (1) this transmits revised irm 4.11.6, examining officers guide (eog), changes in accounting methods. Web in 2021, you made a repayment of $4,500. Web therefore taxpayers have until july 15, 2020 to file all forms 3115 and 1128 that are due on or after april 1, 2020, and before july 15, 2020. Additionally, form 3115 allows you. 22 nov 2006 hello roland, you should meet with a tax advisor. Web the form 3115 for the taxpayer’s last tax year ending before january 31, 2022, may be submitted on or before the due date (including extensions) of the federal.

Web in plr 202223011 [1] the irs denied the taxpayer’s request to file a form 3115 for an overall accounting method change from the cash to accrual basis it had. The calendar year is the most. December 2022) department of the treasury internal revenue service. Web therefore taxpayers have until july 15, 2020 to file all forms 3115 and 1128 that are due on or after april 1, 2020, and before july 15, 2020. This applies only if you. Web so, if your client can benefit from any of the tax saving opportunities from the new tprs, a 3115 should be filed in most cases. Web with certain exceptions, the revenue procedure is effective for a form 3115 filed on or after aug. Web previously, taxpayers filing form 3115 in tax years ending on or after may 31, 2014, and on or before jan. Web requires one form 3115 for an automatic change to, from or within an nae method of accounting under section 15.04 and a required change to an overall accrual method. Web introduction every taxpayer (individuals, business entities, etc.) must figure taxable income for an annual accounting period called a tax year.

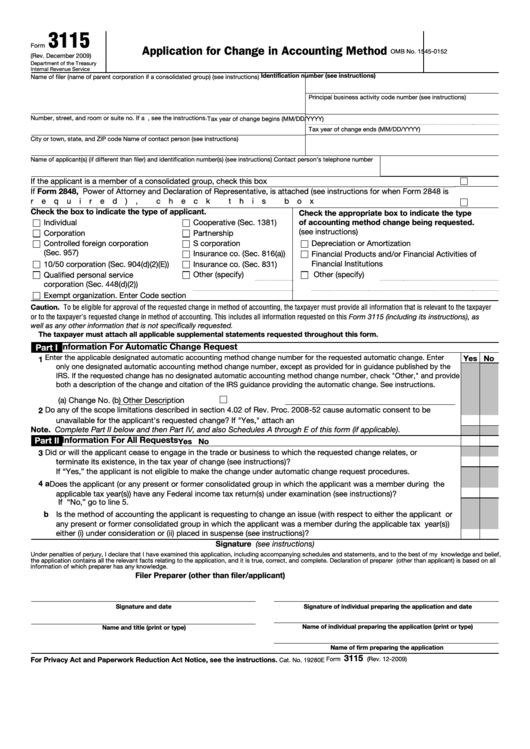

Form 3115 App for change in acctg method Capstan Tax Strategies

Web february 09, 2021 purpose (1) this transmits revised irm 4.11.6, examining officers guide (eog), changes in accounting methods. Web complete a 2022 mtm election filed by the april 18, 2022 deadline on form 3115 filed with your 2022 tax returns — by the due date of the return, including extensions. The excess repayment of $1,500 can be carried. Web.

Form 3115 Application for Change in Accounting Method(2015) Free Download

Web the form 3115 for the taxpayer’s last tax year ending before january 31, 2022, may be submitted on or before the due date (including extensions) of the federal. Web introduction every taxpayer (individuals, business entities, etc.) must figure taxable income for an annual accounting period called a tax year. Web with the issuance of the new guidance, the procedures.

Form 3115 Application for Change in Accounting Method(2015) Free Download

31, 2015, had until the due date of their timely filed federal income tax return. Web previously, taxpayers filing form 3115 in tax years ending on or after may 31, 2014, and on or before jan. Web february 09, 2021 purpose (1) this transmits revised irm 4.11.6, examining officers guide (eog), changes in accounting methods. Web so, if your client.

Fillable Form 3115 Application For Change In Accounting Method

Web february 09, 2021 purpose (1) this transmits revised irm 4.11.6, examining officers guide (eog), changes in accounting methods. Web previously, taxpayers filing form 3115 in tax years ending on or after may 31, 2014, and on or before jan. The calendar year is the most. Web in plr 202223011 [1] the irs denied the taxpayer’s request to file a.

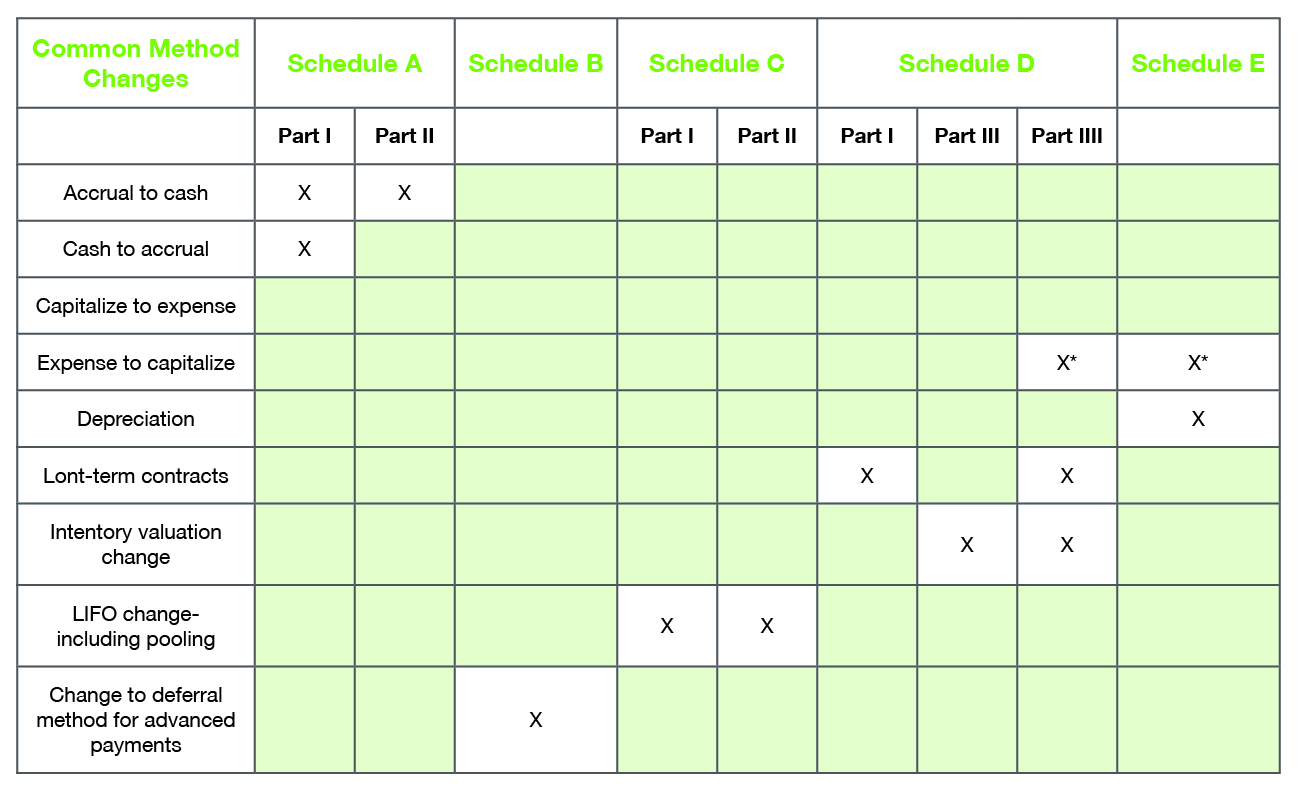

TPAT Form 3115 and New Tangible Property Regulations (TPR)

Web the irs will grant an extension of time to file an automatic form 3115 (i.e., beyond six months from the due date of the return for the year of change, excluding extensions) only. Web therefore taxpayers have until july 15, 2020 to file all forms 3115 and 1128 that are due on or after april 1, 2020, and before.

National Association of Tax Professionals Blog

Web with certain exceptions, the revenue procedure is effective for a form 3115 filed on or after aug. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. The excess repayment of $1,500 can be carried. Web the form 3115 for the taxpayer’s last tax year ending before.

Fill Free fillable Form 3115 2018 Application for Change in

The excess repayment of $1,500 can be carried. Web february 09, 2021 purpose (1) this transmits revised irm 4.11.6, examining officers guide (eog), changes in accounting methods. Web with certain exceptions, the revenue procedure is effective for a form 3115 filed on or after aug. Web introduction every taxpayer (individuals, business entities, etc.) must figure taxable income for an annual.

Form 3115 Application for Change in Accounting Method

Web february 09, 2021 purpose (1) this transmits revised irm 4.11.6, examining officers guide (eog), changes in accounting methods. The excess repayment of $1,500 can be carried. Web complete a 2022 mtm election filed by the april 18, 2022 deadline on form 3115 filed with your 2022 tax returns — by the due date of the return, including extensions. Application.

Form 3115 for a Cash to Accrual Method Accounting Change

December 2022) department of the treasury internal revenue service. Web what is the penalty for not filing form 3115 by the due date? Web the form 3115 for the taxpayer’s last tax year ending before january 31, 2022, may be submitted on or before the due date (including extensions) of the federal. Web with the issuance of the new guidance,.

Form 3115 Application for Change in Accounting Method(2015) Free Download

This applies only if you. 22 nov 2006 hello roland, you should meet with a tax advisor. Additionally, form 3115 allows you. December 2022) department of the treasury internal revenue service. 31, 2015, had until the due date of their timely filed federal income tax return.

Web So, If Your Client Can Benefit From Any Of The Tax Saving Opportunities From The New Tprs, A 3115 Should Be Filed In Most Cases.

Application for change in accounting method. Web complete a 2022 mtm election filed by the april 18, 2022 deadline on form 3115 filed with your 2022 tax returns — by the due date of the return, including extensions. Web what is the penalty for not filing form 3115 by the due date? Web february 09, 2021 purpose (1) this transmits revised irm 4.11.6, examining officers guide (eog), changes in accounting methods.

Web Information About Form 3115, Application For Change In Accounting Method, Including Recent Updates, Related Forms And Instructions On How To File.

31, 2015, had until the due date of their timely filed federal income tax return. Web with the issuance of the new guidance, the procedures for filing a form 3115, application for change in accounting method, for both automatic and nonautomatic method changes. Web in 2021, you made a repayment of $4,500. Additionally, form 3115 allows you.

The Excess Repayment Of $1,500 Can Be Carried.

Web introduction every taxpayer (individuals, business entities, etc.) must figure taxable income for an annual accounting period called a tax year. This applies only if you. Web with certain exceptions, the revenue procedure is effective for a form 3115 filed on or after aug. Web the form 3115 for the taxpayer’s last tax year ending before january 31, 2022, may be submitted on or before the due date (including extensions) of the federal.

Web The Irs Will Grant An Extension Of Time To File An Automatic Form 3115 (I.e., Beyond Six Months From The Due Date Of The Return For The Year Of Change, Excluding Extensions) Only.

Accounting treatment of certain credit card fees. Web previously, taxpayers filing form 3115 in tax years ending on or after may 31, 2014, and on or before jan. Web requires one form 3115 for an automatic change to, from or within an nae method of accounting under section 15.04 and a required change to an overall accrual method. The calendar year is the most.