What Is The Consent Form On Turbotax

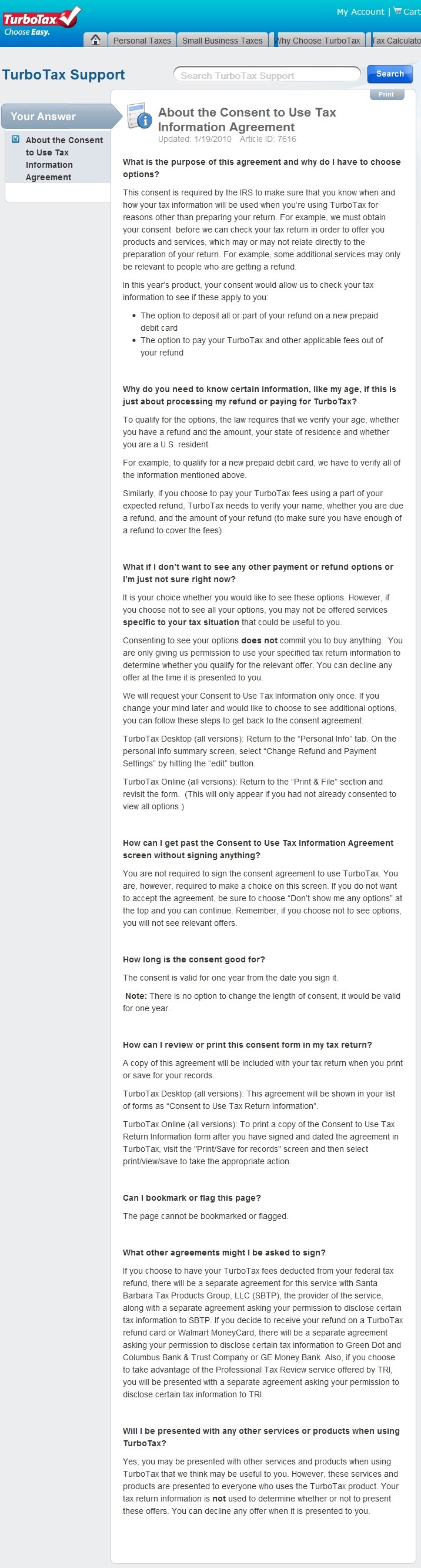

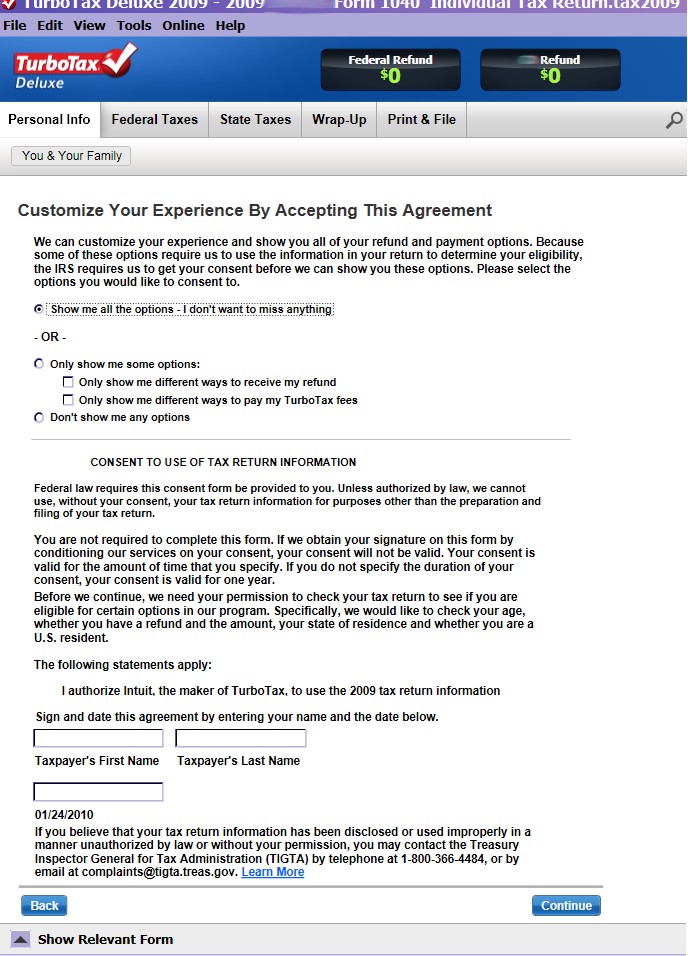

What Is The Consent Form On Turbotax - Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Only certain taxpayers are eligible. Web the quote is federal law requires this consent form be provided to you. They are customized to include the specific use or disclosure. 2.1k views 1 year ago. Web information about form 8821, tax information authorization, including recent updates, related forms, and instructions on how to file. I consent to allow my intermediate service provider, transmitter, or electronic return originator (ero) to send this form to irs and to receive the following information from irs United states (english) united states (spanish) canada (english) canada (french) turbotax; Form 8821 is used to authorize certain entities to review confidential information in any irs office. Unless authorized by law, we cannot use your tax return information for purposes other than the preparation and filing of your tax return without your consent.

Web easy online amend: This would apply to offering the taxpayer any type of product, such as a. Sign in to and community or log in until turbotax real start work on your fees. Web consent for third party contact go to www.irs.gov/form2624 for the latest information. Web these messages can arrive in the form of an unsolicited text or email to lure unsuspecting victims to provide valuable personal and financial information that can lead to identity theft, including phishing and smishing. Web general terms and conditions. Being aware of tax terms as well as both 1040 and 1099 rules is beneficial. Name(s) shown on return your social security number you must use this form to authorize the irs to contact a third party on your behalf or to revoke that authorization. Web the quote is federal law requires this consent form be provided to you. Web information about form 8821, tax information authorization, including recent updates, related forms, and instructions on how to file.

Form 8821 is used to authorize certain entities to review confidential information in any irs office. The doj is expected to recommend probation, although a federal. I'm being asked for consent to disclosure of your tax return information. i want to decline but i can't go past this screen w/o entering my name/date. The 1099 form provides information needed to complete a tax return, while the 1040 form is used to file the actual taxes due. And (b) to maintain and update this information to keep it true, accurate, current and complete. Web the quote is federal law requires this consent form be provided to you. Web taxslayer support what is the consent to use of tax return information? Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Web for turbotax, you have to email privacy@intuit.com. When setting up your account, you will review a page titled personalize your taxslayer experience with two consents (for use and disclosure) of your tax return information.

View larger

What are the pluses and minuses? The irs requires us to provide this consent to you. Make changes to your 2022 tax return online for up to 3 years after it has been filed and accepted by the irs through 10/31/2025. Web the quote is federal law requires this consent form be provided to you. Web 1 best answer.

Adoptive Child Worksheet Turbotax Worksheet Resume Examples

Why sign in to this community? This would apply to offering the taxpayer any type of product, such as a. Web taxslayer support what is the consent to use of tax return information? They are customized to include the specific use or disclosure. The irs requires us to provide this consent to you.

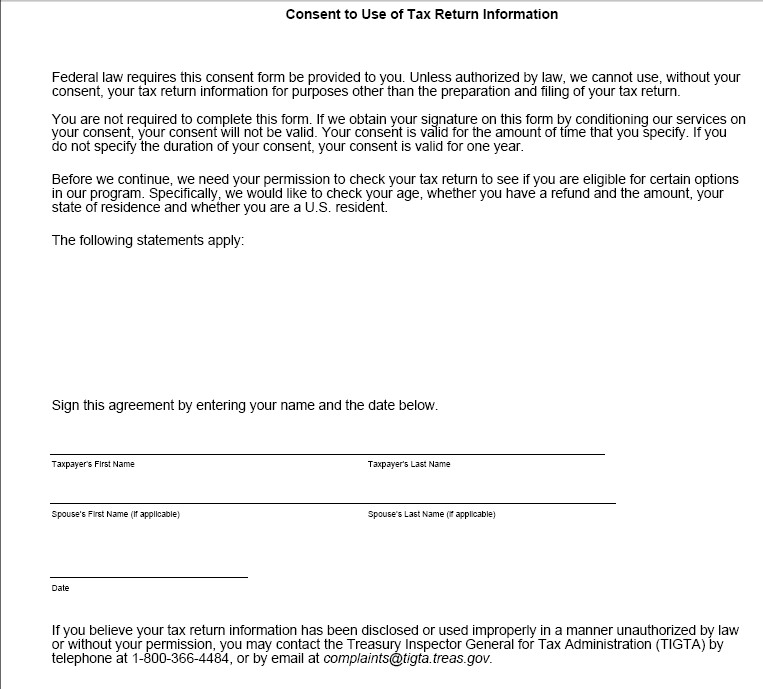

Consent Form

Name(s) shown on return your social security number you must use this form to authorize the irs to contact a third party on your behalf or to revoke that authorization. The consent form is just to be offered certain services later, like getting your refund on a card or paying your fees with your refund. 2.1k views 1 year ago..

TurboTax Tax efile federal and state return rejected after correcting

Web consents are paper or electronic documents that contain specific information, including the names of the tax return preparer and the taxpayer. It may seem silly, but turbotax can't offer you those services unless you officially give it permission to know about your tax refund status. This is a requirement from the irs in order to file your return. Make.

Warning TurboTax 2009's Fraudulent Consent to Steal Your Tax Data

Web the quote is federal law requires this consent form be provided to you. Web easy online amend: Make changes to your 2022 tax return online for up to 3 years after it has been filed and accepted by the irs through 10/31/2025. Why sign in to this community? You have clicked a link to a site outside of the.

form 2106 turbotax Fill Online, Printable, Fillable Blank

2.1k views 1 year ago. United states (english) united states (spanish) canada (english) canada (french) turbotax; Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web the quote is federal law requires this consent form be provided to you. Do most.

Warning TurboTax 2009's Fraudulent Consent to Steal Your Tax Data

Do most people agree and consent? You have clicked a link to a site outside of the turbotax community. Form 8821 is used to authorize certain entities to review confidential information in any irs office. In consideration of use of the site, you agree to: When setting up your account, you will review a page titled personalize your taxslayer experience.

What is the TurboTax consent form? YouTube

Web go to turbotax pricing. The doj is expected to recommend probation, although a federal. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Here's a link to a screen capture i made of the consent form from turbotax 2009: 2.1k.

Warning TurboTax 2009's Fraudulent Consent to Steal Your Tax Data

What are the pluses and minuses? Make changes to your 2022 tax return online for up to 3 years after it has been filed and accepted by the irs through 10/31/2025. This is a requirement from the irs in order to file your return. Web i'm a little confused by the consent to disclosure form. Web for turbotax, you have.

Solved TurboTax 2019 not showing 1098T form

Web taxslayer support what is the consent to use of tax return information? It may seem silly, but turbotax can't offer you those services unless you officially give it permission to know about your tax refund status. I'm being asked for consent to disclosure of your tax return information. i want to decline but i can't go past this screen.

Situations Covered (Assuming No Added Tax Complexity):

Web for turbotax, you have to email privacy@intuit.com. Web general terms and conditions. The doj is expected to recommend probation, although a federal. Web consent for third party contact go to www.irs.gov/form2624 for the latest information.

Make Changes To Your 2022 Tax Return Online For Up To 3 Years After It Has Been Filed And Accepted By The Irs Through 10/31/2025.

Web the quote is federal law requires this consent form be provided to you. If any information provided by you is untrue. Web hunter biden allegedly received at least $1.5 million each year in 2017 and 2018 but didn't pay taxes, according to court records. Only certain taxpayers are eligible.

Web Taxslayer Support What Is The Consent To Use Of Tax Return Information?

You have clicked a link to a site outside of the turbotax community. Web information about form 8821, tax information authorization, including recent updates, related forms, and instructions on how to file. Web this is what the consent form is allowing us to do. In consideration of use of the site, you agree to:

When Setting Up Your Account, You Will Review A Page Titled Personalize Your Taxslayer Experience With Two Consents (For Use And Disclosure) Of Your Tax Return Information.

Unless authorized by law, we cannot use your tax return information for purposes other than the preparation and filing of your tax return without your consent. Do most people agree and consent? This would apply to offering the taxpayer any type of product, such as a. Why sign in to this community?