What Is Form 8990

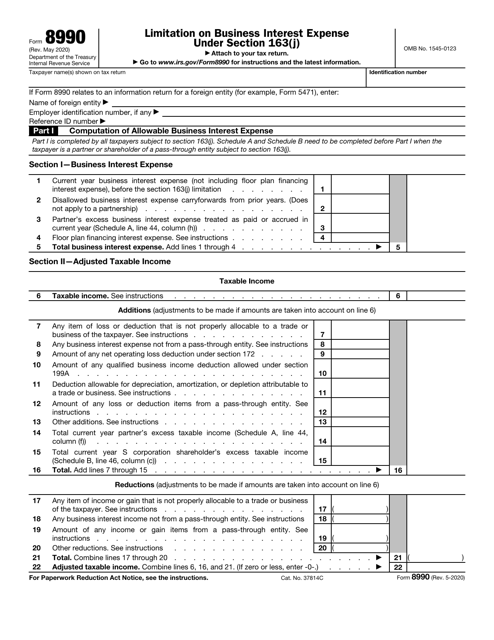

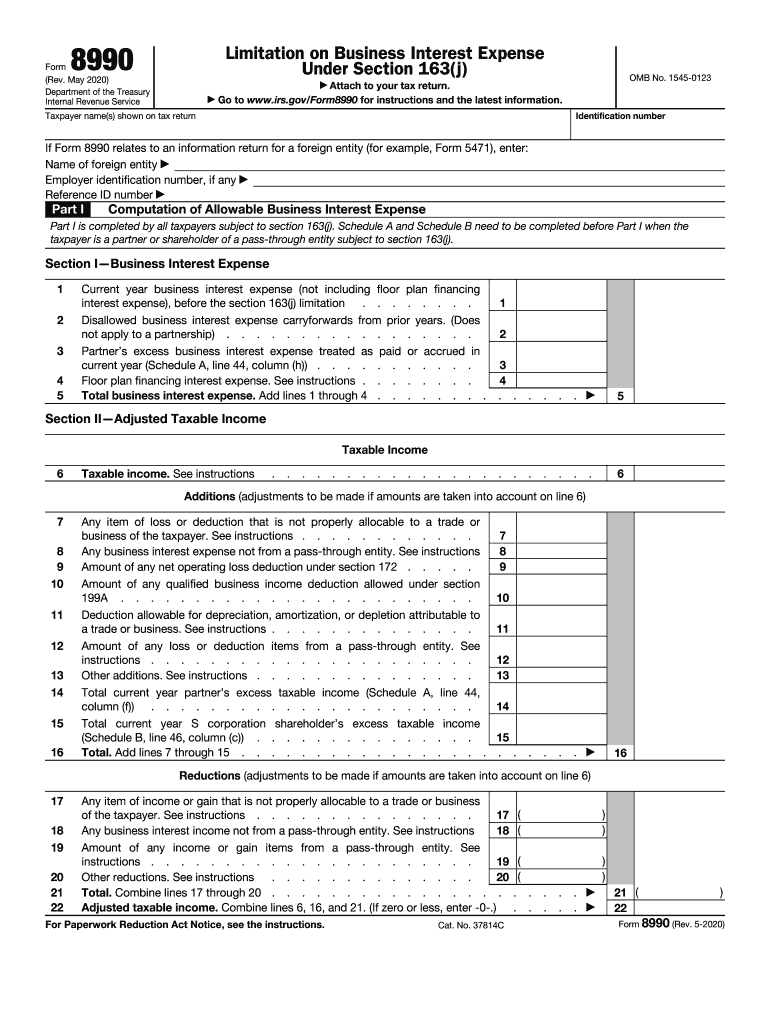

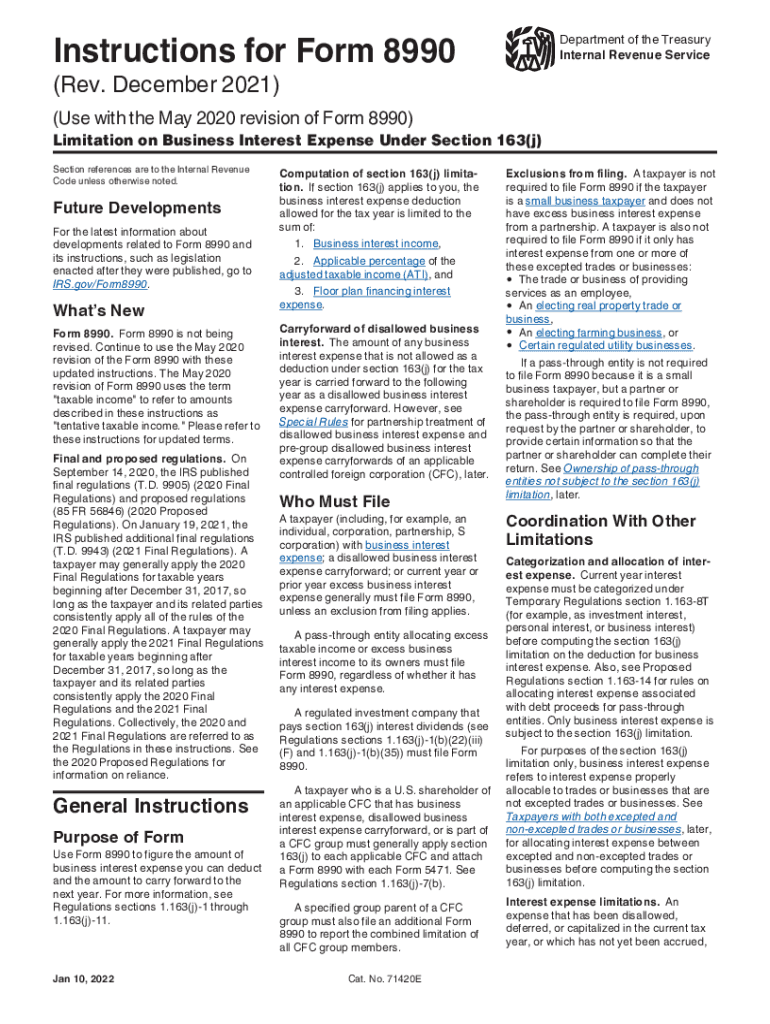

What Is Form 8990 - Web form 8990 instructions for details on the gross receipts test and other exclusions for excepted businesses. Web form 8990 is used by the irs to determine if you have earned enough money from your business to meet the required tax requirements for that year. Web form 8990 the new section 163 (j) business interest expense deduction and carryover amounts are reported on form 8990. The form calculates the section 163 (j) limitation on. Web form 8990 the new section 163 (j) business interest expense deduction and carryover amounts are reported on form 8990. You must submit a copy of. What i need the 8990 form for? Web form 8990 get your form 8990 in 3 easy steps 1. Web form 8990 calculates the business interest expense deduction and carryover amounts.the form utilizes the section 163(j) limitation on business interest expenses in. How to fill out the 8990 form?

For more information, see proposed. Web the irs recently released form 8990, limitation on business interest expense under section 163 (j), along with instructions to this form. Irs form 8990, limitation on business interest expense under section 163(j), is the form business taxpayers must use to calculate. Web use form 8990 to figure the amount of business interest expense you can deduct and the amount to carryforward to the next year. Web if the partnership reports excess business interest expense to the partner, the partner is required to file form 8990. What i need the 8990 form for? Web form 8990 is used by the irs to determine if you have earned enough money from your business to meet the required tax requirements for that year. You must submit a copy of. How to fill out the 8990 form? What is an 8990 form?

Web use form 8990 to figure the amount of business interest expense you can deduct and the amount to carryforward to the next year. Web form 8990 get your form 8990 in 3 easy steps 1. Web form 8990 instructions for details on the gross receipts test and other exclusions for excepted businesses. The form calculates the section 163 (j) limitation. Web if the partnership reports excess business interest expense to the partner, the partner is required to file form 8990. Note that passthrough entities not subject to the. You must submit a copy of. What is an 8990 form? The form calculates the section 163 (j) limitation on. How to fill out the 8990 form?

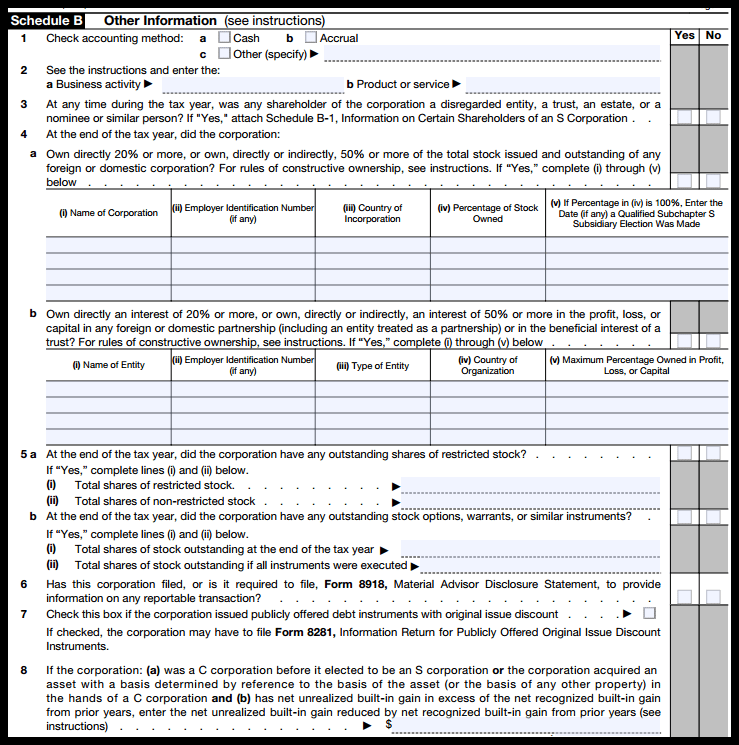

Fill Free fillable 2019 Form 1120C Tax Return for Cooperative

Web form 8990 get your form 8990 in 3 easy steps 1. Web form 8990 calculates the business interest expense deduction and carryover amounts.the form utilizes the section 163(j) limitation on business interest expenses in. Web use form 8990 to figure the amount of business interest expense you can deduct and the amount to carryforward to the next year. For.

IRS Form 8990 Download Fillable PDF or Fill Online Limitation on

Irs form 8990, limitation on business interest expense under section 163(j), is the form business taxpayers must use to calculate. What is an 8990 form? Web form 8990 instructions for details on the gross receipts test and other exclusions for excepted businesses. Web if the partnership reports excess business interest expense to the partner, the partner is required to file.

form 8990 Fill Online, Printable, Fillable Blank

Web form 8990 get your form 8990 in 3 easy steps 1. Web per the irs, form 8990 is used to calculate the amount of business interest expense that can be deducted and the amount to carry forward to the next year. What i need the 8990 form for? The form calculates the section 163 (j) limitation. How to fill.

1040NJ Data entry guidelines for a New Jersey partnership K1

Irs form 8990, limitation on business interest expense under section 163(j), is the form business taxpayers must use to calculate. Web form 8990 the new section 163 (j) business interest expense deduction and carryover amounts are reported on form 8990. Web form 8990 instructions for details on the gross receipts test and other exclusions for excepted businesses. Web if the.

Section 163j Photos Free & RoyaltyFree Stock Photos from Dreamstime

To be required to file form 990, a nonprofit should have a. What is an 8990 form? For more information, see proposed. Web form 8990 calculates the business interest expense deduction and carryover amounts.the form utilizes the section 163(j) limitation on business interest expenses in. How to fill out the 8990 form?

IRS Form 1120S Definition, Download, & 1120S Instructions

What is an 8990 form? Note that passthrough entities not subject to the. Web the irs recently released form 8990, limitation on business interest expense under section 163 (j), along with instructions to this form. Web form 8990 get your form 8990 in 3 easy steps 1. Web form 8990 is used by the irs to determine if you have.

Dd Form 2875 Army Fillable Army Military

For more information, see proposed. What i need the 8990 form for? How to fill out the 8990 form? Web if the partnership reports excess business interest expense to the partner, the partner is required to file form 8990. To be required to file form 990, a nonprofit should have a.

Irs Business 163 J Form Fill Out and Sign Printable PDF Template

You must submit a copy of. See the instructions for form 8990 for additional. Web form 8990 the new section 163 (j) business interest expense deduction and carryover amounts are reported on form 8990. For more information, see proposed. Web what is irs form 8990?

Irs Instructions 8990 Fill Out and Sign Printable PDF Template signNow

Web form 8990 instructions for details on the gross receipts test and other exclusions for excepted businesses. Web what is irs form 8990? Web use form 8990 to figure the amount of business interest expense you can deduct and the amount to carryforward to the next year. What i need the 8990 form for? Web form 8990 the new section.

Fill Free fillable form 8990 limitation on business interest expense

See the instructions for form 8990 for additional. Web form 8990 get your form 8990 in 3 easy steps 1. Note that passthrough entities not subject to the. The form calculates the section 163 (j) limitation. Web form 8990 instructions for details on the gross receipts test and other exclusions for excepted businesses.

Web Form 8990 The New Section 163 (J) Business Interest Expense Deduction And Carryover Amounts Are Reported On Form 8990.

Web use form 8990 to figure the amount of business interest expense you can deduct and the amount to carryforward to the next year. For more information, see proposed. What is an 8990 form? Web what is irs form 8990?

Web Form 8990 Get Your Form 8990 In 3 Easy Steps 1.

Web form 8990 instructions for details on the gross receipts test and other exclusions for excepted businesses. Irs form 8990, limitation on business interest expense under section 163(j), is the form business taxpayers must use to calculate. To be required to file form 990, a nonprofit should have a. The form calculates the section 163 (j) limitation on.

You Must Submit A Copy Of.

Web form 8990 is used by the irs to determine if you have earned enough money from your business to meet the required tax requirements for that year. See the instructions for form 8990 for additional. Web form 8990 calculates the business interest expense deduction and carryover amounts.the form utilizes the section 163(j) limitation on business interest expenses in. Web the irs recently released form 8990, limitation on business interest expense under section 163 (j), along with instructions to this form.

Web If The Partnership Reports Excess Business Interest Expense To The Partner, The Partner Is Required To File Form 8990.

What i need the 8990 form for? Note that passthrough entities not subject to the. How to fill out the 8990 form? Web form 8990 the new section 163 (j) business interest expense deduction and carryover amounts are reported on form 8990.