What Is Form 8621

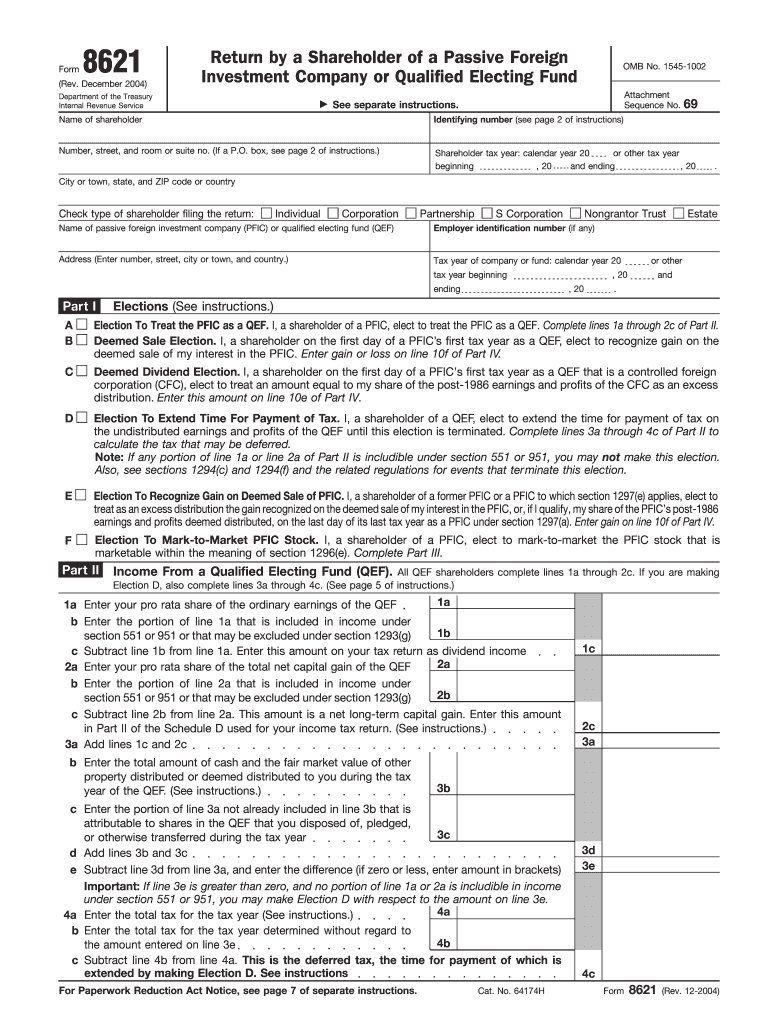

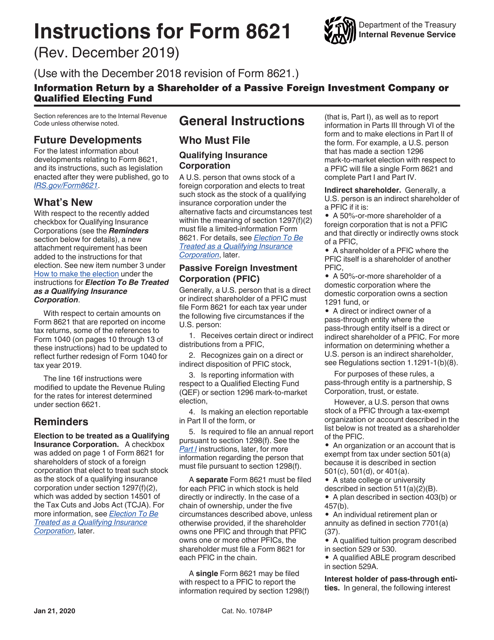

What Is Form 8621 - And (4) allow a u.s. A late purging election is a purging election under section 1298(b)(1) that is. Individuals, corporations, estates and trusts who are us residents or us citizens. Unlike the fbar for example, the form 8621 is. All qef shareholders complete lines 6a through 7c. Web that annual report is form 8621 (information return by a shareholder of a passive foreign investment company or qualified electing fund). Generally, an “excess distribution” is a distribution (after the first. Shareholder to make the election by attaching the. Web form 8621 purpose. A single form 8621 may be filed with respect to a pfic to report the information required by section 1298(f).

Shareholder to make the election by attaching the. We track all the moving pieces that your tax software does not… cost basis. Web the form 8621 is used by us person taxpayers to report ownership in passive foreign investment companies. Web what is form 8621? And (4) allow a u.s. Here is why you need to use the form 8621 calculator. 2 part iii income from a qualified electing fund (qef). Generally, an “excess distribution” is a distribution (after the first. If you are making election b, also. Web unfiled form 8621 means an incomplete tax return unless a person committed fraud and/or has more than $5000 of unreported foreign income or omitted more than 25% of.

If you are making election b, also. Individuals, corporations, estates and trusts who are us residents or us citizens. Person that is a direct or indirect shareholder of a former passive foreign investment company (pfic) or a section 1297 (e) pfic is treated for tax. The confusion is caused by the fact that the form is basically an. This form is used to report. We track all the moving pieces that your tax software does not… cost basis. Web form 8621 is just two pages long, but the instructions consist of seven pages of very confusing information. Web a single form 8621 may be filed with respect to a pfic to report the information required by section 1298 (f) (that is, part i), as well as to report information on. Web form 8621 calculator does all of this! Web that annual report is form 8621 (information return by a shareholder of a passive foreign investment company or qualified electing fund).

Form 8621A Return by a Shareholder Making Certain Late Elections to

Person that is a direct or indirect shareholder of a former passive foreign investment company (pfic) or a section 1297 (e) pfic is treated for tax. Web form 8621 purpose. Web pfic and form 8621 feb 11, 2021 the pfic rules apply to us persons. Web that annual report is form 8621 (information return by a shareholder of a passive.

Form 8621 PDF Fill Out and Sign Printable PDF Template signNow

Web the form 8621 is used by us person taxpayers to report ownership in passive foreign investment companies. A single form 8621 may be filed with respect to a pfic to report the information required by section 1298(f). Here is why you need to use the form 8621 calculator. Person that is a direct or indirect shareholder of a former.

Form 8621A Return by a Shareholder Making Certain Late Elections to

Web a single form 8621 may be filed with respect to a pfic to report the information required by section 1298 (f) (that is, part i), as well as to report information on. The confusion is caused by the fact that the form is basically an. Web the form 8621 is used by us person taxpayers to report ownership in.

“PFICs” What is a PFIC and their Complications for USCs and LPRs

Web the form 8621 is used by us person taxpayers to report ownership in passive foreign investment companies. And (4) allow a u.s. Unlike the fbar for example, the form 8621 is. Person that is a direct or indirect shareholder of a former passive foreign investment company (pfic) or a section 1297 (e) pfic is treated for tax. Web form.

Form 8621 Information Return by a Shareholder of a Passive Foreign

Web unfiled form 8621 means an incomplete tax return unless a person committed fraud and/or has more than $5000 of unreported foreign income or omitted more than 25% of. And (4) allow a u.s. A late purging election is a purging election under section 1298(b)(1) that is. Unlike the fbar for example, the form 8621 is very complex —. Unlike.

Form 8621 Calculator PFIC FAQ

Web pfic and form 8621 feb 11, 2021 the pfic rules apply to us persons. Web the form 8621 is used by us person taxpayers to report ownership in passive foreign investment companies. Web form 8621 purpose. Web unfiled form 8621 means an incomplete tax return unless a person committed fraud and/or has more than $5000 of unreported foreign income.

The Only Business U.S. Expat Tax blog you need to read

Person that is a direct or indirect shareholder of a passive foreign investment company (pfic) or qualified electing fund (qef). A late purging election is a purging election under section 1298(b)(1) that is. A single form 8621 may be filed with respect to a pfic to report the information required by section 1298(f). Web form 8621 is just two pages.

Form 8621A Return by a Shareholder Making Certain Late Elections to

Individuals, corporations, estates and trusts who are us residents or us citizens. Unlike the fbar for example, the form 8621 is. Unlike the fbar for example, the form 8621 is very complex —. Person that is a direct or indirect shareholder of a passive foreign investment company (pfic) or qualified electing fund (qef). We track all the moving pieces that.

Form 8621 Instructions 2020 2021 IRS Forms

Such form should be attached to the. Web unfiled form 8621 means an incomplete tax return unless a person committed fraud and/or has more than $5000 of unreported foreign income or omitted more than 25% of. Individuals, corporations, estates and trusts who are us residents or us citizens. Unlike the fbar for example, the form 8621 is very complex —..

Download Instructions for IRS Form 8621 Information Return by a

Web what is form 8621? Individuals, corporations, estates and trusts who are us residents or us citizens. Web the form 8621 is used by us person taxpayers to report ownership in passive foreign investment companies. Web shareholder must file a form 8621 for each pfic in the chain. Web form 8621 must be filed to compute the tax due on.

Here Is Why You Need To Use The Form 8621 Calculator.

Generally, an “excess distribution” is a distribution (after the first. All qef shareholders complete lines 6a through 7c. 2 part iii income from a qualified electing fund (qef). Web shareholder must file a form 8621 for each pfic in the chain.

We Track All The Moving Pieces That Your Tax Software Does Not… Cost Basis.

If you are making election b, also. Web form 8621, or the “pfic form” is an information reporting form that first came into being in 1986 when new regulations were put into place to close some loopholes folks were using. Web the form 8621 is used by us person taxpayers to report ownership in passive foreign investment companies. Unlike the fbar for example, the form 8621 is very complex —.

Web A Single Form 8621 May Be Filed With Respect To A Pfic To Report The Information Required By Section 1298 (F) (That Is, Part I), As Well As To Report Information On.

Web form 8621 is just two pages long, but the instructions consist of seven pages of very confusing information. Individuals, corporations, estates and trusts who are us residents or us citizens. Tax form 8621 is also referred to as the information return for shareholders of passive foreign investment companies. Person that is a direct or indirect shareholder of a former passive foreign investment company (pfic) or a section 1297 (e) pfic is treated for tax.

Web Form 8621 Calculator Does All Of This!

Unlike the fbar for example, the form 8621 is. Such form should be attached to the. Web the form 8621 is used by us person taxpayers to report ownership in passive foreign investment companies. Web that annual report is form 8621 (information return by a shareholder of a passive foreign investment company or qualified electing fund).