What Is Form 6252

What Is Form 6252 - Instead, report the entire sale on form 4797, sales of. An installment sale is one that allows the buyer to pay for a property over time. Complete, edit or print tax forms instantly. Web generally, use form 6252 to report income from casual sales during this tax year of real or personal property (other than inventory) if you will receive any payments in a tax year. It’s required to report income from an installment sale, which is a sale of property where. Federal section income less common income installment sale income 6252 what is an installment sale? Try it for free now! Form 6252 is used for installment sales. Web don’t file form 6252 for sales that don’t result in a gain, even if you will receive a payment in a tax year after the year of sale. Web what is form 6252?

Complete, edit or print tax forms instantly. It’s required to report income from an installment sale, which is a sale of property where. Upload, modify or create forms. Complete, edit or print tax forms instantly. An installment sale is one that allows the buyer to pay for a property over time. Web to locate form 6252, installment sale income in the program go to: Installment sales occur when at least one payment is. For the seller, it allows. Web generally, use form 6252 to report income from casual sales during this tax year of real or personal property (other than inventory) if you will receive any payments in a tax year. Installment sale income is an irs form used to report income from a sale of real or personal property coming from an installment sale.

The form is used to report the sale in the year it takes place and to report payments received. For the seller, it allows. Form 6252 is used for installment sales. Web form 6252 is a document used by the internal revenue service (irs) in the united states. Web what is the form used for? Ad complete irs tax forms online or print government tax documents. Generally, an installment sale is a disposition of property where at. Complete, edit or print tax forms instantly. Web if you are selling assets using the installment sale method, you may need to report the transaction on irs form 6252 for each year in which you. Use form 6252 to report a sale of property on the installment method.

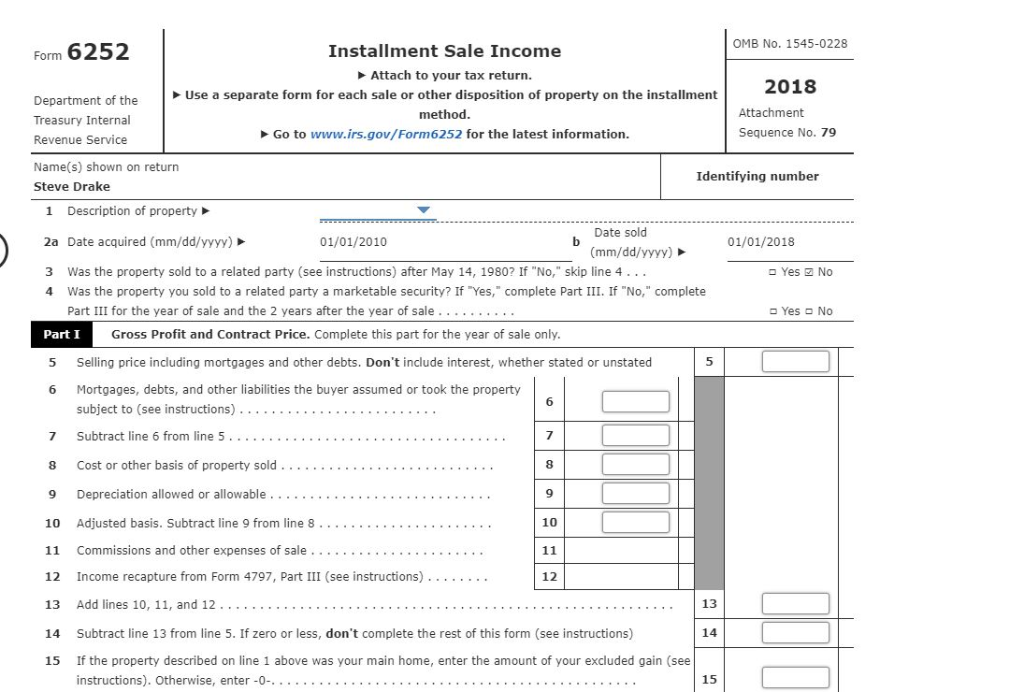

IRS Form 6252 2018 2019 Fillable and Editable PDF Template

Web to locate form 6252, installment sale income in the program go to: Web generally, use form 6252 to report income from casual sales during this tax year of real or personal property (other than inventory) if you will receive any payments in a tax year. Web form 6252 is a document used by the internal revenue service (irs) in.

What is IRS Form 6252 Installment Sale TurboTax Tax Tips & Videos

Complete, edit or print tax forms instantly. Web form 6252 is a document used by the internal revenue service (irs) in the united states. Ad complete irs tax forms online or print government tax documents. Use form 6252 to report a sale of property on the installment method. Web if you are selling assets using the installment sale method, you.

8 IRS Business Forms Every Business Owner Should Know About Silver

Form 6252 to report income from an installment sale on the installment method. Web if you are selling assets using the installment sale method, you may need to report the transaction on irs form 6252 for each year in which you. For example, if one sells a truck in october for $1,000 and. Web taxpayers must use form 6252 (installment.

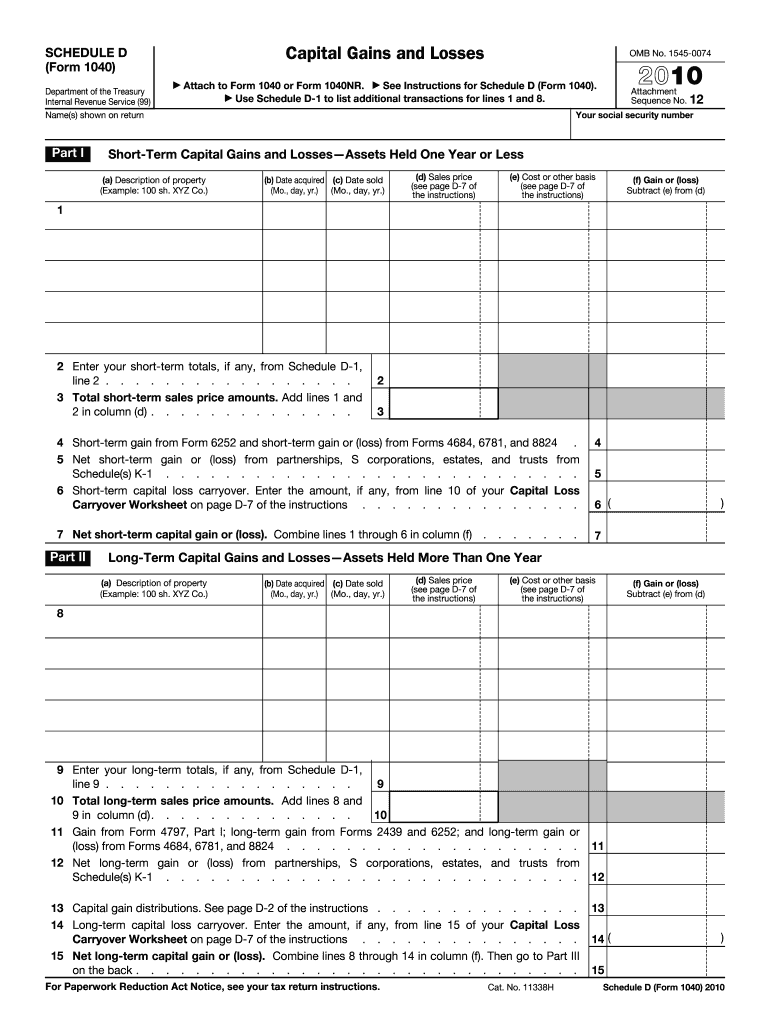

Schedule D Form Fill Out and Sign Printable PDF Template signNow

Web form 6252 is a document used by the internal revenue service (irs) in the united states. It’s required to report income from an installment sale, which is a sale of property where. The form is used to report the sale in the year it takes place and to report payments received. For the seller, it allows. Form 6252 is.

Calculation of Gain or Loss, Installment Sales (LO

The form is used to report the sale in the year it takes place and to report payments received. Installment sales occur when at least one payment is. Use form 6252 to report a sale of property on the installment method. It’s required to report income from an installment sale, which is a sale of property where. Web what is.

Schedule D

Web generally, use form 6252 to report income from casual sales during this tax year of real or personal property (other than inventory) if you will receive any payments in a tax year. Web taxpayers must use form 6252 (installment sale income) to report income from installment sales of real or personal property. Web if you are selling assets using.

Form 6252 Installment Sale (2015) Free Download

Web to locate form 6252, installment sale income in the program go to: For example, if one sells a truck in october for $1,000 and. Web what is form 6252? Web if you are selling assets using the installment sale method, you may need to report the transaction on irs form 6252 for each year in which you. A separate.

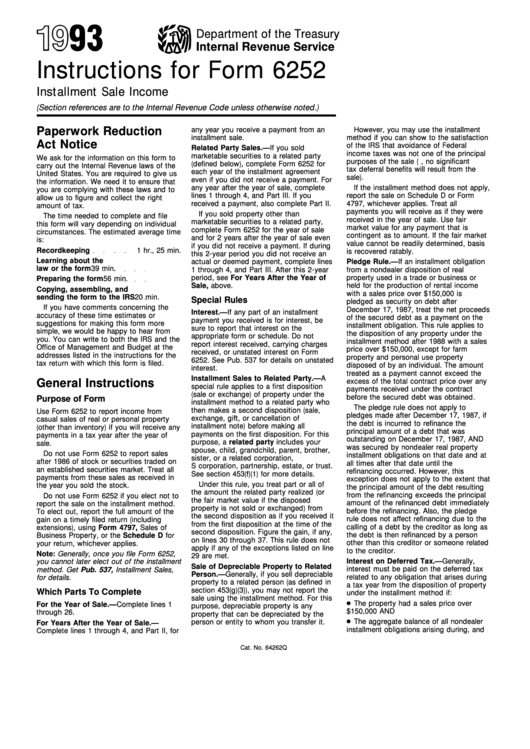

Irs Instructions For Form 6252 1993 printable pdf download

Try it for free now! Form 6252 is used for installment sales. Upload, modify or create forms. Generally, an installment sale is a disposition of property where at. Web a form one files with the irs to report income in the current year from an installment sale made in a previous year.

Form 6252 Installment Sale (2015) Free Download

Federal section income less common income installment sale income 6252 what is an installment sale? Ad complete irs tax forms online or print government tax documents. It’s required to report income from an installment sale, which is a sale of property where. The form is used to report the sale in the year it takes place and to report payments.

IRS 4797 2020 Fill out Tax Template Online US Legal Forms

Web what is the form used for? Installment sales occur when at least one payment is. Web form 6252 is a document used by the internal revenue service (irs) in the united states. Web to locate form 6252, installment sale income in the program go to: Web up to 10% cash back installment sales are reported on irs form 6252,.

Web Taxpayers Must Use Form 6252 (Installment Sale Income) To Report Income From Installment Sales Of Real Or Personal Property.

Form 6252 is a tax form that is used to report the sale of property that was either received in an installment sale or was sold under the installment method. For the seller, it allows. Installment sales occur when at least one payment is. Web what is form 6252?

Web What Is The Form Used For?

Web form 6252 is a document used by the internal revenue service (irs) in the united states. Ad complete irs tax forms online or print government tax documents. Web use form 6252 to report income from casual sales of real or personal property (other than inventory) if you will receive any payments in a tax year after the year of sale. Form 6252 to report income from an installment sale on the installment method.

Web Don’t File Form 6252 For Sales That Don’t Result In A Gain, Even If You Will Receive A Payment In A Tax Year After The Year Of Sale.

Try it for free now! Web a form one files with the irs to report income in the current year from an installment sale made in a previous year. Web what is form 6252? For example, if one sells a truck in october for $1,000 and.

Form 6252 Is Used For Installment Sales.

Complete, edit or print tax forms instantly. Generally, an installment sale is a disposition of property where at. Instead, report the entire sale on form 4797, sales of. It’s required to report income from an installment sale, which is a sale of property where.

:max_bytes(150000):strip_icc()/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png)