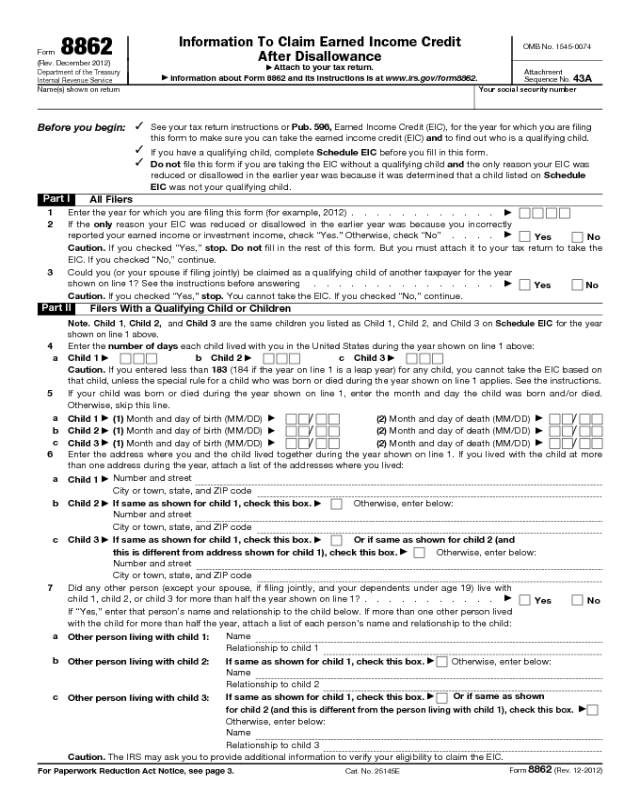

What Does Form 8862 Look Like

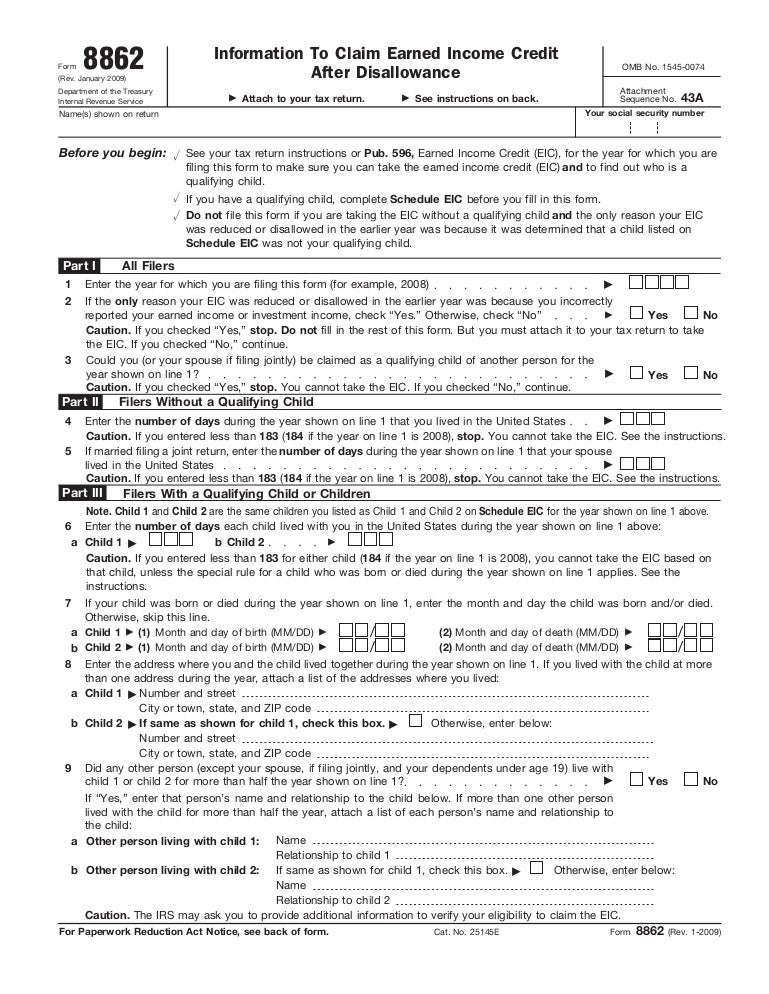

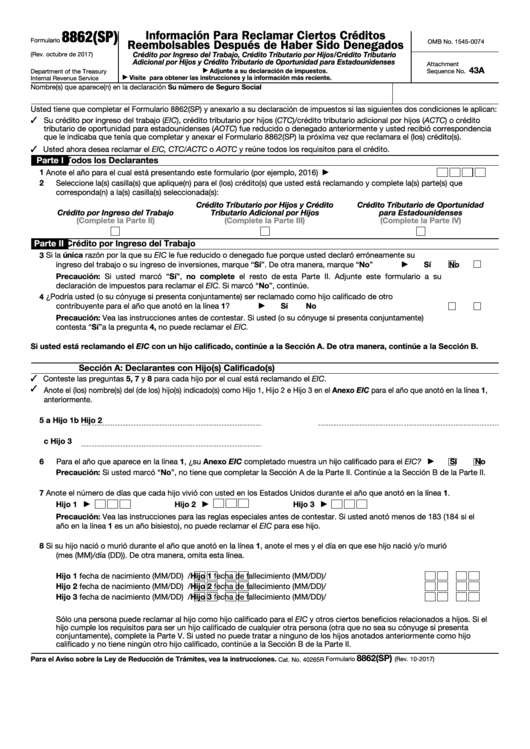

What Does Form 8862 Look Like - Web information to claim certain credits after disallowance you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. If you file your taxes online, your online tax software will fill it out for you when you indicate you were previously disallowed to claim this tax credit. Web turbotax can help you fill out your 8862 form, see below for instructions on how to find this form in turbotax and on how to complete it. Fortunately, for the u.s., the shot from portugal. Web 124 votes quick guide on how to complete what is 8862 form forget about scanning and printing out forms. This form is for income earned in tax year 2022, with tax returns due in april 2023. Turbotax can help you fill out your 8862 form, see below for instructions on how to find this form in turbotax and on how to complete it. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/actc/odc, or aotc if both of the following apply. Turbotax online guarantees turbotax security and fraud protection tax. Easily fill out pdf blank, edit, and sign them.

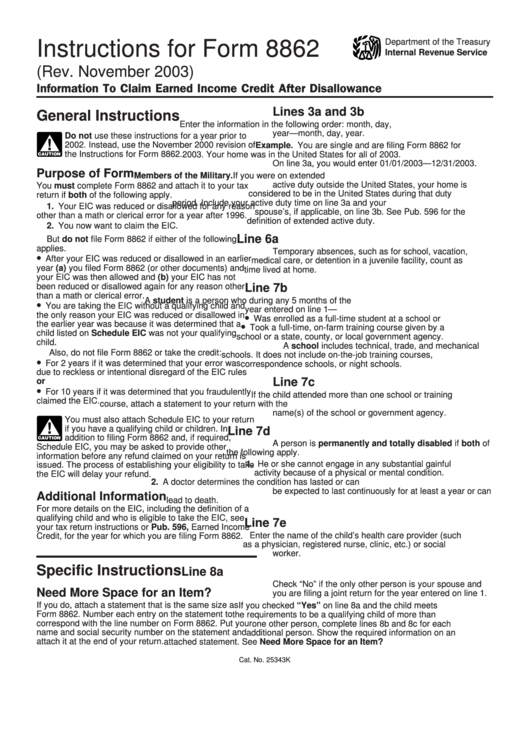

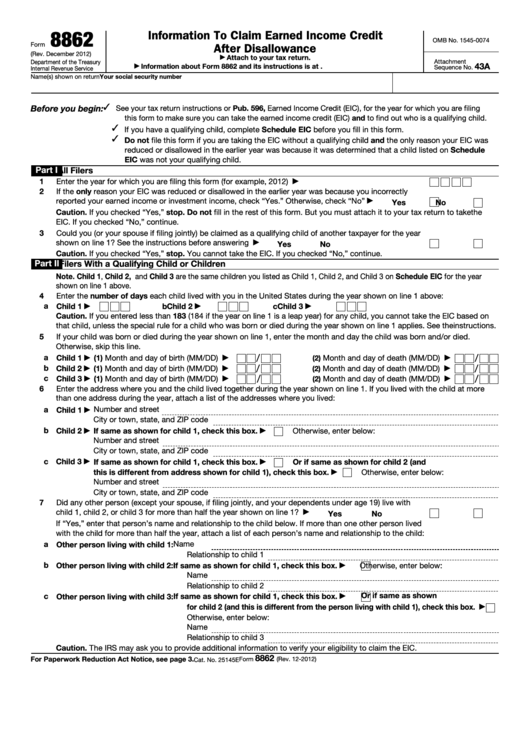

Form 8862 is the form the irs requires to be filed when the earned income credit or eic has been disallowed in a prior year. When you get to, do any of these uncommon. On the screen titled, looks like the earned income credit may put more money in your. To find the 8862 in turbotax: Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than a math or clerical error and they now meet the requirements for the credit and wish to take it: The lifetime learning credit, which is nonrefundable. Web irs form 8862 (information to claim certain credits after disallowance) must be included with your tax return if you have previously been denied the earned income tax credit (eitc), child tax credit, additional child tax credit, credit for other dependents, or american opportunity tax credit. You now meet all the requirements for and want to take the ctc, rctc, actc, or. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/actc/odc, or aotc if both of the following apply. Web if your eic was disallowed or reduced for reasons other than math or clerical errors after 1996, you may need to file form 8862 before the internal revenue service allows you to use the credit again.

Select search, enter form 8862, and select jump to form 8862; We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Naturally, you'll also need to follow the etias rules to stay in. United states (spanish) canada (french) how do i enter form 8862? instructions for form 8862 irs form 8862 do you live in the us for more than six months in 2021? Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Scroll down/ expand the list and look for you and your family. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than a math or clerical error and they now meet the requirements for the credit and wish to take it: Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Women's national team came to being eliminated from the 2023 world cup. Watch this turbotax guide to learn more.turbotax home:

Form 8862 Claim Earned Credit After Disallowance YouTube

Your eic, ctc/actc/odc, or aotc was previously reduced or disallowed for any. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/actc/odc, or aotc if both of the following apply. When you get to, do any of these uncommon. Select search, enter form 8862, and select jump to form 8862; You need.

Instructions for IRS Form 8862 Information to Claim Certain Credits

Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than a math or clerical error and they now meet the requirements for the credit and wish to take it: There are two education credits..

Form 8862 Edit, Fill, Sign Online Handypdf

Scroll down/ expand the list and look for you and your family. Web information to claim certain credits after disallowance you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Web taxpayers complete form 8862 and attach it to their tax return if: Their earned.

Instructions For Form 8862 Information To Claim Earned Credit

Select search, enter form 8862, and select jump to form 8862; When completed, attach irs form 8862 to your income tax return for the year listed in line 1. Scroll down/ expand the list and look for you and your family. You need to complete form 8962 if. Form 8862 is a federal individual income tax form.

Form 8862Information to Claim Earned Credit for Disallowance

Your eic, ctc/actc/odc, or aotc was previously reduced or disallowed for any. Web what is form 8862? The american opportunity credit, part of which may be refundable. Your ctc, rctc, actc, or odc for a year after 2015 was reduced or disallowed for any reason other than a math or clerical error: Save or instantly send your ready documents.

Form 8862 Information to Claim Earned Credit After

You need to complete form 8962 if. Turbotax can help you fill out your 8862 form, see below for instructions on how to find this form in turbotax and on how to complete it. Fortunately, for the u.s., the shot from portugal. The american opportunity credit, part of which may be refundable. Web what is form 8862?

What Does Form 8862 Look Like Fill Online, Printable, Fillable, Blank

Web we last updated federal form 8862 from the internal revenue service in december 2022. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or disallowed for any reason other than a math or clerical error. You now meet all the requirements for and.

Top 14 Form 8862 Templates free to download in PDF format

Form 8862 is the form the irs requires to be filed when the earned income credit or eic has been disallowed in a prior year. If you file your taxes online, your online tax software will fill it out for you when you indicate you were previously disallowed to claim this tax credit. When completed, attach irs form 8862 to.

Fillable Form 8862 Information To Claim Earned Credit After

Web if your eic was disallowed or reduced for reasons other than math or clerical errors after 1996, you may need to file form 8862 before the internal revenue service allows you to use the credit again. If you file your taxes online, your online tax software will fill it out for you when you indicate you were previously disallowed.

886회차 로또 자동 4장 로또 반자동 6장 로또분석방법 로또 1등되기 프로젝트! 로또만이살길이다! YouTube

Turbotax can help you fill out your 8862 form, see below for instructions on how to find this form in turbotax and on how to complete it. Web irs form 8862 (information to claim certain credits after disallowance) must be included with your tax return if you have previously been denied the earned income tax credit (eitc), child tax credit,.

Web Irs Form 8862 (Information To Claim Certain Credits After Disallowance) Must Be Included With Your Tax Return If You Have Previously Been Denied The Earned Income Tax Credit (Eitc), Child Tax Credit, Additional Child Tax Credit, Credit For Other Dependents, Or American Opportunity Tax Credit.

Web you must file form 8862: You need to complete form 8962 if. Log into your account and click take me to my return go to search box in top right cover and click there to type in 8862 and hit enter then click on jump to 8862 that appears in search results Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file.

Web Watch Newsmax Live For The Latest News And Analysis On Today's Top Stories, Right Here On Facebook.

The american opportunity credit, part of which may be refundable. Web we last updated federal form 8862 in december 2022 from the federal internal revenue service. Web if you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Web what is form 8862?

Their Earned Income Credit (Eic), Child Tax Credit (Ctc)/Additional Child Tax Credit (Actc), Credit For Other Dependents (Odc) Or American Opportunity Credit (Aotc) Was Reduced Or Disallowed For Any Reason Other Than A Math Or Clerical Error.

Web we last updated federal form 8862 from the internal revenue service in december 2022. Select search, enter form 8862, and select jump to form 8862; Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits; Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than a math or clerical error and they now meet the requirements for the credit and wish to take it:

Web 1 Best Answer Andreac1 Level 9 You Can Use The Steps Below To Help You Get To Where To Fill Out Information For Form 8862 To Add It To Your Tax Return.

Web then enter the relationship of each person to the child on the appropriate line. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web the european union says etias approval will stay valid for three years or until the passport you used in your application expires. Naturally, you'll also need to follow the etias rules to stay in.