W 9 Form Landlord Tenant

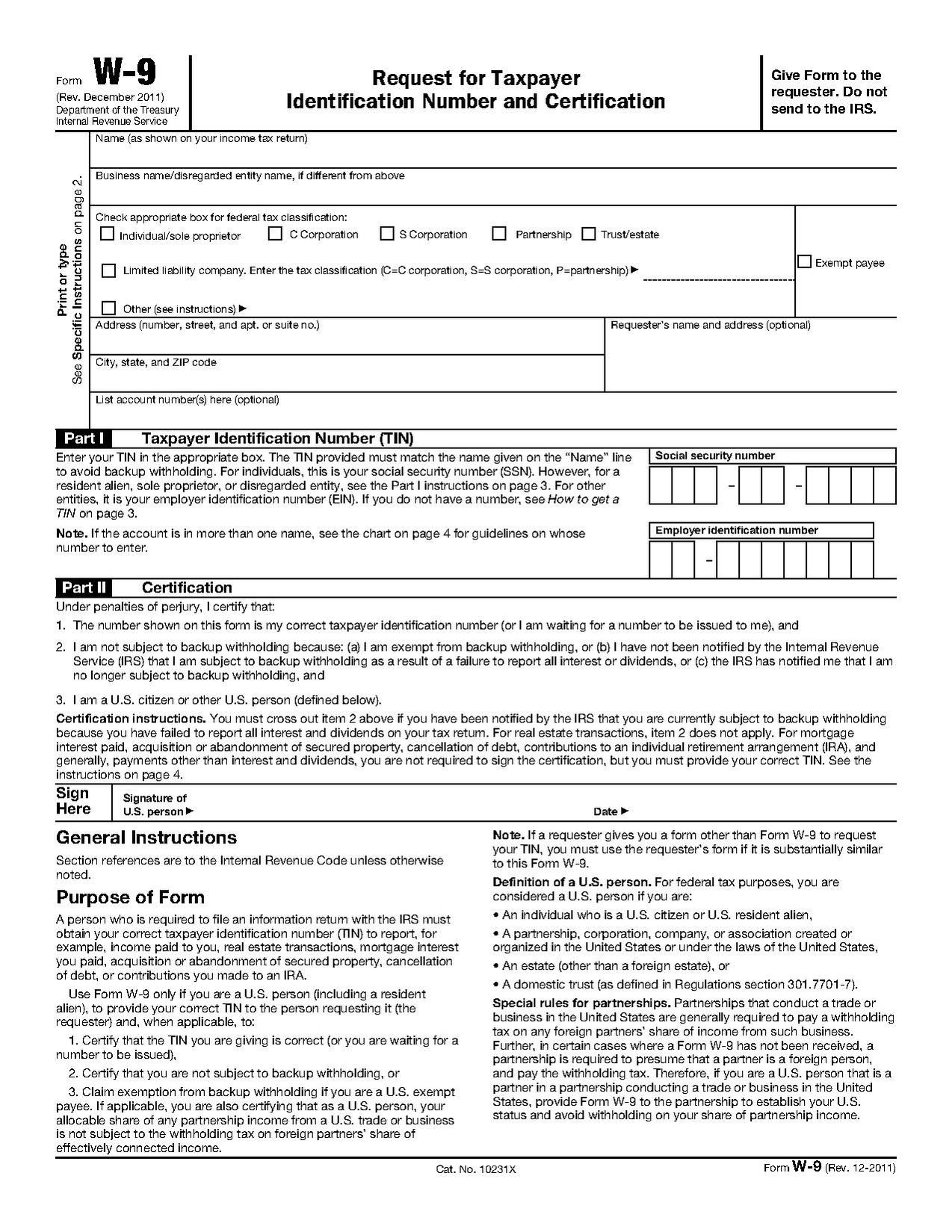

W 9 Form Landlord Tenant - Property managers must do the same for all contractors not taxed as corporations that were hired and paid in excess of $600 over the course of the year. To use the landlord w 9 form as a tenant, click here. Unless one of the cpas or experienced owners of rental properties knows otherwise, i would tell them to pound sand. Web 2 attorney answers. The tax identification or social security number you provide must belong to the owner or persons responsible for payment of taxes. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to www.irs.gov/formw9 for instructions and the latest information. Nj law requires that your ll set up a separate a interest bearing account to hold your security. Section 4 — rent inquiry. By signing it you attest that: Contributions you made to an ira.

Web 2 attorney answers. Unless one of the cpas or experienced owners of rental properties knows otherwise, i would tell them to pound sand. Section 3 — property description; Contributions you made to an ira. Web the w9 is a standard tax form landlords need in order to properly deal with your security deposit, though many of them don't bother with it, says sam himmelstein, a lawyer who represents residential and commercial tenants and tenant associations. What is backup withholding, later. Section 1 — information section 2 — address/address change; One of my tenants is asking me for a w9. You get the benefit of any interest earned. By signing it you attest that:

Web i am a renter who received emergency rental assistance from a distributing entity for use in paying my rent, utilities, and/or home energy expenses, but the distributing entity made the payments directly to my landlord and/or my utility companies on my behalf. To use the landlord w 9 form as a tenant, click here. One of my tenants is asking me for a w9. A personal check, a check from their first business, and a check from their second business. Are these payments includible in my gross income? Web the w9 is a standard tax form landlords need in order to properly deal with your security deposit, though many of them don't bother with it, says sam himmelstein, a lawyer who represents residential and commercial tenants and tenant associations. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to www.irs.gov/formw9 for instructions and the latest information. As far as i know, a tenant has no such requirement. You get the benefit of any interest earned. Unless one of the cpas or experienced owners of rental properties knows otherwise, i would tell them to pound sand.

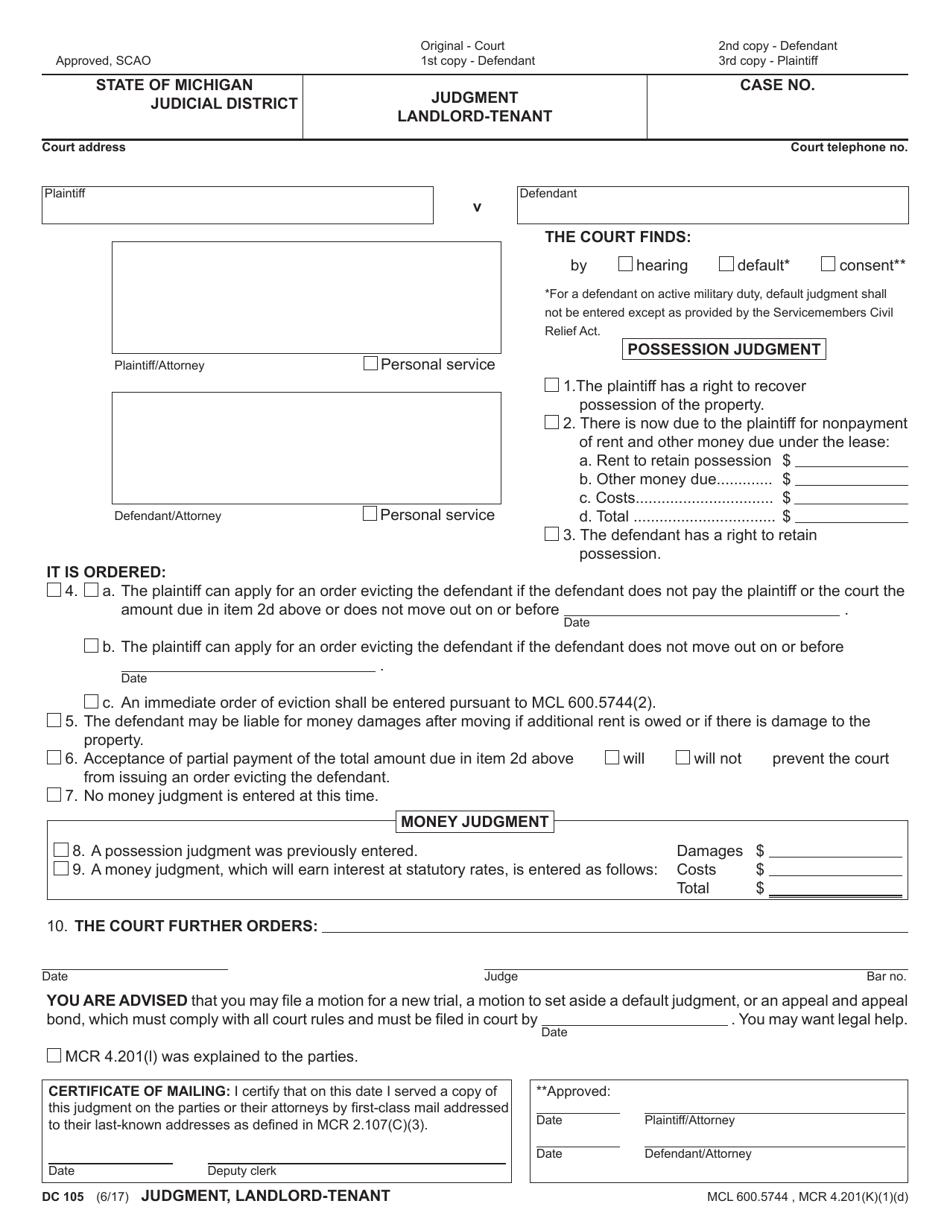

Form DC105 Download Fillable PDF or Fill Online Judgment Landlord

The tin you gave is correct. (updated may 18, 2021) q4. The taxpayer (you, the payee) isn’t subject to backup withholding. Acquisition or abandonment of secured property. Person (including a resident alien) and to request certain certifications and claims for exemption.

W9 forms for New Jersey Landlords YouTube

Acquisition or abandonment of secured property. To use the landlord w 9 form as a tenant, click here. Section 1 — information section 2 — address/address change; One of my tenants is asking me for a w9. There are four sections of the landlord w 9 form:

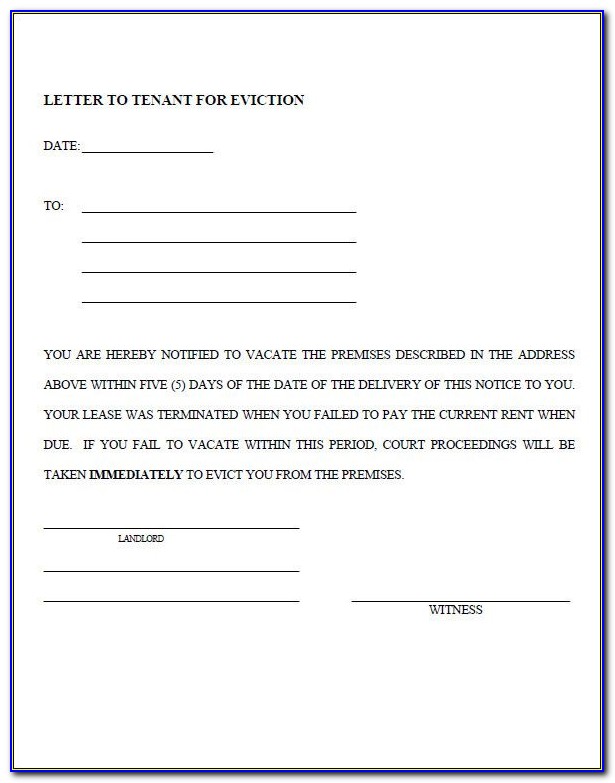

Landlord Eviction Notice Example Form Resume Examples gzOee2nOWq

Acquisition or abandonment of secured property. This has not been a problem so far. Nj law requires that your ll set up a separate a interest bearing account to hold your security. To use the landlord w 9 form as a tenant, click here. A personal check, a check from their first business, and a check from their second business.

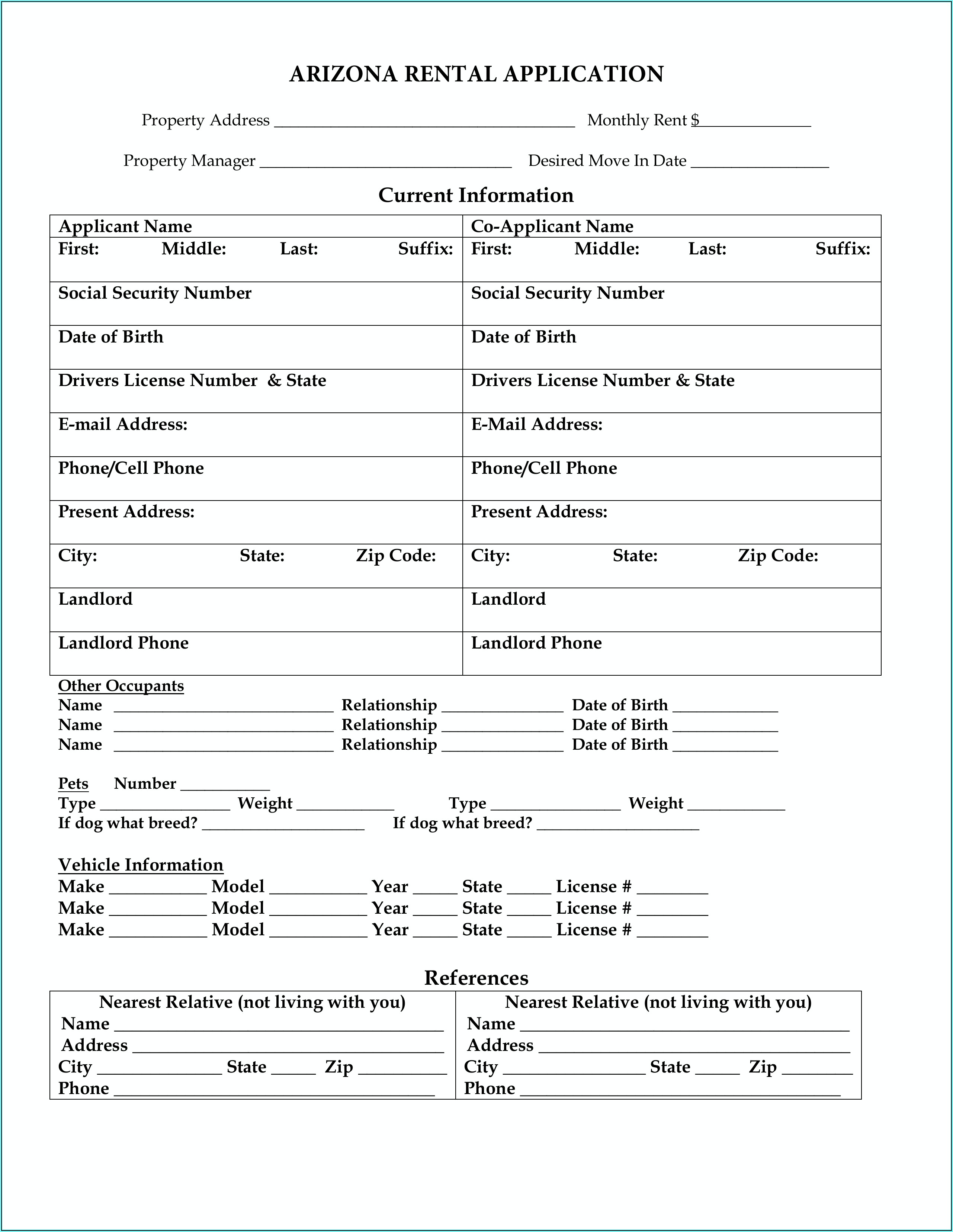

Arizona Landlord Tenant Eviction Forms Form Resume Examples Wk9yWe0V3D

The taxpayer (you, the payee) isn’t subject to backup withholding. Nj law requires that your ll set up a separate a interest bearing account to hold your security. Web 2 attorney answers. Web the w9 is a standard tax form landlords need in order to properly deal with your security deposit, though many of them don't bother with it, says.

W 9 Form Pdf Online

Person (including a resident alien), to provide your correct tin. Posted on jul 23, 2012. Assuming you live in a building with six or more units, or in any building if your landlord voluntarily chooses to hold deposits in interest bearing. Property managers must do the same for all contractors not taxed as corporations that were hired and paid in.

FREE 8+ Sample Landlord Agreement Forms in PDF MS Word

Are these payments includible in my gross income? Name (as shown on your income tax return). Section 1 — information section 2 — address/address change; Individual property owner = social security number Person (including a resident alien) and to request certain certifications and claims for exemption.

Landlord Tenant Credit Check Authorization Download Free Printable

Person (including a resident alien), to provide your correct tin. Unless one of the cpas or experienced owners of rental properties knows otherwise, i would tell them to pound sand. The taxpayer (you, the payee) isn’t subject to backup withholding. Do not leave this line blank. There are four sections of the landlord w 9 form:

Landlord Tenant Eviction Forms Florida Universal Network

Section 3 — property description; Acquisition or abandonment of secured property. Name is required on this line; By signing it you attest that: One of my tenants is asking me for a w9.

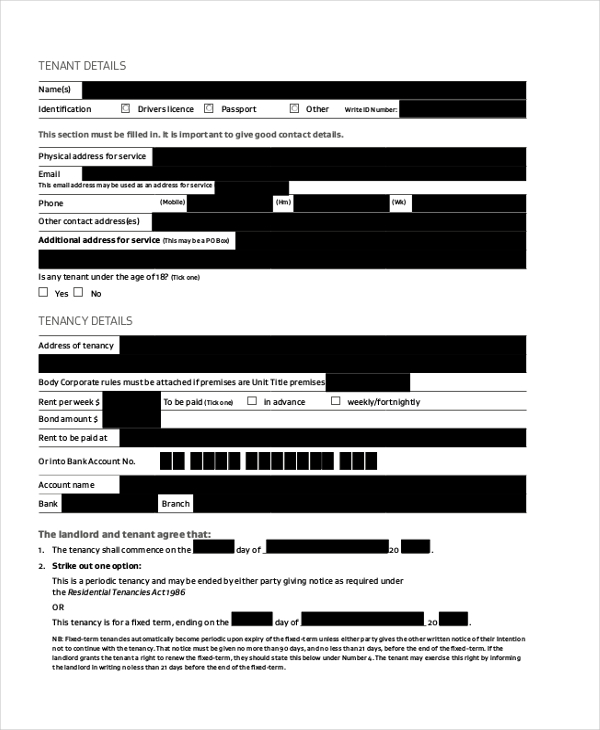

Landlord Tenant Application Form Ontario

Individual property owner = social security number What is backup withholding, later. As far as i know, a tenant has no such requirement. To use the landlord w 9 form as a tenant, click here. Person (including a resident alien) and to request certain certifications and claims for exemption.

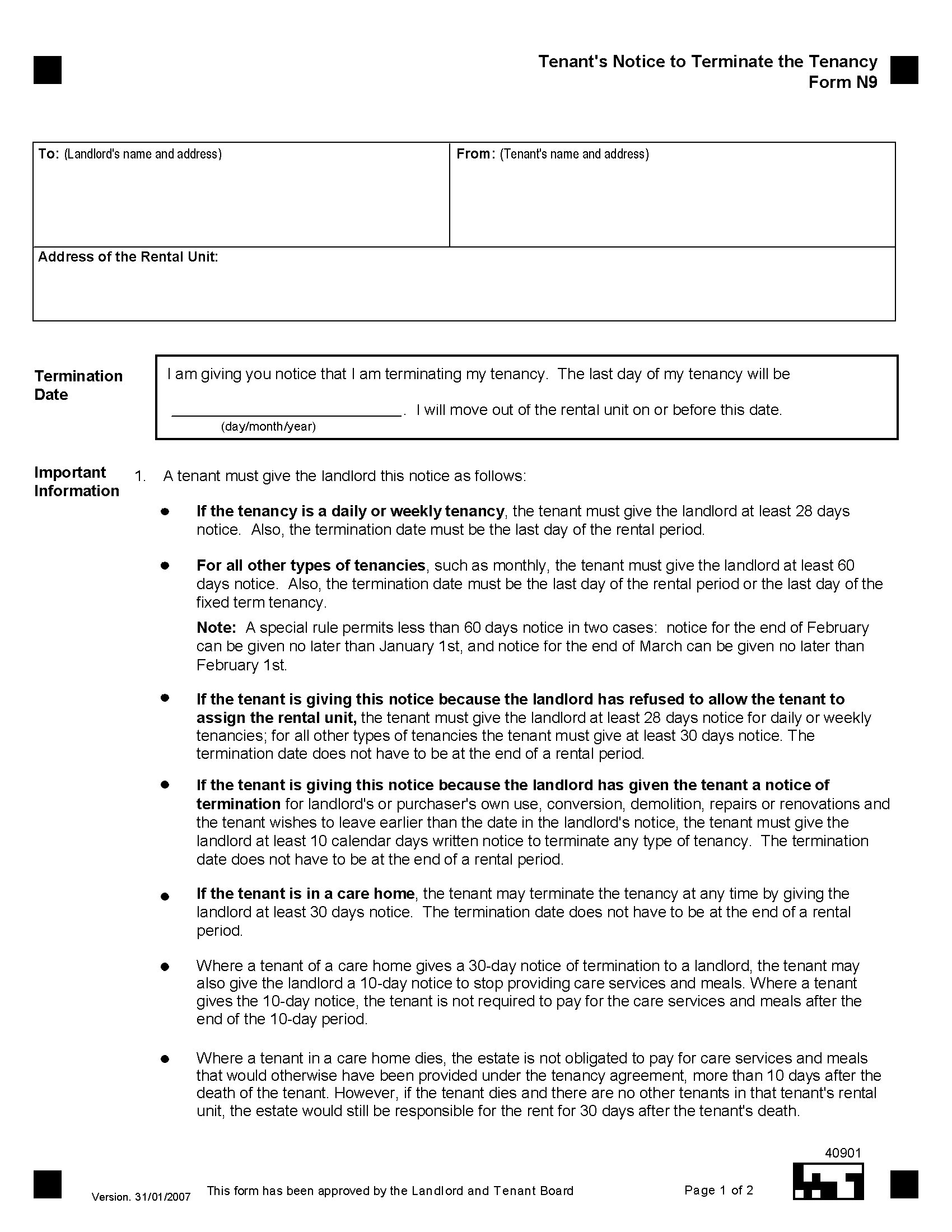

Landlord Tenant Eviction Forms Nj Universal Network

Property managers must do the same for all contractors not taxed as corporations that were hired and paid in excess of $600 over the course of the year. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to www.irs.gov/formw9 for instructions and the latest information. What is backup withholding, later. Acquisition or.

Web I Am A Renter Who Received Emergency Rental Assistance From A Distributing Entity For Use In Paying My Rent, Utilities, And/Or Home Energy Expenses, But The Distributing Entity Made The Payments Directly To My Landlord And/Or My Utility Companies On My Behalf.

Web to use our landlord w 9 form for a landlord, click here. The tax identification or social security number you provide must belong to the owner or persons responsible for payment of taxes. Name (as shown on your income tax return). What is backup withholding, later.

Ever Since They've Moved In, They've Been Paying Their Rent In 3 Checks:

Unless one of the cpas or experienced owners of rental properties knows otherwise, i would tell them to pound sand. The workshop will cover current nebraska cash rental rates and land values, best practices for agricultural. Person (including a resident alien), to provide your correct tin. This can be a social security number or the employer identification number (ein) for a business.

Person (Including A Resident Alien) And To Request Certain Certifications And Claims For Exemption.

How does a landlord w 9 form work? Are these payments includible in my gross income? Section 4 — rent inquiry. The tin you gave is correct.

One Of My Tenants Is Asking Me For A W9.

Acquisition or abandonment of secured property. Nj law requires that your ll set up a separate a interest bearing account to hold your security. October 2018) department of the treasury internal revenue service request for taxpayer identification number and certification go to www.irs.gov/formw9 for instructions and the latest information. Posted on jul 23, 2012.