Virginia Form Va 6

Virginia Form Va 6 - If you do not file this form, your employer must withhold virginia income tax as if you had no exemptions. Please make check or money order payable to state health department. Easily fill out pdf blank, edit, and sign them. Web file online at cis.scc.virginia.gov. Please make check or money order payable to state health department. You must file this form with your employer when your employment begins. Complete and deliver to 1300 east main street, tyler building, 1st. If you do not agree to withhold additional tax, the employee may need to make estimated tax payments. Select an eform below to start filing. Click iat notice to review the details.

Web see the following information: Select an eform below to start filing. If you do not agree to withhold additional tax, the employee may need to make estimated tax payments. Forms and instructions for declaration of estimated income tax. Web eforms are a fast and free way to file and pay state taxes online. Complete and mail to p.o. You can print other virginia tax forms here. You must file this form with your employer when your employment begins. Who is exempt from virginia withholding? Form & instructions for virginia consumer's use tax return for individuals (use for purchases made on and after july 1, 2023) 762.

Check if this is an amended return. If you do not file this form, your employer must withhold virginia income tax as if you had no exemptions. Save or instantly send your ready documents. Form & instructions for virginia consumer's use tax return for individuals (use for purchases made on and after july 1, 2023) 762. Web see the following information: Total va tax withheld 6c. Forms and instructions for declaration of estimated income tax. Select an eform below to start filing. Web eforms are a fast and free way to file and pay state taxes online. Employers are not responsible for monitoring their monthly tax liabilities to see if a status change is needed.

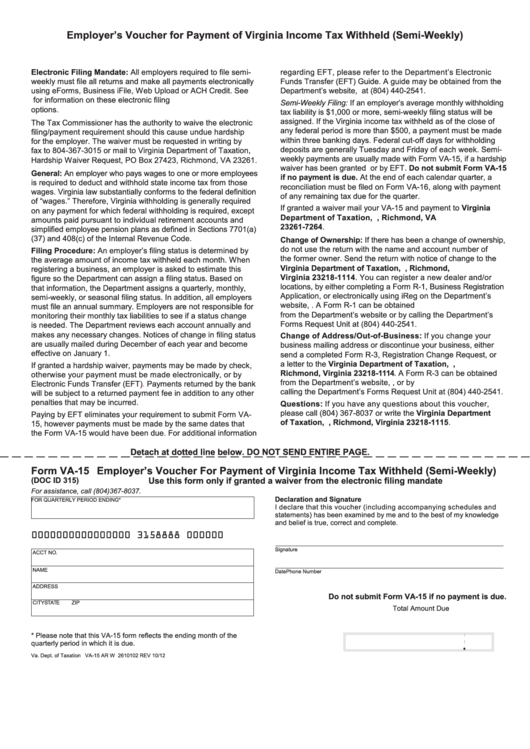

Fillable Form Va15 Employer'S Voucher For Payment Of Virginia

Web commonwealth of virginia application for certification of a vital record virginia statutes require a fee of $12.00 be charged for each certification of a vital record or for a search of the files when no certification is made. Who is exempt from virginia withholding? A return must be filed even if no tax is due. Employers are not responsible.

1+ Virginia Offer to Purchase Real Estate Form Free Download

Easily fill out pdf blank, edit, and sign them. Complete and mail to p.o. Total va tax withheld 6c. Please note, a $35 fee may be assessed if your payment is declined by your. Forms and instructions for declaration of estimated income tax.

Sr22 Virginia Fill Online, Printable, Fillable, Blank pdfFiller

Complete and mail to p.o. A return must be filed even if no tax is due. Select an eform below to start filing. Complete and deliver to 1300 east main street, tyler building, 1st. Form & instructions for virginia consumer's use tax return for individuals (use for purchases made on and after july 1, 2023) 762.

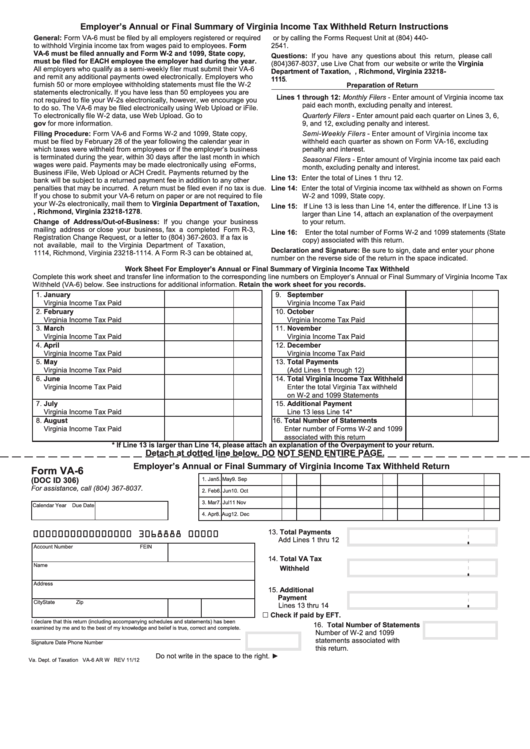

Fillable Form Va6 Employer'S Annual Or Final Summary Of Virginia

The department reviews each account annually and makes any necessary changes. Please make check or money order payable to state health department. Who is exempt from virginia withholding? If you do not file this form, your employer must withhold virginia income tax as if you had no exemptions. A return must be filed even if no tax is due.

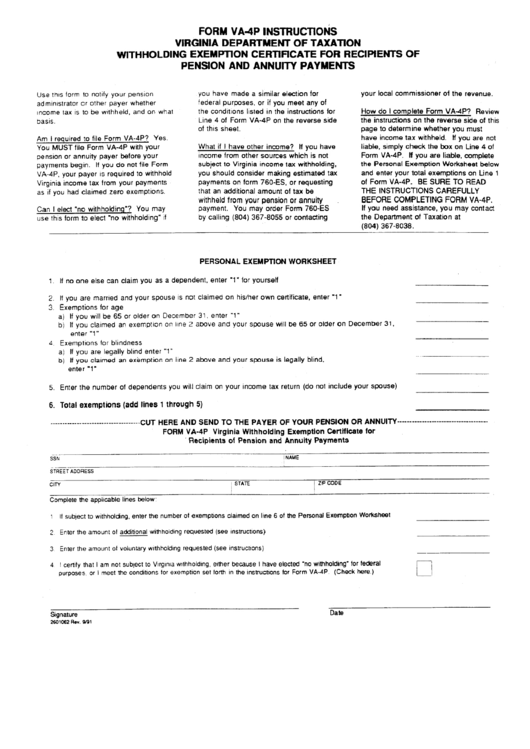

Form Va 4p Instructions Virginia Departnebt Of Taxation Withholding

A return must be filed even if no tax is due. Complete and deliver to 1300 east main street, tyler building, 1st. Please note, a $35 fee may be assessed if your payment is declined by your. You must file this form with your employer when your employment begins. Total va tax withheld 6c.

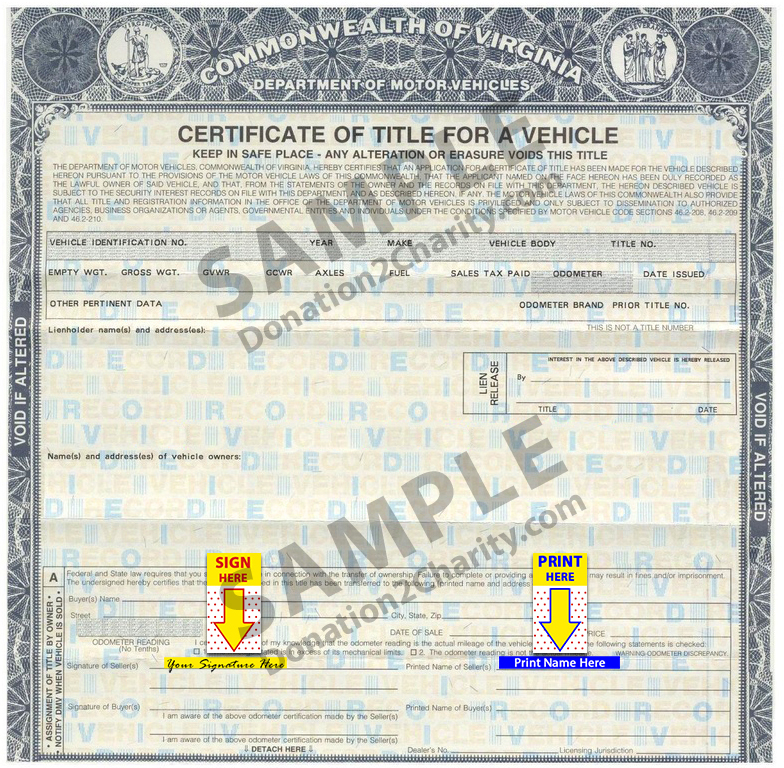

Virginia Donation2Charity

Click iat notice to review the details. Select an eform below to start filing. Forms and instructions for declaration of estimated income tax. A return must be filed even if no tax is due. If you do not agree to withhold additional tax, the employee may need to make estimated tax payments.

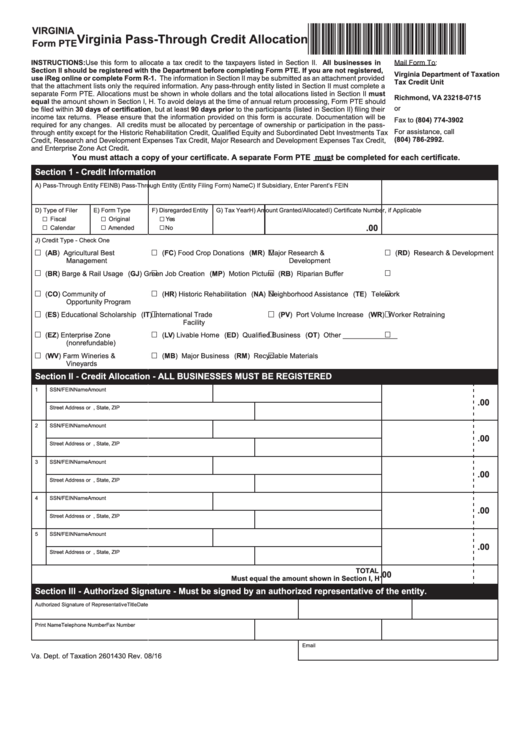

Fillable Virginia Form Pte Virginia PassThrough Credit Allocation

Please make check or money order payable to state health department. Click iat notice to review the details. Complete and mail to p.o. Employers are not responsible for monitoring their monthly tax liabilities to see if a status change is needed. If you haven't filed or paid taxes using eforms and need more information, see:

Va 2022 State Tax Withholding dailybasis

Check if this is an amended return. Who is exempt from virginia withholding? Web eforms are a fast and free way to file and pay state taxes online. Web see the following information: Returns and payments must be submitted

Unlawful Detainer Form Virginia Form Resume Examples 9x8ralQw3d

Select an eform below to start filing. Please make check or money order payable to state health department. Click iat notice to review the details. 1546001745 at present, virginia tax does not support international ach transactions (iat). Easily fill out pdf blank, edit, and sign them.

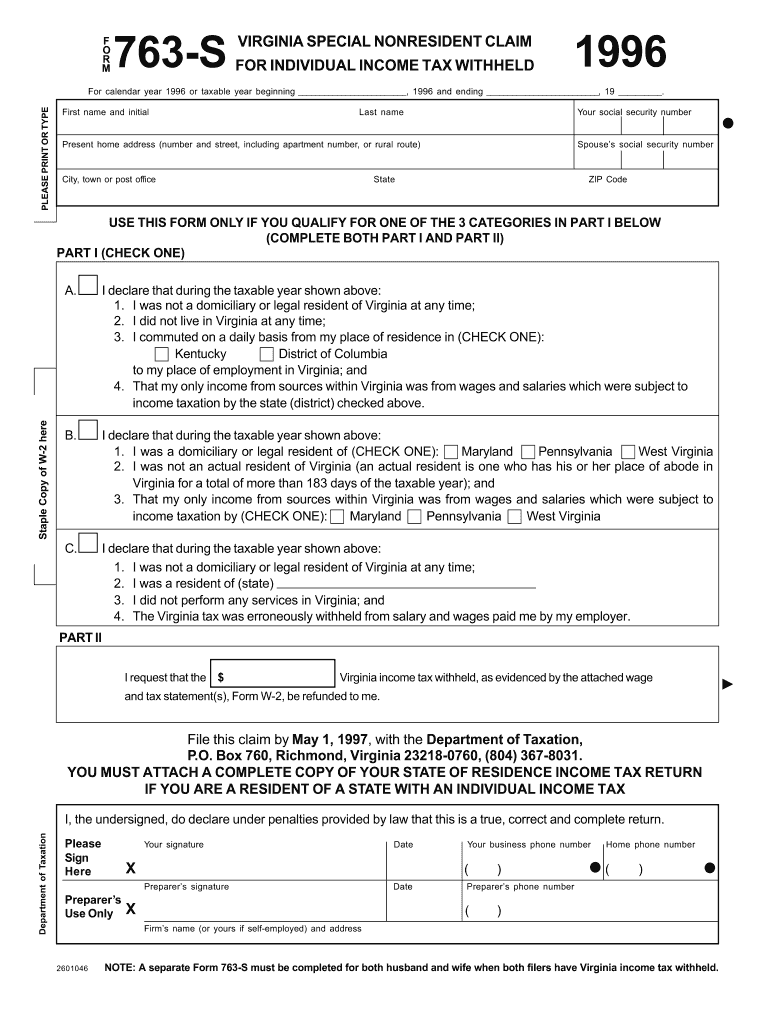

1996 Form VA 763S Fill Online, Printable, Fillable, Blank pdfFiller

The department reviews each account annually and makes any necessary changes. Web eforms are a fast and free way to file and pay state taxes online. Returns and payments must be submitted If you haven't filed or paid taxes using eforms and need more information, see: You must file this form with your employer when your employment begins.

Complete And Mail To P.o.

Total va tax withheld 6c. A return must be filed even if no tax is due. 1546001745 at present, virginia tax does not support international ach transactions (iat). Forms and instructions for declaration of estimated income tax.

Total Va Tax Withheld 6C.

Web eforms are a fast and free way to file and pay state taxes online. Form & instructions for virginia consumer's use tax return for individuals (use for purchases made on and after july 1, 2023) 762. Employers are not responsible for monitoring their monthly tax liabilities to see if a status change is needed. Web commonwealth of virginia application for certification of a vital record virginia statutes require a fee of $12.00 be charged for each certification of a vital record or for a search of the files when no certification is made.

31 Of The Following Calendar Year, Or Within 30 Days After The Final Payment Of Wages By Your Company.

Please note, a $35 fee may be assessed if your payment is declined by your. Please make check or money order payable to state health department. If you haven't filed or paid taxes using eforms and need more information, see: Check if this is an amended return.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Returns and payments must be submitted If you do not file this form, your employer must withhold virginia income tax as if you had no exemptions. Please make check or money order payable to state health department. Save or instantly send your ready documents.