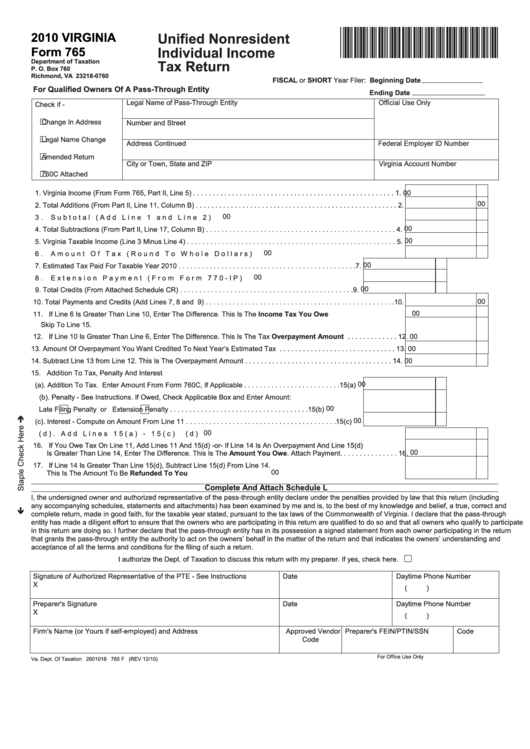

Virginia Form 765 Instructions 2021

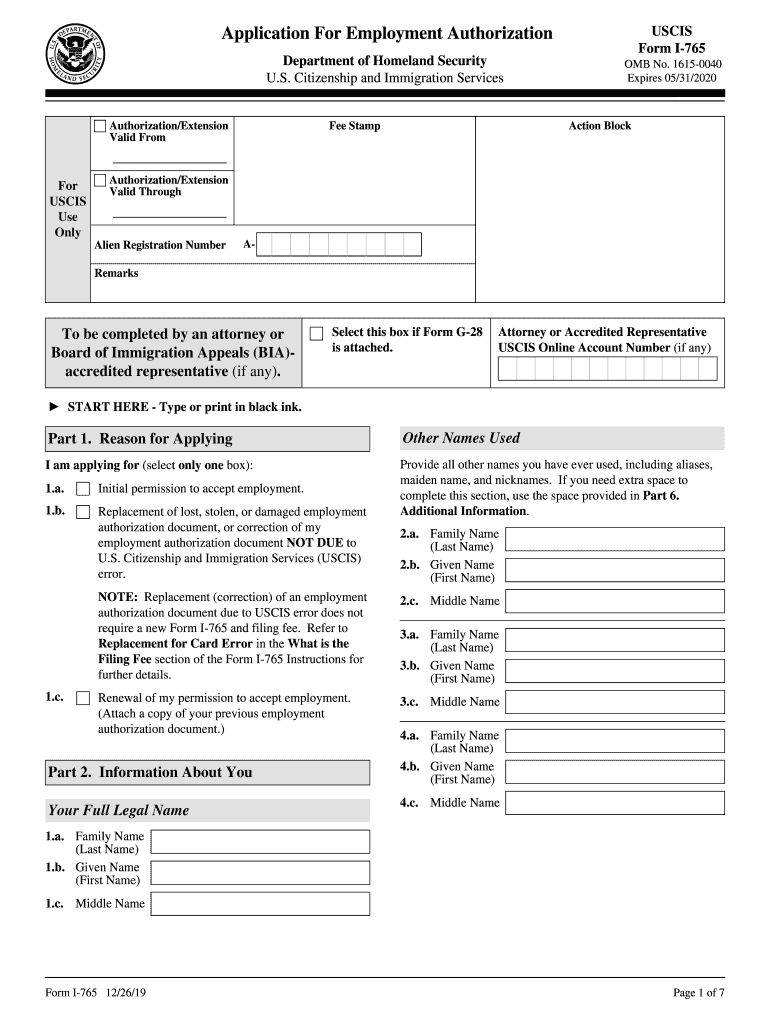

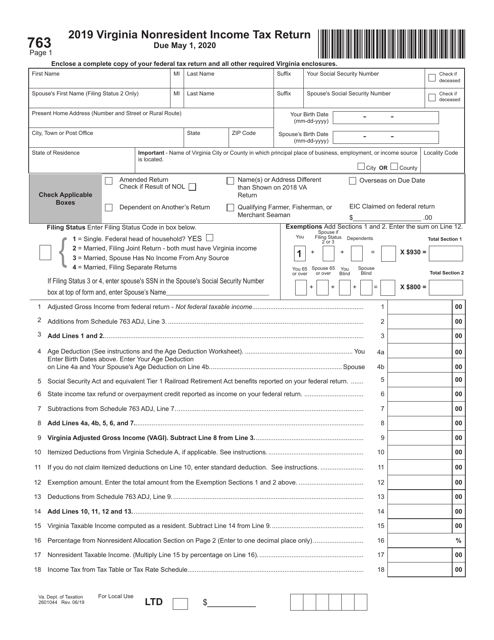

Virginia Form 765 Instructions 2021 - Web virginia sources in addition to pte income, they must file a nonresident individual income tax return (form 763) to account for that income. Printable virginia state tax forms for the 2022 tax. Taxformfinder has an additional 135 virginia income tax forms that you may need, plus all federal income. In screen 5, shareholder information. Initial permission to accept employment. Web attach schedule cr to your return. If all of the rules described in these instructions cannot be met, the pte must receive written approval from the tax commissioner before submitting a composite. Web we last updated virginia form 765 in january 2023 from the virginia department of taxation. If you are a lawful permanent resident, a conditional permanent resident, or a nonimmigrant only authorized for employment with a specific. Web item numbers 1.

Replacement of lost, stolen, or damaged employment. Reason for applying am applying for (select only one box): Web 2021 form 765 instructions, unified nonresident individual. The individual may deduct income. Printable virginia state tax forms for the 2022 tax. Web attach schedule cr to your return. Web we last updated virginia form 765 in january 2023 from the virginia department of taxation. In screen 5, shareholder information. Web virginia sources in addition to pte income, they must file a nonresident individual income tax return (form 763) to account for that income. Web virginia, filing may be simplified through the use of the form 765.

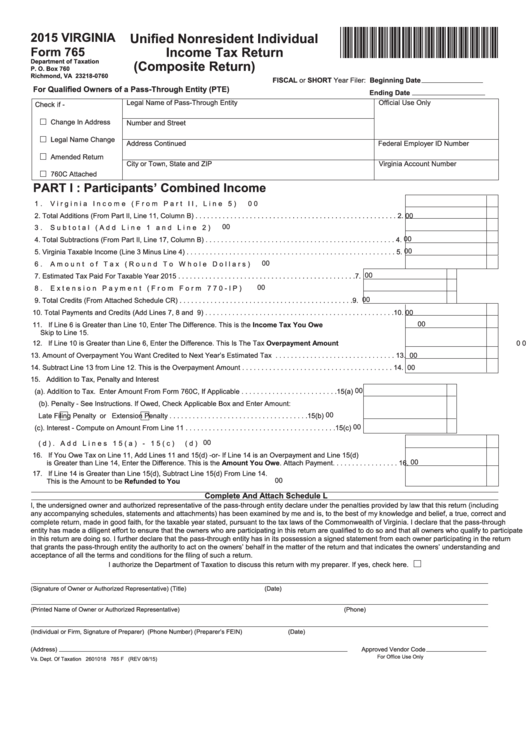

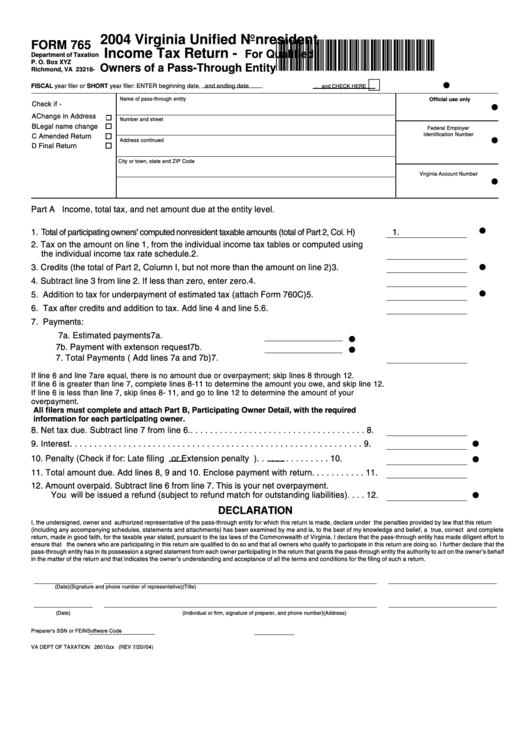

Unified nonresident individual income tax return (composite return). The individual may deduct income. If you are a lawful permanent resident, a conditional permanent resident, or a nonimmigrant only authorized for employment with a specific. Web we last updated virginia form 765 in january 2023 from the virginia department of taxation. Web form 765 is an optional “unified return” (henceforth referred to as a composite return) that is filed by the pte on behalf of its qualified nonresident owners. Web virginia state income tax form 760 must be postmarked by may 1, 2023 in order to avoid penalties and late fees. Web file now with turbotax other virginia individual income tax forms: Reason for applying am applying for (select only one box): Web we last updated the unified nonresident individual income tax return in january 2023, so this is the latest version of form 765, fully updated for tax year 2022. In screen 5, shareholder information.

Virginia Form 765 Unified Nonresident Individual Tax Return

All of the virginia source. Taxformfinder has an additional 135 virginia income tax forms that you may need, plus all federal income. Web file now with turbotax other virginia individual income tax forms: Web virginia, filing may be simplified through the use of the form 765. Effective july 1, 2021, unified nonresidents must electronically file all installment payments of estimated.

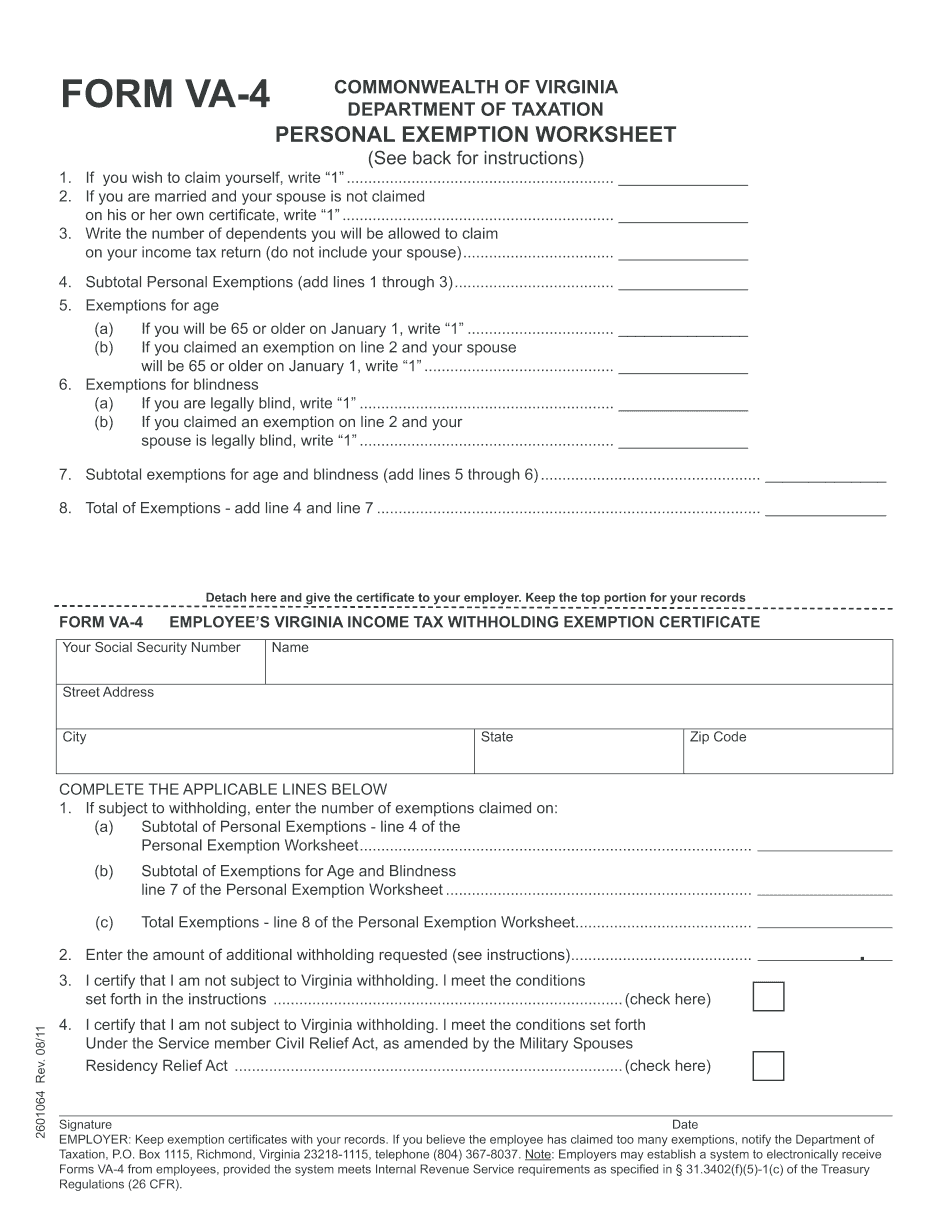

Virginia Form VA4 Printable (Employee's Withholding Exemption Certificate)

All of the virginia source. In screen 5, shareholder information. Web we last updated the unified nonresident individual income tax return in january 2023, so this is the latest version of form 765, fully updated for tax year 2022. Initial permission to accept employment. Web virginia, filing may be simplified through the use of the form 765.

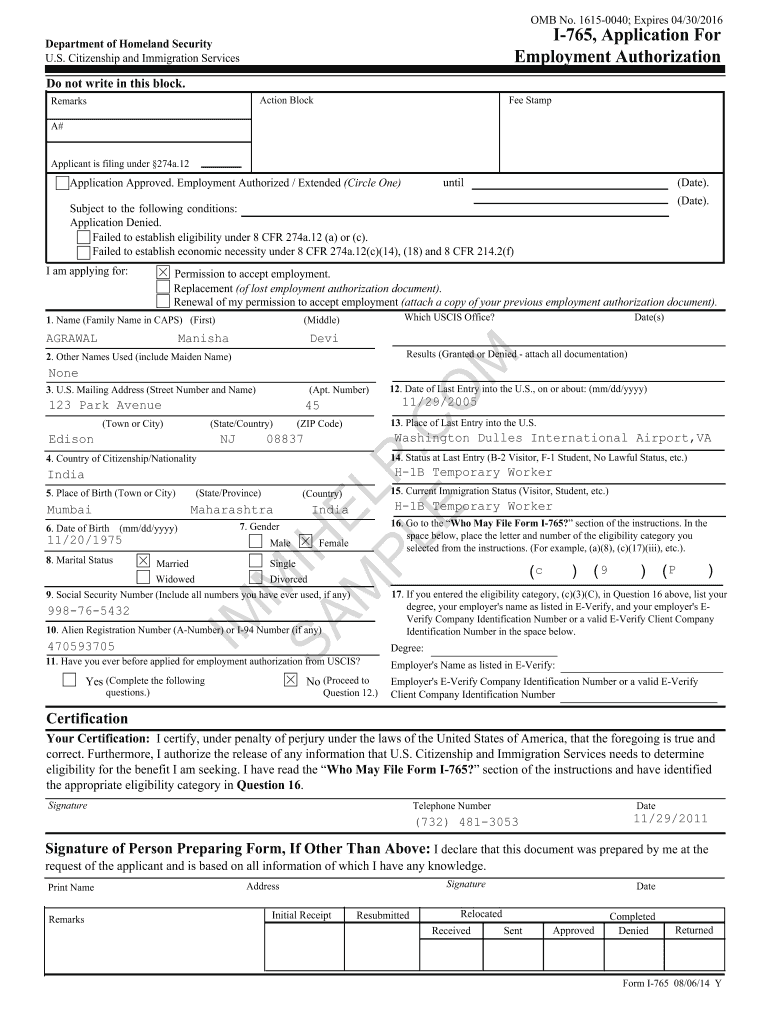

20192021 Form USCIS I765 Fill Online, Printable, Fillable, Blank

This form is for income earned in tax year 2022, with tax returns due in. Initial permission to accept employment. Web we last updated the unified nonresident individual income tax return in january 2023, so this is the latest version of form 765, fully updated for tax year 2022. Web virginia, filing may be simplified through the use of the.

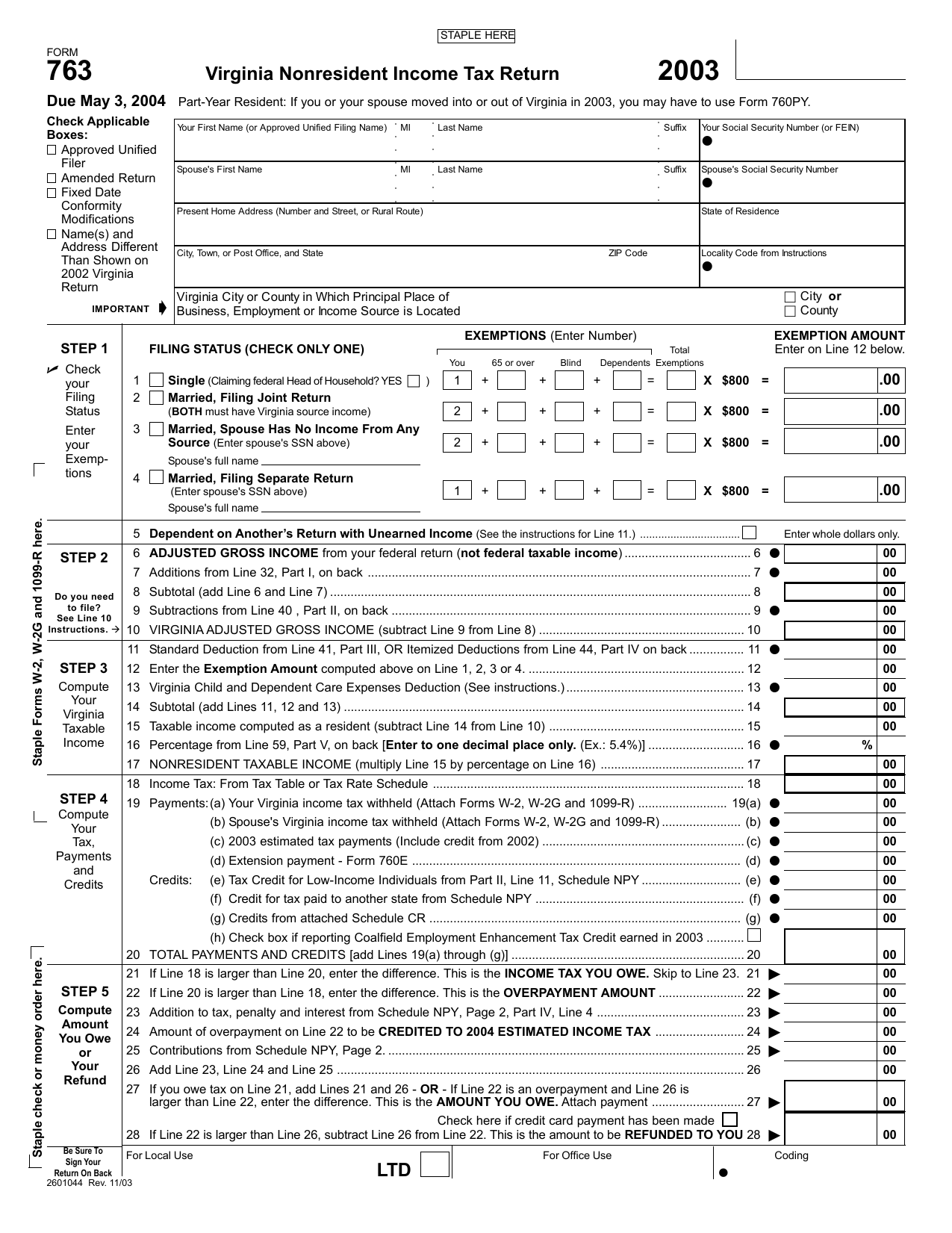

Virginia Form 763 designingreflections

Web virginia, filing may be simplified through the use of the form 765. Web virginia state income tax form 760 must be postmarked by may 1, 2023 in order to avoid penalties and late fees. We last updated the credit computation schedule for forms 760, 760py, 763 and 765 in january 2023, so this is the latest version of. Effective.

Form 763 Download Fillable PDF or Fill Online Virginia Nonresident

Web virginia, filing may be simplified through the use of the form 765. Web 2021 form 765 instructions, unified nonresident individual. Web item numbers 1. Web virginia sources in addition to pte income, they must file a nonresident individual income tax return (form 763) to account for that income. The individual may deduct income.

Fillable Form 765 Unified Nonresident Individual Tax Return

Web 2021 form 765 instructions, unified nonresident individual. Web we last updated the unified nonresident individual income tax return in january 2023, so this is the latest version of form 765, fully updated for tax year 2022. This form is for income earned in tax year 2022, with tax returns due in. Web virginia, filing may be simplified through the.

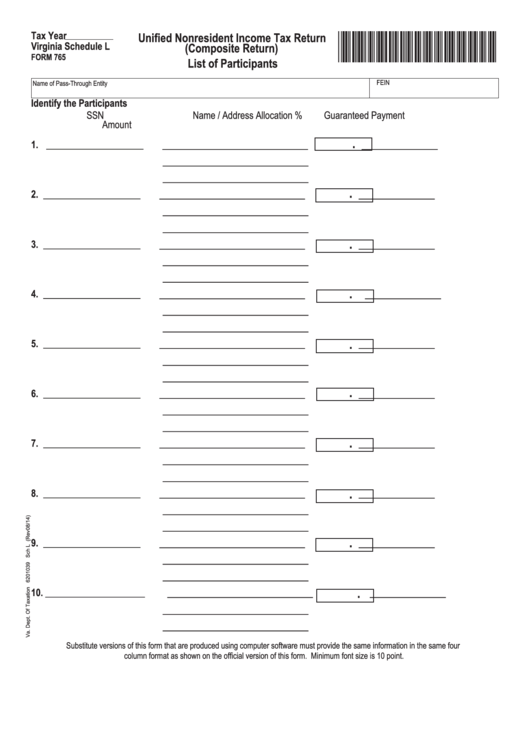

Fillable Virginia Schedule L (Form 765) Unified Nonresident

Web item numbers 1. Taxformfinder has an additional 135 virginia income tax forms that you may need, plus all federal income. Web we last updated the unified nonresident individual income tax return in january 2023, so this is the latest version of form 765, fully updated for tax year 2022. All of the virginia source. In screen 5, shareholder information.

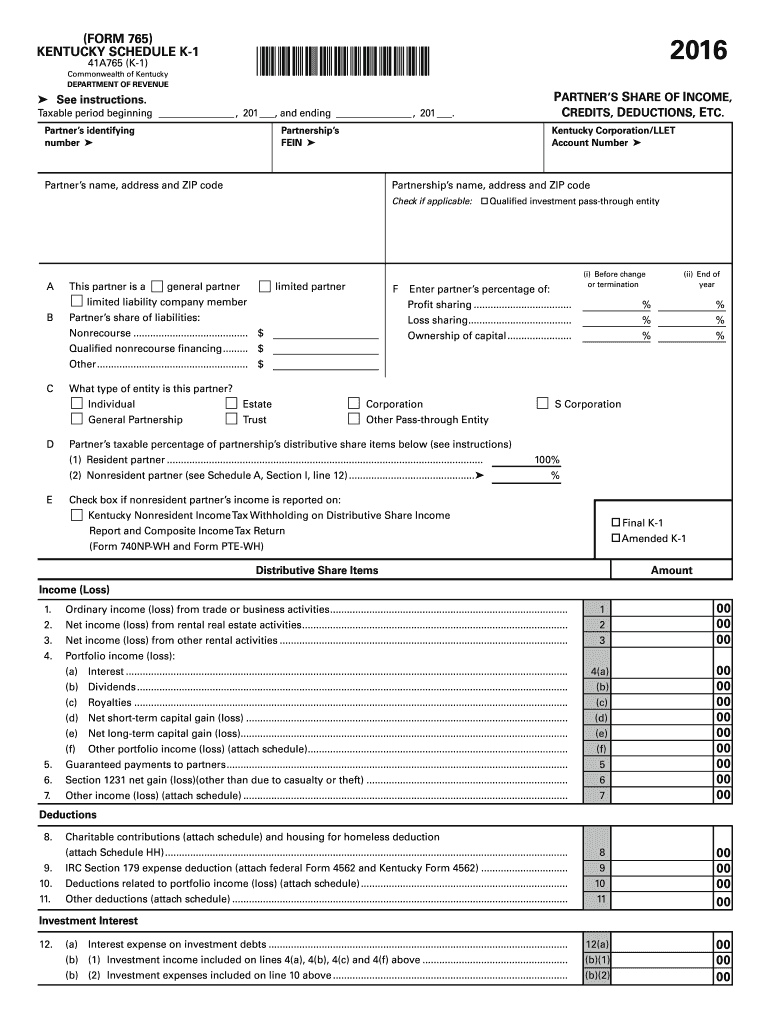

Kentucky Form 765 Fill Out and Sign Printable PDF Template signNow

Web attach schedule cr to your return. Effective july 1, 2021, unified nonresidents must electronically file all installment payments of estimated tax and all. Web virginia sources in addition to pte income, they must file a nonresident individual income tax return (form 763) to account for that income. Printable virginia state tax forms for the 2022 tax. Web 2021 form.

i 765 form sample Fill out & sign online DocHub

Form 765 is an optional “unified return” (henceforth referred to as a composite return) that is filed by the pte on. Replacement of lost, stolen, or damaged employment. The individual may deduct income. Web 2021 form 765 instructions, unified nonresident individual. Printable virginia state tax forms for the 2022 tax.

Form 7652004 Virginia Unified Nonresident Tax Return

Web virginia sources in addition to pte income, they must file a nonresident individual income tax return (form 763) to account for that income. Web item numbers 1. Reason for applying am applying for (select only one box): We last updated the credit computation schedule for forms 760, 760py, 763 and 765 in january 2023, so this is the latest.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In.

Web form 765 is an optional “unified return” (henceforth referred to as a composite return) that is filed by the pte on behalf of its qualified nonresident owners. Web item numbers 1. Web file now with turbotax other virginia individual income tax forms: If all of the rules described in these instructions cannot be met, the pte must receive written approval from the tax commissioner before submitting a composite.

Form 765 Is An Optional “Unified Return” (Henceforth Referred To As A Composite Return) That Is Filed By The Pte On.

In screen 5, shareholder information. The individual may deduct income. Unified nonresident individual income tax return (composite return). Web attach schedule cr to your return.

Replacement Of Lost, Stolen, Or Damaged Employment.

All of the virginia source. Effective july 1, 2021, unified nonresidents must electronically file all installment payments of estimated tax and all. Web virginia state income tax form 760 must be postmarked by may 1, 2023 in order to avoid penalties and late fees. We last updated the credit computation schedule for forms 760, 760py, 763 and 765 in january 2023, so this is the latest version of.

Web We Last Updated Virginia Form 765 In January 2023 From The Virginia Department Of Taxation.

Initial permission to accept employment. Reason for applying am applying for (select only one box): Web 2021 form 765 instructions, unified nonresident individual. Taxformfinder has an additional 135 virginia income tax forms that you may need, plus all federal income.