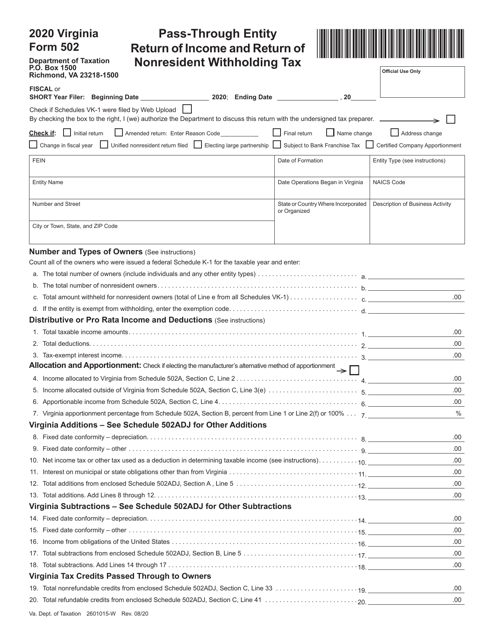

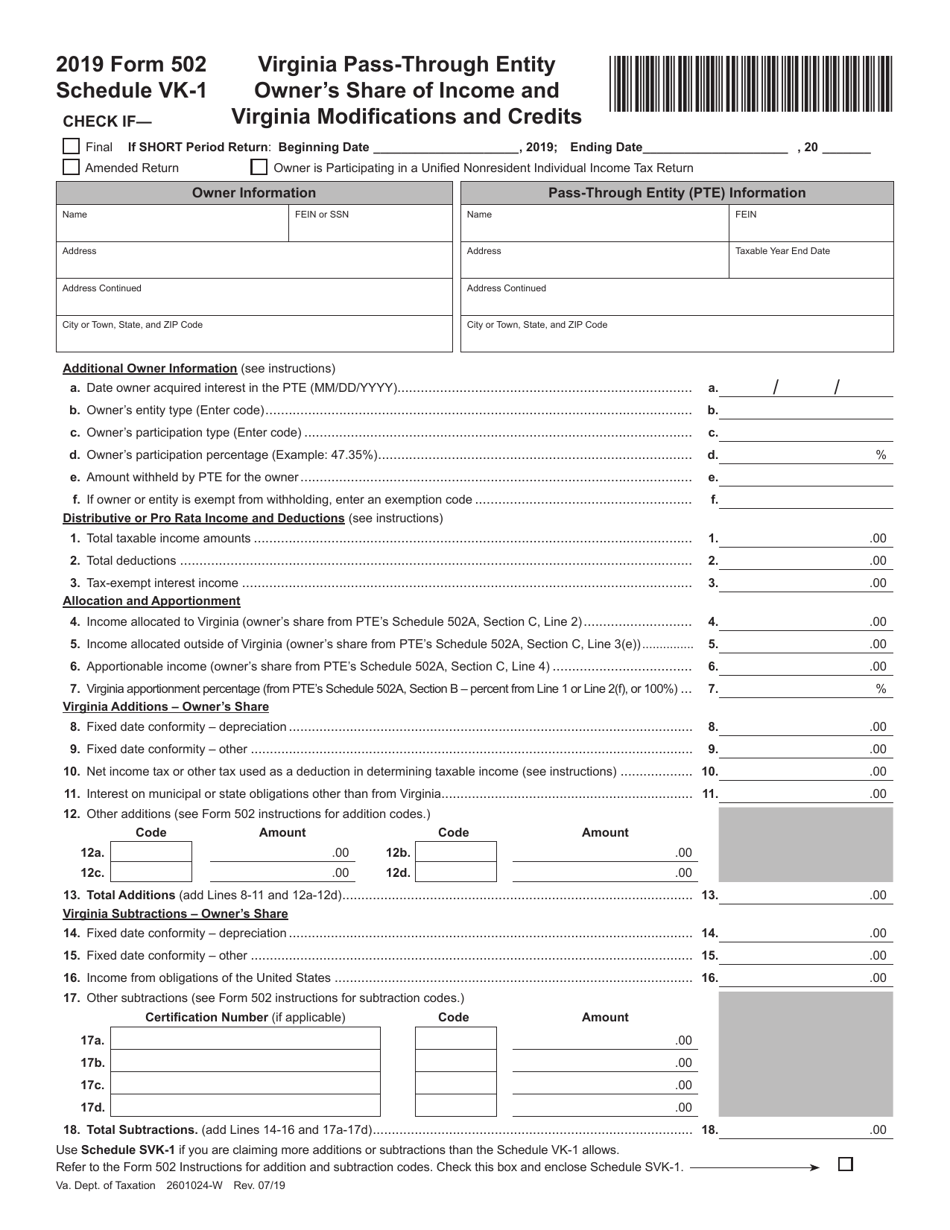

Virginia Form 502 Instructions

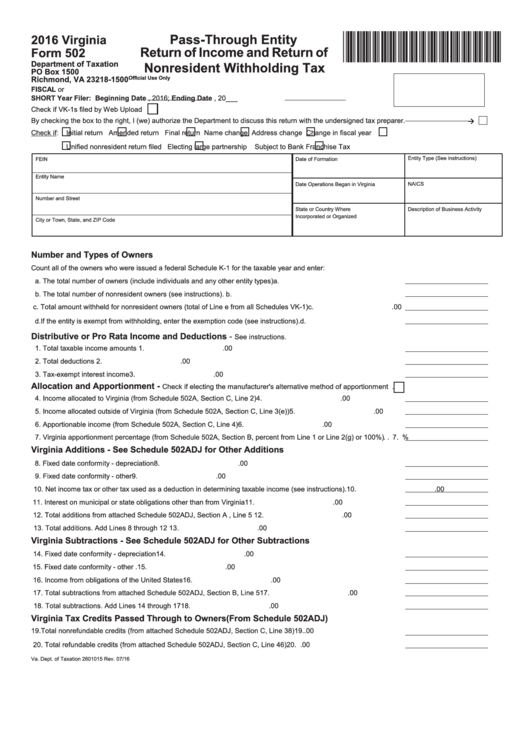

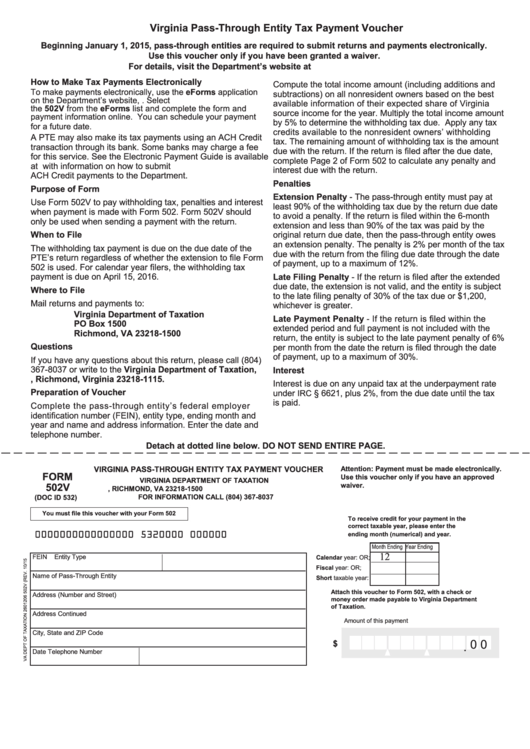

Virginia Form 502 Instructions - Web to the form 502 instructions for more information. Web the entity’s virginia return of income (form 502) filed with the department of taxation. Not filed contact us 502w. Virginia form 502 pass through entity income tax return; Allocable and apportionable income virginia law provides that dividends received are to be allocated to the state of. Web include a copy of your federal return with form 502. No application for extension is required. Web date of formation entity type (see instructions) entity name date operations began in virginia naics code number and street: No paper submissions will be accepted. Web the draft guidelines provide four steps for a pte to determine its taxable income and tax amount.

Web and trusts that file virginia form 770 are not subject to the form 502 filing requirements. Web date of formation entity type (see instructions) entity name date operations began in virginia naics code number and street: Web form 502ptet and all corresponding schedules must be filed electronically. Web include a copy of your federal return with form 502. Allocable and apportionable income virginia law provides that dividends received are to be allocated to the state of. Web the entity’s virginia return of income (form 502) filed with the department of taxation. An owner of a pte may be an individual, a corporation, a partnership, or any other type. 1546001745 at present, virginia tax does not support international ach. Web the draft guidelines provide four steps for a pte to determine its taxable income and tax amount. Beginning with the 2008 return, there are two additional lines to complete under.

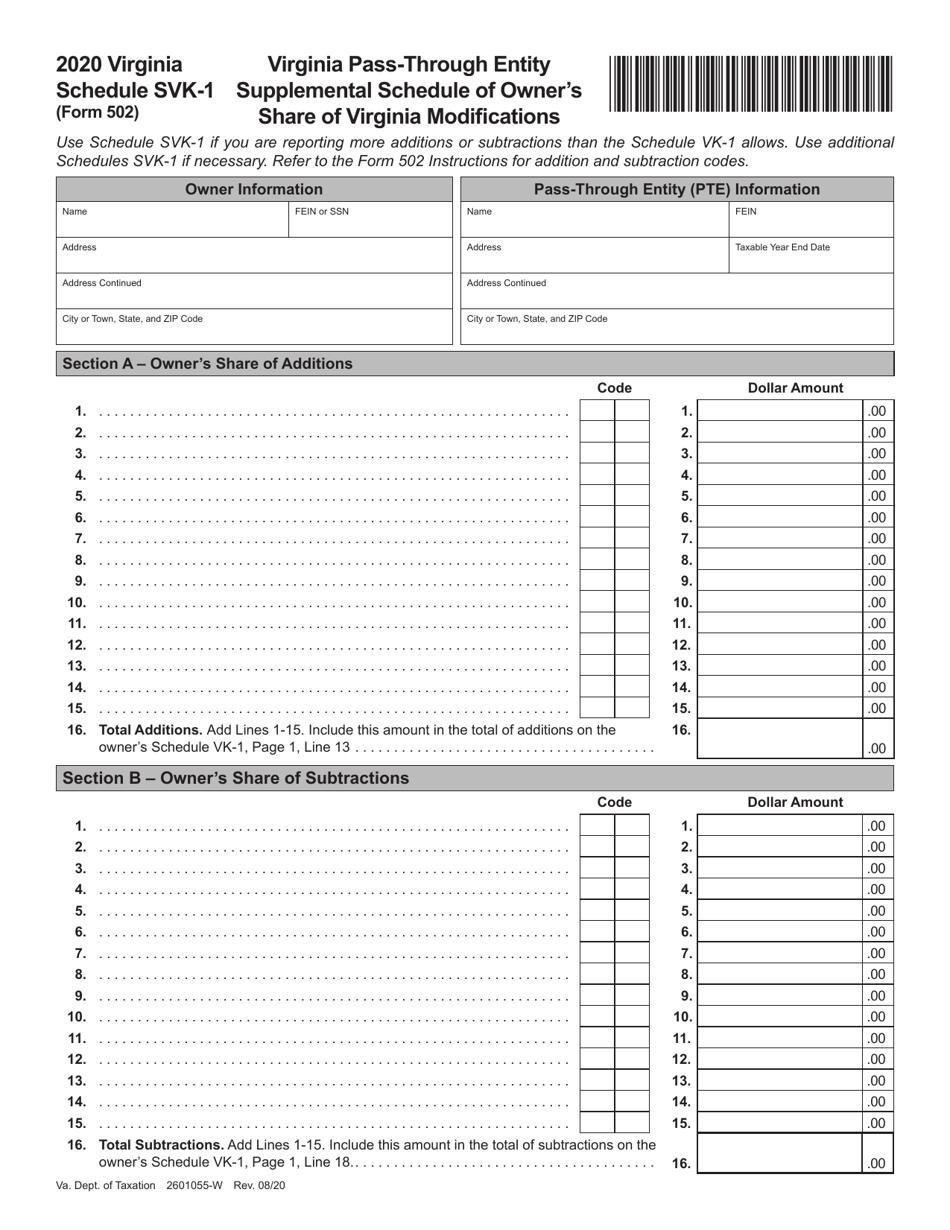

Virginia form 502 pass through entity income tax return; 1546001745 at present, virginia tax does not support international ach. (1) first, a pte should determine the allocation and. Web include a copy of your federal return with form 502. An owner of a pte may be an individual, a corporation, a partnership, or any other type. Web the draft guidelines provide four steps for a pte to determine its taxable income and tax amount. Web and trusts that file virginia form 770 are not subject to the form 502 filing requirements. If form 502 is filed more than 6 months after the due date or more. Beginning with the 2008 return, there are two additional lines to complete under. Virginia schedule 502adj form 502.

Ckht 502 Form 2019 / CA Olympic Archery In Schools New School

Web and trusts that file virginia form 770 are not subject to the form 502 filing requirements. 1546001745 at present, virginia tax does not support international ach. Not filed contact us 502v. Web form 502ptet and all corresponding schedules must be filed electronically. Virginia schedule 502adj form 502.

Virginia form Cc 1680 Brilliant Au 1998 A 5 Ests for Secreted Proteins

No application for extension is required. 1546001745 at present, virginia tax does not support international ach. Not filed contact us 502ez. Not filed contact us 502v. Virginia schedule 502adj form 502.

Fillable Virginia Form 502 PassThrough Entity Return Of And

No paper submissions will be accepted. Web the following forms and schedules are prepared for the virginia return: Payments must be made electronically by the filing. Web the draft guidelines provide four steps for a pte to determine its taxable income and tax amount. Virginia schedule 502adj form 502.

Form 502 Schedule SVK1 Download Fillable PDF or Fill Online Virginia

Allocable and apportionable income virginia law provides that dividends received are to be allocated to the state of. Web form 502ptet and all corresponding schedules must be filed electronically. Web the entity’s virginia return of income (form 502) filed with the department of taxation. Web date of formation entity type (see instructions) entity name date operations began in virginia naics.

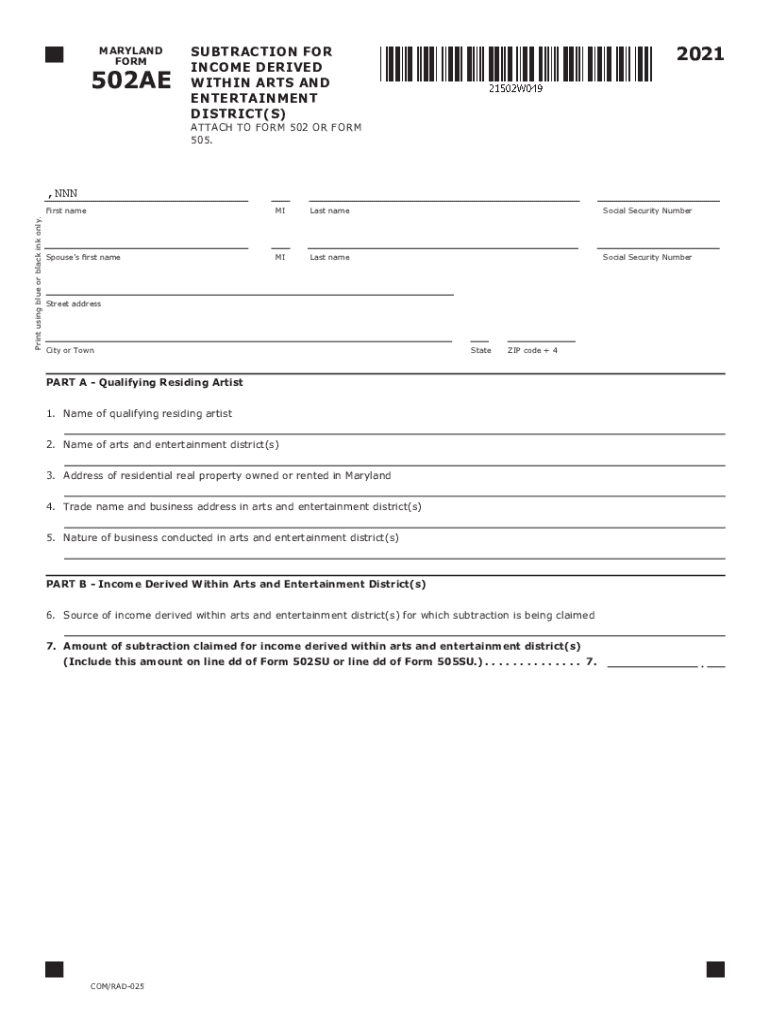

2021 Form MD 502AE Fill Online, Printable, Fillable, Blank pdfFiller

No paper submissions will be accepted. (1) first, a pte should determine the allocation and. Virginia form 502 pass through entity income tax return; If form 502 is filed more than 6 months after the due date or more. Virginia schedule 502adj form 502.

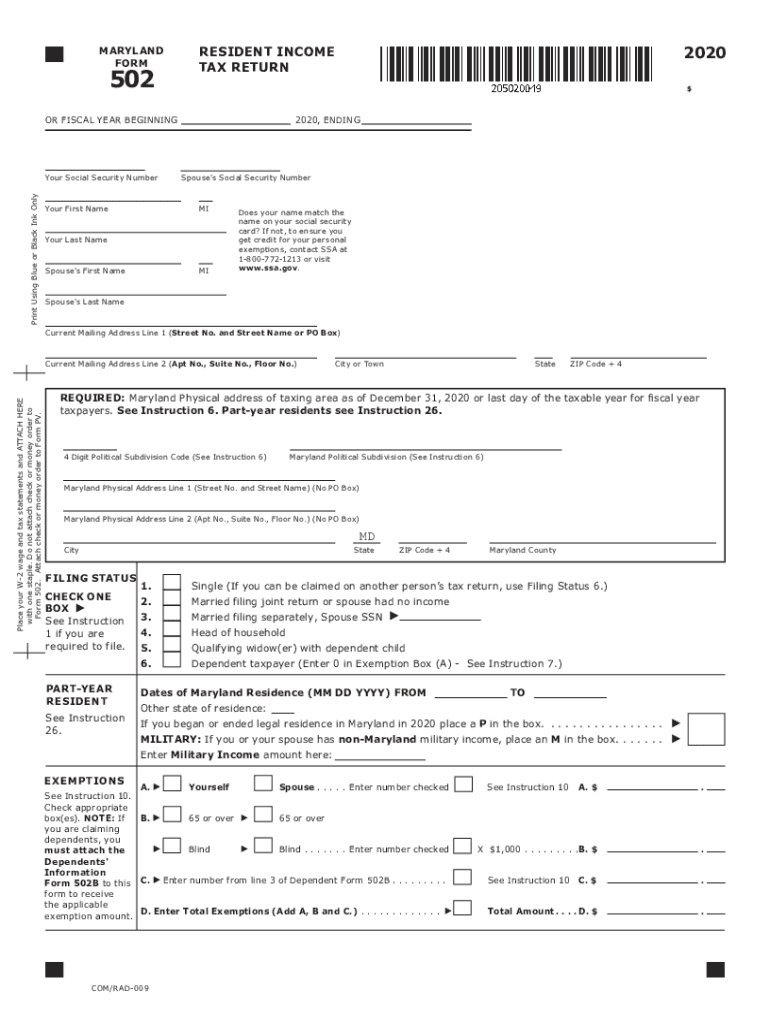

Md 502 instructions 2018 Fill out & sign online DocHub

Web form 502ptet and all corresponding schedules must be filed electronically. 1546001745 at present, virginia tax does not support international ach. Web the draft guidelines provide four steps for a pte to determine its taxable income and tax amount. Web to the form 502 instructions for more information. Web date of formation entity type (see instructions) entity name date operations.

Form 502 Download Fillable PDF or Fill Online PassThrough Entity

Web include a copy of your federal return with form 502. An owner of a pte may be an individual, a corporation, a partnership, or any other type. Web the draft guidelines provide four steps for a pte to determine its taxable income and tax amount. Not filed contact us 502w. Not filed contact us 502v.

Form 502 Schedule VK1 Download Fillable PDF or Fill Online Virginia

Not filed contact us 502v. 1546001745 at present, virginia tax does not support international ach. Beginning with the 2008 return, there are two additional lines to complete under. Web date of formation entity type (see instructions) entity name date operations began in virginia naics code number and street: Web and trusts that file virginia form 770 are not subject to.

Virginia form Cc 1680 Awesome Probate Lawyers and Estate Lawyers In

Allocable and apportionable income virginia law provides that dividends received are to be allocated to the state of. An owner of a pte may be an individual, a corporation, a partnership, or any other type. Not filed contact us 502ez. Not filed contact us 502v. 1546001745 at present, virginia tax does not support international ach.

Top 11 Virginia Form 502 Templates free to download in PDF format

No application for extension is required. Web date of formation entity type (see instructions) entity name date operations began in virginia naics code number and street: No paper submissions will be accepted. Web form 502ptet and all corresponding schedules must be filed electronically. Virginia schedule 502adj form 502.

An Owner Of A Pte May Be An Individual, A Corporation, A Partnership, Or Any Other Type.

Beginning with the 2008 return, there are two additional lines to complete under. Web the following forms and schedules are prepared for the virginia return: 1546001745 at present, virginia tax does not support international ach. Virginia form 502 pass through entity income tax return;

Web The Entity’s Virginia Return Of Income (Form 502) Filed With The Department Of Taxation.

State or country where incorporated. Not filed contact us 502w. Virginia schedule 502adj form 502. No application for extension is required.

Web Date Of Formation Entity Type (See Instructions) Entity Name Date Operations Began In Virginia Naics Code Number And Street:

Web to the form 502 instructions for more information. (1) first, a pte should determine the allocation and. Not filed contact us 502v. If form 502 is filed more than 6 months after the due date or more.

Web Form 502Ptet And All Corresponding Schedules Must Be Filed Electronically.

Web the draft guidelines provide four steps for a pte to determine its taxable income and tax amount. Web include a copy of your federal return with form 502. 1546001745 at present, virginia tax does not support international ach. Allocable and apportionable income virginia law provides that dividends received are to be allocated to the state of.