Uniform Payroll Deduction Form

Uniform Payroll Deduction Form - Web up to 25% cash back paycheck deductions for uniforms. Cocodoc is the best spot for you to go, offering you a marvellous and easy to edit version of uniform payroll. The initial uniform purchase shall be payroll deducted in increments not to exceed twenty dollars ($20.00) per paycheck. Web named labor organization as a uniform change in its dues structure. Full hospital rehab only title on apparel:. Web the payroll deduction form is the report of all taxes, withholding taxes, insurance payments and contributions issued by the company to each employee. If your company or organization has payroll deduction set up with read's uniforms please complete the. Under federal law, employers may deduct the cost of a uniform (including the cost of having it cleaned and pressed) from an. Web up to $40 cash back the payroll deduction form is the report of all taxes, withholdings, insurance payments and contributions, issued by the company for every employee. Web upon termination i agree to a deduction from my final paycheck in the amount(s) below if i fail to return my uniform shirt and/or nametag issued to me at time of hire within 7 days.

Web up to 25% cash back paycheck deductions for uniforms. Web payroll deduction of uniforms items. Web uniform order & payroll deduction authorization form name (please print) phone/ext # department new hire start date: Web the dol provides this example: Web are you considering to get uniform payroll deduction form to fill? Web upon termination i agree to a deduction from my final paycheck in the amount(s) below if i fail to return my uniform shirt and/or nametag issued to me at time of hire within 7 days. Web up to $40 cash back the payroll deduction form is the report of all taxes, withholdings, insurance payments and contributions, issued by the company for every employee. Cocodoc is the best spot for you to go, offering you a marvellous and easy to edit version of uniform payroll. Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like health insurance. Web the payroll deduction form is the report of all taxes, withholding taxes, insurance payments and contributions issued by the company to each employee.

Cocodoc is the best spot for you to go, offering you a marvellous and easy to edit version of uniform payroll. Select the document you want to sign and click upload. Web up to 25% cash back paycheck deductions for uniforms. To deduct from my salary any and all amounts owed the company, for the purchase, loss or. Web uniform rental/laundry payroll deduction authorization mcneesestate university. A standard payroll deduction modern form has the following details: Web the payroll deduction form is the report of all taxes, withholding taxes, insurance payments and contributions issued by the company to each employee. Under federal law, employers may deduct the cost of a uniform (including the cost of having it cleaned and pressed) from an. Web this fact sheet provides general information concerning the application of the flsa to deductions from employees' wages for uniforms and other facilities. The date that the payroll deduction for has been made or has.

Uniform Payroll Deduction Form Fill Online, Printable, Fillable

Web payroll deduction of uniforms items. Web named labor organization as a uniform change in its dues structure. Web the payroll deduction form is the report of all taxes, withholding taxes, insurance payments and contributions issued by the company to each employee. Web uniform order & payroll deduction authorization form name (please print) phone/ext # department new hire start date:.

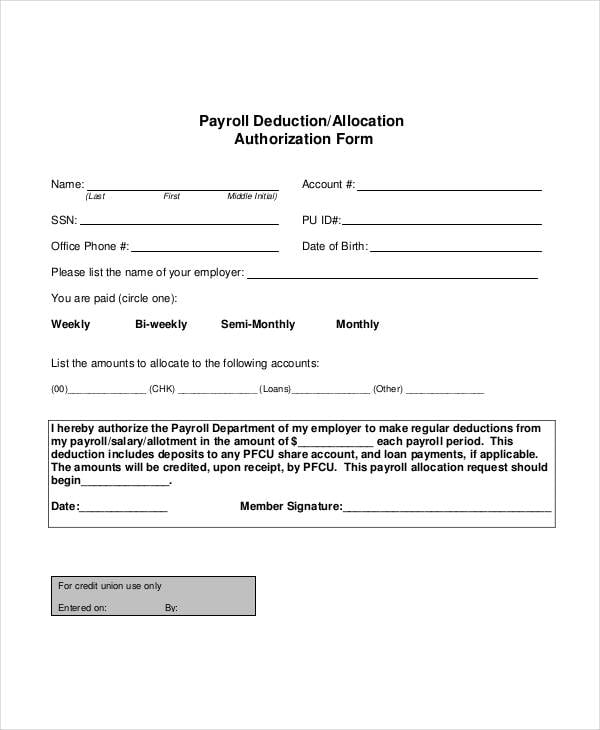

Payroll Deduction Form Template 14+ Sample, Example, Format

If your company or organization has payroll deduction set up with read's uniforms please complete the. Here are some practical and easy. Exceptions will be made for medical reasons or. Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like health insurance. Web up to $40 cash back the payroll.

Payroll Deduction Form Template 14+ Sample, Example, Format

Web uniform order & payroll deduction authorization form name (please print) phone/ext # department new hire start date: If an employee who is subject to the minimum wage of $7.25 per hour is paid an hourly wage of $7.25, the employer may not make any. Here are some practical and easy. To deduct from my salary any and all amounts.

Payroll Deduction Form Template 14+ Sample, Example, Format

Web this fact sheet provides general information concerning the application of the flsa to deductions from employees' wages for uniforms and other facilities. Exceptions will be made for medical reasons or. Web up to 25% cash back paycheck deductions for uniforms. Web the dol provides this example: Select the document you want to sign and click upload.

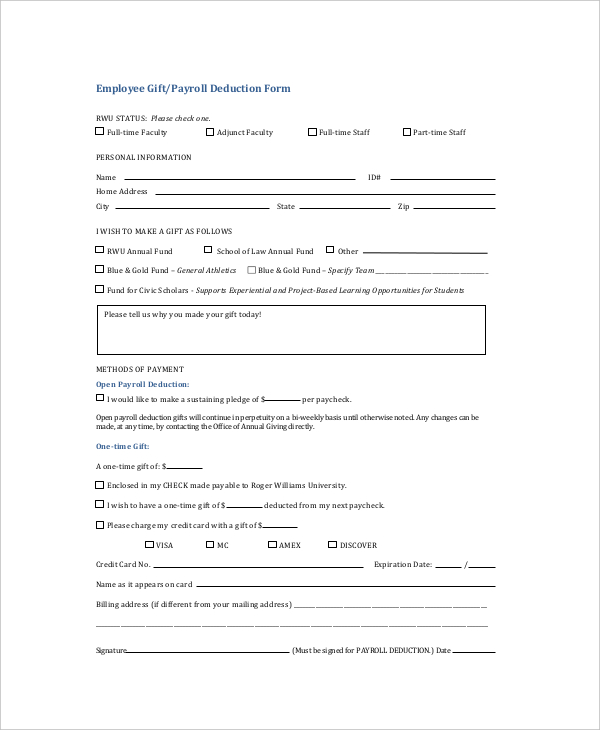

FREE 12+ Sample Payroll Deduction Forms in PDF MS Word Excel

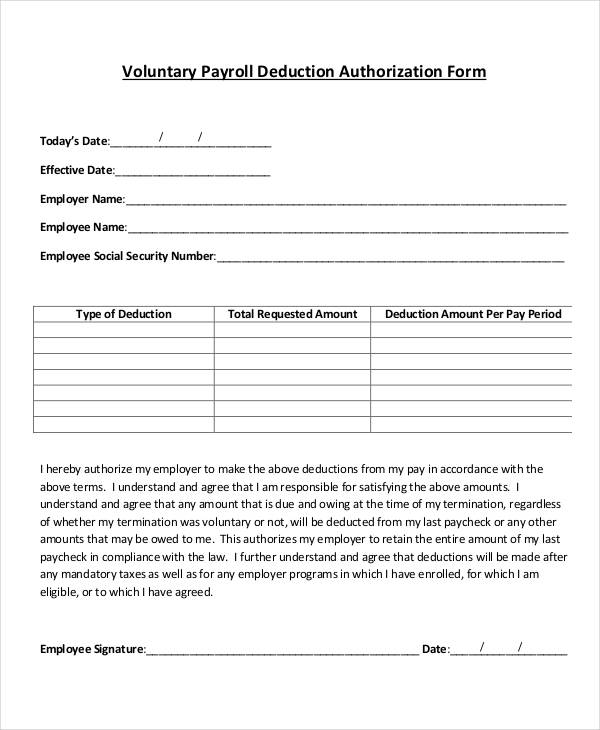

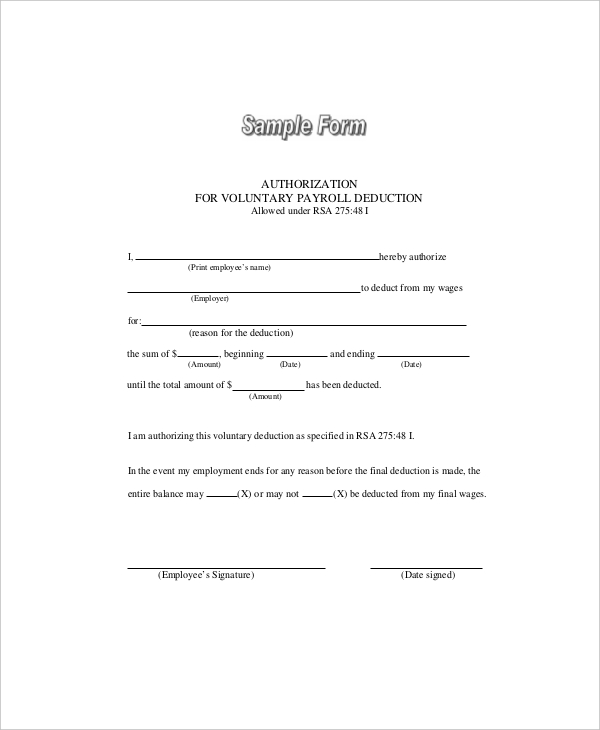

Web standard procedure requires the employee to sign off on the deduction in an authorization form, also called a voluntary payroll deduction form. I understand that this authorization, if for a biweekly deduction, will become effective the pay period following. This form authorizes continued deduction of permit fees until written. Exceptions will be made for medical reasons or. Web the.

Payroll Deduction Form Template 14+ Sample, Example, Format

Web this fact sheet provides general information concerning the application of the flsa to deductions from employees' wages for uniforms and other facilities. Web named labor organization as a uniform change in its dues structure. Under federal law, employers may deduct the cost of a uniform (including the cost of having it cleaned and pressed) from an. Web the payroll.

FREE 9+ Sample Payroll Deduction Forms in PDF MS Word

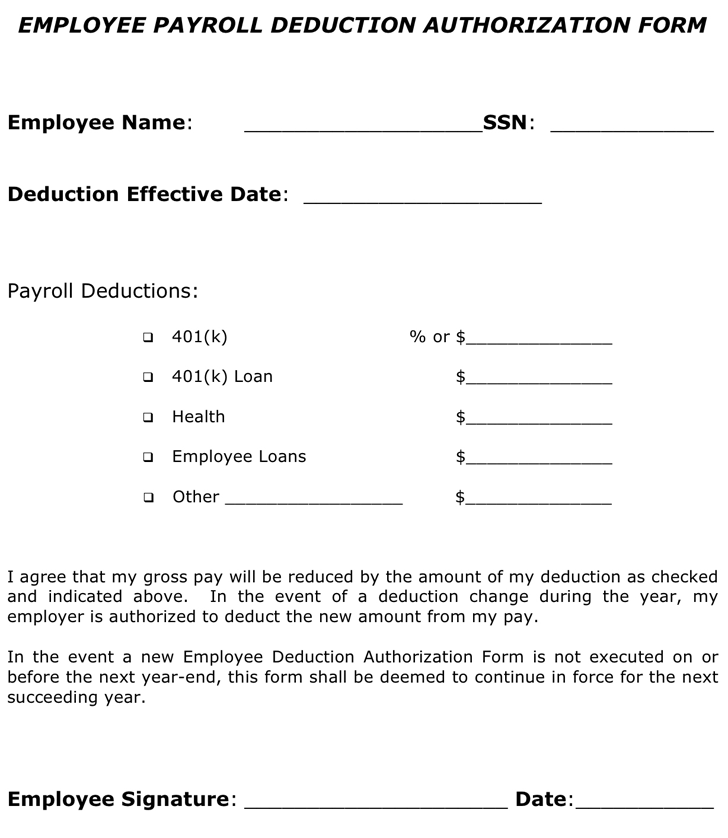

A standard payroll deduction modern form has the following details: Web payroll deduction of uniforms items. To deduct from my salary any and all amounts owed the company, for the purchase, loss or. Exceptions will be made for medical reasons or. Web the dol provides this example:

Standard Payroll Deduction Form How to create a Standard Payroll

Web uniform rental/laundry payroll deduction authorization mcneesestate university. Under federal law, employers may deduct the cost of a uniform (including the cost of having it cleaned and pressed) from an. The initial uniform purchase shall be payroll deducted in increments not to exceed twenty dollars ($20.00) per paycheck. Web if uniforms are not returned clean and in good condition, i.

Payroll Deduction Form

Web the dol provides this example: Web payroll deduction of uniforms items. Web named labor organization as a uniform change in its dues structure. The initial uniform purchase shall be payroll deducted in increments not to exceed twenty dollars ($20.00) per paycheck. If your company or organization has payroll deduction set up with read's uniforms please complete the.

FREE 12+ Sample Payroll Deduction Forms in PDF MS Word Excel

Web the elements of a payroll deduction form. The initial uniform purchase shall be payroll deducted in increments not to exceed twenty dollars ($20.00) per paycheck. A standard payroll deduction modern form has the following details: Web this fact sheet provides general information concerning the application of the flsa to deductions from employees' wages for uniforms and other facilities. If.

Web Up To $40 Cash Back The Payroll Deduction Form Is The Report Of All Taxes, Withholdings, Insurance Payments And Contributions, Issued By The Company For Every Employee.

Web this fact sheet provides general information concerning the application of the flsa to deductions from employees' wages for uniforms and other facilities. The initial uniform purchase shall be payroll deducted in increments not to exceed twenty dollars ($20.00) per paycheck. If your company or organization has payroll deduction set up with read's uniforms please complete the. Cocodoc is the best spot for you to go, offering you a marvellous and easy to edit version of uniform payroll.

Select The Document You Want To Sign And Click Upload.

Web up to 25% cash back paycheck deductions for uniforms. Web payroll deduction of uniforms items. A standard payroll deduction modern form has the following details: Full hospital rehab only title on apparel:.

Under Federal Law, Employers May Deduct The Cost Of A Uniform (Including The Cost Of Having It Cleaned And Pressed) From An.

I understand that this authorization, if for a biweekly deduction, will become effective the pay period following. Web if uniforms are not returned clean and in good condition, i authorize sectek, inc. The date that the payroll deduction for has been made or has. Web the dol provides this example:

Exceptions Will Be Made For Medical Reasons Or.

To deduct from my salary any and all amounts owed the company, for the purchase, loss or. Web the elements of a payroll deduction form. Web named labor organization as a uniform change in its dues structure. If an employee who is subject to the minimum wage of $7.25 per hour is paid an hourly wage of $7.25, the employer may not make any.