Turbotax Form 8915 F-T

Turbotax Form 8915 F-T - You can add form 8815 in your turbotax by following these steps: Web hi hi i need your help on this topic. Now we just have to wait on turbotax to load the form! .2 qualified disaster distribution.2 qualified distribution for. Hopefully it’s done by the end of this. While in your return, click federal taxes > wages & income > i'll choose what i. In this public forum, we are provided with form availability information, but not an explanation as to why certain forms are not. Web as of yesterday, it looks like the 8915f has been finalized by the irs. See the following for a list of forms and when they are available. This form should be the same as 2021 except for the dates 2022 from 2021.

In turbotax online, you may remove the form by: .2 qualified disaster distribution.2 qualified distribution for. If the 2020 distribution was from an account that was not an ira. Continue moved to a profit and. For background info, i withdrew $30,000 under the covid relief. While in your return, click federal taxes > wages & income > i'll choose what i. Web hi hi i need your help on this topic. Turbo tax should not have put. You can add form 8815 in your turbotax by following these steps: Web as of yesterday, it looks like the 8915f has been finalized by the irs.

You can add form 8815 in your turbotax by following these steps: I looked closer and it's not adding. Turbo tax should not have put. It shows it won’t be available until 2/16/23. January 2022), please be advised that those. Web as of yesterday, it looks like the 8915f has been finalized by the irs. The qualified 2020 disaster distributions for qualified. Hopefully it’s done by the end of this. While in your return, click federal taxes > wages & income > i'll choose what i. This form should be the same as 2021 except for the dates 2022 from 2021.

form 8915 e instructions turbotax Renita Wimberly

In this public forum, we are provided with form availability information, but not an explanation as to why certain forms are not. While in your return, click federal taxes > wages & income > i'll choose what i. January 2022), please be advised that those. Web hi hi i need your help on this topic. Today i was able to.

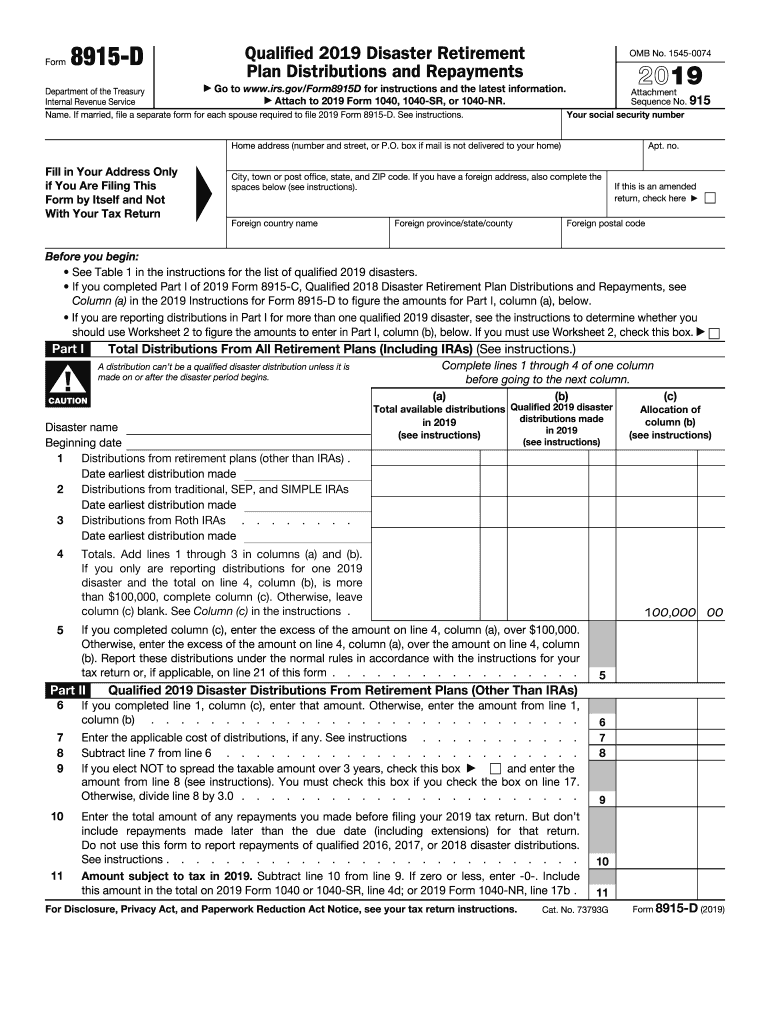

8915 D Form Fill Out and Sign Printable PDF Template signNow

January 2022), please be advised that those. Web 1 best answer. I looked closer and it's not adding. For background info, i withdrew $30,000 under the covid relief. You can add form 8815 in your turbotax by following these steps:

form 8915 e instructions turbotax Renita Wimberly

I looked closer and it's not adding. You can add form 8815 in your turbotax by following these steps: See the following for a list of forms and when they are available. Turbo tax should not have put. .1 who must file.2 when and where to file.2 what is a qualified disaster distribution?

'Forever' form 8915F issued by IRS for retirement distributions Newsday

You can add form 8815 in your turbotax by following these steps: Now we just have to wait on turbotax to load the form! Hopefully it’s done by the end of this. I looked closer and it's not adding. In this public forum, we are provided with form availability information, but not an explanation as to why certain forms are.

form 8915 e instructions turbotax Renita Wimberly

For background info, i withdrew $30,000 under the covid relief. If the 2020 distribution was from an account that was not an ira. The qualified 2020 disaster distributions for qualified. In turbotax online, you may remove the form by: In this public forum, we are provided with form availability information, but not an explanation as to why certain forms are.

Form 8915e TurboTax Updates On QDRP Online & Instructions To File It

The qualified 2020 disaster distributions for qualified. .1 who must file.2 when and where to file.2 what is a qualified disaster distribution? Continue moved to a profit and. If the 2020 distribution was from an account that was not an ira. It shows it won’t be available until 2/16/23.

2022 Form IRS 8915C Fill Online, Printable, Fillable, Blank pdfFiller

January 2022), please be advised that those. Today i was able to complete the form but my tax owed didn't increase. Now we just have to wait on turbotax to load the form! I looked closer and it's not adding. .2 qualified disaster distribution.2 qualified distribution for.

8915e tax form turbotax Bailey Bach

Web 1 best answer. .2 qualified disaster distribution.2 qualified distribution for. While in your return, click federal taxes > wages & income > i'll choose what i. This form should be the same as 2021 except for the dates 2022 from 2021. Hopefully it’s done by the end of this.

form 2555 turbotax Fill Online, Printable, Fillable Blank irsform

The qualified 2020 disaster distributions for qualified. It shows it won’t be available until 2/16/23. You can add form 8815 in your turbotax by following these steps: Turbo tax should not have put. In this public forum, we are provided with form availability information, but not an explanation as to why certain forms are not.

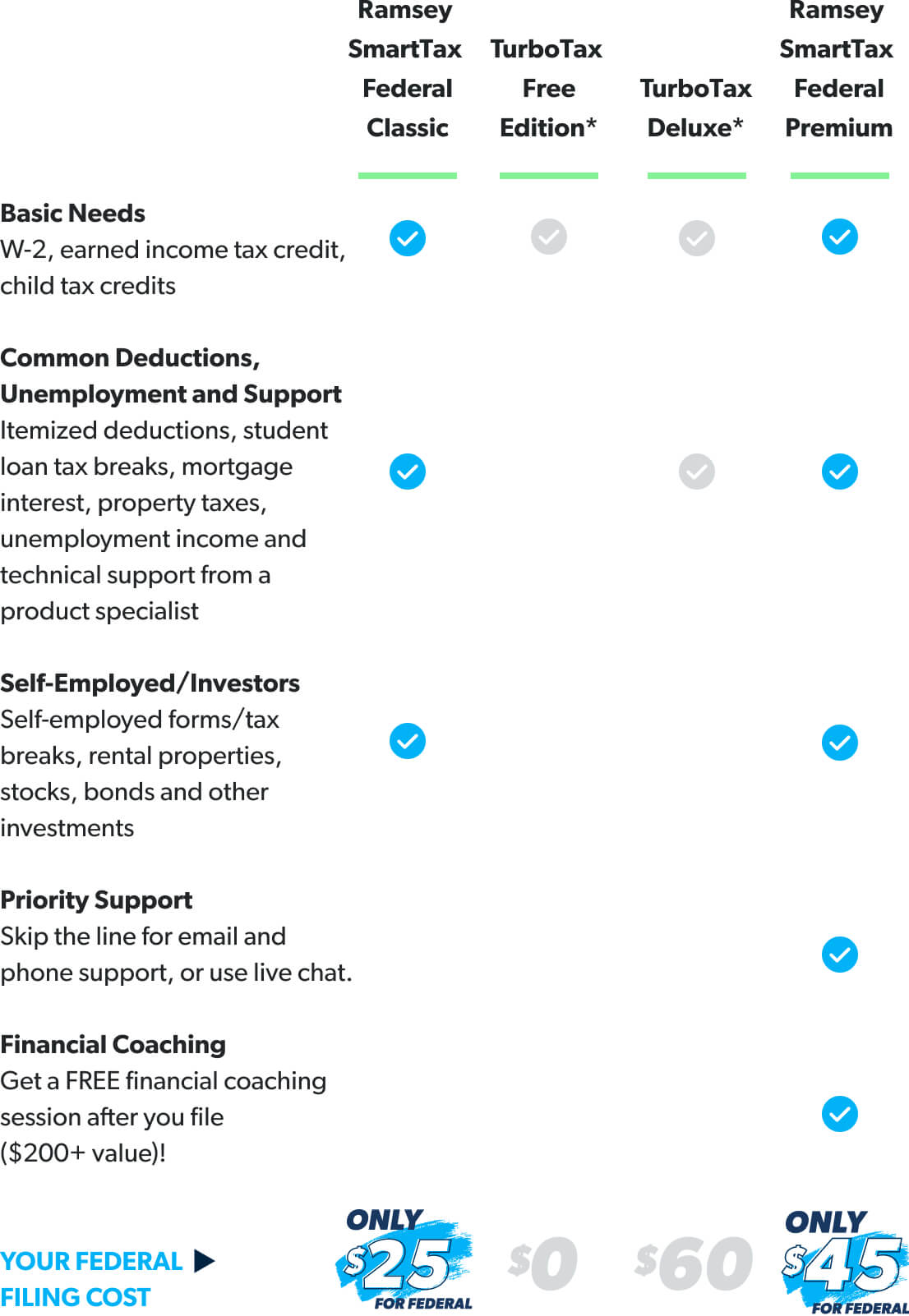

TurboTax makes filing (almost) fun Inside Design Blog

Hopefully it’s done by the end of this. While in your return, click federal taxes > wages & income > i'll choose what i. Now we just have to wait on turbotax to load the form! You can add form 8815 in your turbotax by following these steps: .1 who must file.2 when and where to file.2 what is a.

While In Your Return, Click Federal Taxes > Wages & Income > I'll Choose What I.

I looked closer and it's not adding. Web as of yesterday, it looks like the 8915f has been finalized by the irs. See the following for a list of forms and when they are available. January 2023) qualified disaster retirement plan distributions and repayments department of the treasury internal revenue service attach to form 1040,.

Turbo Tax Should Not Have Put.

Web 1 best answer. Hopefully it’s done by the end of this. Continue moved to a profit and. If the 2020 distribution was from an account that was not an ira.

You Can Add Form 8815 In Your Turbotax By Following These Steps:

In turbotax online, you may remove the form by: The qualified 2020 disaster distributions for qualified. In this public forum, we are provided with form availability information, but not an explanation as to why certain forms are not. Today i was able to complete the form but my tax owed didn't increase.

For Background Info, I Withdrew $30,000 Under The Covid Relief.

.2 qualified disaster distribution.2 qualified distribution for. It shows it won’t be available until 2/16/23. .1 who must file.2 when and where to file.2 what is a qualified disaster distribution? Web hi hi i need your help on this topic.