Tiaa Withdrawal Form

Tiaa Withdrawal Form - You can review your required minimum distributions by logging in to your account from the my account tab. Web the tiaa group of companies does not provide legal or tax advice. A reduced withholding rate may apply if there is a tax treaty between the. Web if this is not included, the withdrawal request will not be processed. Open and fund an ira. Withdrawal forms requesting a check to be mailed without a bank signature guarantee must be received. Withdrawal reason ira assets can be withdrawn at any time. No minimums to open or invest. Web take money out of your account(s) through loans, withdrawals, payouts, retirement income and distributions. Select the web sample in the catalogue.

Web complete withdrawal forms tiaa cref online with us legal forms. Irs rules specify the distribution code. Enter all necessary information in the required. Save or instantly send your ready documents. When you request a withdrawal online, available options will be displayed to you. Easily fill out pdf blank, edit, and sign them. Ad no account opening or maintenance fees. You complete the enclosed forms choosing an amount of $10,000 or more (100% if your account balance is less than $10,000 but greater than $2,000). Web visit tiaa.org to request a withdrawal use your remaining balance for other income options from all mutual funds, cref accounts and the tiaa real estate account in all university. Web the tiaa group of companies does not provide legal or tax advice.

You complete the enclosed forms choosing an amount of $10,000 or more (100% if your account balance is less than $10,000 but greater than $2,000). Web the tiaa group of companies does not provide legal or tax advice. Web limited periodic withdrawals from tiaa retirement annuities and mutual funds tacc/opypayswt f10828 (12/18) important information. Federal reporting, state reporting and withholding. Fill in the blank areas; Web how does it work? Web follow our simple actions to get your tiaa cref withdrawal form well prepared rapidly: No minimums to open or invest. Withdrawal reason ira assets can be withdrawn at any time. Web withdrawals by a nonresident alien generally are subject to a tax withholding rate of 30 percent.

Tiaa Cash withdrawal form Unique Ohio Statesman Columbus Ohio 1870 1871

Involved parties names, addresses and phone. Federal reporting, state reporting and withholding. Web if your plan allows it, you can withdraw money online. Web the tiaa group of companies does not provide legal or tax advice. Tiaa has been making retirement accessible for over 100 years.

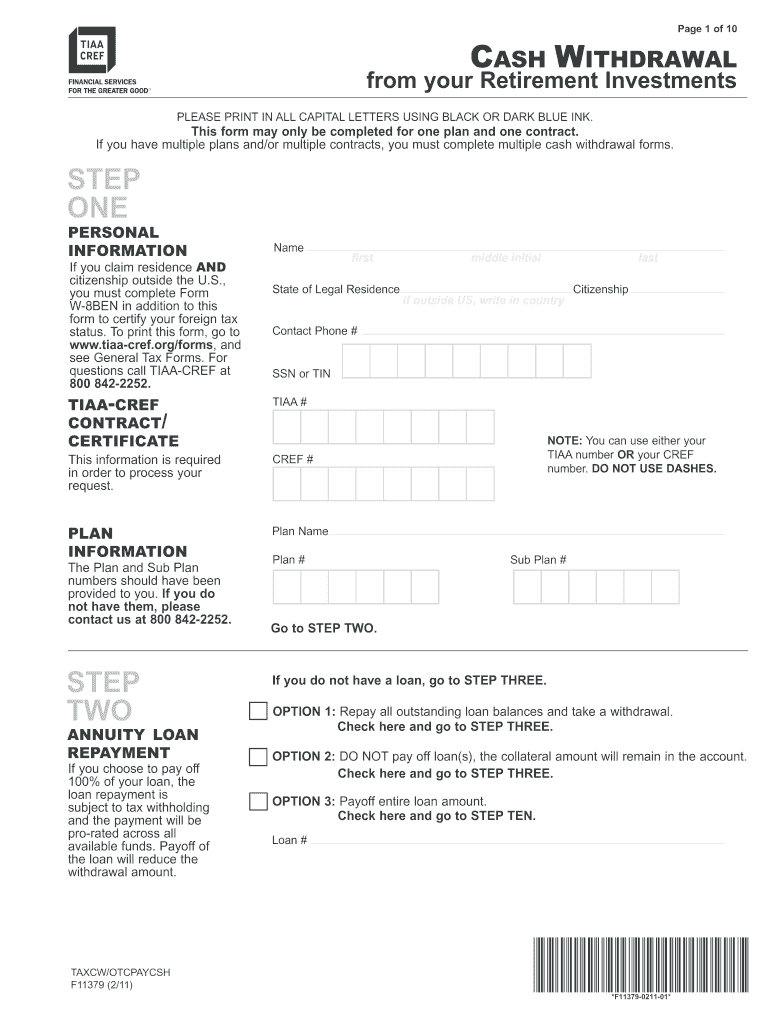

Tiaa Forms F11379 Fill Online, Printable, Fillable, Blank pdfFiller

Enter all necessary information in the required. Withdrawal reason ira assets can be withdrawn at any time. Fill in the blank areas; Web loans, withdrawals, payouts, retirement income and distributions. Tiaa has been making retirement accessible for over 100 years.

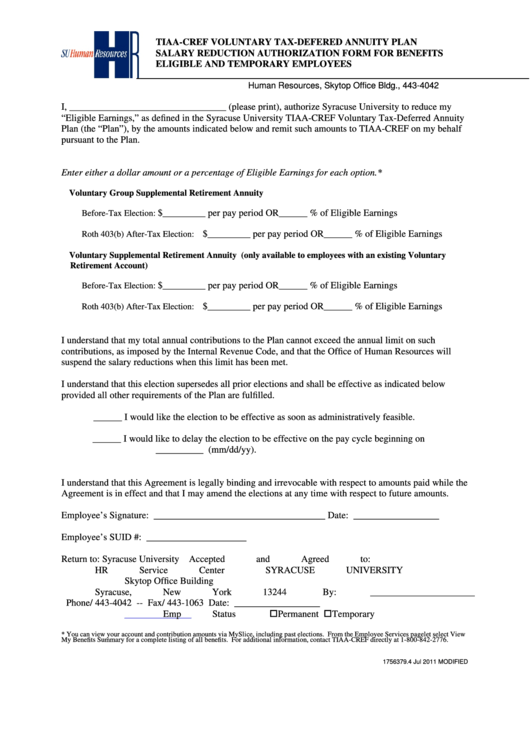

Top Tiaa Cref Forms And Templates free to download in PDF format

Withdrawal reason ira assets can be withdrawn at any time. You complete the enclosed forms choosing an amount of $10,000 or more (100% if your account balance is less than $10,000 but greater than $2,000). Please consult your tax or legal advisor to address your specific circumstances. Web visit tiaa.org to request a withdrawal use your remaining balance for other.

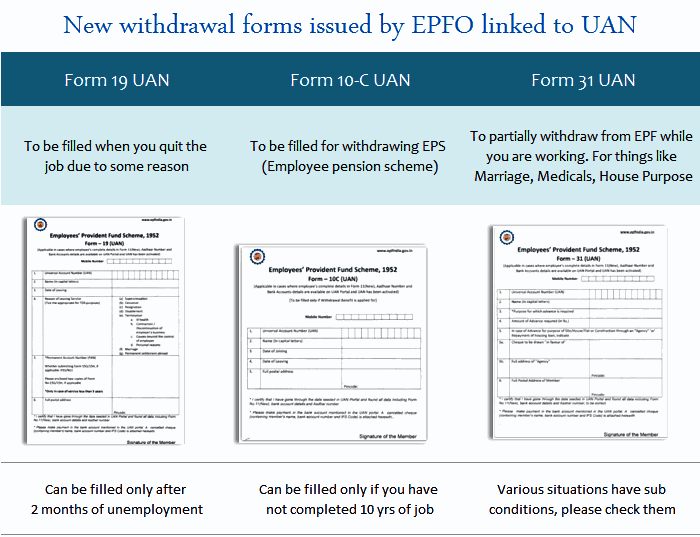

PF Withdrawal Online Procedure EPF Withdrawal Forms, New Rules, Status

Open and fund an ira. Web visit tiaa.org to request a withdrawal use your remaining balance for other income options from all mutual funds, cref accounts and the tiaa real estate account in all university. If you have terminated employment and are not retirement eligible and would like to take a withdrawal from your rsp account, please. Web withdrawal information.

Fill Free fillable TIAA CREF Rollover Form F10462 trans exch 1912

Web complete withdrawal forms tiaa cref online with us legal forms. You complete the enclosed forms choosing an amount of $10,000 or more (100% if your account balance is less than $10,000 but greater than $2,000). Easily fill out pdf blank, edit, and sign them. Web loans, withdrawals, payouts, retirement income and distributions. Ad no account opening or maintenance fees.

F11379 Form Fill Out and Sign Printable PDF Template signNow

A reduced withholding rate may apply if there is a tax treaty between the. Tiaa has been making retirement accessible for over 100 years. Withdrawal reason ira assets can be withdrawn at any time. Save or instantly send your ready documents. When you request a withdrawal online, available options will be displayed to you.

Tiaa Cash withdrawal form New the Daily Dispatch Richmond [va ] 1850

Irs rules specify the distribution code. Save or instantly send your ready documents. You can review your required minimum distributions by logging in to your account from the my account tab. Tiaa has been making retirement accessible for over 100 years. Web the tiaa group of companies does not provide legal or tax advice.

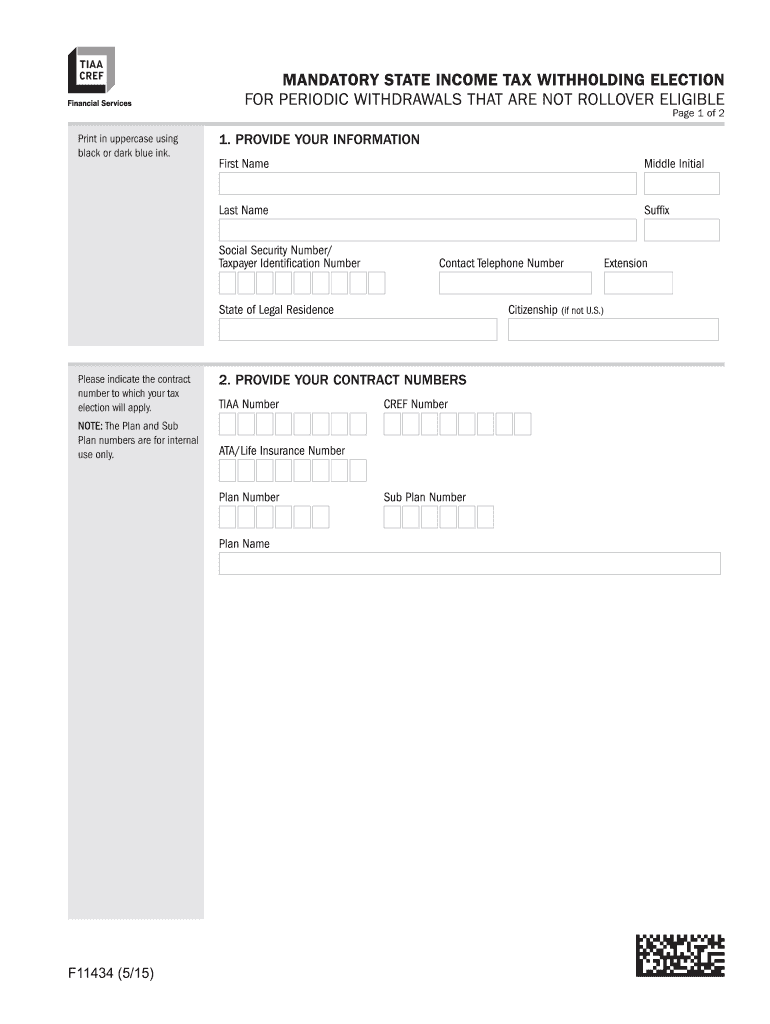

NY TIAA F11434 20152022 Fill and Sign Printable Template Online US

Web limited periodic withdrawals from tiaa retirement annuities and mutual funds tacc/opypayswt f10828 (12/18) important information. You complete the enclosed forms choosing an amount of $10,000 or more (100% if your account balance is less than $10,000 but greater than $2,000). Web how does it work? Fill in the blank areas; Web the tiaa group of companies does not provide.

Tiaa Cash withdrawal form Unique form N Csrs Putnam Premier In E for Jan 31

Enter all necessary information in the required. Web loans, withdrawals, payouts, retirement income and distributions. Web withdrawals by a nonresident alien generally are subject to a tax withholding rate of 30 percent. Easily fill out pdf blank, edit, and sign them. Web complete withdrawal forms tiaa cref online with us legal forms.

Save Or Instantly Send Your Ready Documents.

Most ira withdrawals are reported to the irs. Easily fill out pdf blank, edit, and sign them. Web how does it work? Web loans, withdrawals, payouts, retirement income and distributions.

If You Have Terminated Employment And Are Not Retirement Eligible And Would Like To Take A Withdrawal From Your Rsp Account, Please.

Web take money out of your account(s) through loans, withdrawals, payouts, retirement income and distributions. Web complete withdrawal forms tiaa cref online with us legal forms. Web follow our simple actions to get your tiaa cref withdrawal form well prepared rapidly: Fill in the blank areas;

Web Withdrawals By A Nonresident Alien Generally Are Subject To A Tax Withholding Rate Of 30 Percent.

Withdrawal forms requesting a check to be mailed without a bank signature guarantee must be received. Enter all necessary information in the required. Easily fill out pdf blank, edit, and sign them. You can review your required minimum distributions by logging in to your account from the my account tab.

Web Retirement Savings Plan (Rsp) Forms.

Tiaa has been making retirement accessible for over 100 years. Web follow the simple instructions below: Open and fund an ira. Web withdrawal information total withdrawal amount withdrawal date this withdrawal will close this ira withdrawal reason (select one) transfer to.

![Tiaa Cash withdrawal form New the Daily Dispatch Richmond [va ] 1850](https://www.flaminke.com/wp-content/uploads/2019/10/tiaa-cash-withdrawal-form-new-the-daily-dispatch-richmond-va-1850-1884-august-07-of-tiaa-cash-withdrawal-form.jpg)