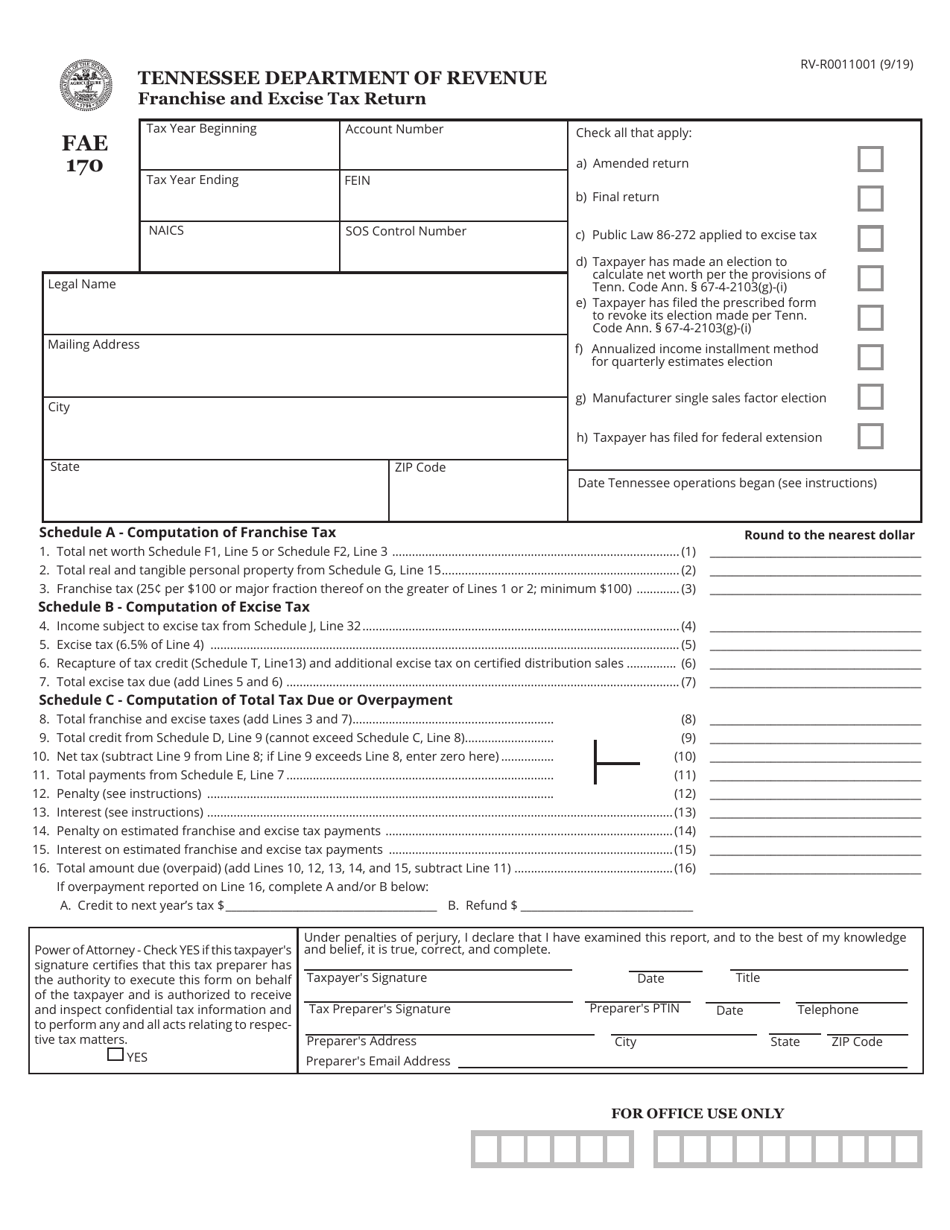

Tennessee Form 170

Tennessee Form 170 - On filler, you can find forms for the 2008, 2010 and 2014 taxable years. Multiply amounts on lines 11(a) through 14(a) by the multiples on lines 11(b) through 14(b), and enter each total on lines 11(c) through 14(c). Web follow the simple instructions below: Web use our detailed instructions to fill out and esign your documents online. The link below will provide everything you need for filing the form. Web up to $40 cash back this form in particular is designed for entrepreneurs in the state of tennessee. For tax years beginning on or after 1/1/20, and ending on or before 12/31/20. Web file a franchise and excise tax return (form fae170). Complete, edit or print tax forms instantly. Tennessee form fae 170, page 1, is then prepared and a minimum franchise tax of.

Web the franchise & excise tax return (fae 170) can be filed as an amended return. Web how do i generate tennessee form fae 170 sch m in individual tax using worksheet view? Web form fae 170, consolidated net worth election registration application tennessee franchise, excise fae 170 tax return if the partnership is inactive in tennessee, enter an x on the tennessee > general > basic data > taxpayer is inactive in tn field. You can print other tennessee tax forms here. To indicate that the return is amended, from the main menu of the tennessee return select heading information > amended return. Use the tips on how to fill out the tn dor fae 170: We will update this page with a new version of the form for 2024 as soon as it is made available by the tennessee government. For tax years beginning on or after 1/1/20, and ending on or before 12/31/20. Web follow the simple instructions below: Get ready for tax season deadlines by completing any required tax forms today.

The link below will provide everything you need for filing the form. Web thinking of filing tennessee form fae 170? This form is for income earned in tax year 2022, with tax returns due in april 2023. Taxpayers incorporated or otherwise formed What is form fae 170 for? Tennessee form fae 170, page 1, is then prepared and a minimum franchise tax of. Web the franchise & excise tax return (fae 170) can be filed as an amended return. Web form fae170 returns, schedules and instructions for prior years. Get ready for tax season deadlines by completing any required tax forms today. Fae in the form index stands for franchise and excise.

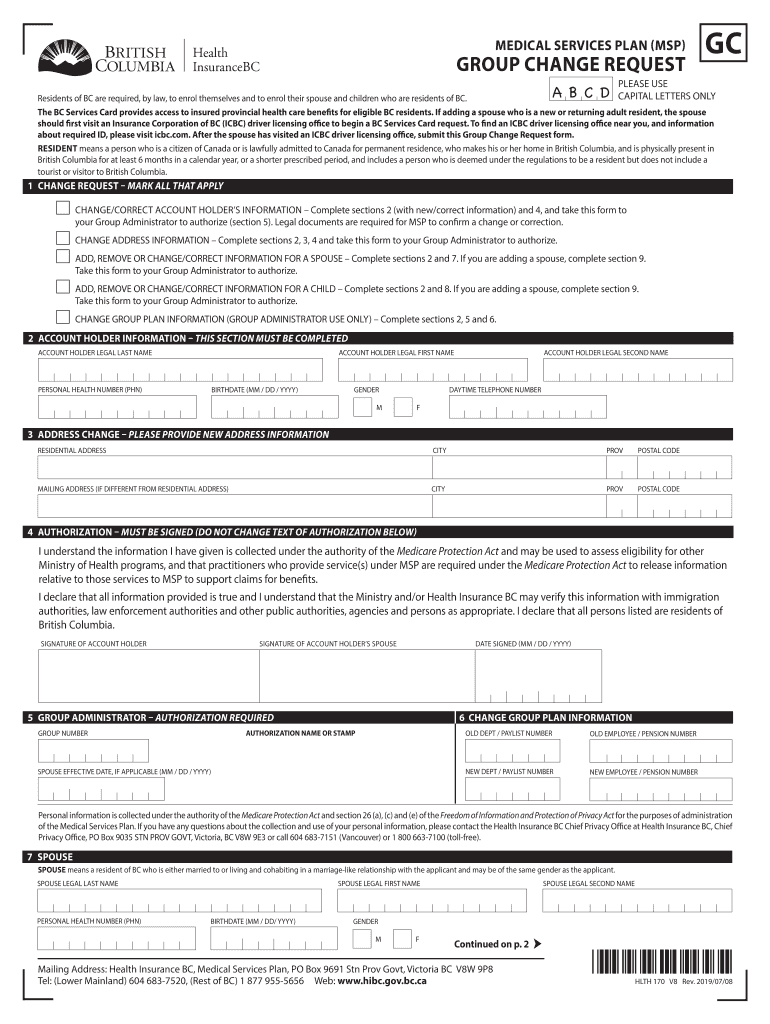

20192021 Form Canada HLTH 170 Fill Online, Printable, Fillable, Blank

We will update this page with a new version of the form for 2024 as soon as it is made available by the tennessee government. You can print other tennessee tax forms here. Tennessee form fae 170, page 1, is then prepared and a minimum franchise tax of. It's not supported for electronic filing when prepared in conjunction with federal.

Form FAE170 (RVR0011001) Download Printable PDF or Fill Online

Web annual rental paid for property located in tennessee. Taxable year fein or ssn beginning: You can print other tennessee tax forms here. File a franchise and excise tax return for an entity that only owes the $100 minimum franchise tax. Complete, edit or print tax forms instantly.

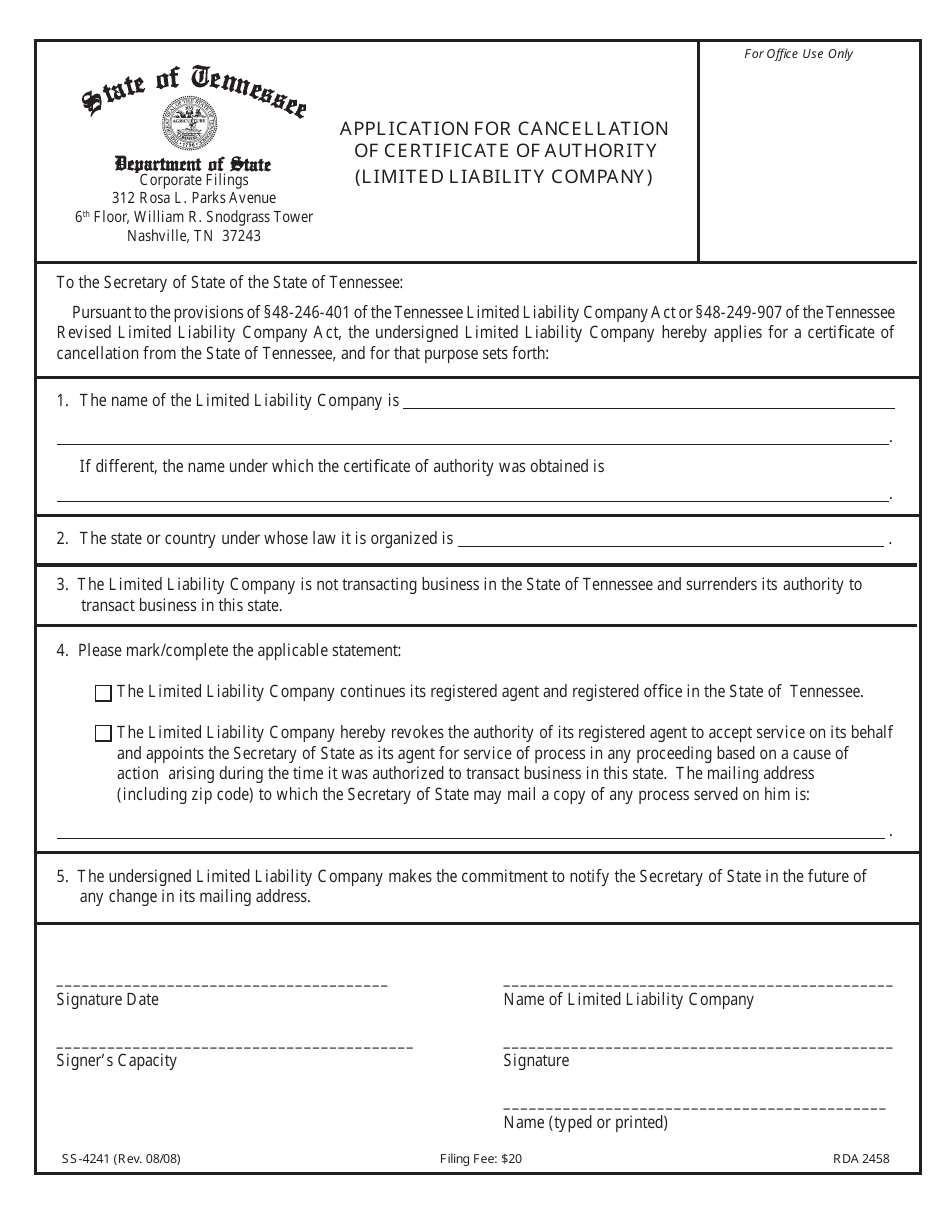

Form SS4241 Download Printable PDF or Fill Online Application for

Tennessee franchise & excise tax form fae 170 franchise and excise tax return. Web use our detailed instructions to fill out and esign your documents online. Web how do i generate tennessee form fae 170 sch m in individual tax using worksheet view? Taxpayers incorporated or otherwise formed You can print other tennessee tax forms here.

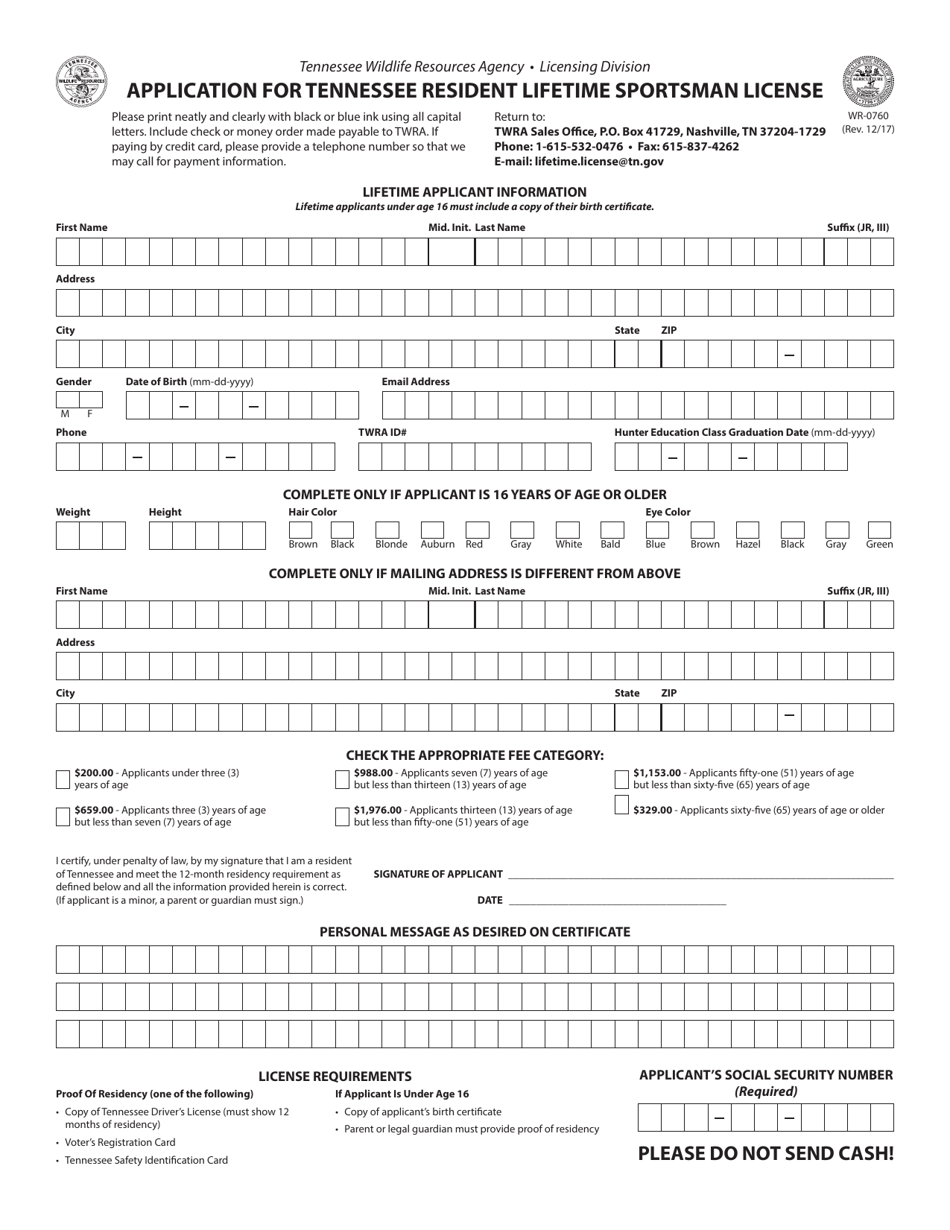

Form WR0760 Download Printable PDF or Fill Online Application for

Tennessee form fae 170, page 1, is then prepared and a minimum franchise tax of. Web how do i generate tennessee form fae 170 sch m in individual tax using worksheet view? This form includes 8 pages of schedules for the annual franchise and excise tax reports. Tax blank completion can become a serious challenge and serious headache if no.

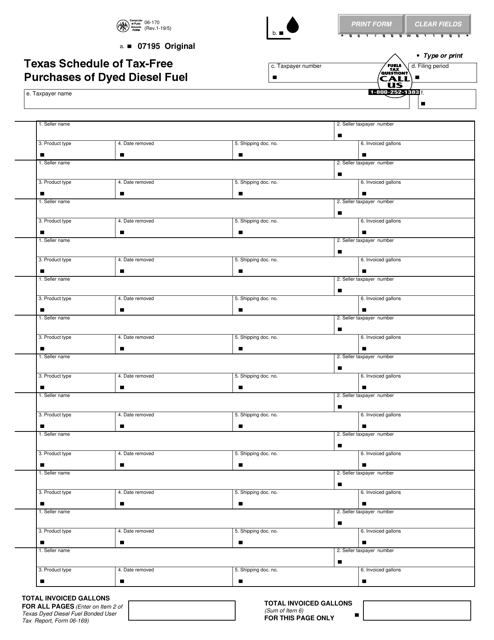

Form 06170 Download Fillable PDF or Fill Online Texas Schedule of Tax

To indicate that the return is amended, from the main menu of the tennessee return select heading information > amended return. Web fae 170if this is an amended return, please} check the box at right. Ad register and subscribe now to work on your tn dor form fae 170 & more fillable forms. It's not supported for electronic filing when.

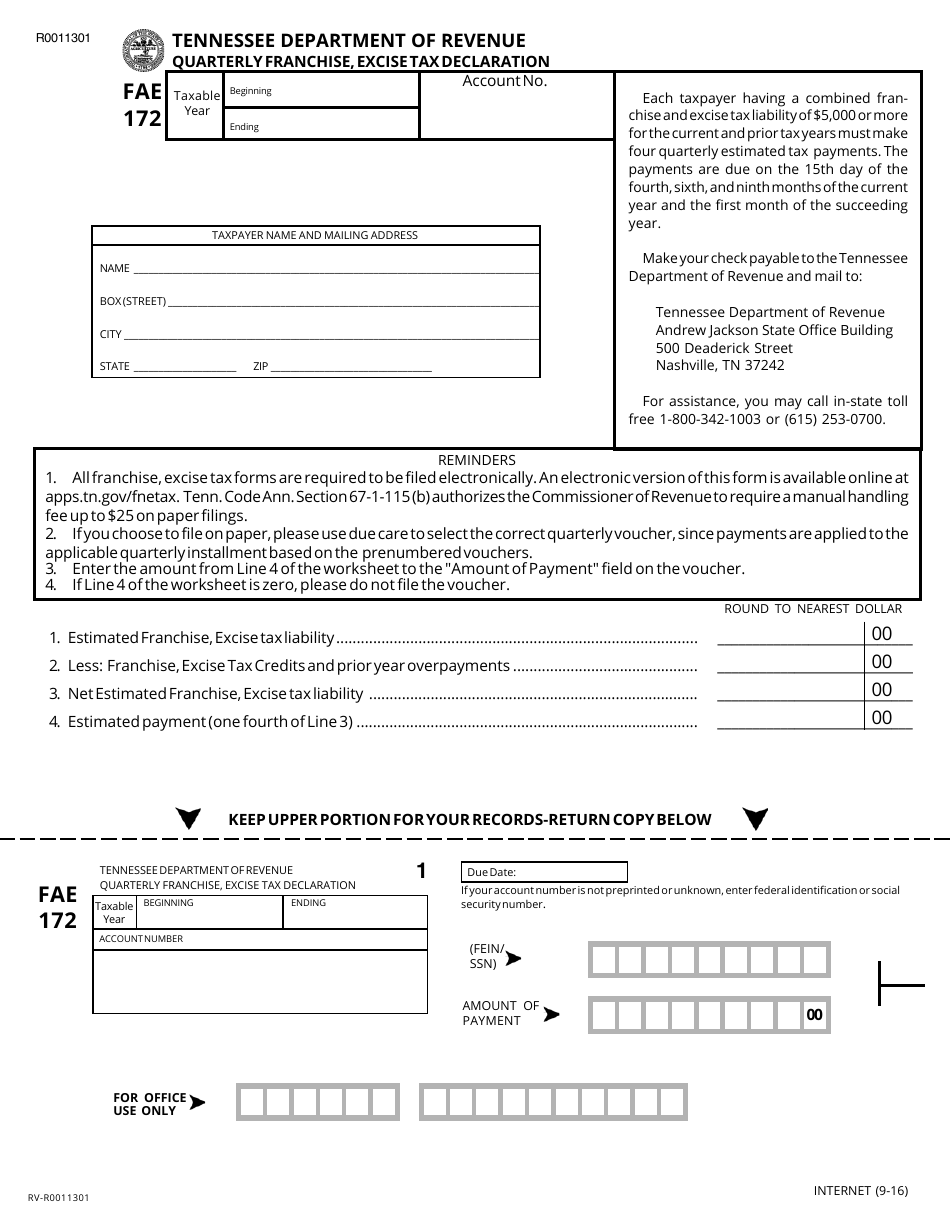

Form FAE172 Download Printable PDF or Fill Online Quarterly Franchise

Web how do i generate tennessee form fae 170 sch m in individual tax using worksheet view? Ad register and subscribe now to work on your tn dor form fae 170 & more fillable forms. Tennessee form fae 170, page 1, is then prepared and a minimum franchise tax of. Web date tennessee operations began should be completed if this.

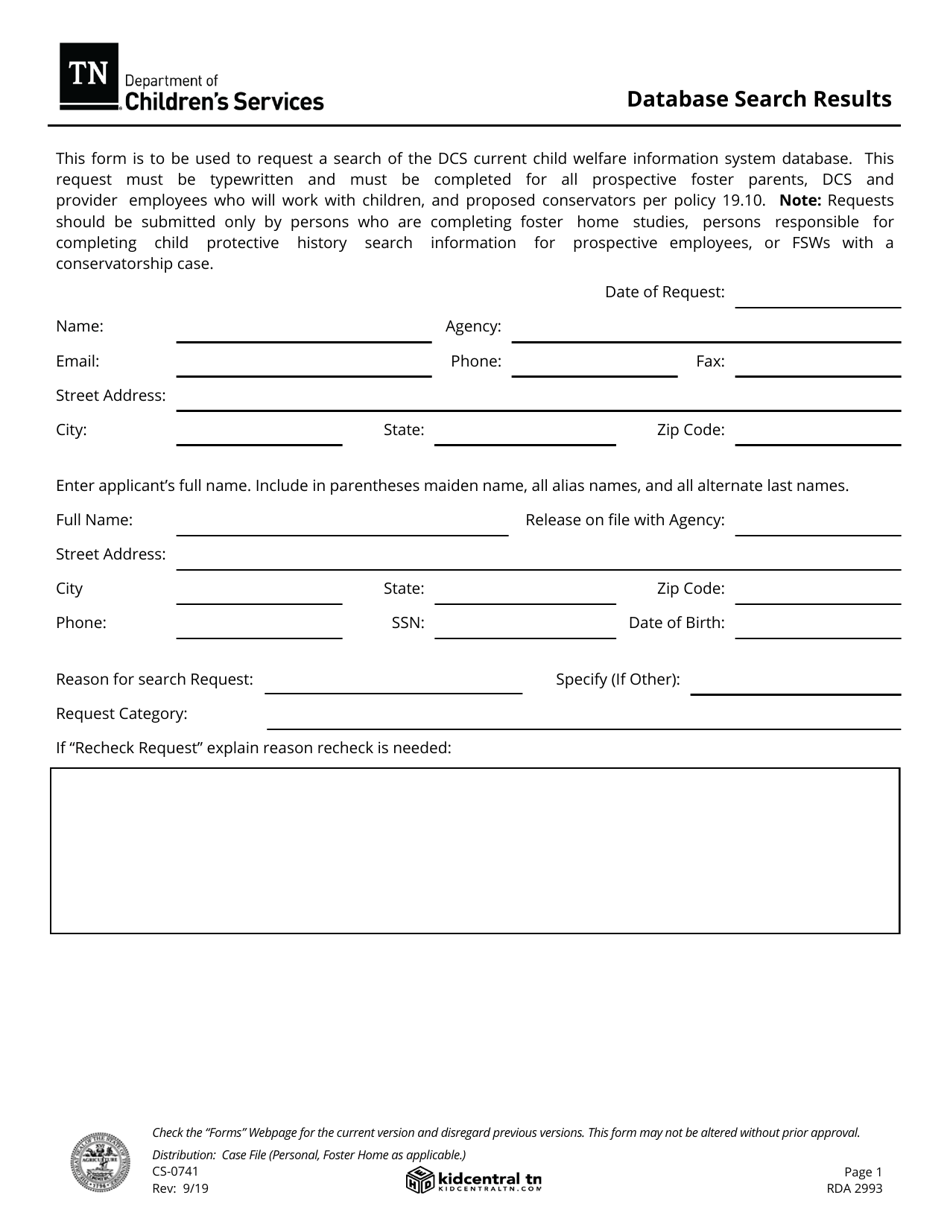

Form CS0741 Download Fillable PDF or Fill Online Database Search

Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date tennessee operations began, whichever occurred first. On filler, you can find forms for the 2008, 2010 and 2014 taxable years. Tennessee form fae 170, page 1, is then prepared and a minimum franchise tax of. Tennessee franchise.

TN DoR FAE 170 2017 Fill out Tax Template Online US Legal Forms

On filler, you can find forms for the 2008, 2010 and 2014 taxable years. File the annual exemption renewal (form fae183). Web annual rental paid for property located in tennessee. Web the franchise & excise tax return (fae 170) can be filed as an amended return. Tax blank completion can become a serious challenge and serious headache if no correct.

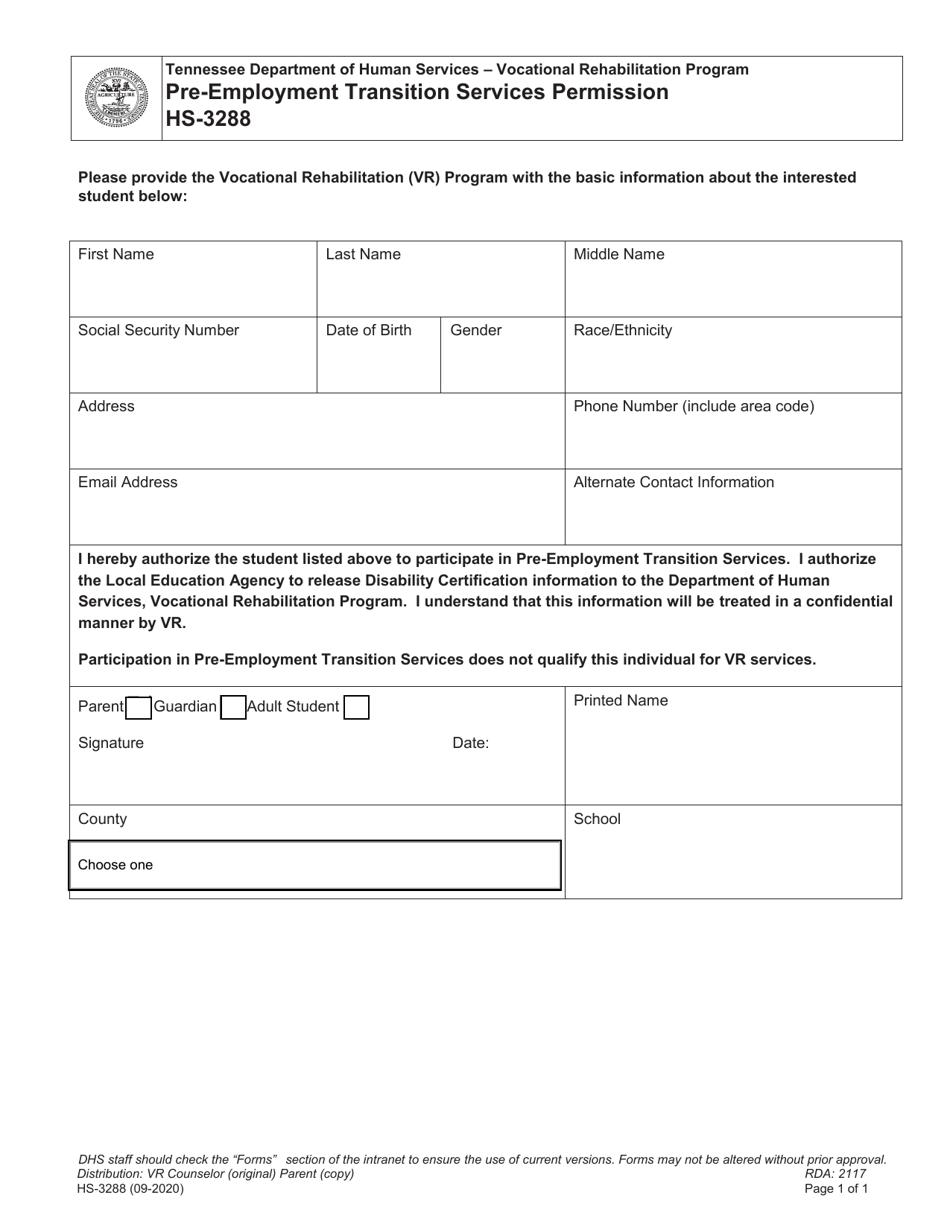

Form HS3288 Download Fillable PDF or Fill Online Preemployment

Web thinking of filing tennessee form fae 170? Complete, edit or print tax forms instantly. Web how do i generate tennessee form fae 170 sch m in individual tax using worksheet view? Tennessee form fae 170, page 1, is then prepared and a minimum franchise tax of. Use the tips on how to fill out the tn dor fae 170:

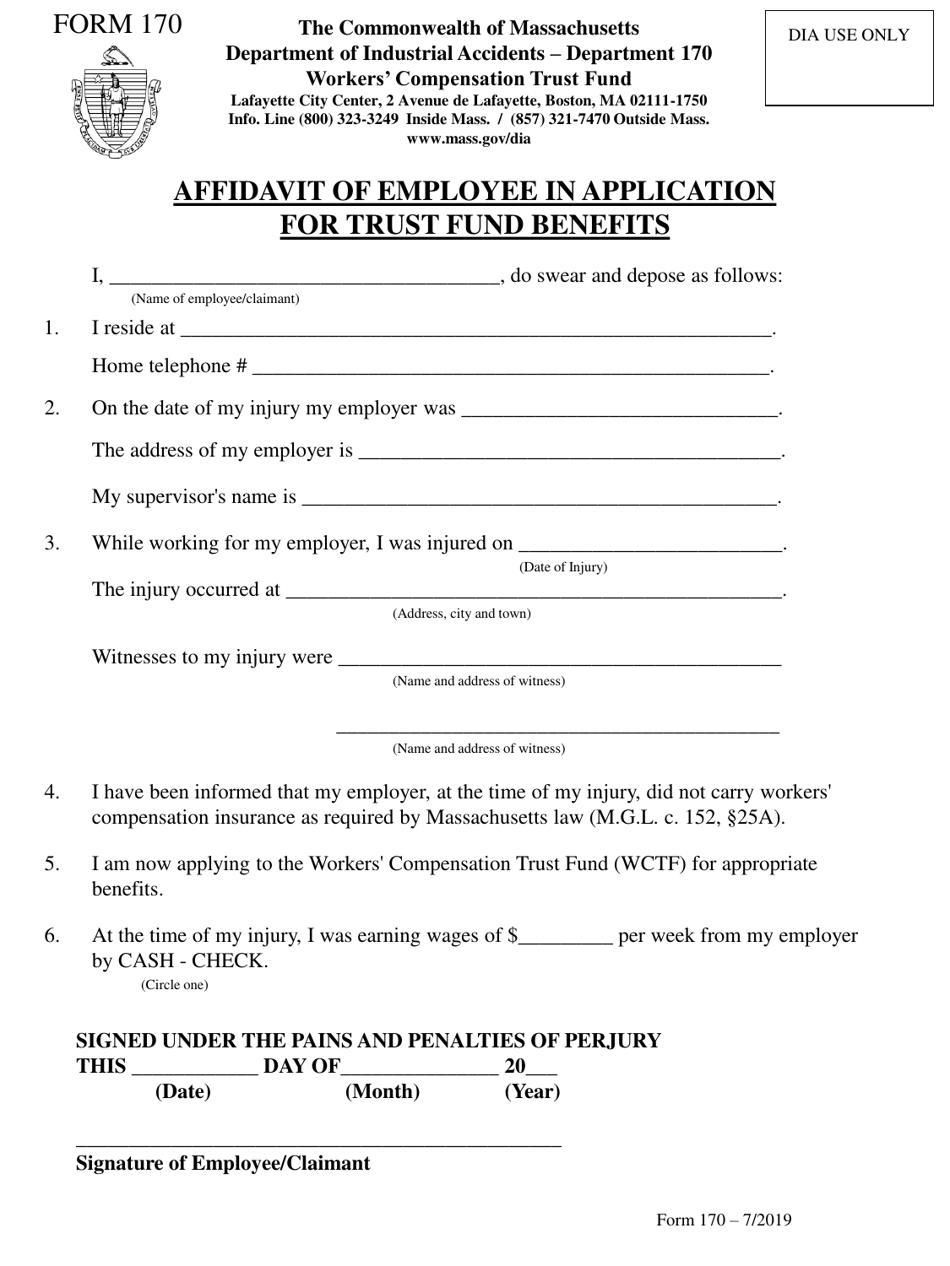

Form 170 Download Fillable PDF or Fill Online Affidavit of Employee in

Use the tips on how to fill out the tn dor fae 170: Taxable year fein or ssn beginning: For tax years beginning on or after 1/1/19, and ending on or before 12/31/19. Web follow the simple instructions below: It's not supported for electronic filing when prepared in conjunction with federal forms 1040 and 1041.

Web Date Tennessee Operations Began Should Be Completed If This Is The Initial Return.

It's not supported for electronic filing when prepared in conjunction with federal forms 1040 and 1041. For tax years beginning on or after 1/1/21, and ending on or before 12/31/21. For tax years beginning on or after 1/1/20, and ending on or before 12/31/20. Web form fae170 returns, schedules and instructions for prior years.

Web The Franchise & Excise Tax Return (Fae 170) Can Be Filed As An Amended Return.

To indicate that the return is amended, from the main menu of the tennessee return select heading information > amended return. Web form fae 170, consolidated net worth election registration application tennessee franchise, excise fae 170 tax return if the partnership is inactive in tennessee, enter an x on the tennessee > general > basic data > taxpayer is inactive in tn field. Taxable year fein or ssn beginning: File the annual exemption renewal (form fae183).

This Form Includes 8 Pages Of Schedules For The Annual Franchise And Excise Tax Reports.

Web file a franchise and excise tax return (form fae170). Complete, edit or print tax forms instantly. File a franchise and excise tax return for an entity that only owes the $100 minimum franchise tax. Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date tennessee operations began, whichever occurred first.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

Taxpayers incorporated or otherwise formed Tax blank completion can become a serious challenge and serious headache if no correct assistance provided. Web use our detailed instructions to fill out and esign your documents online. The link below will provide everything you need for filing the form.