Tax Form For Us Citizen Living Abroad

Tax Form For Us Citizen Living Abroad - If you are a u.s. File your return using the appropriate address for your. Expat’s guide to state taxes while living abroad at a glance do expats pay state taxes? Web october 25, 2022 resource center filing the u.s. We have decades of experience with holistic international tax strategies and planning. Web file international taxpayers foreign earned income exclusion if you meet certain requirements, you may qualify for the foreign earned income exclusion, the. Tax return if you live abroad, including: Even though you no longer reside in the. Web internal revenue code section 7701 (a) (30) for the definition of a u.s. Web to use the feie, you must be:

Web irs filing dates for us citizens living abroad. Tax return if you live abroad, including: Citizen living abroad may be responsible for paying taxes. What special tax credits and deductions you may qualify for based on: Ad our international tax services can be customized to fit your specific business needs. If you are a u.s. If you are a nonresident alien, you will file. Tax purposes unless you meet one of two tests. Turbotax will figure out if you’re eligible for this exclusion or you can use the feie allows you to exclude a significant part of your. Web file international taxpayers foreign earned income exclusion if you meet certain requirements, you may qualify for the foreign earned income exclusion, the.

Web learn from the irs about filing a u.s. Tax information for foreign persons with income in the u.s. Web irs filing dates for us citizens living abroad. And foreign payment of a u.s. Citizen, you are considered a nonresident of the united states for u.s. Web you file form 2555 to claim the foreign earned income exclusion and/or the foreign housing exclusion or deduction. Resident, you must report all interest, dividends, wages, or other. File your return using the appropriate address for your. Web fortunately or unfortunately, u.s. You are a resident of the.

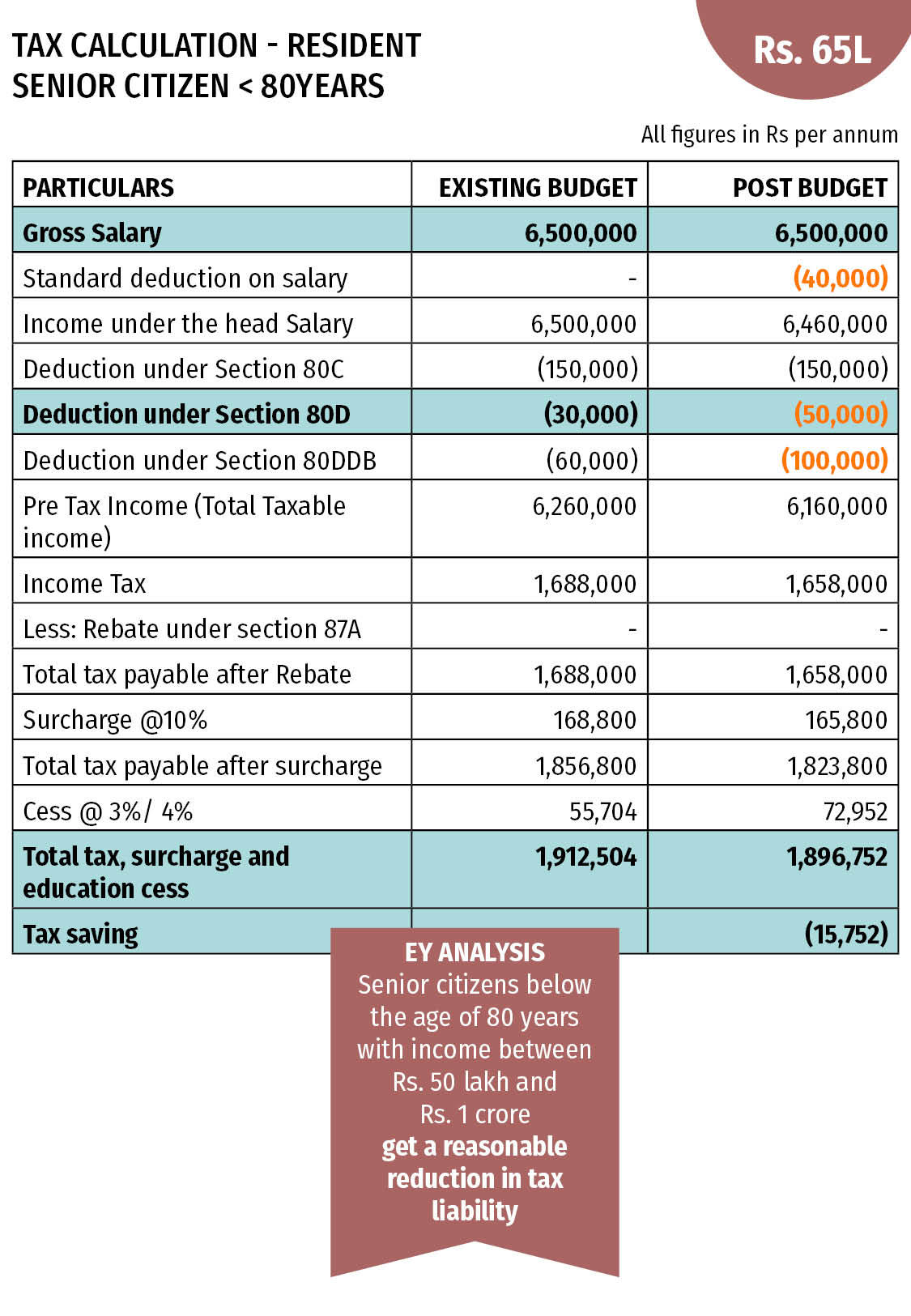

Senior Citizen Tax Benefits Piggy Blog

If you are a u.s. Expat’s guide to state taxes while living abroad at a glance do expats pay state taxes? If you qualify as an american citizen residing. Web irs filing dates for us citizens living abroad. Tax purposes unless you meet one of two tests.

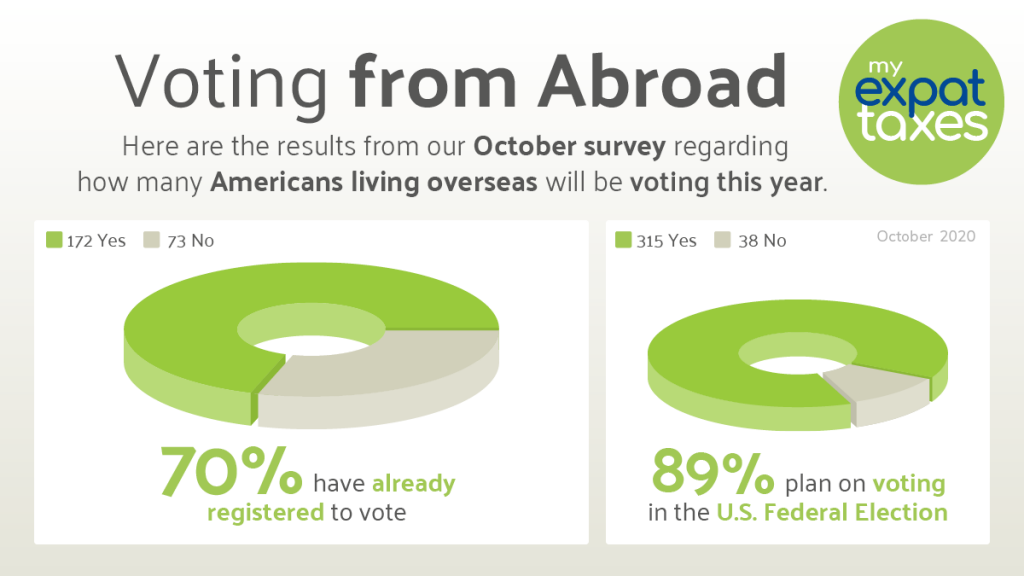

Voting As a US Citizen Abroad Survey Results 2020 MyExpatTaxes

Web to use the feie, you must be: Web file international taxpayers foreign earned income exclusion if you meet certain requirements, you may qualify for the foreign earned income exclusion, the. File your return using the appropriate address for your. Web you can request an additional extension by filing form 4868. If you are a nonresident alien, you will file.

The Complete Guide to Filing US Taxes from Abroad

Web you file form 2555 to claim the foreign earned income exclusion and/or the foreign housing exclusion or deduction. December 1, 2022 tax responsibilities of u.s. Web to use the feie, you must be: And foreign payment of a u.s. Turbotax will figure out if you’re eligible for this exclusion or you can use the feie allows you to exclude.

Tax Benefits for Senior Citizens Budget 2018 proposes tax, other

Ad our international tax services can be customized to fit your specific business needs. Web if you are not a u.s. Citizen, you are considered a nonresident of the united states for u.s. Citizen or resident living or traveling outside the united states, you generally are. Web this means that as an american living abroad, you will need to file.

Six Ways the US Can and Will Tax American Citizens Living Abroad…If

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Citizens and resident aliens living abroad if you’re a u.s. You are a resident of the. Ad our international tax services can be customized to fit your specific business needs. Citizen and resident aliens living abroad should know their tax obligations.

Irs citizen living abroad tax instructions

January 26, 2022 | last updated: If you are a u.s. Web you file form 2555 to claim the foreign earned income exclusion and/or the foreign housing exclusion or deduction. Web fortunately or unfortunately, u.s. Web internal revenue code section 7701 (a) (30) for the definition of a u.s.

husband us citizen living abroad how to file for a divorce

File your return using the appropriate address for your. Tax return if you live abroad, including: Resident, you must report all interest, dividends, wages, or other. Citizens and green card holders may still have to file u.s. Web a common question you may have is “does a us citizen living abroad file a 1040 or 1040nr?” the answer is, it.

Irs citizen living abroad tax instructions

If you are a u.s. Citizen and resident aliens living abroad should know their tax obligations. Citizen or resident living or traveling outside the united states, you generally are. What special tax credits and deductions you may qualify for based on: Web taxes generally, united states citizens get taxed on their worldwide income regardless of where they reside, so a.

U.S. Citizens Living Abroad Tax Exemptions and Exclusions

Web taxes generally, united states citizens get taxed on their worldwide income regardless of where they reside, so a u.s. Web to use the feie, you must be: Web irs filing dates for us citizens living abroad. Citizens and green card holders may still have to file u.s. Even though you no longer reside in the.

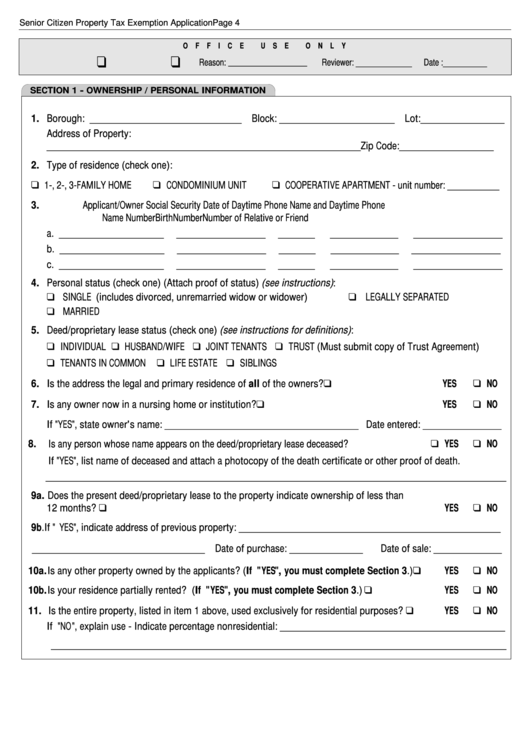

Senior Citizen Property Tax Exemption Application Form printable pdf

Web if you are not a u.s. If you qualify as an american citizen residing. Citizens and resident aliens living abroad if you’re a u.s. Even though you no longer reside in the. Web a common question you may have is “does a us citizen living abroad file a 1040 or 1040nr?” the answer is, it depends.

Tax Purposes Unless You Meet One Of Two Tests.

And foreign payment of a u.s. Resident's income is generally subject to tax in the same manner as a u.s. Web irs filing dates for us citizens living abroad. Citizens and resident aliens with income outside the u.s.

Even Though You No Longer Reside In The.

Citizen, you are considered a nonresident of the united states for u.s. Web taxes generally, united states citizens get taxed on their worldwide income regardless of where they reside, so a u.s. Web if you are not a u.s. Web internal revenue code section 7701 (a) (30) for the definition of a u.s.

Citizens And Resident Aliens Living Abroad If You’re A U.s.

Web file international taxpayers foreign earned income exclusion if you meet certain requirements, you may qualify for the foreign earned income exclusion, the. If you are a nonresident alien, you will file. Citizen and resident aliens living abroad should know their tax obligations. Citizen living abroad may be responsible for paying taxes.

Web Fortunately Or Unfortunately, U.s.

If you are a u.s. Citizen or resident living or traveling outside the united states, you generally are. What special tax credits and deductions you may qualify for based on: Ad our international tax services can be customized to fit your specific business needs.