Tax Form Daycare Providers Give Parents

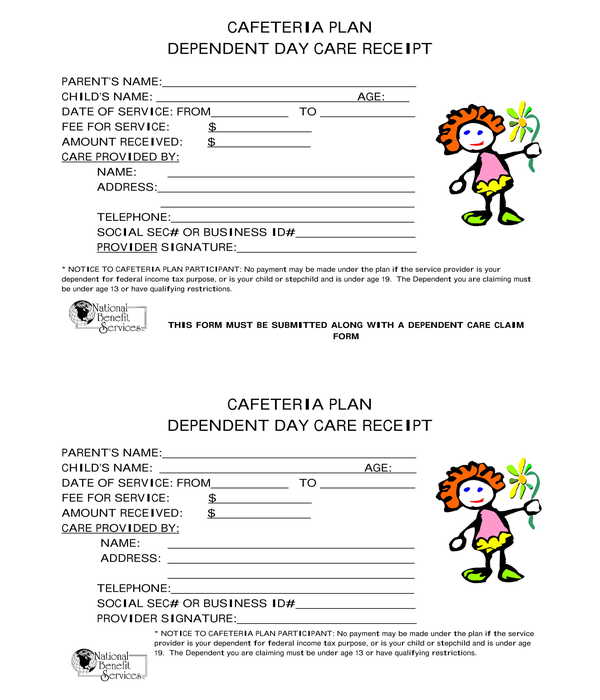

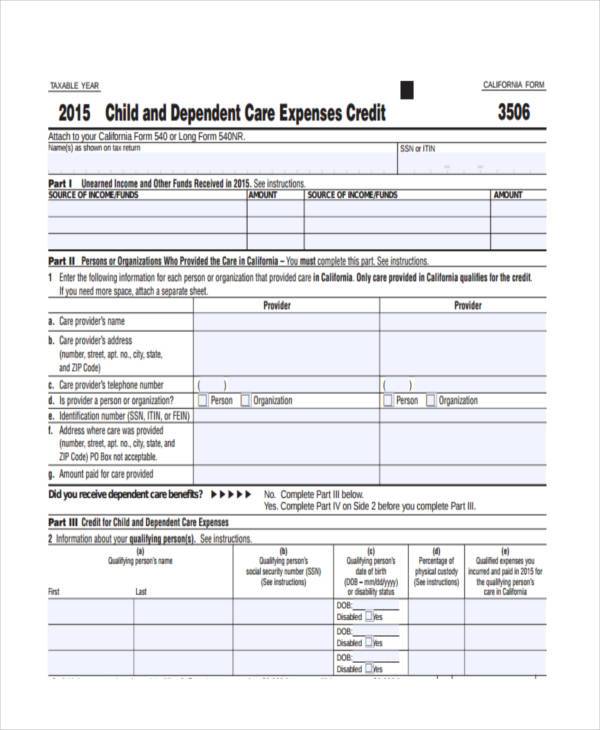

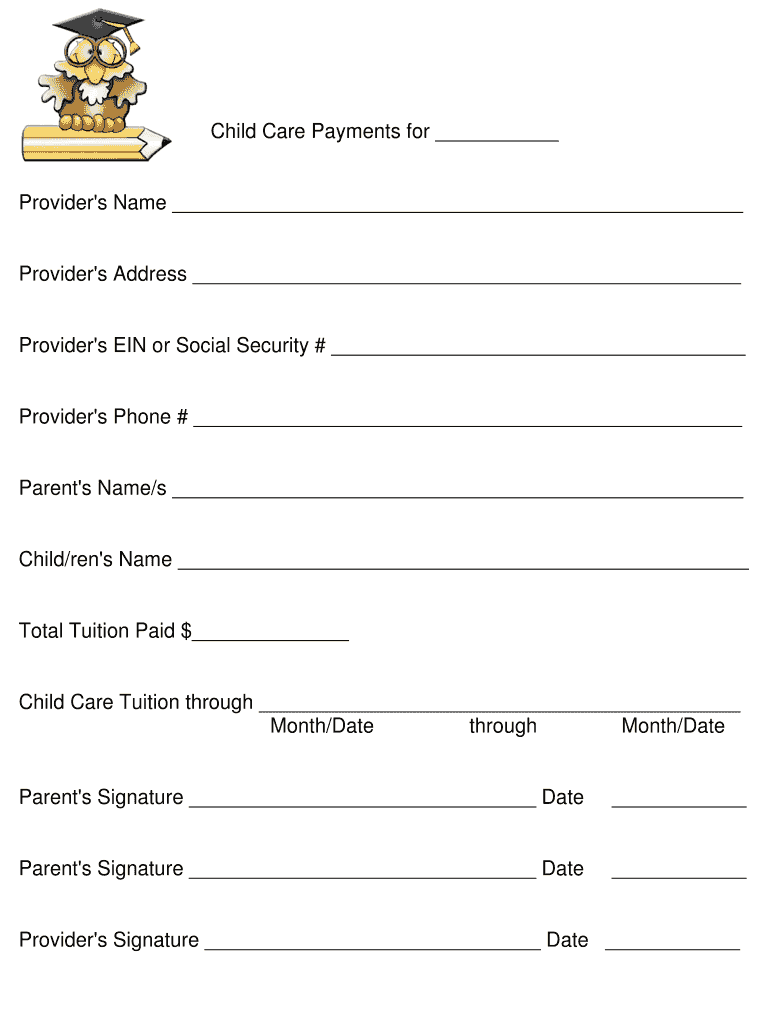

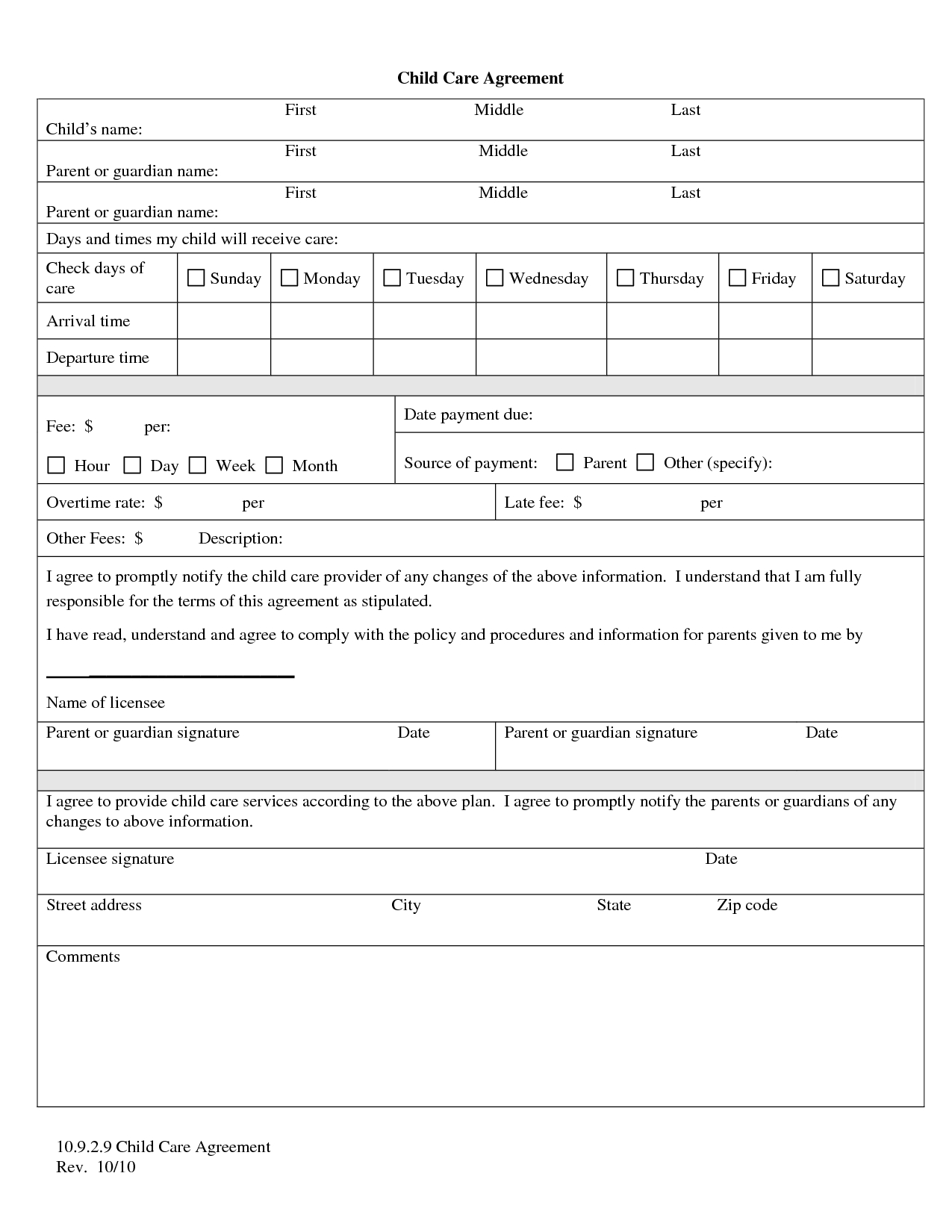

Tax Form Daycare Providers Give Parents - If the provider is your employer’s dependent care plan, a copy of the statement provided by your employer under the plan. Web updated for tax year 2022 • june 26, 2023 08:58 am. This form is used for certification of the dependent care provider's name, address, and taxpayer identification number to report on form 2441, child and dependent care expenses. The parents will use it to claim a deduction if they are eligible. Ask your primary childcare provider to copy the template below to its letterhead and input the needed information to replace the guidelines in the brackets < > and the brackets. Web irs form 2441 is completed by the taxpayer to report child and dependent care expenses paid for the year. They don’t have to have the piece of paper to file the amount, but it’s a good idea to provide them. The amount that you claim must match exactly with the amount parents are claiming. Parent</strong>/guardian’s name and address> re: You also are not required to mail them.

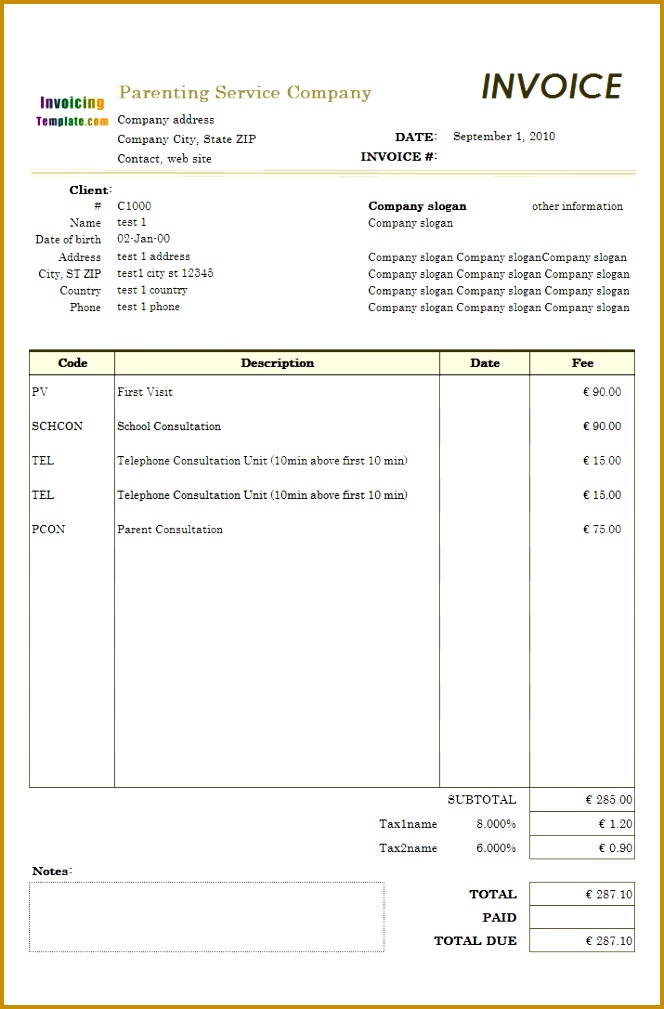

Web irs form 2441 is completed by the taxpayer to report child and dependent care expenses paid for the year. Congress extended this law as part of the fiscal cliff negotiations. The parents will use it to claim a deduction if they are eligible. Web parents can only count up to $3,000 of child care expenses for one child ($6,000 for 2 or more) towards their child care tax credit because that's all that congress will allow. A copy of the provider’s social security card. Web updated for tax year 2022 • june 26, 2023 08:58 am. A recently printed letterhead or printed invoice that shows the provider’s name, address, and tin. They don’t have to have the piece of paper to file the amount, but it’s a good idea to provide them. You will use it to claim all income received. Ask your primary childcare provider to copy the template below to its letterhead and input the needed information to replace the guidelines in the brackets < > and the brackets.

You will use it to claim all income received. Ask your primary childcare provider to copy the template below to its letterhead and input the needed information to replace the guidelines in the brackets < > and the brackets. You also are not required to mail them. Web form 8282, child care year end receipt for parents is required by law for every parent receiving child care payments from child care services. Web parents can only count up to $3,000 of child care expenses for one child ($6,000 for 2 or more) towards their child care tax credit because that's all that congress will allow. Web a daycare tax statement must be given to parents at the end of the year. This form is used for certification of the dependent care provider's name, address, and taxpayer identification number to report on form 2441, child and dependent care expenses. A copy of the provider’s social security card. You can obtain the child care year end receipt form or download the form from the child care services website. Keep track during the year of all payments made to you.

Stationery Paper & Party Supplies PDF and Word Daycare Resource Total

They don’t have to have the piece of paper to file the amount, but it’s a good idea to provide them. You can obtain the child care year end receipt form or download the form from the child care services website. Keep track during the year of all payments made to you. The amount that you claim must match exactly.

Sample Daycare Tax Forms For Parents Classles Democracy

Web a daycare tax form for parents is helpful but not required by law for parents to take the child care tax credit on their taxes. This form must be filed if you’re planning to claim a credit for child and dependent. Keep track during the year of all payments made to you. This form is used for certification of.

30 Home Daycare Tax Worksheet Education Template

This form must be filed if you’re planning to claim a credit for child and dependent. Web a daycare tax form for parents is helpful but not required by law for parents to take the child care tax credit on their taxes. Ask your primary childcare provider to copy the template below to its letterhead and input the needed information.

Home Daycare Business & Emergency Forms Daycare forms, Home daycare

Web updated for tax year 2022 • june 26, 2023 08:58 am. Keep track during the year of all payments made to you. The amount that you claim must match exactly with the amount parents are claiming. This form is used for certification of the dependent care provider's name, address, and taxpayer identification number to report on form 2441, child.

Home Daycare Tax Deductions for Child Care Providers Where

A recently printed letterhead or printed invoice that shows the provider’s name, address, and tin. They don’t have to have the piece of paper to file the amount, but it’s a good idea to provide them. If the provider is your employer’s dependent care plan, a copy of the statement provided by your employer under the plan. You also are.

3 Daycare Tax form for Parents FabTemplatez

Web a daycare tax statement must be given to parents at the end of the year. Congress extended this law as part of the fiscal cliff negotiations. The amount that you claim must match exactly with the amount parents are claiming. Web sample template for use by childcare providers note: You can obtain the child care year end receipt form.

FREE 8+ Sample Child Care Expense Forms in PDF MS Word

The amount that you claim must match exactly with the amount parents are claiming. This form must be filed if you’re planning to claim a credit for child and dependent. A recently printed letterhead or printed invoice that shows the provider’s name, address, and tin. Keep track during the year of all payments made to you. Web updated for tax.

Daycare Tax Statement for Parents Form Fill Out and Sign Printable

This form is used for certification of the dependent care provider's name, address, and taxpayer identification number to report on form 2441, child and dependent care expenses. You will use it to claim all income received. Web irs form 2441 is completed by the taxpayer to report child and dependent care expenses paid for the year. Web sample template for.

Free Printable Daycare Forms For Parents Free Printable

If the provider is your employer’s dependent care plan, a copy of the statement provided by your employer under the plan. A copy of the provider’s social security card. Congress extended this law as part of the fiscal cliff negotiations. Web irs form 2441 is completed by the taxpayer to report child and dependent care expenses paid for the year..

Government figures show parents are still not taking up taxfree

Web a daycare tax statement must be given to parents at the end of the year. This form is used for certification of the dependent care provider's name, address, and taxpayer identification number to report on form 2441, child and dependent care expenses. A recently printed letterhead or printed invoice that shows the provider’s name, address, and tin. A copy.

You Also Are Not Required To Mail Them.

Web sample template for use by childcare providers note: Web irs form 2441 is completed by the taxpayer to report child and dependent care expenses paid for the year. Ask your primary childcare provider to copy the template below to its letterhead and input the needed information to replace the guidelines in the brackets < > and the brackets. Web a daycare tax statement must be given to parents at the end of the year.

Web Parents Can Only Count Up To $3,000 Of Child Care Expenses For One Child ($6,000 For 2 Or More) Towards Their Child Care Tax Credit Because That's All That Congress Will Allow.

Web the irs usually considers childcare providers as independent contractors. Keep track during the year of all payments made to you. You can obtain the child care year end receipt form or download the form from the child care services website. You will use it to claim all income received.

There Are A Number Of Eligibility Requirements To Satisfy Before Potentially Receiving A Child Or Dependent Care Credit, So It's A Good Idea To Familiarize Yourself With The Rules Before Preparing Form 2441.

The amount that you claim must match exactly with the amount parents are claiming. This will determine your taxes for childcare. Congress extended this law as part of the fiscal cliff negotiations. This form is used for certification of the dependent care provider's name, address, and taxpayer identification number to report on form 2441, child and dependent care expenses.

Parent</Strong>/Guardian’s Name And Address> Re:

Web a daycare tax form for parents is helpful but not required by law for parents to take the child care tax credit on their taxes. This form must be filed if you’re planning to claim a credit for child and dependent. They don’t have to have the piece of paper to file the amount, but it’s a good idea to provide them. A recently printed letterhead or printed invoice that shows the provider’s name, address, and tin.