Tax Form 990 Ez

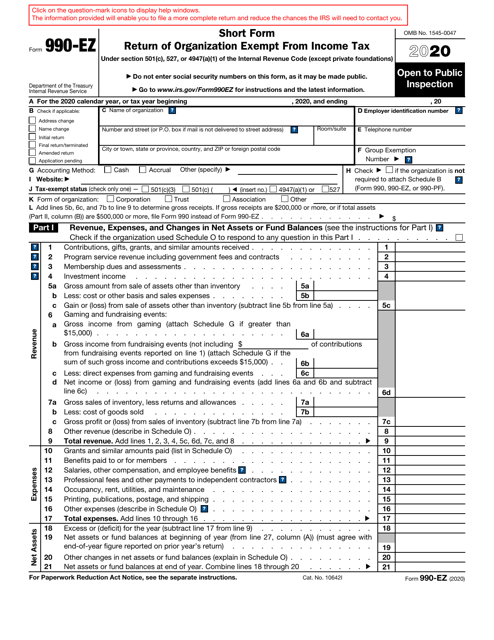

Tax Form 990 Ez - These nonprofit tax filing gross receipts less than $200,000 and total assets less than $500,000. Department of the treasury internal revenue service. Sponsoring organizations of donor advised funds. Organizations that operate a hospital facility. Short form return of organization exempt from income tax. If the organization doesn’t meet these requirements, it must file form 990, unless excepted under general instruction b,. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. If an organization’s assets are worth more than that, a full form 990 will be required, regardless of revenue. In addition, the total valuation of all assets should be less than $500,000.

In addition, the total valuation of all assets should be less than $500,000. If the organization doesn’t meet these requirements, it must file form 990, unless excepted under general instruction b,. These nonprofit tax filing gross receipts less than $200,000 and total assets less than $500,000. Short form return of organization exempt from income tax. Organizations that operate a hospital facility. Sponsoring organizations of donor advised funds. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. Department of the treasury internal revenue service. If an organization’s assets are worth more than that, a full form 990 will be required, regardless of revenue.

Sponsoring organizations of donor advised funds. If an organization’s assets are worth more than that, a full form 990 will be required, regardless of revenue. Department of the treasury internal revenue service. If the organization doesn’t meet these requirements, it must file form 990, unless excepted under general instruction b,. In addition, the total valuation of all assets should be less than $500,000. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. Short form return of organization exempt from income tax. Organizations that operate a hospital facility. These nonprofit tax filing gross receipts less than $200,000 and total assets less than $500,000.

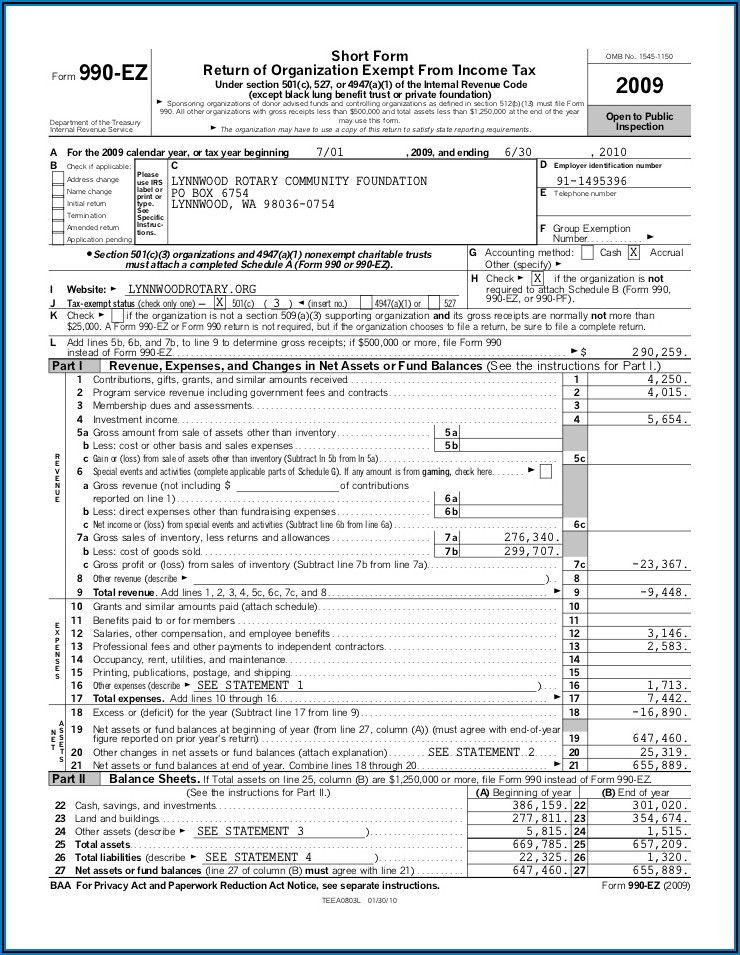

Form 990EZ Short Form Return of Organization Exempt from Tax

Sponsoring organizations of donor advised funds. Short form return of organization exempt from income tax. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. If the organization doesn’t meet these requirements, it must file form 990, unless excepted under general.

Form 990EZ Short Form Return of Organization Exempt from Tax

If an organization’s assets are worth more than that, a full form 990 will be required, regardless of revenue. In addition, the total valuation of all assets should be less than $500,000. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made.

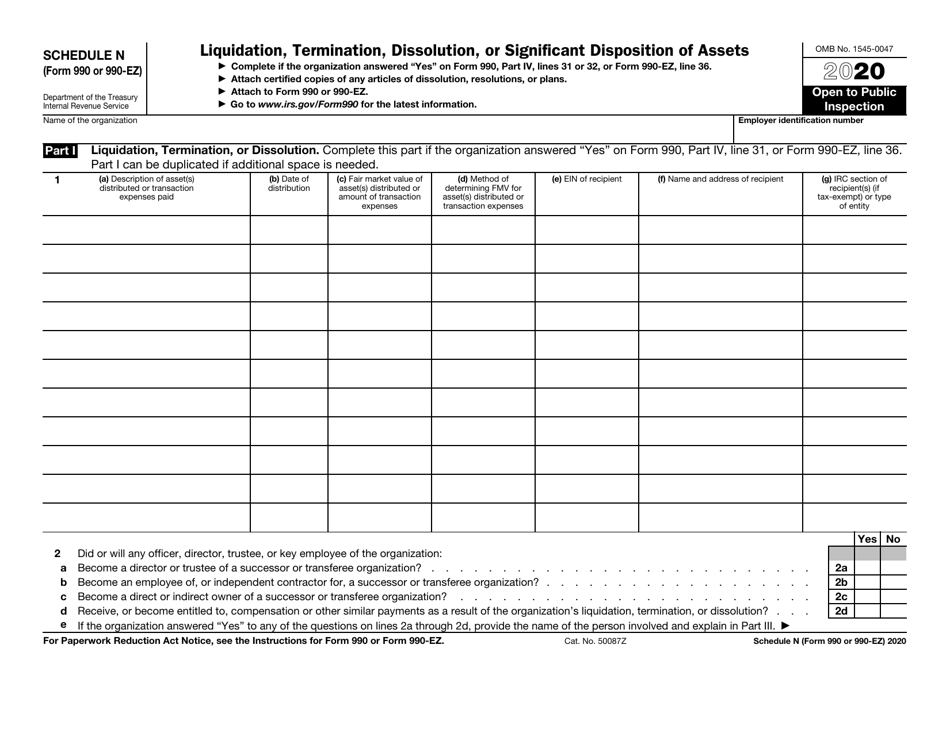

IRS Form 990 (990EZ) Schedule N Download Fillable PDF or Fill Online

If an organization’s assets are worth more than that, a full form 990 will be required, regardless of revenue. These nonprofit tax filing gross receipts less than $200,000 and total assets less than $500,000. Department of the treasury internal revenue service. Short form return of organization exempt from income tax. Organizations that operate a hospital facility.

Fillable Online tax form 990 ez Fax Email Print pdfFiller

If an organization’s assets are worth more than that, a full form 990 will be required, regardless of revenue. Department of the treasury internal revenue service. Sponsoring organizations of donor advised funds. These nonprofit tax filing gross receipts less than $200,000 and total assets less than $500,000. In addition, the total valuation of all assets should be less than $500,000.

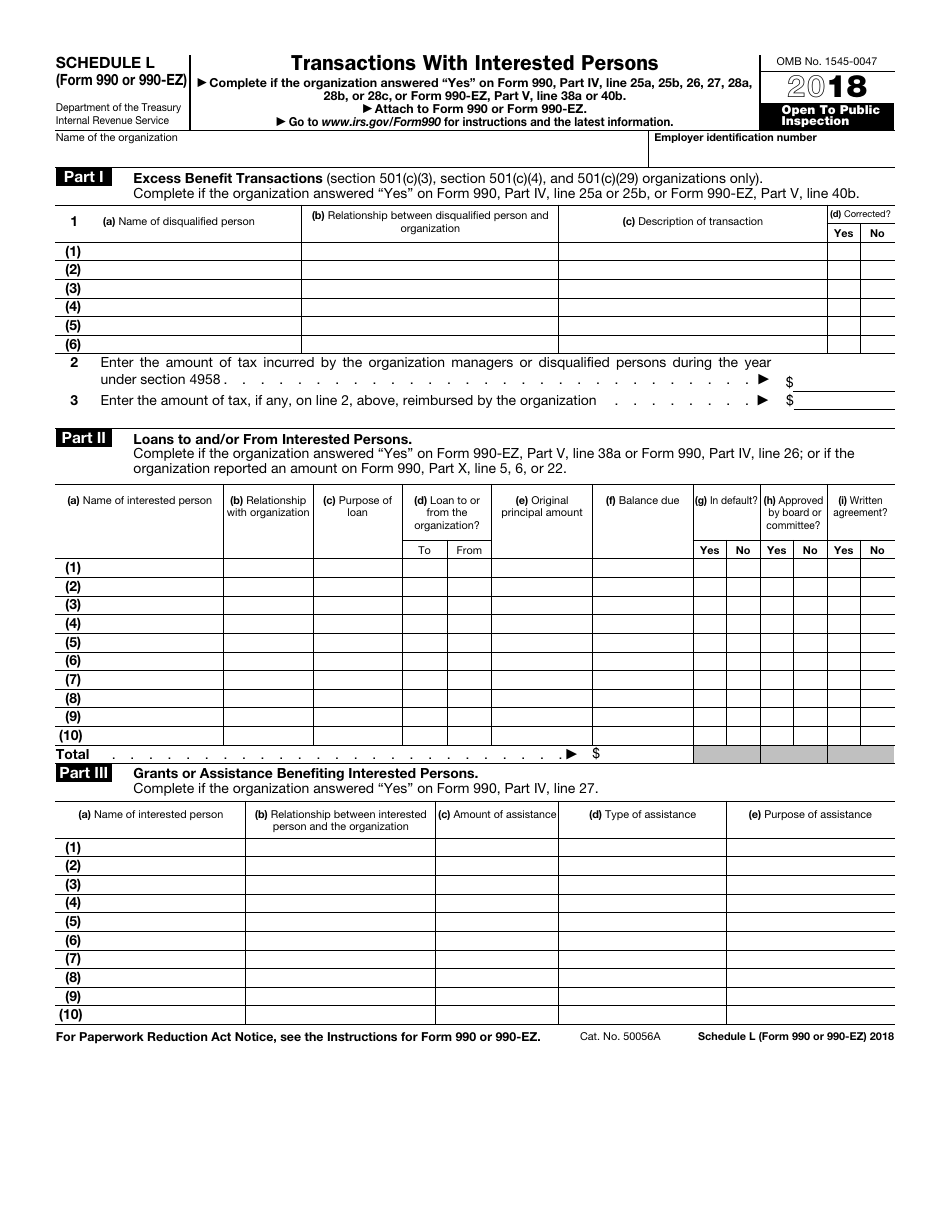

IRS Form 990 (990EZ) Schedule L Download Fillable PDF or Fill Online

These nonprofit tax filing gross receipts less than $200,000 and total assets less than $500,000. In addition, the total valuation of all assets should be less than $500,000. Department of the treasury internal revenue service. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it.

Federal Tax Form 990 Ez Instructions Form Resume Examples 0g27lBAx9P

Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. In addition, the total valuation of all assets should be less than $500,000. Department of the treasury internal revenue service. Sponsoring organizations of donor advised funds. Organizations that operate a hospital.

Form 990, 990EZ, 990PF (Sch B) Schedule of Contributors (2015) Free

Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. Sponsoring organizations of donor advised funds. If an organization’s assets are worth more than that, a full form 990 will be required, regardless of revenue. These nonprofit tax filing gross receipts.

IRS Form 990EZ Download Fillable PDF or Fill Online Short Form Return

These nonprofit tax filing gross receipts less than $200,000 and total assets less than $500,000. Organizations that operate a hospital facility. Department of the treasury internal revenue service. Sponsoring organizations of donor advised funds. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may.

Form 990 or 990EZ (Sch N) Liquidation, Termination, Dissolution, or

Sponsoring organizations of donor advised funds. Short form return of organization exempt from income tax. Organizations that operate a hospital facility. If an organization’s assets are worth more than that, a full form 990 will be required, regardless of revenue. These nonprofit tax filing gross receipts less than $200,000 and total assets less than $500,000.

Form 990 or 990EZ (Sch L) Transactions with Interested Persons (2015

If the organization doesn’t meet these requirements, it must file form 990, unless excepted under general instruction b,. These nonprofit tax filing gross receipts less than $200,000 and total assets less than $500,000. Sponsoring organizations of donor advised funds. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on.

Department Of The Treasury Internal Revenue Service.

Sponsoring organizations of donor advised funds. If an organization’s assets are worth more than that, a full form 990 will be required, regardless of revenue. In addition, the total valuation of all assets should be less than $500,000. Organizations that operate a hospital facility.

Short Form Return Of Organization Exempt From Income Tax.

If the organization doesn’t meet these requirements, it must file form 990, unless excepted under general instruction b,. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. These nonprofit tax filing gross receipts less than $200,000 and total assets less than $500,000.