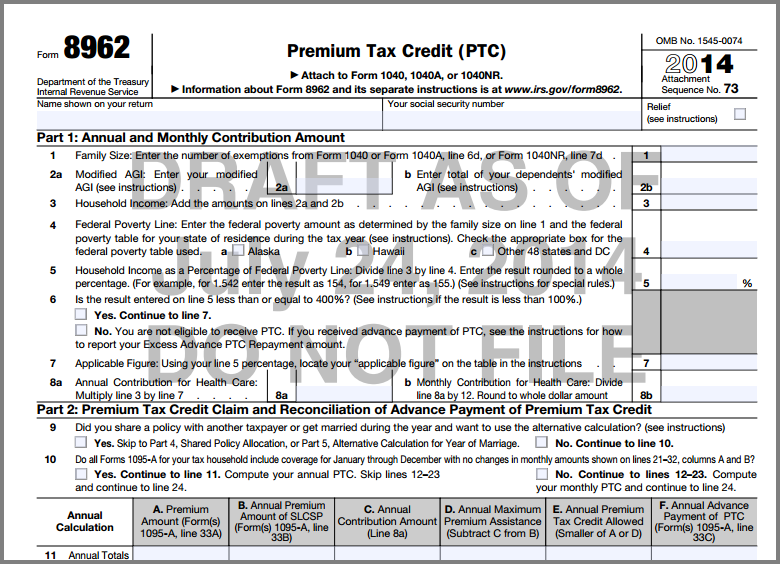

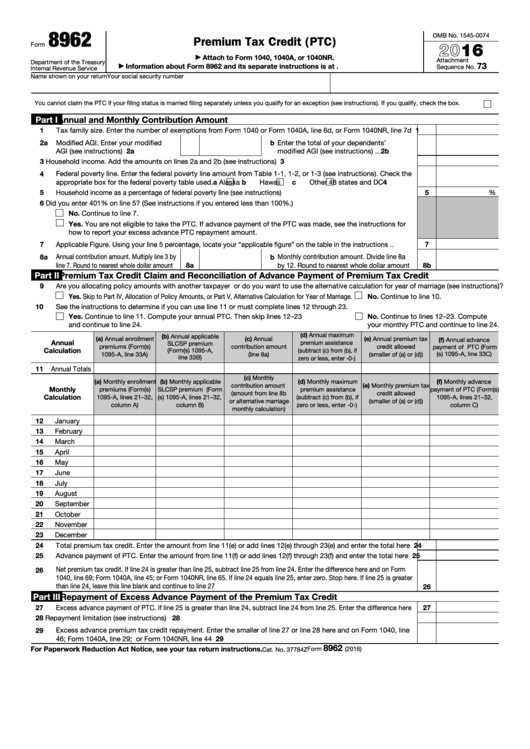

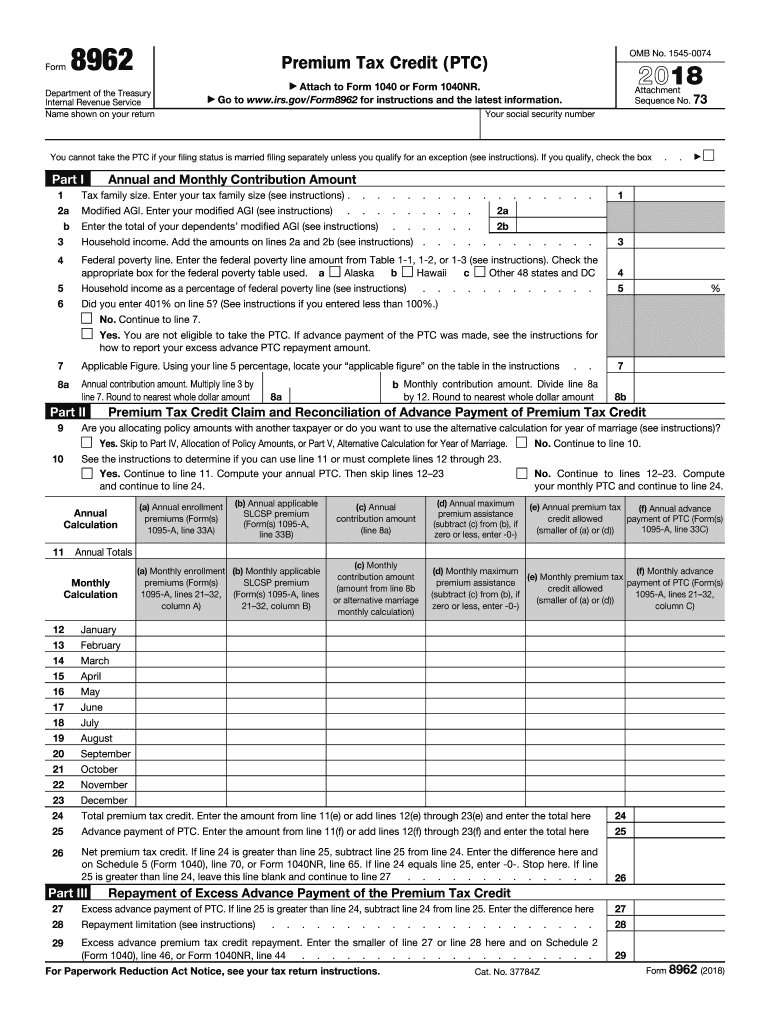

Tax Form 8962 Pdf

Tax Form 8962 Pdf - Web tax form 8962 📝 get irs form 8962 printable: Web a refund, or increasing your refund amount. Details, guidelines, & deadlines the irs form 8962 is used when you need to. Ad download or email form 8962 & more fillable forms, register and subscribe now! Refigure the final ptc on another form 8962. Ad access irs tax forms. Attach this form 8962 to your tax return. Download your fillable irs form 8962 in pdf. You have to include form 8962 with your tax return if: Irs 8962 is the form that was made for taxpayers who want to find out.

Refigure the final ptc on another form 8962. Web a refund, or increasing your refund amount. Fill out online, instructions, pdf irs form 8962: Advance payment of the premium tax credit (aptc). Web 01 fill and edit template 02 sign it online 03 export or print immediately what is a 8962 form (2022)? Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Ad download or email form 8962 & more fillable forms, register and subscribe now! Form 8962 is used either (1) to reconcile a premium tax. The irs form 8962 is supposed to be created when an individual needs to calculate their ptc and.

Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web a refund, or increasing your refund amount. Are you allocating policy amounts with another taxpayer or do you want to use the. Fill out online, instructions, pdf irs form 8962: Attach this form 8962 to your tax return. Complete, edit or print tax forms instantly. Web to confirm the aptc was not paid, you should attach to your return a pdf attachment titled aca explanation with a written explanation of the reason why you. You can get the irs form 8962 from the website of department of the treasury, internal revenue service or you can simply download irs form 8962 here. You may take ptc (and aptc may. Details, guidelines, & deadlines the irs form 8962 is used when you need to.

Fillable Tax Form 8962 Universal Network

Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Are you allocating policy amounts with another taxpayer or do you want to use the. Refigure the final ptc on another form 8962. Web to confirm the aptc was not paid, you should attach.

How To Fill Out Tax Form 8962 amulette

Details, guidelines, & deadlines the irs form 8962 is used when you need to. Refigure the final ptc on another form 8962. Irs 8962 is the form that was made for taxpayers who want to find out. Complete this form 8962 through line 29. You may take ptc (and aptc may.

Find IRS Form 1040 and Instructions in 2020 Irs forms, Irs, Tax extension

Form 8962 will be present in the pdf of your tax return. Advance payment of the premium tax credit (aptc). The irs form 8962 is supposed to be created when an individual needs to calculate their ptc and. Here you need to enter the annual and monthly contributions based on family size, household income, and. Get ready for tax season.

Form 8962 Premium Tax Credit (PTC) for Shared Policy Allocation DocHub

Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Easily fill out pdf blank, edit, and sign them. Web how do i get my irs form 8962? Web 01 fill and edit template 02 sign it online 03 export or print immediately what.

Fillable Form 8962 Premium Tax Credit (Ptc) 2016 printable pdf download

Web a refund, or increasing your refund amount. Web to confirm the aptc was not paid, you should attach to your return a pdf attachment titled aca explanation with a written explanation of the reason why you. Web tax form 8962 📝 get irs form 8962 printable: Complete, edit or print tax forms instantly. Details, guidelines, & deadlines the irs.

Instructions for Form 8962 for 2018 KasenhasLopez

Ad download or email form 8962 & more fillable forms, register and subscribe now! Get ready for tax season deadlines by completing any required tax forms today. Web to confirm the aptc was not paid, you should attach to your return a pdf attachment titled aca explanation with a written explanation of the reason why you. You may take ptc.

2020 Form 8962 Instructions Fill Online, Printable, Fillable, Blank

Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. You have to include form 8962 with your tax return if: Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced.

Health Insurance 1095A Subsidy Flow Through IRS Tax Return

Are you allocating policy amounts with another taxpayer or do you want to use the. Complete, edit or print tax forms instantly. Form 8962 will be present in the pdf of your tax return. Here you need to enter the annual and monthly contributions based on family size, household income, and. Attach this form 8962 to your tax return.

Form 8962 Fill Out and Sign Printable PDF Template signNow

Irs 8962 is the form that was made for taxpayers who want to find out. Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Web 01 fill and edit template 02 sign it online 03 export or print immediately what is a 8962.

Web 01 Fill And Edit Template 02 Sign It Online 03 Export Or Print Immediately What Is A 8962 Form (2022)?

Complete this form 8962 through line 29. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Are you allocating policy amounts with another taxpayer or do you want to use the. Web to confirm the aptc was not paid, you should attach to your return a pdf attachment titled aca explanation with a written explanation of the reason why you.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Form 8962 is used either (1) to reconcile a premium tax. Details, guidelines, & deadlines the irs form 8962 is used when you need to. You may take ptc (and aptc may. You must file form 8962 to compute and take the ptc on your tax return.

Advance Payment Of The Premium Tax Credit (Aptc).

Refigure the final ptc on another form 8962. Form 8962 will be present in the pdf of your tax return. Web premium tax credit claim and reconciliation of advance payment of premium tax credit. Web how do i get my irs form 8962?

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Download your fillable irs form 8962 in pdf. Save or instantly send your ready documents. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. Here you need to enter the annual and monthly contributions based on family size, household income, and.