Tax Form 4549

Tax Form 4549 - Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. Web in chief counsel advice (cca), irs has held that form 4549, income tax examination changes, i.e., the form irs issued at the end of its audit, was an informal refund claim. At this point, you have the options of: Taxhelp believes the tax court is more fair to taxpayers than the other forums. 1) presenting further evidence, 2) appealing to the agent's manager, 3) appealing to irs appeals, or 4) waiting for the irs notice of deficiency and petitioning tax court. The irs form 4549 also called the income tax examination letter informs the taxpayer about the proposed changes to the tax return, penalties, and interest as a result of the audit. Generally, letter 525 is issued if your audit was conducted by mail and letter 915 is issued if your audit was conducted in person. Web a regular agreed report (form 4549) may contain up to three tax years. Web following an audit, the irs will communicate with you about the results. Web form 4549, income tax examination changes, is sent by the irs at the end of an audit explaining proposed changes to your tax return.

The irs form 4549 also called the income tax examination letter informs the taxpayer about the proposed changes to the tax return, penalties, and interest as a result of the audit. Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited. Web form 4549, income tax examination changes, is sent by the irs at the end of an audit explaining proposed changes to your tax return. 1) presenting further evidence, 2) appealing to the agent's manager, 3) appealing to irs appeals, or 4) waiting for the irs notice of deficiency and petitioning tax court. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. Irs also ruled on other issues, including whether a refund claim made after the taxpayer signed the form 4549 was a separate refund claim from that made on the form. It will include information, including: Learn more from the tax experts at h&r block. This form means the irs is questioning your tax return.

Generally, letter 525 is issued if your audit was conducted by mail and letter 915 is issued if your audit was conducted in person. Web a regular agreed report (form 4549) may contain up to three tax years. 1) presenting further evidence, 2) appealing to the agent's manager, 3) appealing to irs appeals, or 4) waiting for the irs notice of deficiency and petitioning tax court. The agency may think you failed to report some income, took too many deductions, or didn't pay enough taxes. This form means the irs is questioning your tax return. Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited. Web form 4549, report of income tax examination changes. At this point, you have the options of: It will include information, including: Web in chief counsel advice (cca), irs has held that form 4549, income tax examination changes, i.e., the form irs issued at the end of its audit, was an informal refund claim.

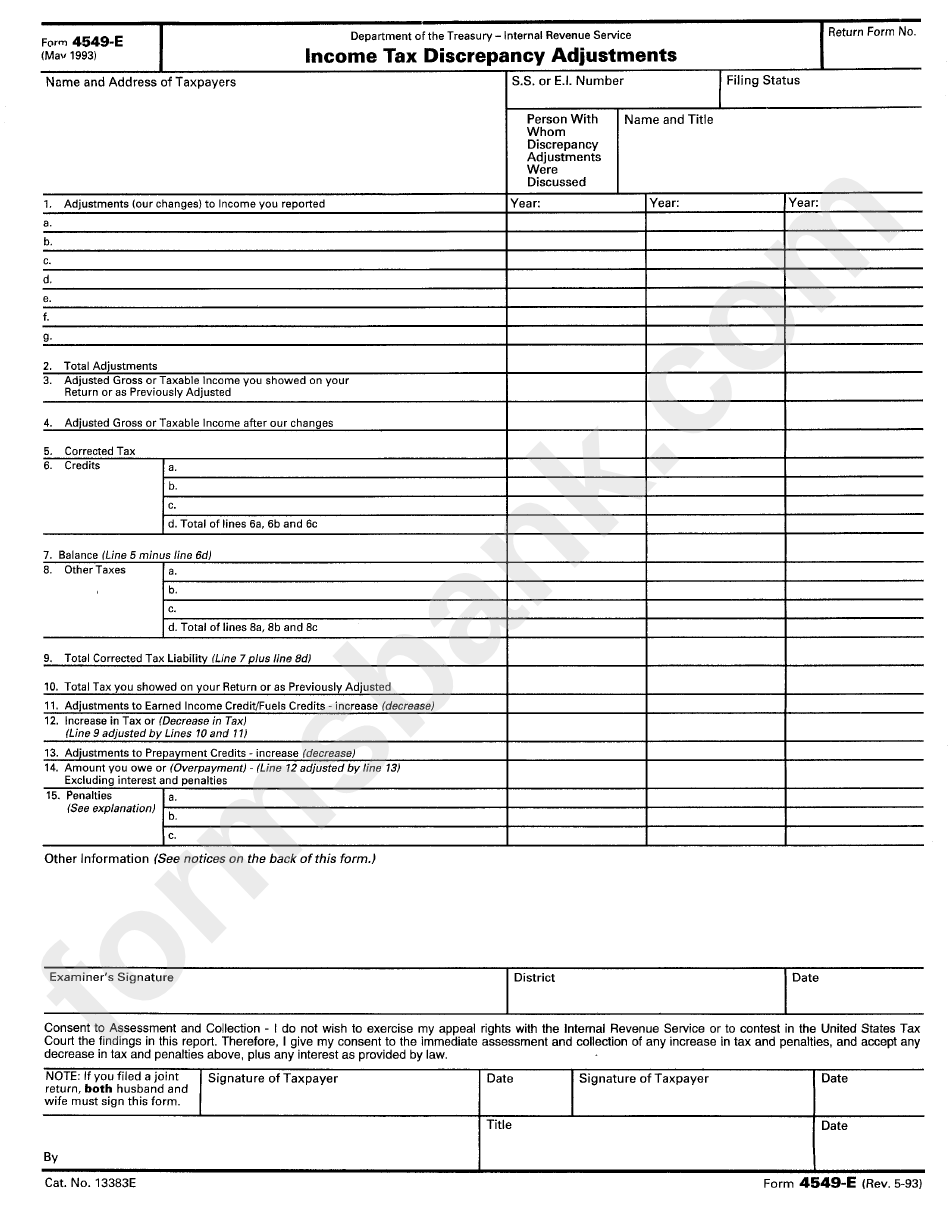

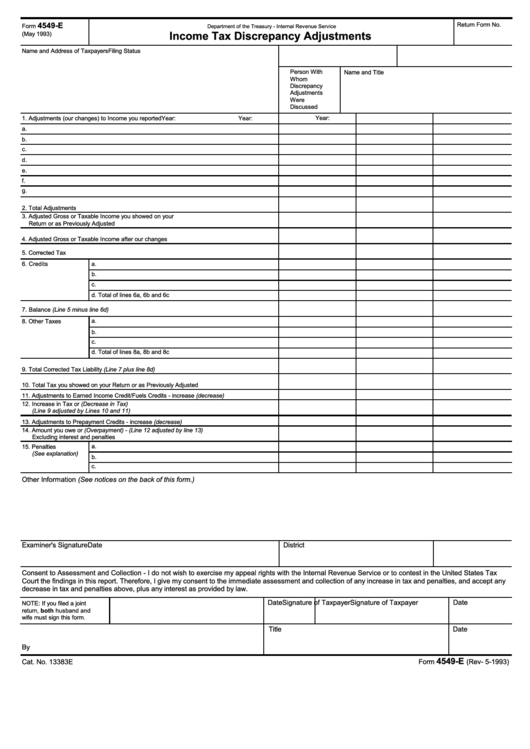

Form 4549e Tax Dicrepancy Adjustments printable pdf download

Learn more from the tax experts at h&r block. Web a regular agreed report (form 4549) may contain up to three tax years. Web following an audit, the irs will communicate with you about the results. At this point, you have the options of: The agency may think you failed to report some income, took too many deductions, or didn't.

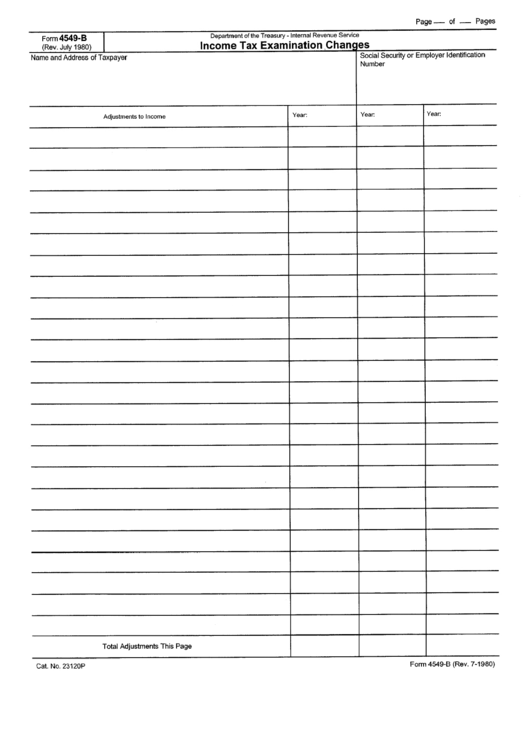

Form 4549B Tax Examitation Changes printable pdf download

The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. The agency may think you failed to report some income, took too many deductions, or didn't pay enough taxes. This form means the irs is questioning your tax return. Agreed rars require the taxpayer’s signature and.

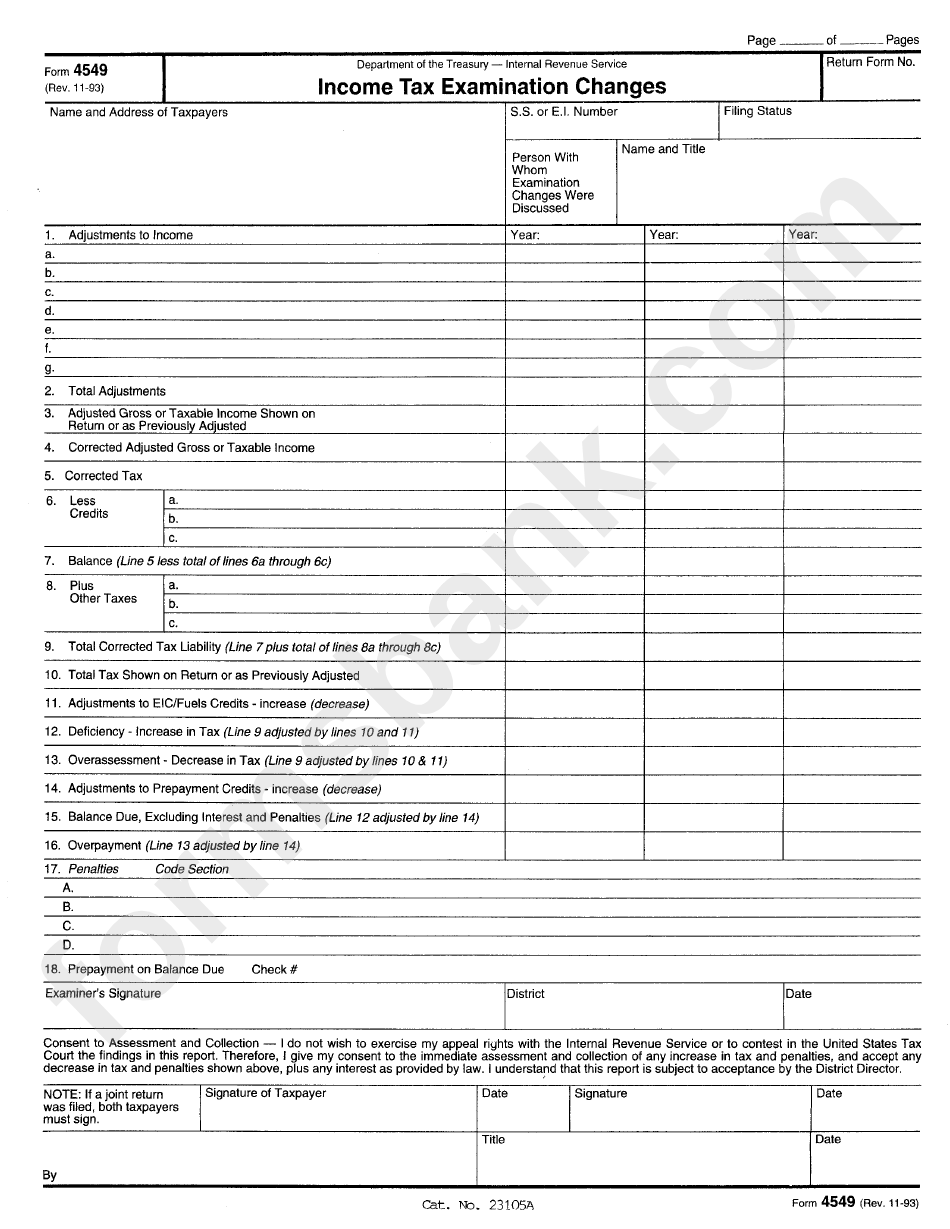

Form 4549 Tax Examination Changes Internal Revenue Service

Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area director, area manager, specialty tax program chief, or director of field operations. Web form 4549, income tax examination changes, is sent by the irs at the end of an audit explaining proposed changes to your tax return. Web steps.

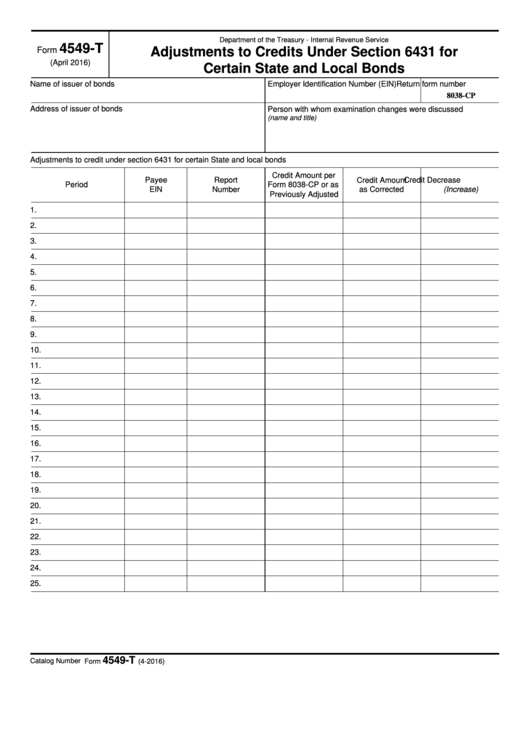

Top 9 Form 4549 Templates free to download in PDF format

Web steps in response to form 4549: Web form 4549, income tax examination changes, is sent by the irs at the end of an audit explaining proposed changes to your tax return. Web a regular agreed report (form 4549) may contain up to three tax years. Agreed rars require the taxpayer’s signature and include a statement that the report is.

Tax Letters Washington Tax Services

Web the irs form 4549 is the income tax examination changes letter. Learn more from the tax experts at h&r block. The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. Taxhelp believes the tax court is more fair to taxpayers than the other forums. Web.

Fillable Form 4549E Tax Discrepancy Adjustments Form

Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited. Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of the area director, area manager, specialty tax program chief, or director of field operations. Web a regular agreed report (form 4549) may contain up.

36 Irs Form 886 A Worksheet support worksheet

Taxhelp believes the tax court is more fair to taxpayers than the other forums. It will include information, including: At this point, you have the options of: 1) presenting further evidence, 2) appealing to the agent's manager, 3) appealing to irs appeals, or 4) waiting for the irs notice of deficiency and petitioning tax court. Web form 4549, report of.

IRS Audit Letter 692 Sample 1

Web form 4549, income tax examination changes, is sent by the irs at the end of an audit explaining proposed changes to your tax return. Learn more from the tax experts at h&r block. Generally, letter 525 is issued if your audit was conducted by mail and letter 915 is issued if your audit was conducted in person. Web form.

Form 4549 IRS Audit Reconsideration The Full Guide Silver Tax Group

Web a regular agreed report (form 4549) may contain up to three tax years. Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited. This form means the irs is questioning your tax return. Agreed rars require the taxpayer’s signature and include a statement that the report is subject to the acceptance of.

4.10.8 Report Writing Internal Revenue Service

Web form 4549, income tax examination changes, is sent by the irs at the end of an audit explaining proposed changes to your tax return. Generally, letter 525 is issued if your audit was conducted by mail and letter 915 is issued if your audit was conducted in person. Web form 4549, report of income tax examination changes, a report.

Web In Chief Counsel Advice (Cca), Irs Has Held That Form 4549, Income Tax Examination Changes, I.e., The Form Irs Issued At The End Of Its Audit, Was An Informal Refund Claim.

At this point, you have the options of: 1) presenting further evidence, 2) appealing to the agent's manager, 3) appealing to irs appeals, or 4) waiting for the irs notice of deficiency and petitioning tax court. Generally, letter 525 is issued if your audit was conducted by mail and letter 915 is issued if your audit was conducted in person. Web form 4549, income tax examination changes, is sent by the irs at the end of an audit explaining proposed changes to your tax return.

Web Form 4549 Is An Irs Form That Is Sent To Taxpayers Whose Returns Have Been Audited.

Web the irs form 4549 is the income tax examination changes letter. Web following an audit, the irs will communicate with you about the results. Web steps in response to form 4549: Irs also ruled on other issues, including whether a refund claim made after the taxpayer signed the form 4549 was a separate refund claim from that made on the form.

Web A Regular Agreed Report (Form 4549) May Contain Up To Three Tax Years.

This form means the irs is questioning your tax return. Taxhelp believes the tax court is more fair to taxpayers than the other forums. Learn more from the tax experts at h&r block. The irs form 4549 also called the income tax examination letter informs the taxpayer about the proposed changes to the tax return, penalties, and interest as a result of the audit.

Agreed Rars Require The Taxpayer’s Signature And Include A Statement That The Report Is Subject To The Acceptance Of The Area Director, Area Manager, Specialty Tax Program Chief, Or Director Of Field Operations.

The agency may think you failed to report some income, took too many deductions, or didn't pay enough taxes. Web form 4549, report of income tax examination changes, a report showing the proposed adjustments to your tax return, will be enclosed with the letter. The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. Web form 4549, report of income tax examination changes.