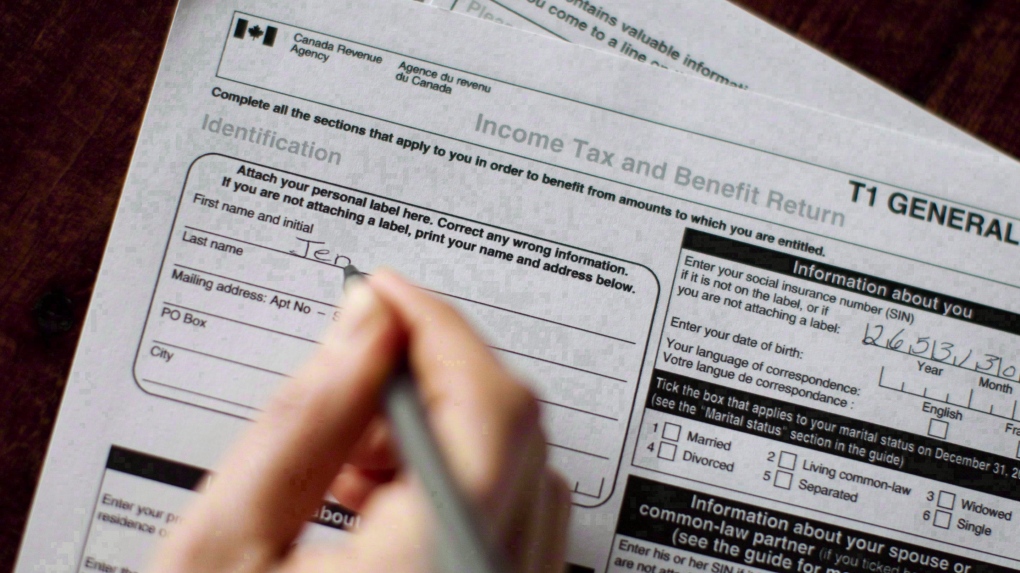

T1 Tax Form

T1 Tax Form - Tier 1 employee additional medicare. Web the t1 general or t1 (entitled income tax and benefit return) is the form used in canada by individuals to file their personal income tax return. Enter what you know/have, leave others for us to complete. Here is an overview of everything canadians need to know about the t1 form, including who should. Reserved for future use 5. Tier 1 employee medicare tax—sick pay. File your form 2290 online & efile with the irs. Web create federal and provincial or territorial forms td1, following the instructions at electronic td1 form, and have your employees send them to you online for best. Web td1ns 2023 nova scotia personal tax credits return; Web statewide sales/use tax rates for the period beginning august, 2022.

Wage earner return earnings tax. Here is an overview of everything canadians need to know about the t1 form, including who should. This is used to calculate the amounts to. Web form td1, personal tax credits return, must be filled out when individuals start a new job or they want to increase income tax deductions. Statewide sales/use tax rates for the period beginning july, 2022. $ × 6.2% = 10 11. Web tier 1 employee tax—sick pay. Web the t1 general income tax and benefit return is the tax return used by individuals to calculate their annual tax liability and get federal or provincial benefits such as the. Enter what you know/have, leave others for us to complete. Number of new tires subject to fee 4.

Web create federal and provincial or territorial forms td1, following the instructions at electronic td1 form, and have your employees send them to you online for best. See general information for details. Tier 1 employee additional medicare. Web form td1, personal tax credits return, must be filled out when individuals start a new job or they want to increase income tax deductions. To determine earnings attributable to their period of residency. File your form 2290 today avoid the rush. Number of new tires sold 2d. Check if an application to determine eligibility of a trustee pursuant to section 305(b)(2) (exact name of trustee as specified in its charter). Finish tax return in minutes on laptop, tablet or smart. Web the t1 general or t1 (entitled income tax and benefit return) is the form used in canada by individuals to file their personal income tax return.

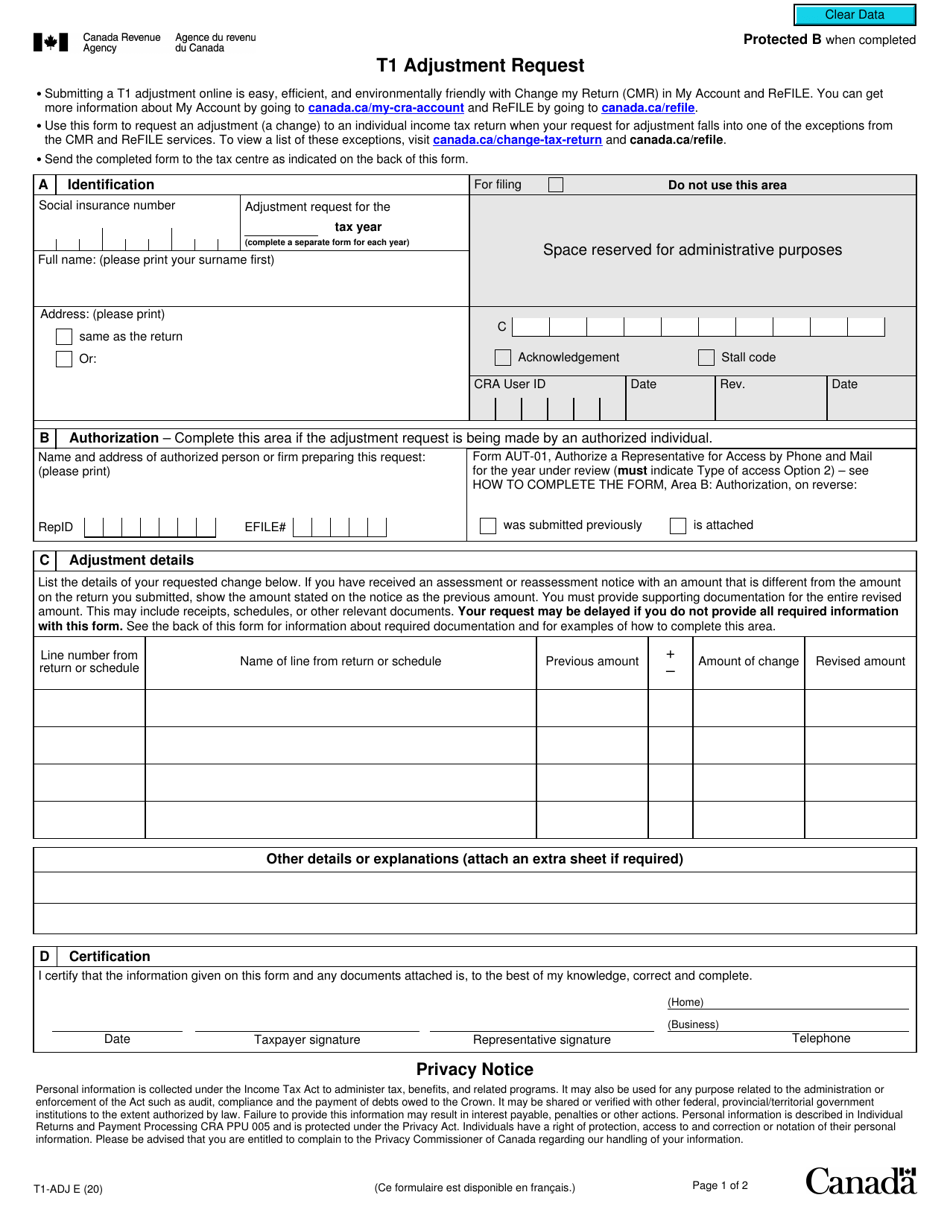

Form T1ADJ Download Fillable PDF or Fill Online T1 Adjustment Request

Web td1ns 2023 nova scotia personal tax credits return; $ × 6.2% = 10 11. This is used to calculate the amounts to. Enter what you know/have, leave others for us to complete. Web form td1, personal tax credits return, must be filled out when individuals start a new job or they want to increase income tax deductions.

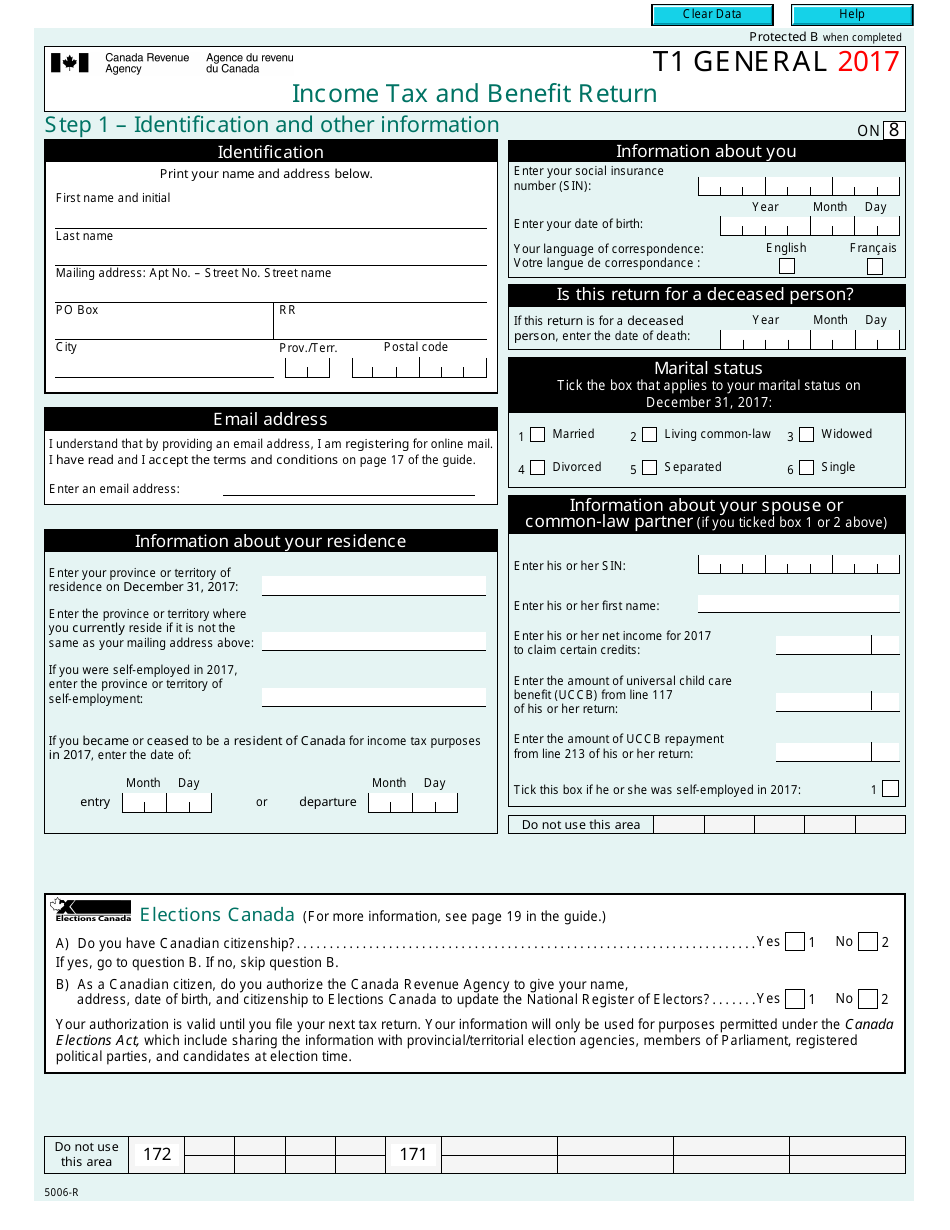

Form T1 GENERAL Download Fillable PDF or Fill Online Tax and

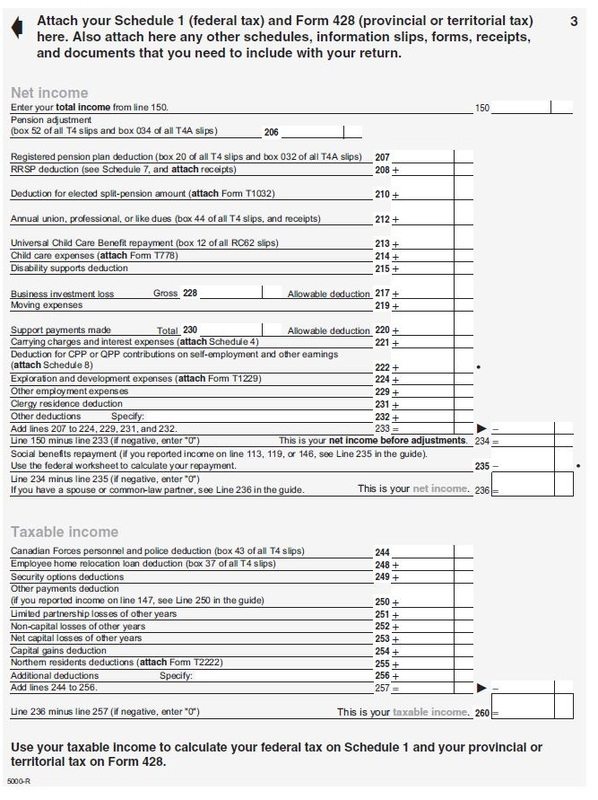

Web the t1 taxpayer's form is also known as the income tax and benefit return. Number of new tires sold 2d. Finish tax return in minutes on laptop, tablet or smart. File your form 2290 online & efile with the irs. Web td1ns 2023 nova scotia personal tax credits return;

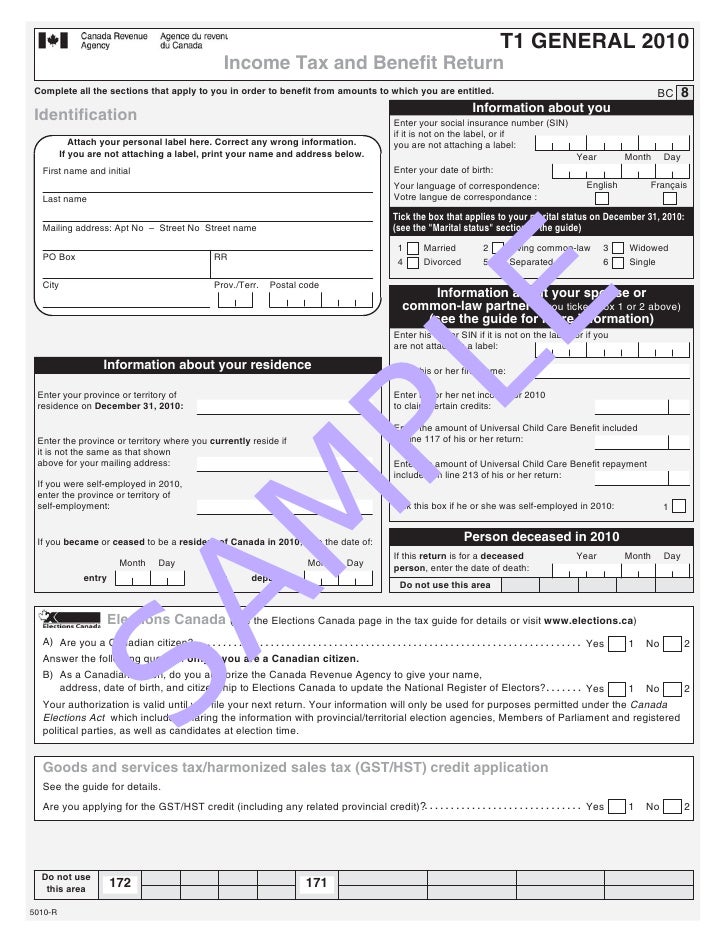

T1 General Sample

Ad don't leave it to the last minute. To determine earnings attributable to their period of residency. See general information for details. Web the t1 taxpayer's form is also known as the income tax and benefit return. Web create federal and provincial or territorial forms td1, following the instructions at electronic td1 form, and have your employees send them to.

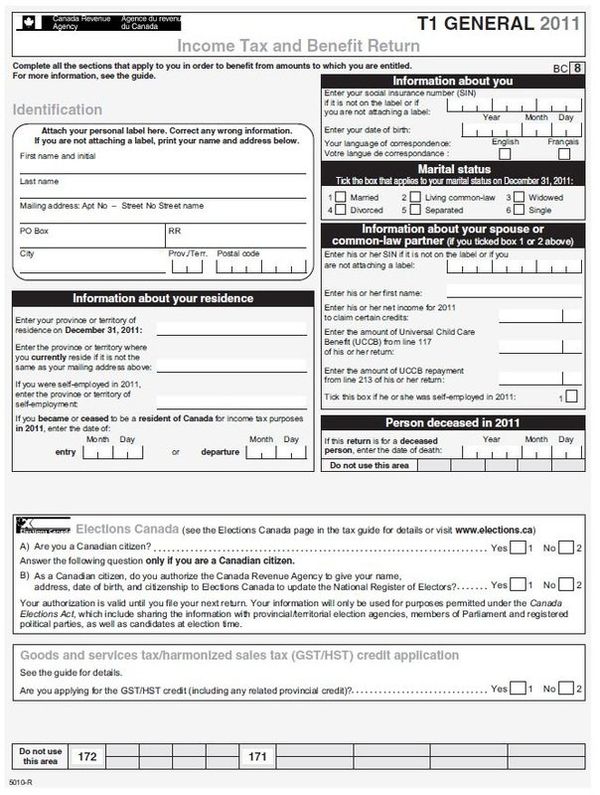

T1 General

Web for best results, download and open this form in adobe reader. See general information for details. Web form td1, personal tax credits return, must be filled out when individuals start a new job or they want to increase income tax deductions. Check if an application to determine eligibility of a trustee pursuant to section 305(b)(2) (exact name of trustee.

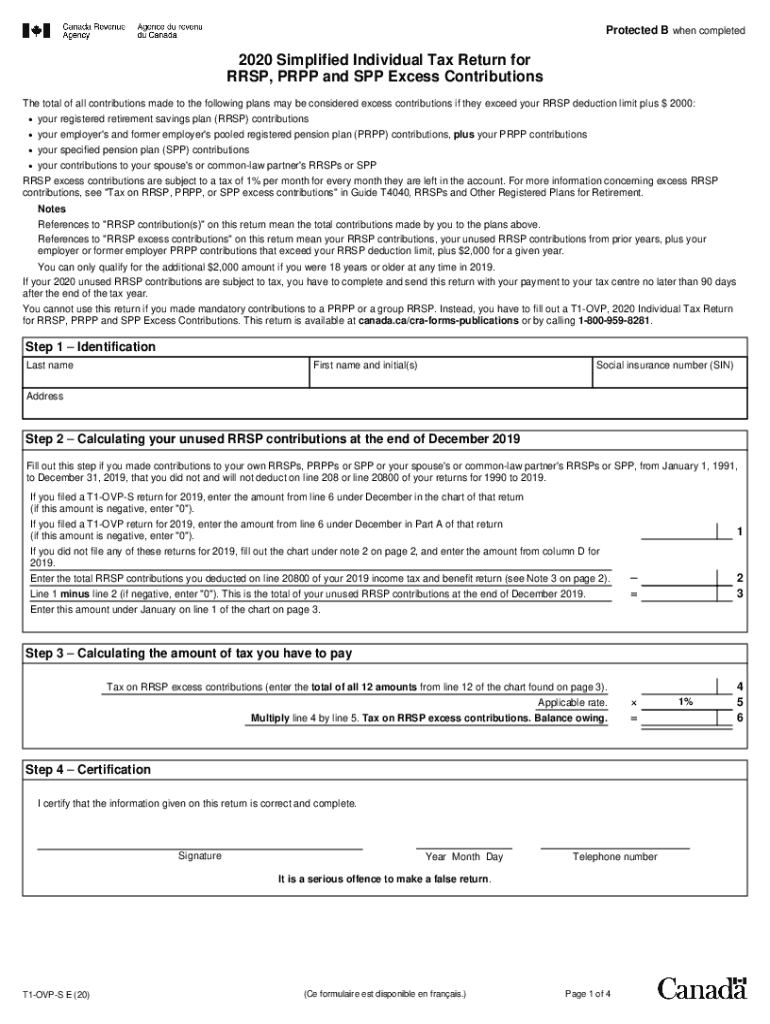

20202022 Form Canada T1213 Fill Online, Printable, Fillable, Blank

Web td1ns 2023 nova scotia personal tax credits return; Here is an overview of everything canadians need to know about the t1 form, including who should. This is used to calculate the amounts to. File your form 2290 online & efile with the irs. Web statewide sales/use tax rates for the period beginning august, 2022.

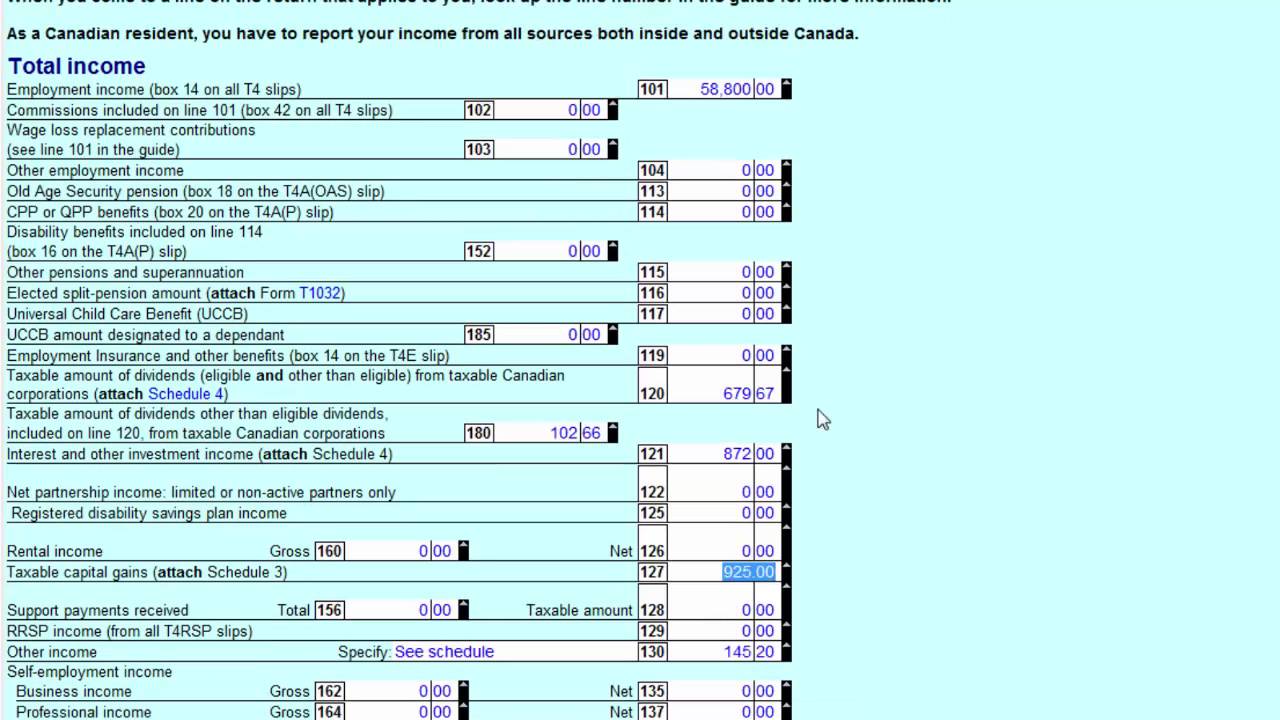

tax season What's different about this year's T1 Personal

Web the t1 taxpayer's form is also known as the income tax and benefit return. Wage earner return earnings tax. File your form 2290 today avoid the rush. This is used to calculate the amounts to. Web the t1 general income tax and benefit return is the tax return used by individuals to calculate their annual tax liability and get.

Need Your T1 General Tax Form? Best Regina Mortgage Advice

File your form 2290 today avoid the rush. Reserved for future use 7. File your form 2290 online & efile with the irs. Web for best results, download and open this form in adobe reader. Tier 1 employee medicare tax—sick pay.

Preparing T1 Returns Reporting and inputting Tslips on the T1

Reserved for future use 7. This is used to calculate the amounts to. Tier 1 employee medicare tax—sick pay. You can view this form in: Reserved for future use 5.

Canada T1OVPS E 20202022 Fill and Sign Printable Template Online

Finish tax return in minutes on laptop, tablet or smart. Enter what you know/have, leave others for us to complete. Web form td1, personal tax credits return, must be filled out when individuals start a new job or they want to increase income tax deductions. Beginning tax year 2022, all requests. See general information for details.

Wage Earner Return Earnings Tax.

File your form 2290 online & efile with the irs. Web create federal and provincial or territorial forms td1, following the instructions at electronic td1 form, and have your employees send them to you online for best. Reserved for future use 7. Here is an overview of everything canadians need to know about the t1 form, including who should.

Web Form Td1, Personal Tax Credits Return, Must Be Filled Out When Individuals Start A New Job Or They Want To Increase Income Tax Deductions.

File your form 2290 today avoid the rush. To determine earnings attributable to their period of residency. Number of new tires sold 2d. Enter what you know/have, leave others for us to complete.

You Can View This Form In:

Web the t1 taxpayer's form is also known as the income tax and benefit return. Tier 1 employee medicare tax—sick pay. Number of new tires subject to fee 4. Web for best results, download and open this form in adobe reader.

This Is Used To Calculate The Amounts To.

Get irs approved instant schedule 1 copy. Web the t1 general income tax and benefit return is the tax return used by individuals to calculate their annual tax liability and get federal or provincial benefits such as the. Check if an application to determine eligibility of a trustee pursuant to section 305(b)(2) (exact name of trustee as specified in its charter). Ad don't leave it to the last minute.