Strong Form Market Efficiency

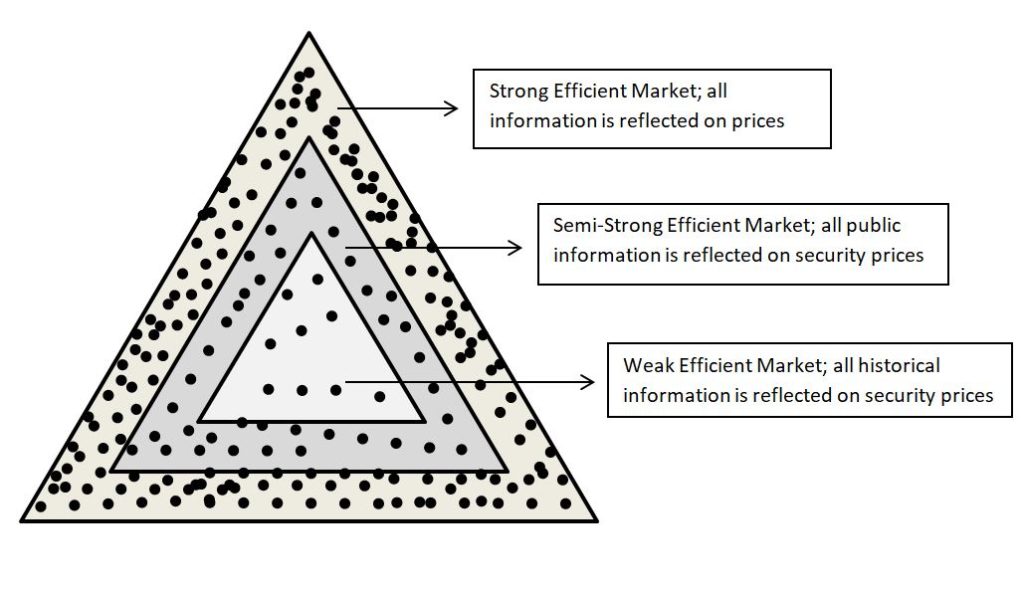

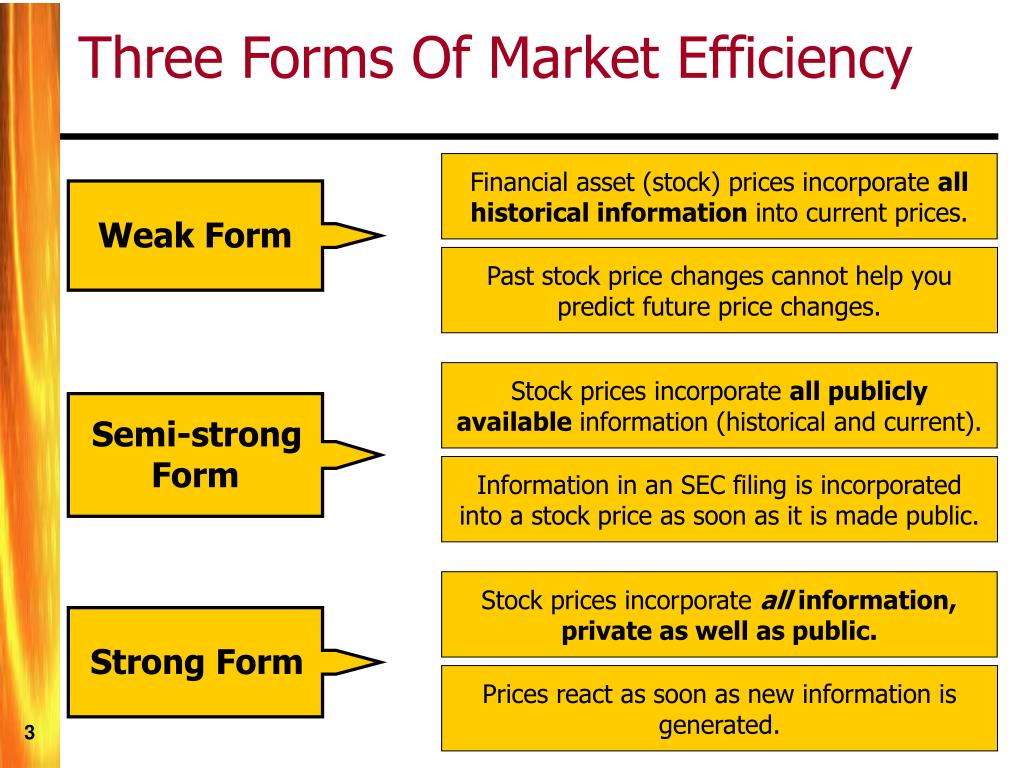

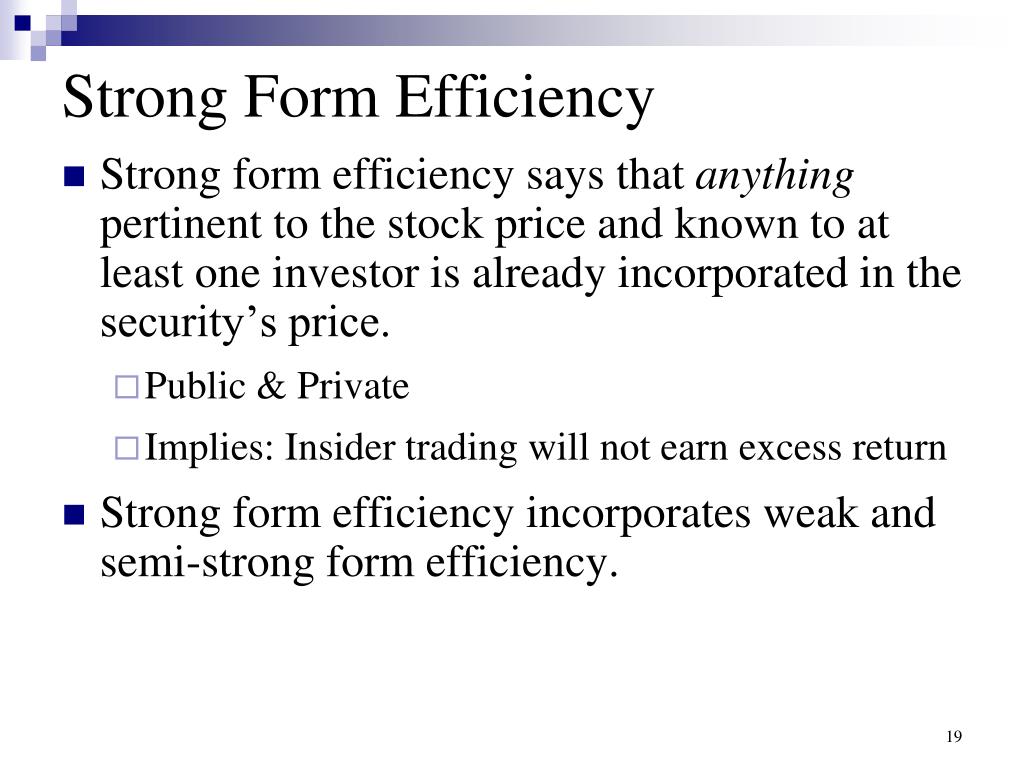

Strong Form Market Efficiency - Web market efficiency is usually described in three levels: Web information would be useful in finding under valued stocks. Web what are the three market efficiency forms? Asset prices fully reflect all of the publicly available information. Strong form efficiency refers to a market efficiency in which prices of stocks reflects all the information in a market, be it. Notice that the level/degree/form of. Web what is the opportunity and why is it there? There are three versions of emh, and it is the toughest of all the. Web what is strong form efficiency? In an efficient market, prices reflect all available information.

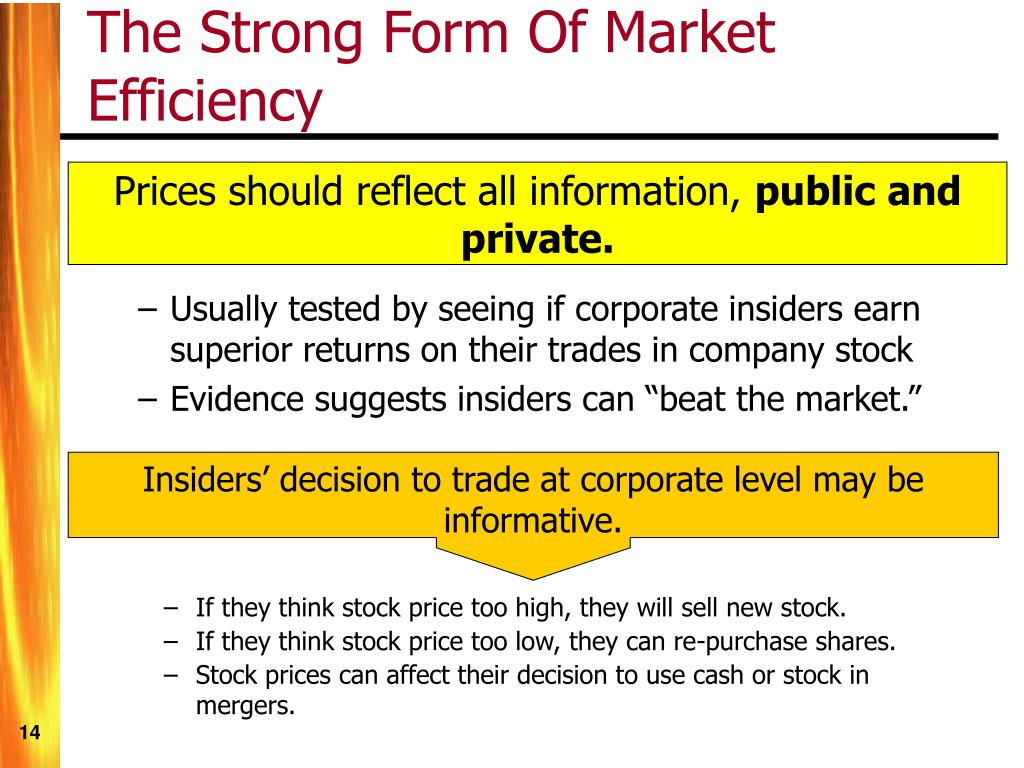

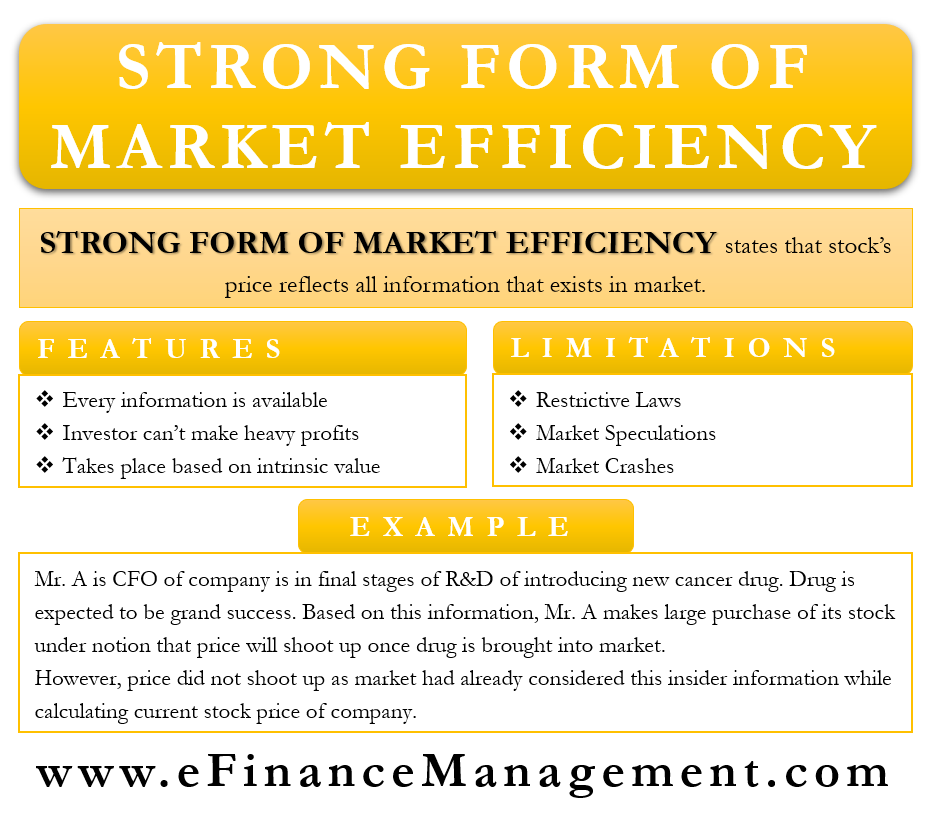

Web strong form efficiency is a type of market efficiency that states that all market information, public or private, is accounted for in a stock price. A direct implication is that it. Web what are the three market efficiency forms? Asset prices fully reflect all of the publicly available information. Web information would be useful in finding under valued stocks. There is a vast amount of literature in the field to test if markets are. Strong form efficiency refers to a market efficiency in which prices of stocks reflects all the information in a market, be it. To answer this question, we start by studying capital markets and the types of managers operating within those markets. The three forms of market efficiency are as follows: Web this model reveals a strong relationship between race/ethnicity and heating eui.

Web to maximize profit, a firm chooses a quantity of output such that marginal revenue equals marginal cost. Web updated september 23, 2022 reviewed by thomas brock fact checked by ryan eichler when you place money in the stock market, the goal is to generate a. Web the strong form of market efficiency is a version of the emh or efficient market hypothesis. To answer this question, we start by studying capital markets and the types of managers operating within those markets. Modeling the efficiency of residential space heating (and cooling) is important. Asset prices fully reflect all of the publicly available information. The three forms of market efficiency are as follows: Web what is the opportunity and why is it there? Web this model reveals a strong relationship between race/ethnicity and heating eui. Notice that the level/degree/form of.

Risk measurement & efficient market hypothesis

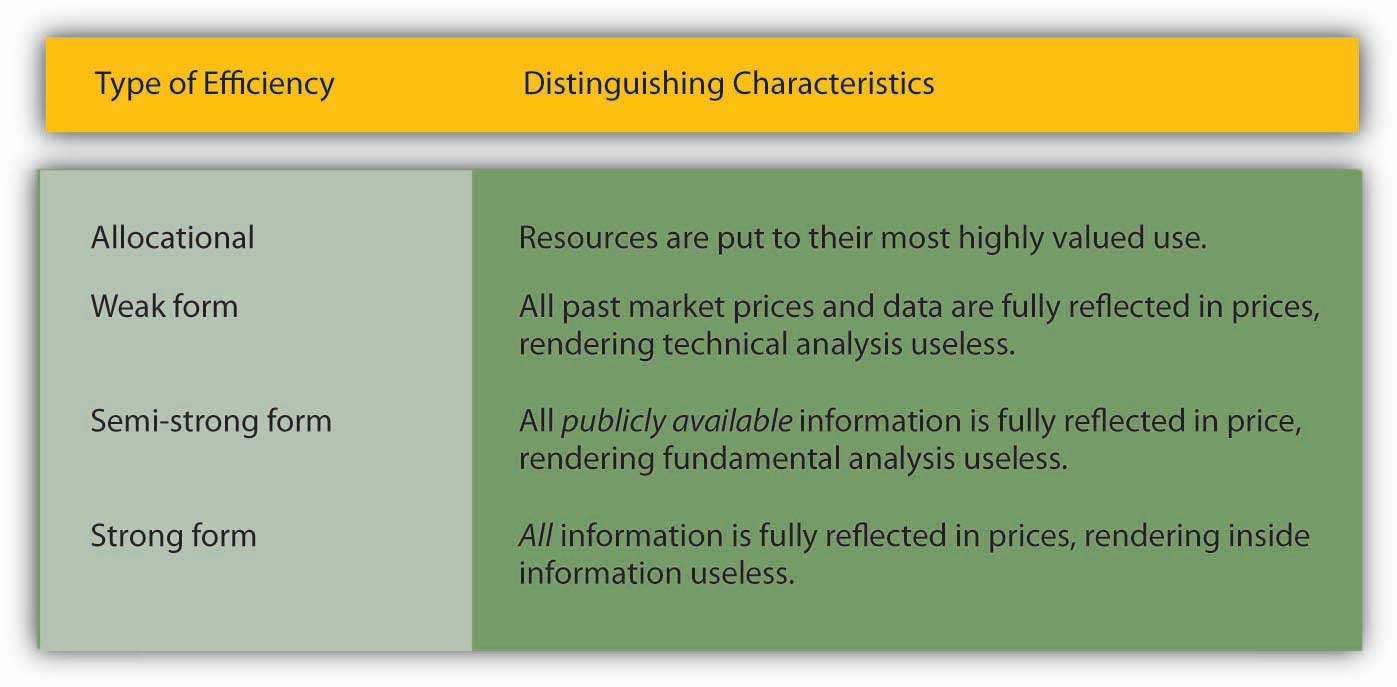

Modeling the efficiency of residential space heating (and cooling) is important. Web what do we mean by “efficiency?” the efficient market hypothesis (emh): The three forms of market efficiency are as follows: There is a vast amount of literature in the field to test if markets are. Asset prices fully reflect all of the publicly available information.

Types of Market Efficiency Points by Card

The three forms of market efficiency are as follows: Web updated september 23, 2022 reviewed by thomas brock fact checked by ryan eichler when you place money in the stock market, the goal is to generate a. Under strong form efficiency, the current price reflects all information, public as well as private, and no investors will be. Web the strong.

PPT Corporate Financing and Market Efficiency PowerPoint Presentation

Web strong form efficiency is a type of market efficiency that states that all market information, public or private, is accounted for in a stock price. Notice that the level/degree/form of. Web reduced pressure principle assembly double check valve assembly air gap required separation initial test date _____ time_____ leaked closed tight held at_____psid There are three versions of emh,.

Efficient Market Theory/Hypothesis EMH Forms, Concepts BBAmantra

Web to maximize profit, a firm chooses a quantity of output such that marginal revenue equals marginal cost. Web what is the opportunity and why is it there? Solution the correct answer is b. Therefore, only investors with additional inside information could have an advantage in. Asset prices fully reflect all of the publicly available information.

PPT Market Efficiency And Modern Financial Management PowerPoint

Web the strong form of market efficiency is a version of the emh or efficient market hypothesis. Strong form efficiency refers to a market efficiency in which prices of stocks reflects all the information in a market, be it. Web what is strong form efficiency? There is a vast amount of literature in the field to test if markets are..

RMIT Vietnam Managerial Finance Efficient Market Hypothesis Wee…

There are three versions of emh, and it is the toughest of all the. Strong form efficiency refers to a market efficiency in which prices of stocks reflects all the information in a market, be it. In an efficient market, prices reflect all available information. Modeling the efficiency of residential space heating (and cooling) is important. Solution the correct answer.

PPT Market Efficiency And Modern Financial Management PowerPoint

Asset prices fully reflect all of the publicly available information. Web what are the three market efficiency forms? To answer this question, we start by studying capital markets and the types of managers operating within those markets. Because marginal revenue for a competitive firm equals the market price,. Web the strong form of market efficiency says that market prices reflect.

PPT Market Efficiency PowerPoint Presentation, free download ID2988410

There are three versions of emh, and it is the toughest of all the. Notice that the level/degree/form of. Strong form efficiency refers to a market efficiency in which prices of stocks reflects all the information in a market, be it. Web reduced pressure principle assembly double check valve assembly air gap required separation initial test date _____ time_____ leaked.

Evidence of Market Efficiency

Modeling the efficiency of residential space heating (and cooling) is important. Web what are the three market efficiency forms? A direct implication is that it. Asset prices fully reflect all of the publicly available information. Web reduced pressure principle assembly double check valve assembly air gap required separation initial test date _____ time_____ leaked closed tight held at_____psid

Strong form of market efficiency Meaning, EMH, Limitations, Example

Therefore, only investors with additional inside information could have an advantage in. Asset prices fully reflect all of the publicly available information. Web updated september 23, 2022 reviewed by thomas brock fact checked by ryan eichler when you place money in the stock market, the goal is to generate a. In an efficient market, prices reflect all available information. Web.

Therefore, Only Investors With Additional Inside Information Could Have An Advantage In.

There are three versions of emh, and it is the toughest of all the. Solution the correct answer is b. In an efficient market, prices reflect all available information. Web market efficiency is usually described in three levels:

Modeling The Efficiency Of Residential Space Heating (And Cooling) Is Important.

Web what is the opportunity and why is it there? Notice that the level/degree/form of. Web reduced pressure principle assembly double check valve assembly air gap required separation initial test date _____ time_____ leaked closed tight held at_____psid Strong form efficiency refers to a market efficiency in which prices of stocks reflects all the information in a market, be it.

Web What Is Strong Form Efficiency?

Web to maximize profit, a firm chooses a quantity of output such that marginal revenue equals marginal cost. A direct implication is that it. Web updated september 23, 2022 reviewed by thomas brock fact checked by ryan eichler when you place money in the stock market, the goal is to generate a. Web the strong form of market efficiency is a version of the emh or efficient market hypothesis.

Under Strong Form Efficiency, The Current Price Reflects All Information, Public As Well As Private, And No Investors Will Be.

Web this model reveals a strong relationship between race/ethnicity and heating eui. To answer this question, we start by studying capital markets and the types of managers operating within those markets. Web what do we mean by “efficiency?” the efficient market hypothesis (emh): Asset prices fully reflect all of the publicly available information.