State Withholding Form California

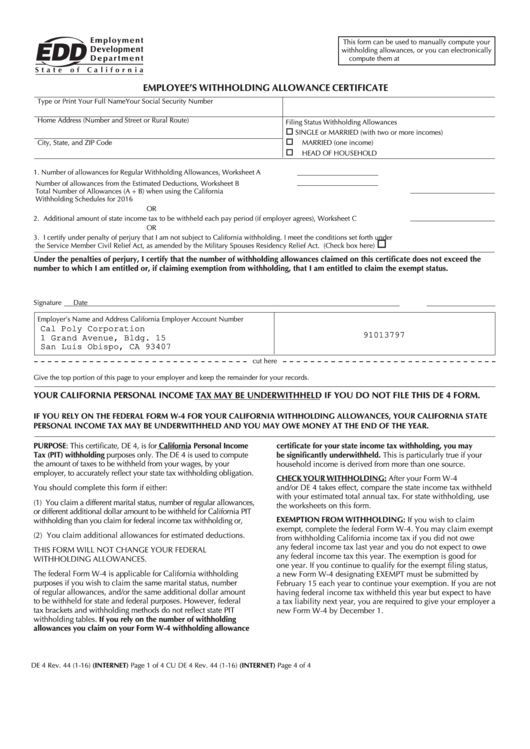

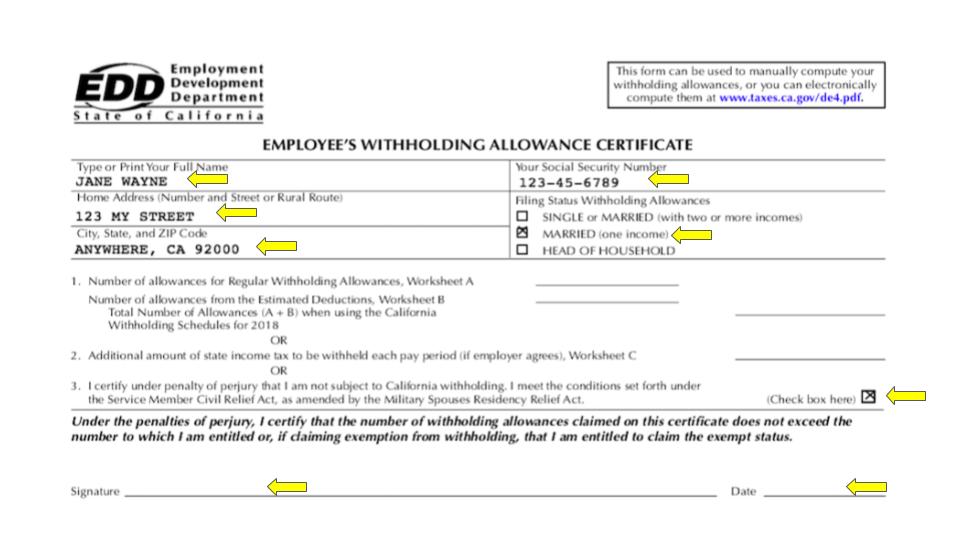

State Withholding Form California - For state withholding, use the worksheets on this form. Web state income tax withheld with your estimated total annual tax. Web up to 10% cash back the california form de 4, employee's withholding allowance certificate, must be completed so that you know how much state income tax to withhold from. Web employee action request (ear) std. Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Try it for free now! Web by checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the. Web landlord tenant lawyer. 686 form and federal withholdings toolkit. 686 (rev 12/2020) withholding change or new employee.

Web the income tax withholdings formula for the state of california includes the following changes: The low income exemption amount for single and married with 0 or 1. Web for state, the amount of tax withheld is determined by the following: Form 590 does not apply to payments of backup withholding. Web of california withholding allowances used in 2020 and prior, then a new de 4 is not needed. Upload, modify or create forms. You must file a de 4 to determine the appropriate california pit withholding. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Arrasmith founder and chief legal counsel of the law offices. Web state income tax withheld with your estimated total annual tax.

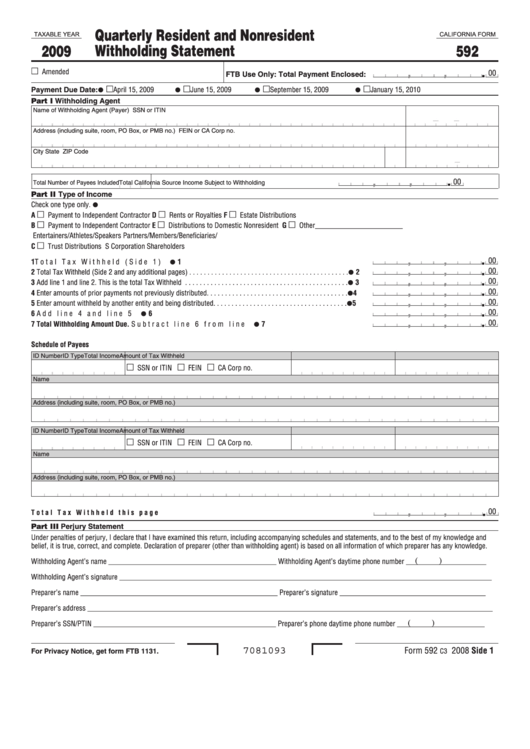

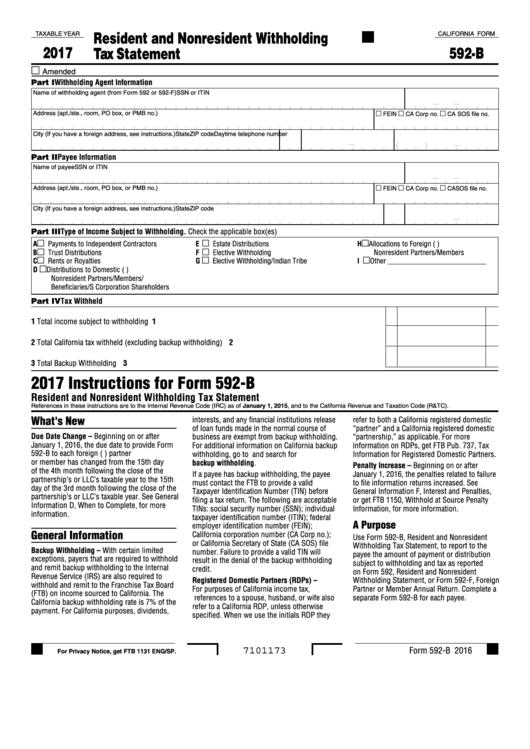

Wages are generally subject to all four. Web employee action request (ear) std. If you wish to claim exempt,. Quickstart guide and ear samples. Web simplified income, payroll, sales and use tax information for you and your business Arrasmith founder and chief legal counsel of the law offices. Web form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts. For state withholding, use the worksheets on this form. Web español 2023 contribution rates, withholding schedules, and meals and lodging values know the current contribution rates, withholding schedules, and meals and lodging. Try it for free now!

CA FTB 589 2019 Fill out Tax Template Online US Legal Forms

Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. If you wish to claim exempt,. 686 form and federal withholdings toolkit. Web employees pay into state payroll taxes with wage withholdings for: The low income exemption amount for single and married with 0 or 1.

California Employee State Withholding Form 2023

Form 590 does not apply to payments of backup withholding. Arrasmith founder and chief legal counsel of the law offices. You must file a de 4 to determine the appropriate california pit withholding. Web the income tax withholdings formula for the state of california includes the following changes: • the number of allowances claimed on ear/spar form.

How to Complete Forms W4 Attiyya S. Ingram, AFC

Web español 2023 contribution rates, withholding schedules, and meals and lodging values know the current contribution rates, withholding schedules, and meals and lodging. For state withholding, use the worksheets on this form. Web form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts..

Filing California State Withholding Form

Web by checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the. State disability insurance (sdi) personal income tax (pit) note: Arrasmith founder and chief legal counsel of the law offices. Upload, modify or create forms. Quickstart guide and ear samples.

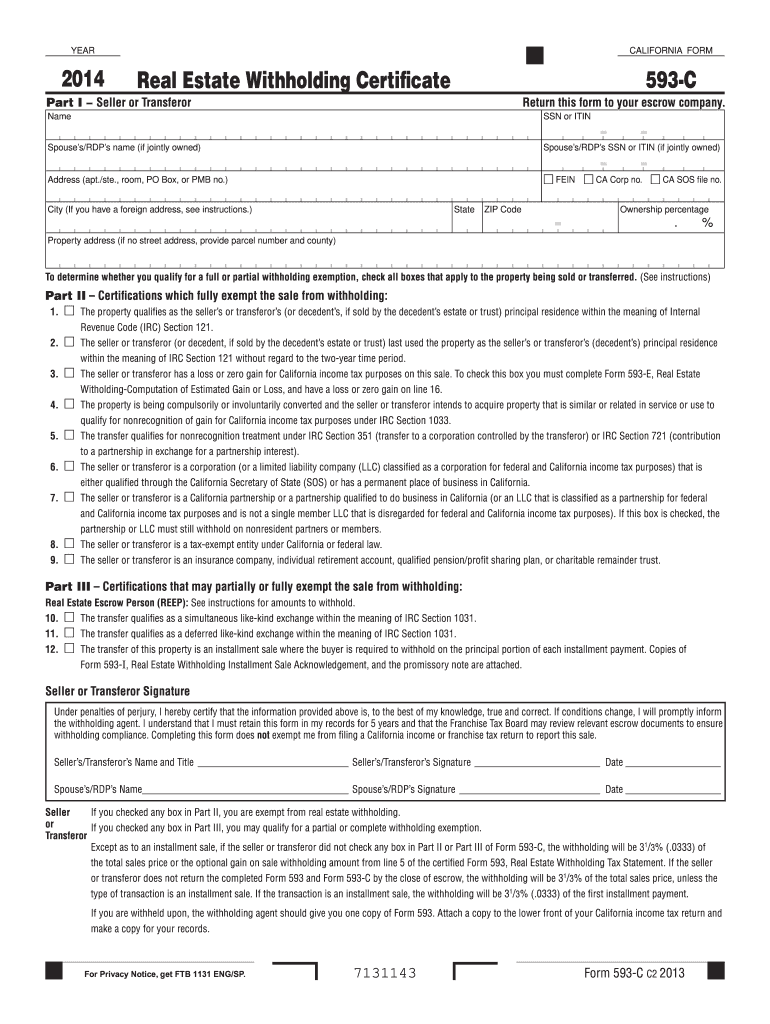

Form 593 C Real Estate Withholding Certificate California Fill Out

For state withholding, use the worksheets on this form. 686 form and federal withholdings toolkit. 686 (rev 12/2020) withholding change or new employee. Web by checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the. Web up to 10% cash back the california form de.

California State Withholding Fillable Form

Try it for free now! If you wish to claim exempt,. The low income exemption amount for single and married with 0 or 1. Wages are generally subject to all four. Web simplified income, payroll, sales and use tax information for you and your business

1+ California State Tax Withholding Forms Free Download

State disability insurance (sdi) personal income tax (pit) note: You must file a de 4 to determine the appropriate california pit withholding. Web of california withholding allowances used in 2020 and prior, then a new de 4 is not needed. 686 form and federal withholdings toolkit. 686 (rev 12/2020) withholding change or new employee.

Fillable California Form 592B Resident And Nonresident Withholding

Web up to 10% cash back the california form de 4, employee's withholding allowance certificate, must be completed so that you know how much state income tax to withhold from. Web employee action request (ear) std. • the number of allowances claimed on ear/spar form. 686 form and federal withholdings toolkit. Quickstart guide and ear samples.

Does California State Have Its Own Withholding Form

Web by checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the. Form 590 does not apply to payments of backup withholding. For state withholding, use the worksheets on this form. Try it for free now! Web use form 592 to report the total withholding.

California withholding form Fill out & sign online DocHub

Web landlord tenant lawyer. Web state income tax withheld with your estimated total annual tax. Web for state, the amount of tax withheld is determined by the following: Web up to 10% cash back the california form de 4, employee's withholding allowance certificate, must be completed so that you know how much state income tax to withhold from. Web español.

Web Employees Pay Into State Payroll Taxes With Wage Withholdings For:

If you wish to claim exempt,. Wages are generally subject to all four. 686 form and federal withholdings toolkit. Try it for free now!

Web Form 592 Includes A Schedule Of Payees Section, On Side 2, That Requires The Withholding Agent To Identify The Payees, The Income Amounts, And The Withholding Amounts.

Form 590 does not apply to payments of backup withholding. • the number of allowances claimed on ear/spar form. Arrasmith founder and chief legal counsel of the law offices. Web español 2023 contribution rates, withholding schedules, and meals and lodging values know the current contribution rates, withholding schedules, and meals and lodging.

Web Simplified Income, Payroll, Sales And Use Tax Information For You And Your Business

Web by checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the. Web employee action request (ear) std. The low income exemption amount for single and married with 0 or 1. Quickstart guide and ear samples.

Web Of California Withholding Allowances Used In 2020 And Prior, Then A New De 4 Is Not Needed.

Upload, modify or create forms. Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. 686 (rev 12/2020) withholding change or new employee. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding.